Microchip Technology: Fiscal 1Q26 Financial Results

Sequential growth but down from last year

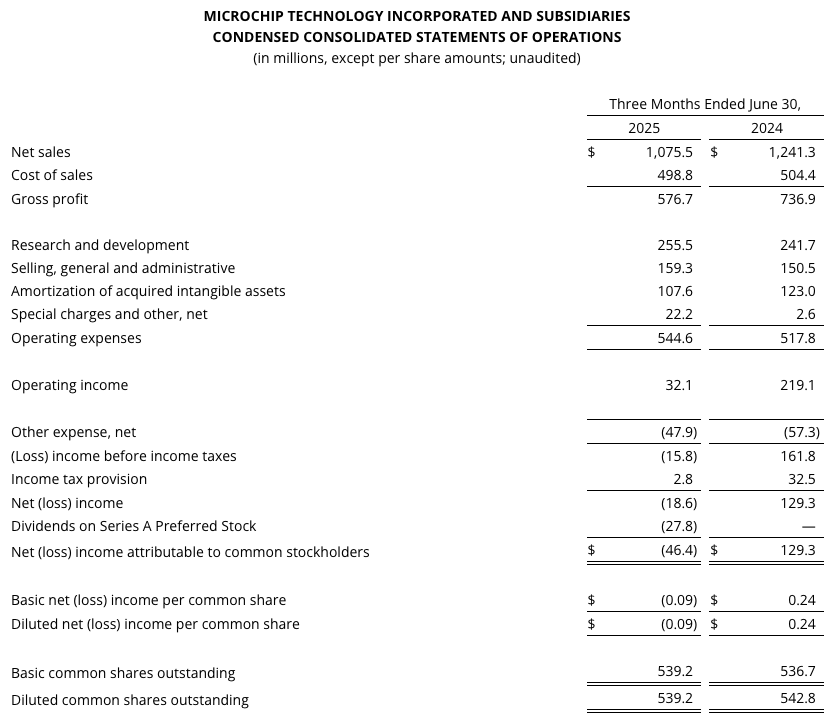

This is a Press Release edited by StorageNewsletter.com on August 19, 2025 at 2:02 pm- Net sales of $1.0755 billion, increased 10.8% sequentially and declined 13.4% from the year ago quarter. The midpoint of our updated guidance provided on May 29, 2025 was net sales of $1.0575 billion.

- On a GAAP basis: gross profit of 53.6%; operating income of $32.1 million and 3.0% of net sales; net loss attributable to common stockholders of $46.4 million; and loss of $0.09 per diluted share. Our updated guidance provided on May 29, 2025 was for GAAP EPS loss per diluted share of $0.11 to $0.07.

- On a Non-GAAP basis: gross profit of 54.3%; operating income of $222.3 million and 20.7% of net sales; net income of $154.7 million; and EPS of $0.27 per diluted share. Our updated guidance provided on May 29, 2025 was for Non-GAAP EPS per diluted share of $0.22 to $0.26.

- Returned approximately $245.5 million to common stockholders in the June quarter through dividends.

- Quarterly dividend on common stock declared for the September quarter of 45.5 cents per share.

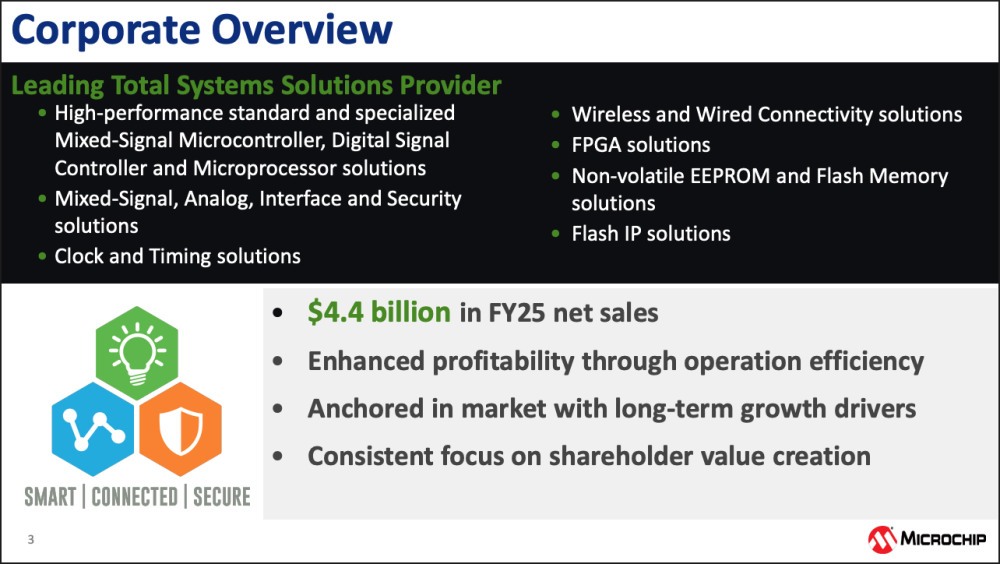

Microchip Technology Inc., a provider of smart, connected, and secure embedded control solutions, reported results for the three months ended June 30, 2025.

“Fiscal 2026 is off to a strong start as revenue grew 10.8% sequentially to approximately $1.0755 billion, well ahead of our revised guidance. As we execute our strategic imperatives under our nine-point recovery plan, we are seeing improvements across key financial metrics and emerging from the prolonged industry downturn with enhanced operational capabilities and a strengthened financial position. The momentum from the March quarter has accelerated into fiscal 2026, validating our strategic plan and positioning us well to capitalize on the recovery,” said Steve Sanghi, CEO and president, Microchip.

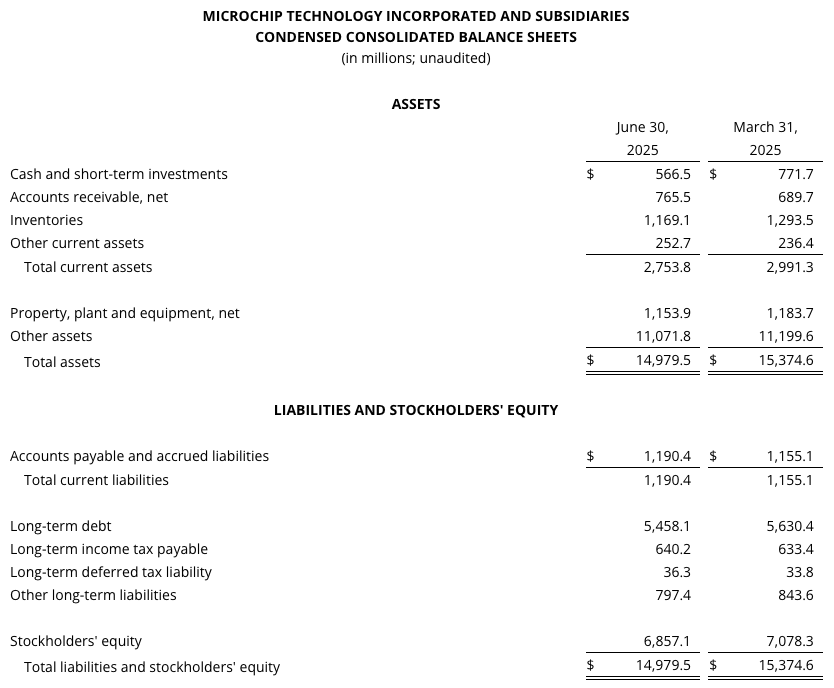

“As a key objective of our recovery plan, we delivered a substantial inventory reduction in the June quarter, reducing overall inventory dollars by $124.4 million, with distribution inventory days reduced by 4 days to 29 days and inventory days on our balance sheet declining to 214 days, improving our working capital efficiency. This continued progress on our inventory optimization demonstrates the effectiveness of our manufacturing improvements and positions us with increased operational flexibility as demand conditions continue to strengthen,” added Sanghi.

“Our first quarter results highlight the leverage in our business model, with incremental non-GAAP gross margins of 76% and incremental non-GAAP operating margins of 82% showcasing our ability to translate revenue growth directly to profitability. We achieved solid sequential margin expansion driven by operational improvements, including declining inventory write-offs and reduced underutilization charges. As we execute our strategic plan and benefit from improving demand conditions, we expect this operational leverage to support sustained margin expansion and enhanced cash flow generation as we drive towards our long-term business model goals,” commented Eric Bjornholt, CFO, Microchip.

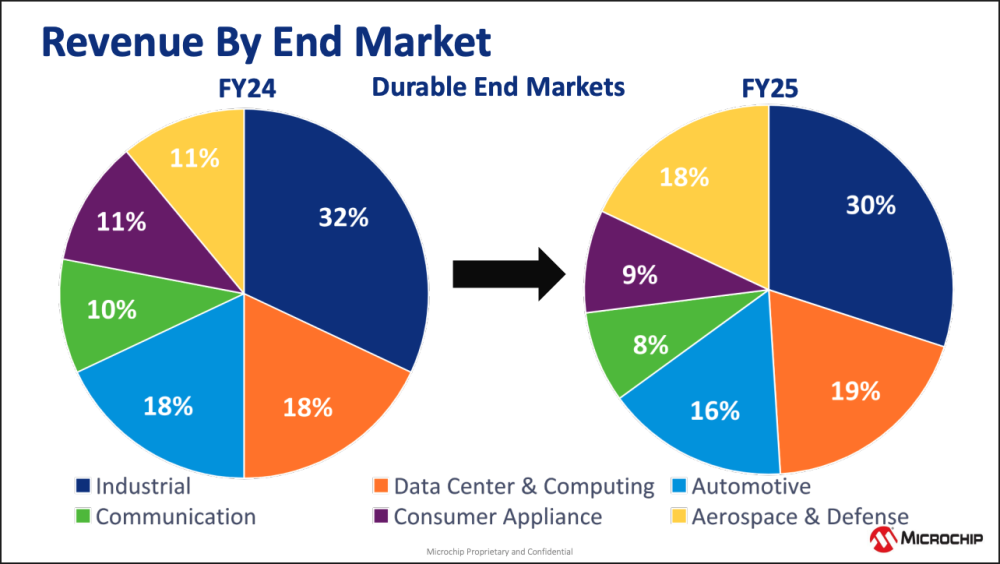

“Our Total System Solutions strategy continues to secure design wins with tier-one cloud providers for AI infrastructure and defense applications amid accelerating global defense spending. These design wins position us at the center of two secular growth trends where our integrated solutions, combining processing power, security, and energy efficiency, are essential,” added Rich Simoncic, COO, Microchip.

“Inventory destocking has continued to occur at our customers, channel partners and their downstream customers. The trifecta effect we have discussed, including recovery in distributor sell-through, narrowing of distributor sell-in and sell-out gaps, and normalization of direct customer inventory, is driving our revenue growth. Our September quarter backlog is running ahead of June quarter levels, and July bookings were the highest since July 2022. Customer engagement levels continue strengthening across our diversified end markets. Taking all these factors into account, we expect September quarter net sales of $1.130 billion plus or minus $20.0 million, representing approximately 5.1% sequential growth at the midpoint. While we are maintaining a disciplined approach given the evolving macro environment, we believe we are well-positioned to deliver sustained growth and enhanced shareholder value as we execute our strategic roadmap throughout fiscal 2026,” concluded Sanghi.

Click to enlarge

Click to enlarge

Comments

To summarize the company has generated $1.07 billion for the Q1 FY2025 up 10.8% QoQ but down 13.4% YoY. The full financial announcement is posted here. For the full FY 2025 Microchip generated $4.4 billion.

Click to enlarge

For our readers, Microchip today is the result of an active strategy of acquisitions and among them, we noticed PMC-Sierra in 2016 for $2.5 billion and Microsemi in 2018 for $10.15 billion. PMC-Sierra has acquired the famous brand Adaptec in 2010, a pioneer of RAID card. At recent FMS conference, Microchip unveiled its last Adaptec SmartRAID accelerator to support NVMe SSDs, more details here.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter