Hewlett Packard Enterprise: Fiscal 3Q25 Financial Results

Delivers record revenue with sequential profitability growth

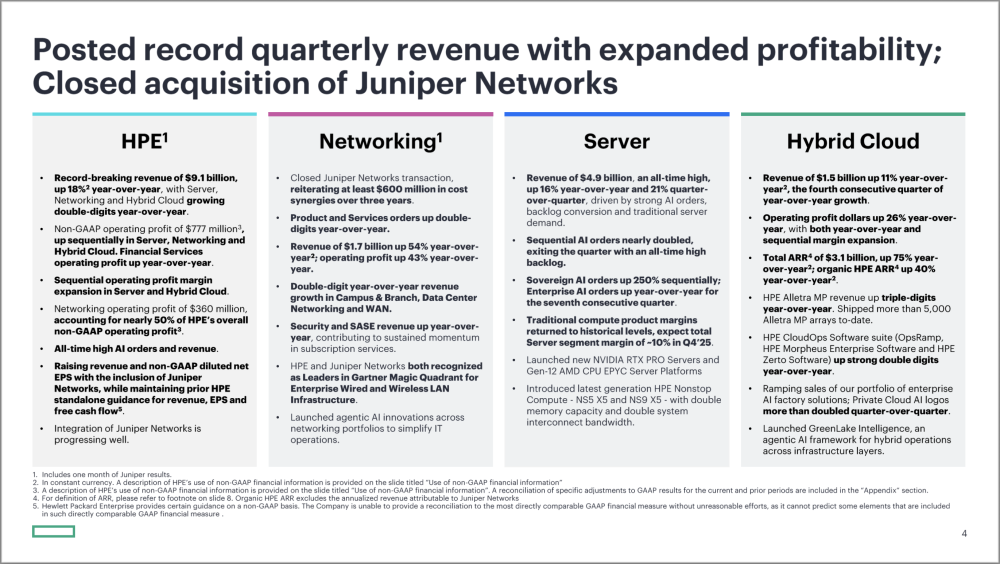

This is a Press Release edited by StorageNewsletter.com on September 11, 2025 at 2:02 pmHPE announced financial results for the third quarter ended July 31, 2025.![]() “HPE delivered record-breaking revenue and improved profitability this quarter as we marked a major milestone by closing our acquisition of Juniper Networks,” said Antonio Neri, president and CEO, HPE. “Customer demand stretched broadly across our portfolio and was particularly strong in our Server and Networking segments. As we enter a new chapter at HPE, we are focused on capturing the tremendous market opportunity through execution that delivers strong, consistent shareholder value.”

“HPE delivered record-breaking revenue and improved profitability this quarter as we marked a major milestone by closing our acquisition of Juniper Networks,” said Antonio Neri, president and CEO, HPE. “Customer demand stretched broadly across our portfolio and was particularly strong in our Server and Networking segments. As we enter a new chapter at HPE, we are focused on capturing the tremendous market opportunity through execution that delivers strong, consistent shareholder value.”

“In Q3, we delivered on our commitments, generating record revenue, as well as improved sequential operating profit with major contributions from our three largest segments,” said Marie Myers, EVP and CFO of HPE. “Acquiring Juniper Networks has already added to our results, with more profit accretion expected as we work to quickly capture planned synergies and drive new market opportunities.”

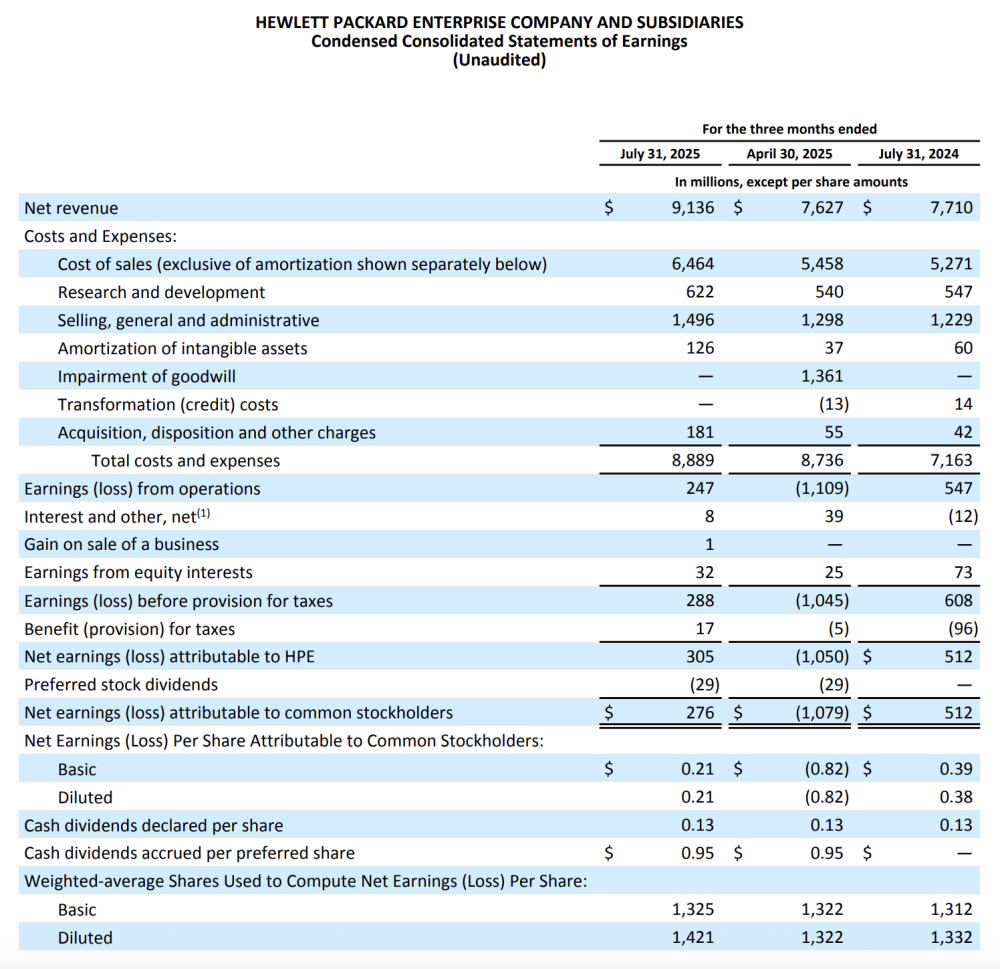

Third Quarter Fiscal 2025 Financial Results

- Revenue: $9.1 billion, up 19% from the prior-year period in actual dollars and 18% in constant currency(1)

- Annualized revenue run-rate (“ARR”)(2): $3.1 billion, up 77% from the prior-year period in actual dollars and 75% in constant currency(1)

- Gross margins

- GAAP of 29.2%, down 240 basis points from the prior-year period and up 80 basis points sequentially

- Non-GAAP(1) of 29.9%, down 190 basis points from the prior-year period and up 50 basis points sequentially

- Diluted net earnings per share (“EPS”)

- GAAP of $0.21, down $0.17 from the prior-year period

- Non-GAAP(1) of $0.44, down $0.06 from the prior-year period and within our outlook range of $0.40 – $0.45

- Cash flow from operations: $1,305 million, an increase of $151 million from the prior-year period

- Free cash flow (“FCF”)(1)(3): $790 million, an increase of $121 million from the prior-year period

- Capital returns to common shareholders: $171 million in the form of dividends

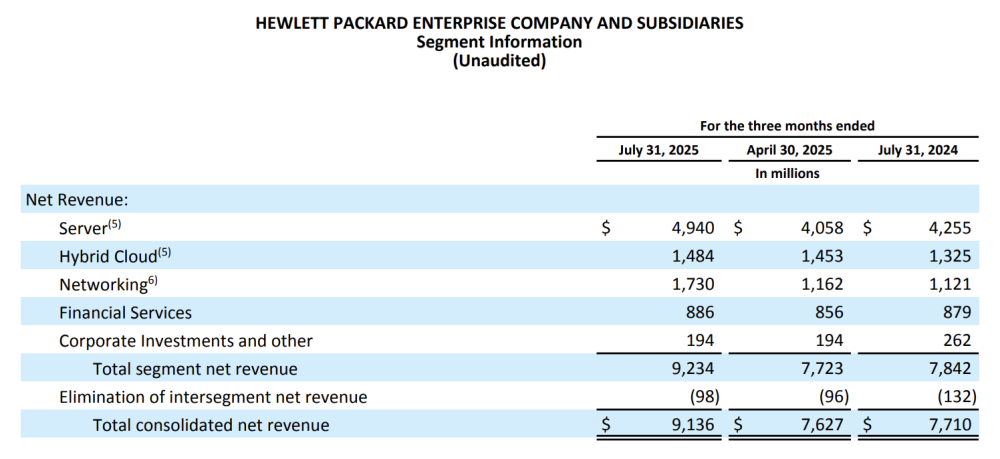

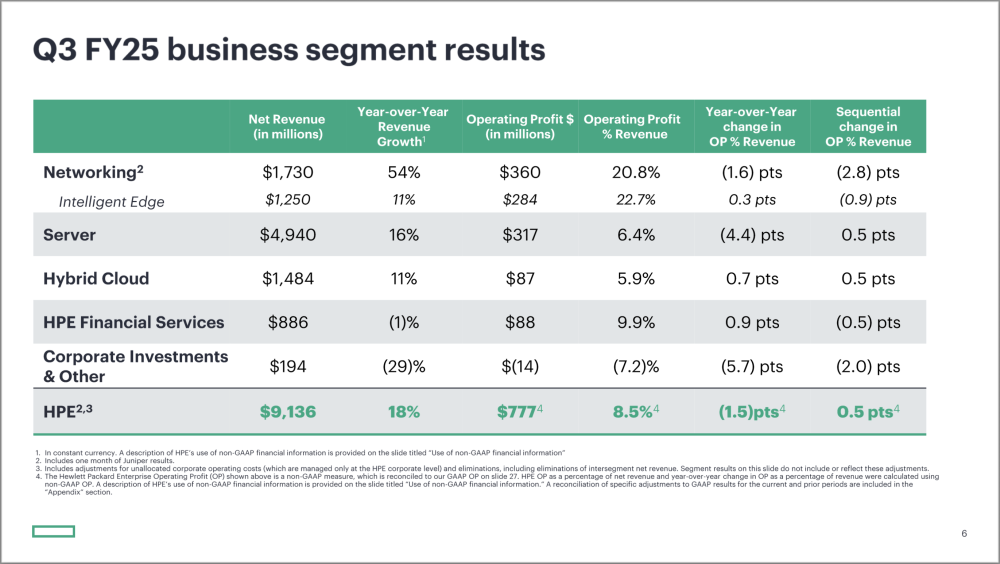

Third Quarter Fiscal 2025 Segment Results

- Server revenue was $4.9 billion, up 16% from the prior-year period in actual dollars and in constant currency(1), with 6.4% operating profit margin, compared to 10.8% from the prior-year period.

- Networking(4) revenue was $1.7 billion, up 54% from the prior-year period in actual dollars and in constant currency(1), with 20.8% operating profit margin, compared to 22.4% from the prior-year period. The Networking segment was renamed from Intelligent Edge to more precisely reflect the business and the market of this segment.

- Hybrid Cloud revenue was $1.5 billion, up 12% from the prior-year period in actual dollars and 11% in constant currency(1), with 5.9% operating profit margin, compared to 5.2% from the prior-year period.

- Financial Services revenue was $886 million, up 1% from the prior-year period in actual dollars and down 1% in constant currency(1), with 9.9% operating profit margin, compared to 9.0% from the prior-year period. Net portfolio assets of $13.2 billion, up 0.7% from the prior-year period and 17.9% in constant currency(1). The business delivered return on equity of 17.7%, up 0.3 points from the prior-year period.

Click to enlarge

Click to enlarge

Fiscal 2025 Fourth Quarter Outlook

HPE estimates revenue to be in the range of $9.7 billion and $10.1 billion. HPE estimates GAAP diluted net EPS to be in the range of $0.50 to $0.54 and non-GAAP diluted net EPS(1) to be in the range of $0.56 to $0.60. Fiscal 2025 fourth quarter non-GAAP diluted net EPS estimate excludes net after-tax adjustments of approximately $0.06 per diluted share, primarily related to acquisition, disposition and other charges, stock-based compensation expense, and cost reduction program, partially offset by tax adjustments.

Fiscal 2025 Outlook

HPE estimates fiscal 2025 revenue growth of 14% to 16%, in constant currency(1)(6), and fiscal 2025 GAAP operating profit growth to be in the range of negative 112% to negative 109%(7) and non-GAAP operating profit(1)(5) growth to be 4% to 7%. HPE estimates GAAP diluted net EPS to be in the range of $0.42 and $0.46(7) and non-GAAP diluted net EPS(1) to be in the range of $1.88 to $1.92. Fiscal 2025 non-GAAP diluted net EPS estimate excludes net after-tax adjustments of approximately $1.46 per diluted share, primarily related to impairment of goodwill, acquisition, disposition and other charges, stock-based compensation expense, and cost reduction program, partially offset by tax adjustments and the gain from the disposition of Communications Technology Group. HPE estimates free cash flow(1)(3)(6) of approximately $700 million.

Close of Juniper Networks Acquisition

HPE closed its acquisition of Juniper Networks Inc. on July 2, 2025. HPE’s Q3 results include the consolidation of Juniper Networks’ financial results from the period between July 2, 2025, and July 31, 2025.

1 A description of HPE’s use of non-GAAP financial information is provided below under “Use of non-GAAP financial information and key performance metrics.”

2 Annualized Revenue Run-Rate (“ARR”) is a financial metric used to assess the growth of the Consumption Services offerings. ARR represents the annualized revenue of all net HPE GreenLake cloud services revenue, related financial services revenue (which includes rental income from operating leases and interest income from finance leases), and software-as-a-Service, software consumption revenue, and other as-a-Service offerings, by taking such revenue recognized during a quarter and multiplying by four. To better align the calculation of ARR with Juniper Networks’ business and offerings, beginning with the quarter ended July 31, 2025, we also included revenue from software licenses support and maintenance in our ARR calculation, and will continue to do so going forward. The impact of this change was not material to the current and prior periods presented. We use ARR as a performance metric. ARR should be viewed independently of net revenue and is not intended to be combined with it.

3 Free cash flow represents cash flow from operations, less net capital expenditures (investments in property, plant & equipment (“PP&E”) and software assets less proceeds from the sale of PP&E), and adjusted for the effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash.

4 During the third quarter of fiscal 2025, the Intelligent Edge segment was renamed to Networking. The segment name change did not result in any change to the composition of the Company’s segments and therefore no prior information was recast; further, the designation change did not impact the Company’s condensed consolidated financial statements.

5 FY25 non-GAAP operating profit excludes costs of approximately $3.6 billion primarily related to impairment of goodwill, acquisition, disposition and other charges, stock-based compensation expense, and cost reduction program.

6 Hewlett Packard Enterprise provides certain guidance on a non-GAAP basis. In reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, Hewlett Packard Enterprise is unable to provide a reconciliation to the most directly comparable GAAP financial measure without unreasonable efforts, as the Company cannot predict some elements that are included in such directly comparable GAAP financial measure. These elements could have a material impact on the Company’s reported GAAP results for the guidance period. Refer to the discussion of non-GAAP financial measures below for more information.

7 Includes the impact of $1.4 billion impairment of goodwill recorded in Q2 of fiscal 2025.

Comments

Very solid quarter with $9.1 billion, up 18% sequentially and 18% YoY. First 9 months reached $24.55 billion with an ARR (here Annual Recurrent Revenue) of $33 billion. FY24 and FY23 were respectively $30.11 billion and $29.12 billion with 3% of growth YoY.

The major event this year is obviously the validated acquisition of Juniper Networks, confirming the desire of the company to dig into advanced networking following some past moves. This new era is illustrated by the new logo.

Click to enlarge

The revenue segmentation chosen by the company confirms that HPE is a generic player exposing revenues with server, hybrid cloud, networking and financial services. Of course, acquisitions by the company invited them to play in some specialized domains, it was the case with Convex, Rackable/SGI or Cray in HPC.

Where is storage? present as a subsegment, so it illustrates that storage is not a priority for HPE but server and networking are. Of course, storage is also covered by some dedicated solutions in HPC and we expect the company to offer some products for AI storage.

Server business contributes for 54% of the quarter revenue, 16% for the hybrid cloud and almost 19% for networking. HPE server revenues illustrates that the company is strong in the processing aspect of AI.

Click to enlarge

What is true for several years, storage is built from server especially with the software-defined storage model in addition to dedicated appliances and hardware as we mentioned above. But the fact that HPE decided to not show storage as a top segment name gives indication to the market. Like many big irons companies, the company invest on block storage and partner for file and object. HPE added its own object storage solution creating some confusion within its partners ecosystem and end-users.

Click to enlarge

And last point, we searched the word "storage" in the Q3 2025 earnings presentation and guest what, no result !!

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter