Cloud IT Infrastructure Market Grew 25.5% Y/Y in 3Q17 – IDC

Reaching $11.3 billion

This is a Press Release edited by StorageNewsletter.com on January 15, 2018 at 2:17 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of infrastructure products (server, storage, and Ethernet switch) for cloud IT, including public and private cloud, grew 25.5% year over year in 3Q17, reaching $11.3 billion.

Public cloud infrastructure revenue grew 32.3% year over year in 3Q17 to $7.7 billion and now represents 30.2% of total worldwide IT infrastructure spending, up from 26.3% one year ago. Private cloud revenue reached $3.6 billion for an annual increase of 13.1%. Total worldwide cloud IT infrastructure revenue is on pace to nearly double in 2017 when compared to 2013. Traditional (non-cloud) IT infrastructure revenue grew 8.0% from a year ago, although it has been generally declining over the past several years; despite the declining trend, at $14.2 billion in 3Q17 traditional IT still represents 55.6% of total worldwide IT infrastructure spending.

Public cloud also represented 68.0% of the total cloud IT infrastructure revenue in 3Q17. The market with the highest growth in the public cloud infrastructure segment was storage platforms with revenue up 45.1% compared to the same quarter of the previous year, and making up 42.0% of the revenue in public cloud. Compute platforms and Ethernet switch public cloud IT infrastructure revenues were up 24.8% and 23.2%, respectively. Compute platforms represented 43.9% of public cloud IT infrastructure revenue. Private cloud infrastructure revenue was driven by the storage platforms growth of 16.1% Y/Y.

“2017 has been a strong year for public cloud IT infrastructure growth, accelerating throughout the year,” said Kuba Stolarski, research director for computing platforms, IDC. “While hyperscalers such as Amazon and Google are driving the lion’s share of the growth, IDC is seeing strong growth in the lower tiers of public cloud and continued growth in private cloud on a worldwide scale. In the near term, new Intel and AMD platforms released during 2017 should aid in refresh and infrastructure expansion throughout the cloud IT infrastructure segment.”

Except for Latin America revenue, which grew 5.0% from a year ago, all other regions in the world grew their cloud IT Infrastructure revenue by double digits. AsiaPac (excluding Japan) and Central and Eastern Europe saw the fastest growth rates at 50.1% and 35.3%, respectively. Canada (22.5%) and Western Europe (24.6%) had annual growth in the twenties, while the U.S. (18.7%), Japan (17.5%), and Middle East and Africa (15.8%) had annual growth in the teens.

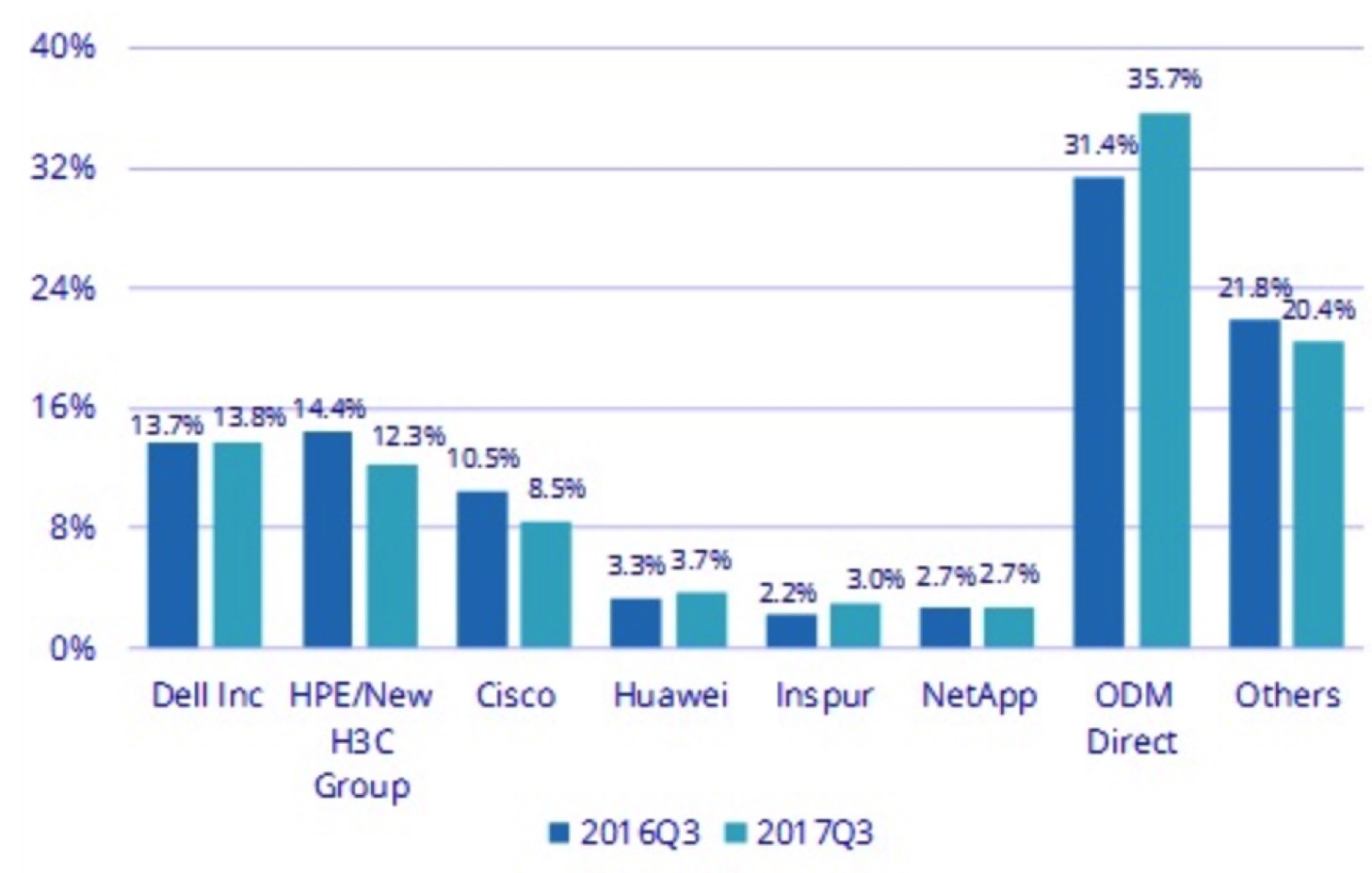

Top Companies, WW Cloud IT Infrastructure Vendor Revenue, Market Share, and Y/Y Growth, 3Q17

(revenues in $ million)

WW Cloud IT Infrastructure Top 5 Cloud Vendors 3Q17 vs. 3Q16

(shares based on vendor revenue)

(Source: IDC’s Quarterly Cloud IT Infrastructure Tracker, 3Q17 January 11, 2018)

(Source: IDC’s Quarterly Cloud IT Infrastructure Tracker, 3Q17 January 11, 2018)

Notes:

* IDC declares a statistical tie in the worldwide cloud IT infrastructure market when there is a difference of 1% or less in the vendor revenue shares among two or more vendors.

** Due to the existing joint venture between HPE and the New H3C Group

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

Read also:

WW Cloud IT Infrastructure Revenue Grows 26% in 2Q17, Reaching $12 Billion – IDC

Driven by expansion in public cloud

2017.10.09 | Press Release

Worldwide Cloud IT Infrastructure Revenue Up 15% to $8 Billion in 1Q17 – IDC

Top three are Dell, HPE and Cisco.

2017.07.05 | Press Release

WW Cloud IT Infrastructure Spend Grew 9% to $33 Billion in 2016 – IDC

Top vendors: Dell, HE/New HC3 Group, Cisco, Huawei, Lenovo, IBM and NetApp

2017.04.10 | Press Release

WW Cloud IT Infrastructure Spending Up 18% in 2017 – IDC

To reach $44.2 billion

2017.01.20 | Press Release

EMEA Cloud IT Infrastructure Revenue Grows 19.5% to $1.5 Billion in 3Q16 – IDC

Cloud storage represented 45% of total capacity.

2017.01.19 | Press Release

WW Cloud IT Infrastructure Market Grew 8% Y/Y to $8.4 Billion in 4Q16 – IDC

1/ Dell EMC, 2/ HPE, 3/ Cisco, 4/ Lenovo, 5/ Huawei, 6/ NetApp 7/ Inspur

2017.01.16 | Press Release

EMEA Cloud IT Infrastructure Revenue Up 37% to $1.4 Billion in 2Q16 – IDC

Cloud represented 24% of total storage capacity, 5% decline over 2Q15.

2016.10.14 | Press Release

WW Cloud IT Infrastructure Revenue Up 14.5% to $7.7 Billion in 2Q16 – IDC

Leaders in order: HPE, Dell, Cisco, EMC, Lenovo, NetApp, IBM, Huawei, Inspur

2016.10.05 | Press Release

EMEA Cloud IT Infrastructure Revenue Grows 18% to $1.3 Billion in 1Q16 – IDC

Storage representing 30% of total capacity, 6% decline Y/Y

2016.07.12 | Press Release

Strong Spending on Cloud IT Infrastructure in 2016: $37 Billion – IDC

Up 15.5% despite first quarter slowdown

2016.07.07 | Press Release

WW Cloud IT Infrastructure Spend Grew 22% to $29 Billion in 2015 – IDC

Major vendors being HPE, Dell, Cisco, EMC, IBM and NetApp in order

2016.04.11 | Press Release

WW Cloud IT Infrastructure Spend Grows 23% Y/Y to $7.6 Billion in 3Q15 – IDC

1/ HP, 2/ Dell, 3/ Cisco, 4/ EMC, 5/ NetApp, 6/ IBM, 7/ Lenovo

2016.01.22 | Press Release

WW Cloud IT Infrastructure Market to Grow 24% at $33 Billion in 2015 – IDC

15% CAGR until 2019 and accounting for 46% of total spending on enterprise IT infrastructure

2015.10.12 | Press Release

WW Cloud IT Infrastructure Market Grew 26% From 2Q14 to 2Q15 at $6.9 Billion – IDC

Top vendors: HP, Dell, Cisco, EMC, Lenovo, and NetApp, only one going down

2015.10.06 | Press Release

WW Cloud IT Infrastructure Market Grows by 25% to $6.3 Billion in 1Q15 – IDC

Led by HP, Dell, Cisco, EMC, NetApp and Lenovo

2015.07.22 | Press Release

WW Cloud IT Infrastructure Spending Forecast to Grow 26% in 2015 – IDC

CAGR of 15.6% to reach $54.6 billion by 2019

2015.07.14 | Press Release

WW Cloud IT Infrastructure Market Expected Up to 21% at $32 Billion in 2015 – IDC

Driven by public cloud datacenter expansion

2015.04.27 | Press Release

WW Cloud IT Infrastructure Market Grew 14% in 4Q14 at $8 Billion – IDC

Top 5 vendors: HP, Dell, EMC, Cisco and IBM

2015.04.24 | Press Release

Cloud IT Infrastructure Accounted for 1/3 of WW Server, Disk Storage, and Ethernet Switch Spending in 3Q14

IDC’s report

2014.12.23 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter