Rubrik: Fiscal 2Q26 Financial Results

Results exceeded all guided metrics

This is a Press Release edited by StorageNewsletter.com on September 16, 2025 at 2:02 pmSummary:

-

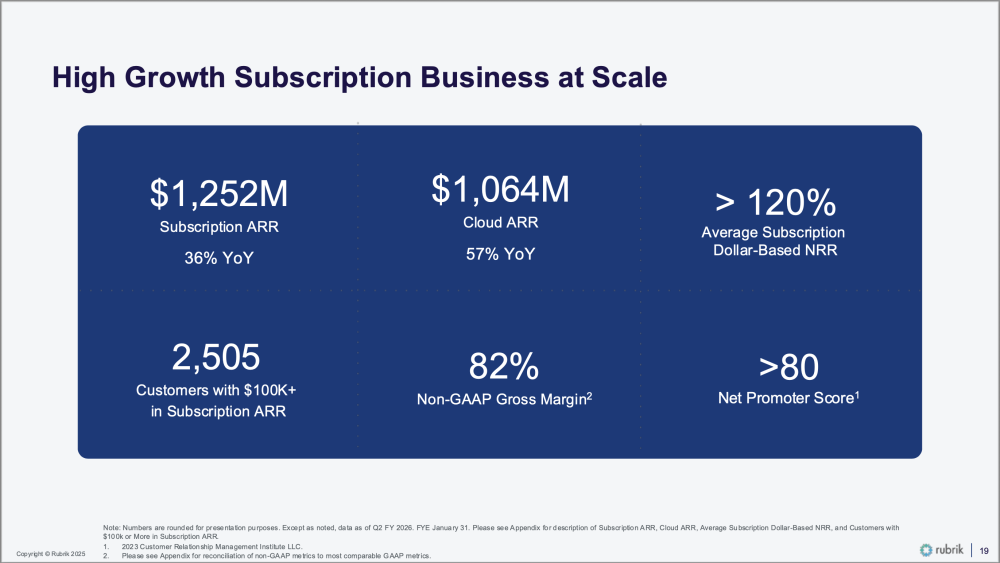

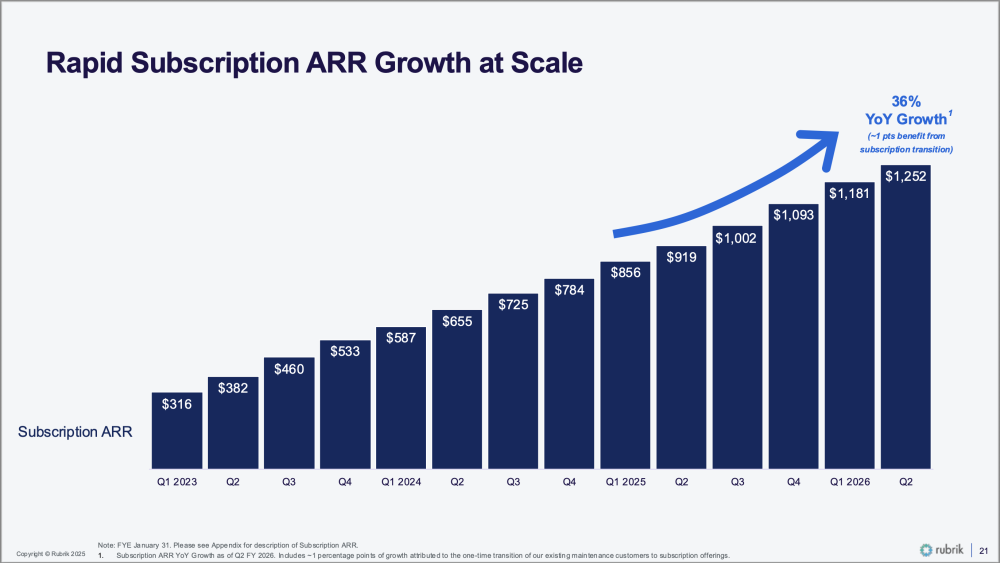

Second quarter subscription ARR grew 36% year-over-year to $1.25 billion

-

Second quarter revenue grew 51% year-over-year to $309.9 million

-

2,505 customers with $100K or more in subscription ARR, up 27% year-over-year

Rubrik, Inc., an active security and AI company, announced financial results for the second quarter of fiscal year 2026, ended July 31, 2025. “We delivered a strong quarter with exceptional top-line growth and significant cash flow margin. We continue to build towards a highly profitable growth business. We’re also pleased to close the acquisition of Predibase, which bolsters our ability to deliver secure, efficient and accelerated GenAI for our customers. We look forward to continuing to unlock new frontiers in data, security, and AI as we build a generational company,” said Bipul Sinha, CEO, chairman, and co-founder, Rubrik.

“We delivered a strong quarter with exceptional top-line growth and significant cash flow margin. We continue to build towards a highly profitable growth business. We’re also pleased to close the acquisition of Predibase, which bolsters our ability to deliver secure, efficient and accelerated GenAI for our customers. We look forward to continuing to unlock new frontiers in data, security, and AI as we build a generational company,” said Bipul Sinha, CEO, chairman, and co-founder, Rubrik.

“We saw solid results in the second quarter with 36% growth in subscription ARR and a 19% free cash flow margin. This was driven by healthy new customer acquisition, robust expansion and increased efficiencies in the business. We’re pleased to raise our outlook for fiscal 2026,” added Kiran Choudary, CFO, Rubrik.

Second Quarter Fiscal 2026 Financial Highlights

-

Subscription Annual Recurring Revenue (ARR): Subscription ARR was up 36% YoY, growing to $1.25 billion as of July 31, 2025.

-

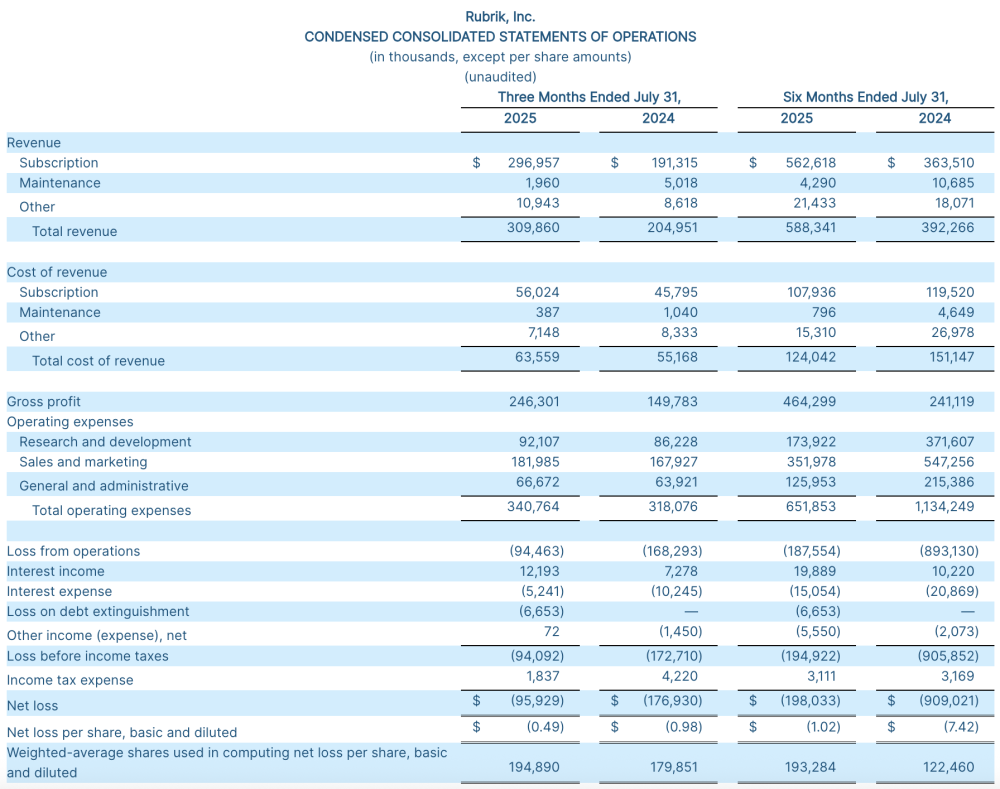

Revenue: Subscription revenue was $297.0 million, a 55% increase compared to $191.3 million in the second quarter of fiscal 2025. Total revenue was $309.9 million, a 51% increase compared to $205.0 million in the second quarter of fiscal 2025.

-

Gross Margin: GAAP gross margin was 79.5%, compared to 73.1% in the second quarter of fiscal 2025. This includes $4.9 million in stock-based compensation expense, compared to $7.0 million in the second quarter of fiscal 2025. Non-GAAP gross margin was 81.6%, compared to 77.0% in the second quarter of fiscal 2025.

-

Subscription ARR Contribution Margin: Subscription ARR contribution margin was 9.4% compared to (8.2)% in the second quarter of fiscal 2025, reflecting the strong net new subscription ARR in the quarter and an improvement in operating leverage in the business.

-

Net Loss per Share: GAAP net loss per share was $(0.49), compared to $(0.98) in the second quarter of fiscal 2025. GAAP net loss includes $88.5 million in stock-based compensation expense, compared to $105.0 million in the second quarter of fiscal 2025. Non-GAAP net loss per share was $(0.03), compared to $(0.40) in the second quarter of fiscal 2025.

-

Cash Flow from Operations: Cash flow from operations was $64.7 million, compared to $(27.1) million in the second quarter of fiscal 2025. Free cash flow was $57.5 million, compared to $(32.0) million in the second quarter of fiscal 2025.

-

Cash, Cash Equivalents, and Short-Term Investments: Cash, cash equivalents, and short-term investments were $1,523.0 million as of July 31, 2025.

Recent Business Highlights

-

As of July 31, 2025, Rubrik had 2,505 customers with Subscription ARR of $100,000 or more, up 27% YoY.

-

Acquired Predibase to accelerate agentic AI adoption from pilot to production at scale. Predibase accelerates production-ready AI by giving organizations an easy-to-use platform to tune models to their own data and run on an optimized inference stack. Together, Predibase and Rubrik will deliver radical simplicity in models and data, resulting in improved accuracy, lower costs, better performance, and automated data governance.

-

Announced the launch of Agent Rewind, powered by Predibase’s AI infrastructure. Agent Rewind is designed to enable organizations to undo mistakes made by agentic AI by tracking agent actions and undoing changes to applications and data.

-

Announced expanded immutability for Amazon RDS for PostgreSQL and comprehensive protection for Amazon DynamoDB, strengthening Rubrik’s leadership in cloud data protection.

Third Quarter and Fiscal Year 2026 Outlook

Rubrik is providing the following guidance for the third quarter of fiscal year 2026 and the full fiscal year 2026:

-

Third Quarter Fiscal 2026 Outlook:

-

Revenue of $319 million to $321 million.

-

Non-GAAP subscription ARR contribution margin of approximately 6.5%.

-

Non-GAAP net loss per share of $(0.18) to $(0.16).

-

Weighted-average shares outstanding of approximately 200 million.

-

-

Full Year 2026 Outlook:

-

Subscription ARR between $1,408 million and $1,416 million.

-

Revenue of $1,227 million to $1,237 million.

-

Non-GAAP subscription ARR contribution margin of approximately 7.0%.

-

Non-GAAP net loss per share of $(0.50) to $(0.44).

-

Weighted-average shares outstanding of approximately 197 million.

-

Free cash flow of $145 million to $155 million.

-

Additional information on Rubrik’s reported results, including a reconciliation of the non-GAAP results to their most comparable GAAP measures, is included in the financial tables below. A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty of expenses that may be incurred in the future, although it is important to note that these factors could be material to Rubrik’s results computed in accordance with GAAP. For example, stock-based compensation-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of Rubrik’s Class A common stock, and Rubrik’s future hiring and retention needs, all of which are difficult to predict and subject to constant change.

Click to enlarge

Comments

Rubrik passed the $300 million barrier for the first time with this quarter and delivered sequential growth since the start of the company. With $309.9 million, it grew 11% QoQ coming from $278.5 million and 51% YoY from $205 million.

FY25 and FY24 were respectively $886.6 million and $627.8 million, up 41%.

Click to enlarge

The first 6 months have generated $588.4 million up 50% YoY from $392.3 million. The ARR is approx. $1.25 billion confirming the growth trend above the billion dollars barrier.

Click to enlarge

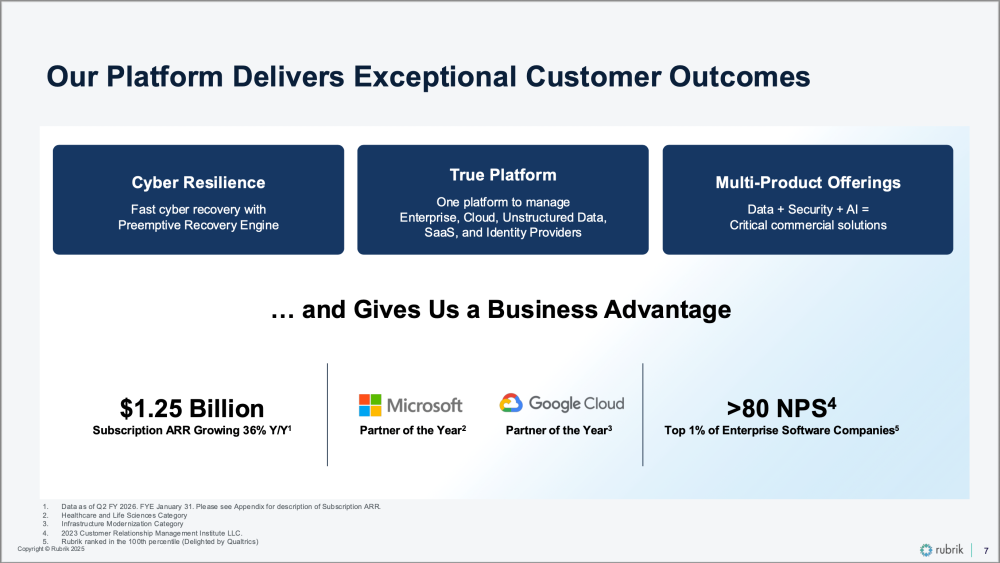

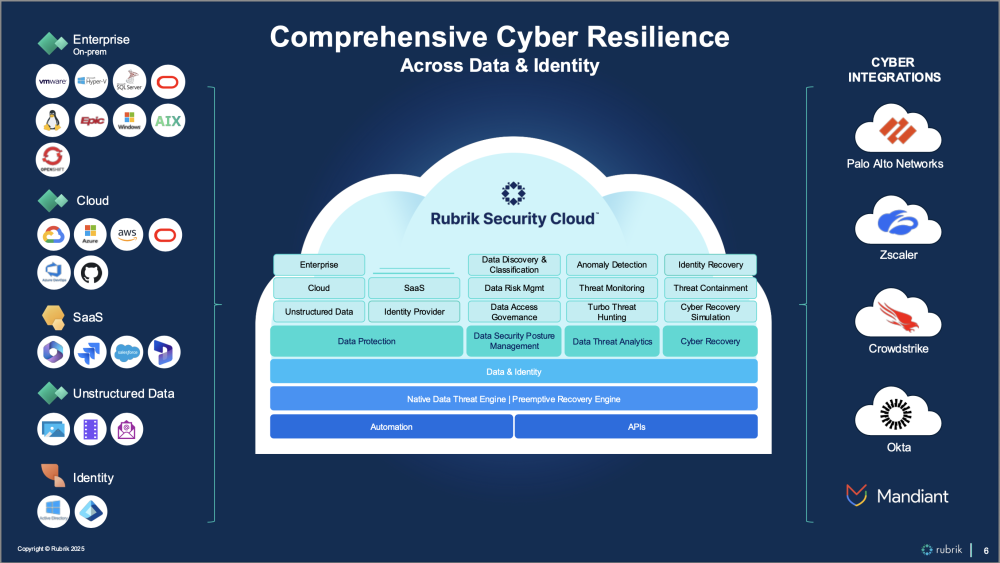

Belonging to the small club of new generation of data protection companies, Rubrik is strong in cyber security that evolved in cyber resilience and this topic is now a real battle among a few key players coupling some cyber threat protection and backup. The company is very active in the AI and security domains picking some innovative partners and acquisitions.

Click to enlarge

The company has been elected as a leader in Gartner Magic Quadrant for Enterprise Backup and Recovery Software Solutions and Coldago Map 2024 for Modern Data Protection.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter