SSD Shipments Up 7%, Exabytes Shipped Rose 14% From 4Q17 to 1Q18 – Trendfocus

Samsung largely top leader in both categories as usual

This is a Press Release edited by StorageNewsletter.com on May 29, 2018 at 2:40 pmThis is an Executive Summary by analyst firm Trendfocus, Inc., NAND/SSD Information Service CQ1 ’18 Quarterly Update, published on May 14, 2018.

SSD Shipments, EBs Rise in Nearly All Categories in CQ1 ’18

NAND Market Climbs to 51EB

Client DFF declines slightly as expected

due to continued transition to M.2 in PCs while all other market segments grow

• Total SSD shipments increased over 7% Q/Q to 45.556 million units while exabyte shipped rose 14% to 19.014.

• Client modules dominated other categories once more with 24.577 million units shipped, climbing nearly 12% Q/Q.

• Although enterprise SATA saw the smallest percentage growth of all enterprise SSD categories, it still outpaced other interfaces in unit volume with 4.154 million units shipped – an upward move of 9.9% Q/Q.

• Enterprise PCIe saw the largest percentage increase in unit shipments, growing 25.8% Q/Q for a total of 1.802 million units and 3.265EB shipped.

• SAS SSDs rebounded to 0.838 million units, showing strong growth of 18% Q/Q with 1.860EB shipped – a 20% increase in total capacity shipped from the previous quarter.

• NAND bits shipped grew 2.6% sequentially to 50.96EB in 1CQ18.

• 3D NAND output continued to gain momentum, and in 1CQ18, 3D NAND accounted for 68% of total bits shipped.

• NAND SSD share rose to 42.5% for the quarter while NAND in mobile slipped to 38.3%.

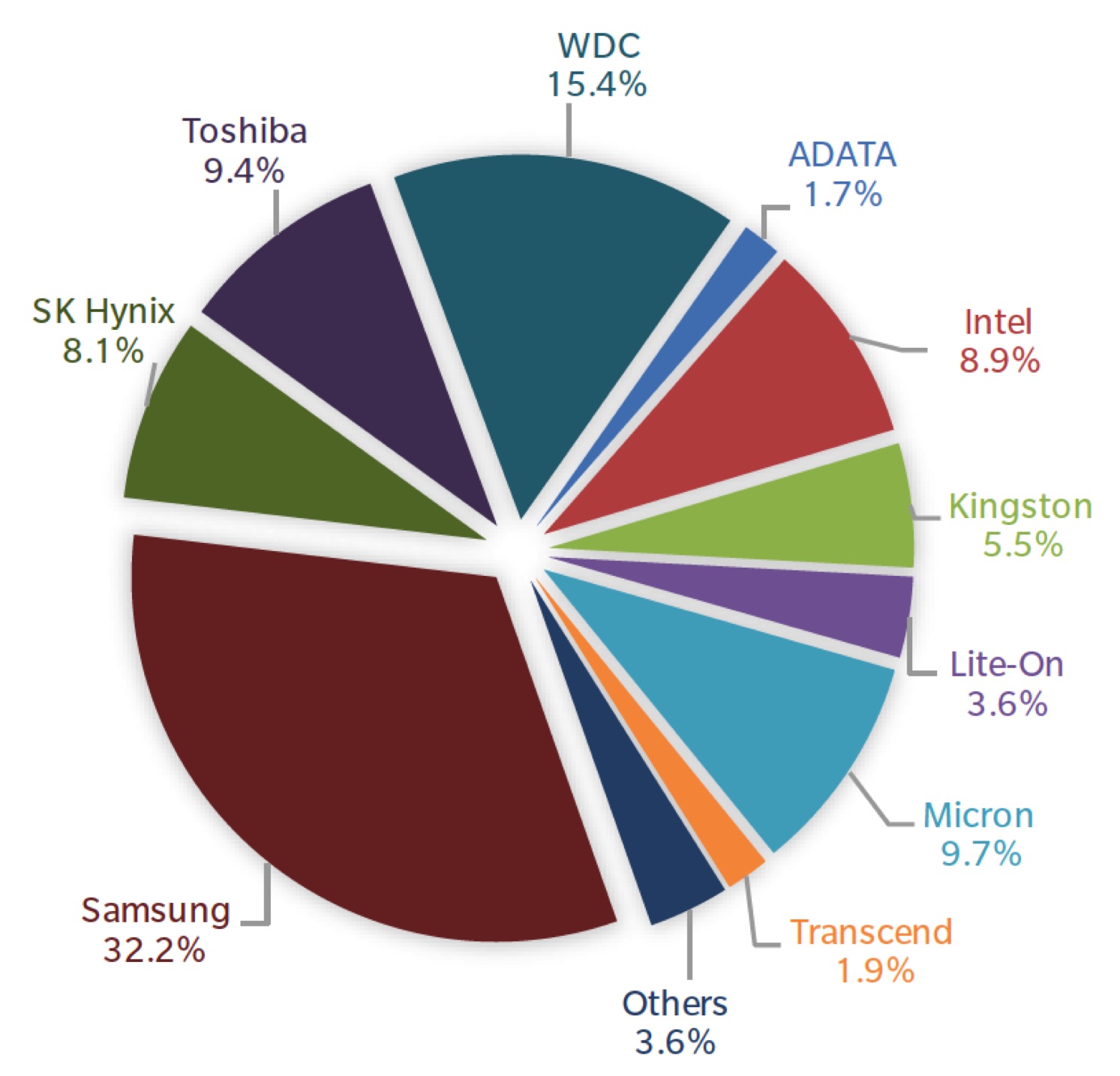

1CQ18 Total SSD Market: 45.556 Million Units

1CQ18 Total SSD Market: 19.014EB

*Exabytes shipped for NAND reflect physical capacity. Exabytes shipped for SSDs reflect user capacity.

**Preliminary data – values may change slightly.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter