Cloud Software Group to Acquire Arctera

The firm continues to extend its IT solutions coverage with extensive portfolio

This is a Press Release edited by StorageNewsletter.com on August 7, 2025 at 2:02 pm- Transaction Marks Key Step in Cloud Software Group’s M&A Focused Growth Strategy

- Bolsters Cloud Software Group’s Portfolio with a Leading Data Management and Protection Provider

Cloud Software Group, Inc. announced that it has entered into a definitive agreement to acquire Arctera, a global player in data management, from funds affiliated with global investment firm Carlyle. Terms of the transaction were not disclosed. Upon close, Arctera will operate as a standalone business unit within the Cloud Software Group portfolio.

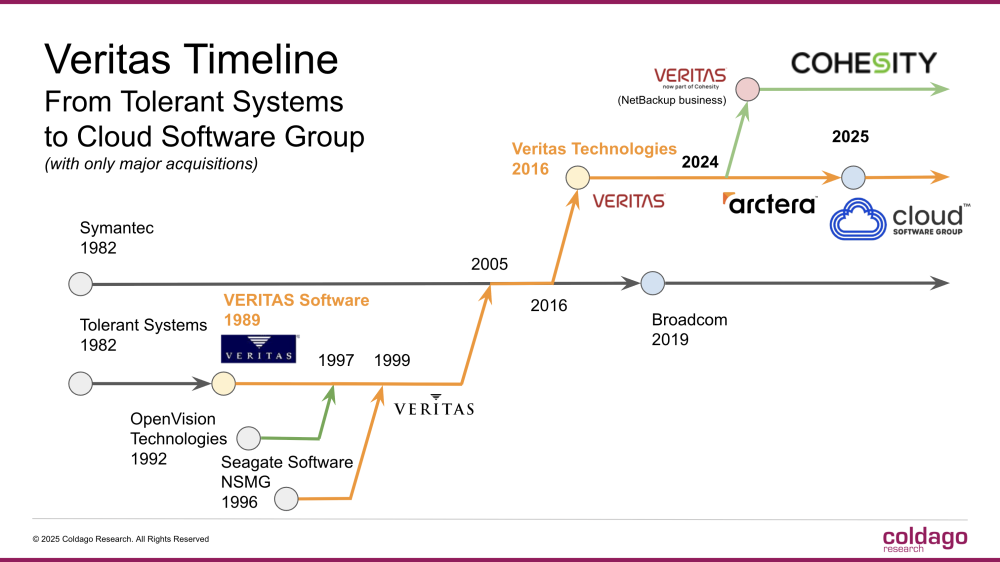

Arctera is a global data management company created in 2024 following the combination of Veritas’ Enterprise Data Protection business with Cohesity. Arctera’s portfolio comprises Data Resilience delivered through InfoScale, Data Compliance through the Insight platform and Data Protection through Backup Exec. Arctera helps organizations thrive by delivering market-leading solutions that enable customers to trust, access and illuminate critical data. Headquartered in Pleasanton, California with employees and facilities around the world, Arctera delivers tailored data solutions to thousands of customers globally and generates more than $400 million of annual revenue and more than 40% adjusted EBITDA margins.

“This acquisition marks an exciting milestone for Cloud Software Group and an important step forward in our long-term growth strategy,” said Tom Krause, CEO, Cloud Software Group. “We have a strong track record of continuing to invest in our portfolio of leading software brands, as evidenced by our work to improve profitability and long-term sustainability of the Citrix and TIBCO businesses. Looking ahead, we aim to acquire at-scale enterprise-focused software businesses that provide proven mission-critical capabilities and high value to public and private sector customers while also ensuring they’re a good fit to operate within our proven Cloud Software Group model.”

“We have long admired Arctera’s business and the work that the Arctera and Carlyle teams have done to expand the business. Arctera has grown into a leading provider of data and enterprise infrastructure software solutions for customers worldwide, and we are confident that Arctera’s portfolio of Data Resilience, Data Compliance and Data Protection products will be a natural complementary addition to Cloud Software Group. We look forward to expanding the services and products we provide for both sets of customers through this acquisition,” added Krause.

“We are thrilled to enter this next chapter in Arctera’s evolution as we become a part of the Cloud Software Group team,” said Lawrence Wong, CEO, Arctera. “Our mission has been to build on our pedigree of innovation across our three distinct product lines, each tailored to solve the most demanding data challenges for their customers. With Cloud Software Group’s global resources, industry leading portfolio and seasoned leadership team, Arctera will be even better positioned to continue helping customers manage one of their most valuable assets: data.”

The transaction is expected to close in the fourth quarter of 2025, subject to certain regulatory approvals and customary closing conditions. Cloud Software Group expects to fund the acquisition using cash on its balance sheet. Skadden, Arps, Slate, Meagher & Flom LLP is acting as legal counsel to Cloud Software Group. Citi is serving as exclusive financial advisor and Alston & Bird LLP is acting as legal counsel to Arctera.

Comments

What a coincidence, I was at the Arctera HQ last Friday as I anticipated some moves for a very simple reason and question: what could be the trajectory of Arctera or in other words, under this new name, will the new entity be able to survive and grow its business?

What could have been the trajectory?

- continue as an independent company, my initial opinion was around 20% of chance, as it represents a very sensitive and delicate direction,

- do an exit first with an IPO, 0% of chance in my humble opinion, but could have decided some acquirers to make offers and finally to do what after that...

- or second, be acquired by a software giant, and my initial prediction was around 80%.

The official split with Cohesity was December 10, 2024 and Carlyle has triggered some clear steps since the initial desire to monetize Veritas investment made in 2016 and we're almost 10 years later...

The root of the questions is based on the fact that Cohesity acquired the Veritas brand with the NetBackup business as these two elements are really linked together even if "purists" can argue that Veritas is historically synonymous of VxFS and VxVM ;-)

The other remark is about the Backup Exec product a bit independent like an orphan with a huge challenge to rebuild its image and channel as it is a real volume product, a reference in the past in the Windows ecosystem.

InfoScale is strong, I should say has a strong faithfull installed base, even lovers, and represent an significant part of the revenue but the market has evolved a lot both in terms of IT models but also in terms of storage topologies, needs, deployments... Cloud had a serious impact on this.

And the compliance line which represents an interesting portfolio.

Back to my original point, it would have been a surprise if Carlyle won't decide to sell this second piece of the puzzle as they own Arctera. So today the financial firms received billions in the Cohesity and Arctera deals.

Now the exit made with Cloud Software Group (CSG) invites me immediately to think about past conglomerates like Platinum or CA even also OpenVision Technologies when they acquired NetBackup...but at a different scale.

For CSG the ambition is clear adding Arctera DNA and product line to existing lines of business with Citrix, Tibco, Information Builders, Stopfire and Jaspersoft. Being already a giant generating $4.3 billion, the company, not so visible as the various brands and entities continue to operate under their name, boosts its valuation with this new asset reinforcing its infrastructure and applications play. And as the timeline below shows, products that have been developed a few decades ago will continue to exist...

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter