WW SSD Shipments Increased 5% Q/Q in 2Q18 – Trendfocus

Samsung continuing to be indisputable leader

This is a Press Release edited by StorageNewsletter.com on August 23, 2018 at 2:18 pmThis is an abstract of an Executive Summary, NAND/SSD Information Service CQ2 ‘18 Quarterly Update by Trendfocus, Inc., published on August 15, 2018.

SSD Market Continued Growth in CQ2’18

Enterprise Jumped 17% and 27% in Units and Exabytes, Respectively

NAND Market Grows Over 10% Q/Q

• Total SSD shipments, client and enterprise combined, increased 5% Q/Q. Client modules dominated DFF by 2:1, shipping over 26 million units, contributing to the 47.8 million overall SSDs shipped.

• Enterprise SSDs showed the largest percentage increase with 17% Q/Q in units, totaling 7.95 million units, and 11.09EB – consuming over 50% of all NAND shipped into SSDs for the first time.

• With supply in line and pricing continuing to decline, enterprise SATA units showed decent growth, shipping 4.3 million units and 3.8EB in the quarter.

• Enterprise SAS and PCIe shipments witnessed superior growth in both units and exabytes, showing strong demand at both system OEMs and hyperscale – PCIe continued to lead in capacity shipped at 4.8EB.

• NAND bits shipped rose over 10% from the prior quarter to 53.05EB in CQ2 ’18.

• 3D NAND output grew to 73% of total bits shipped for the quarter.

• NAND for SSDs increased to 46% for the quarter while NAND for mobile remained flat at 37%.

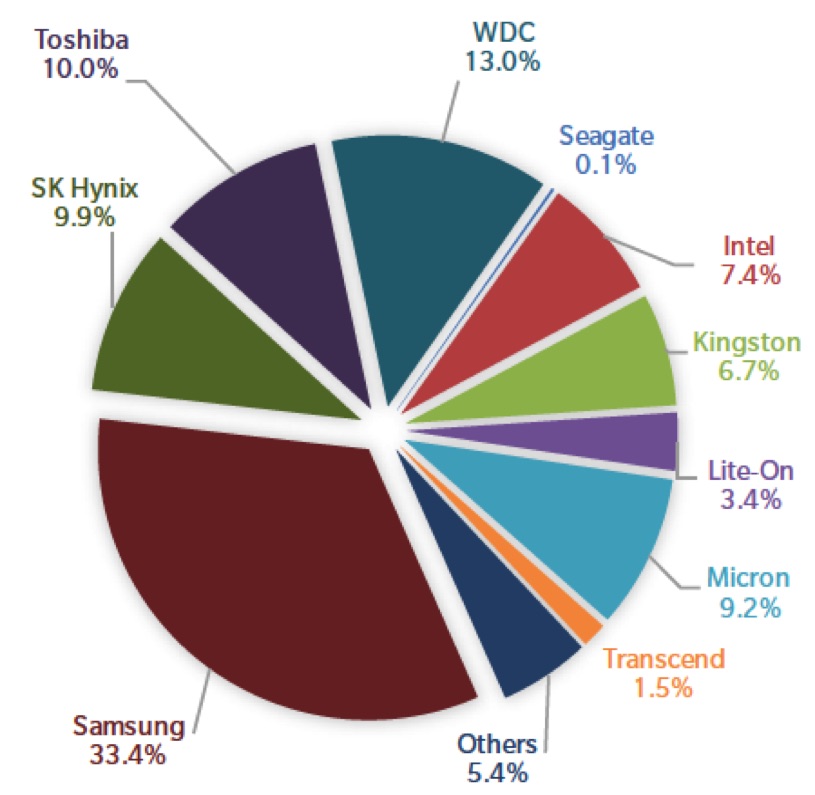

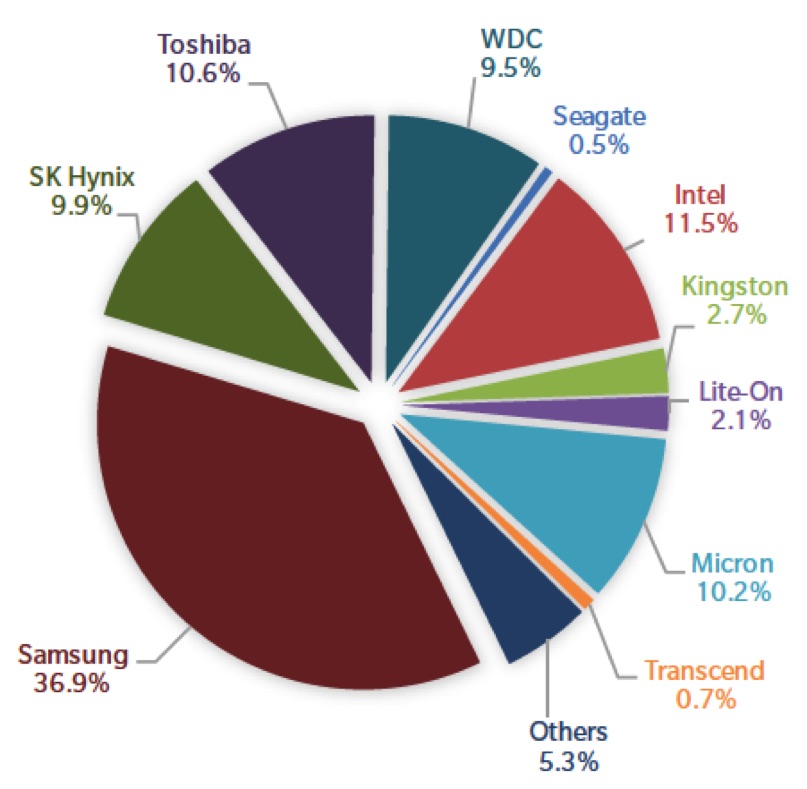

CQ2 ‘18 Total SSD Market Share, by Supplier, Units (in Million), Exabytes

CQ2 ‘18 Total SSD Market: 47.768 Million Units

CQ2 ‘18 Total SSD Market: 21.859 Exabytes*

*Exabytes shipped for NAND reflect physical capacity. Exabytes shipped for SSDs reflect user capacity.

Preliminary data – values may change slightly

Read also:

SSD Shipments Up 7%, Exabytes Shipped Rose 14% From 4Q17 to 1Q18 – Trendfocus

Samsung largely top leader in both categories as usual

2018.05.29 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter