MaxLinear: Fiscal 2Q25 Financial Results

Revenue of $108.8 million, up 13% Q/Q, up 18% Y/Y

This is a Press Release edited by StorageNewsletter.com on August 14, 2025 at 2:02 pmMaxLinear, Inc., a provider of radio frequency (RF), analog, digital and mixed-signal integrated circuits, announced financial results for the second quarter ended June 30, 2025.

Second Quarter Financial Highlights

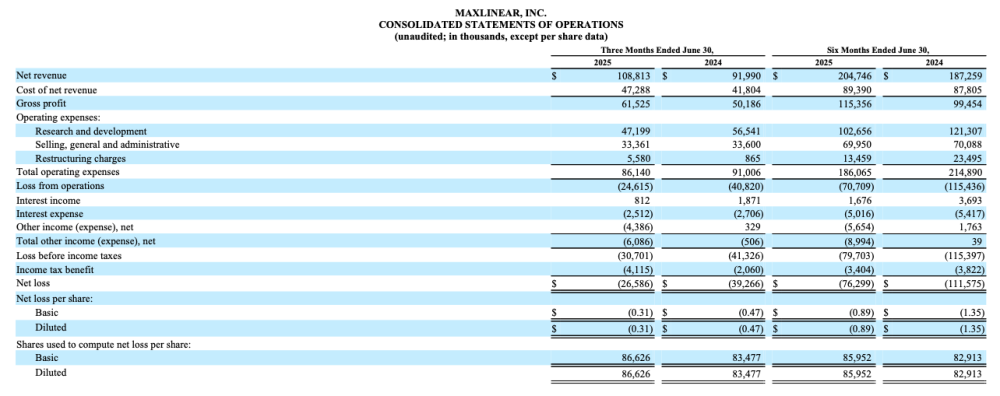

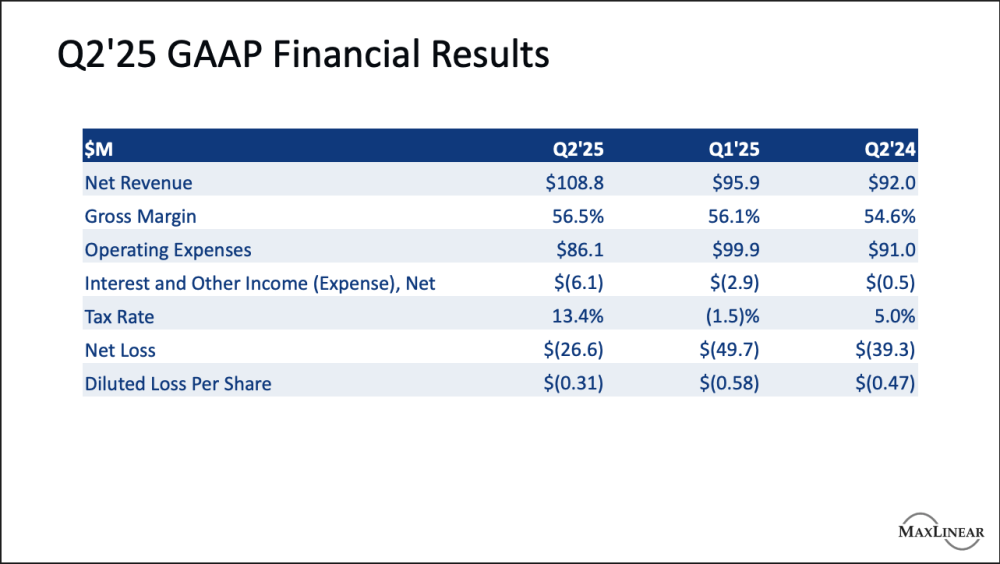

GAAP basis:

- Net revenue was $108.8 million, up 13% sequentially and up 18% from the year-ago quarter.

- GAAP gross margin was 56.5%, compared to 56.1% in the prior quarter, and 54.6% in the year-ago quarter.

- GAAP operating expenses were $86.1 million in the second quarter, or 79% of net revenue, compared to $99.9 million in the prior quarter, or 104% of net revenue, and $91.0 million in the year-ago quarter, or 99% of net revenue.

- GAAP loss from operations was 23% of net revenue, compared to loss from operations of 48% of net revenue in the prior quarter, and loss from operations of 44% of net revenue in the year-ago quarter.

- Net cash flow provided by operating activities was $10.5 million, compared to net cash flow used in operating activities of $11.4 million in the prior quarter, and net cash flow used in operating activities of $2.7 million in the year-ago quarter.

- GAAP diluted loss per share was $0.31, compared to diluted loss per share of $0.58 in the prior quarter, and diluted loss per share of $0.47 in the year-ago quarter.

Non-GAAP basis:

- Non-GAAP gross margin was 59.1%, compared to 59.1% in the prior quarter, and 60.2% in the year-ago quarter.

- Non-GAAP operating expenses were $56.6 million, or 52% of net revenue, compared to $58.4 million or 61% of net revenue in the prior quarter, and $74.8 million or 81% of net revenue in the year-ago quarter.

- Non-GAAP income from operations was 7% of net revenue, compared to loss of 2% in the prior quarter, and loss of 21% in the year-ago quarter.

- Non-GAAP diluted earnings per share was $0.02, compared to loss of $0.05 in the prior quarter, and loss of $0.25 in the year-ago quarter.

Management Commentary

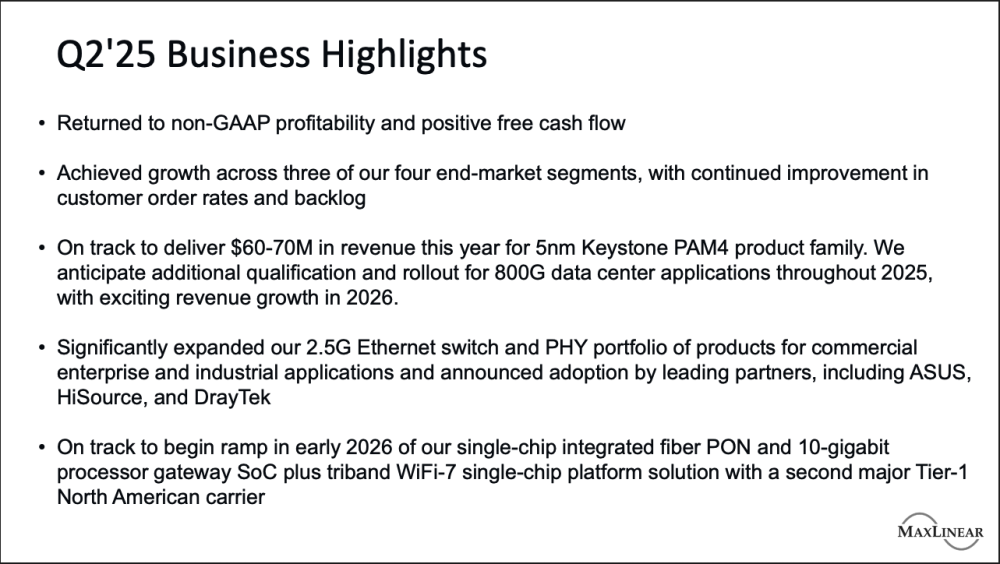

“Our second quarter results reflect strong sequential and year-over-year growth in our business,” said Kishore Seendripu, PhD, chairman and CEO. “With solid execution, we exceeded the mid-point of our revenue guidance, returned to profitability on a non-GAAP basis, and generated positive free cash flow in Q2. We have continued to drive strong customer and product traction in high-speed interconnects for the data center, multi-gigabit PON access, Wi-Fi connectivity, ethernet, and wireless infrastructure. Our success in these strategic end markets, coupled with improved customer order rates, and strengthening product backlog, give us confidence in our growth for 2025 and 2026.”

Third Quarter 2025 Business Outlook

The company expects net revenue in the third quarter of 2025 to be approximately $115 million to $135 million. The Company also estimates the following:

- GAAP gross margin of approximately 55.0% to 58.0%;

- Non-GAAP gross margin of approximately 57.5% to 60.5%;

- GAAP operating expenses of approximately $84 million to $90 million;

- Non-GAAP operating expenses of approximately $55 million to $61 million;

- GAAP and non-GAAP interest and other expense of approximately $3.5 million to $4.5 million, respectively;

- GAAP income tax benefit of $0.6 million and non-GAAP income tax provision of $1.3 million, respectively; and

- Basic and diluted share count of approximately 87.1 million and 87.5 million, respectively.

Click to enlarge

Comments

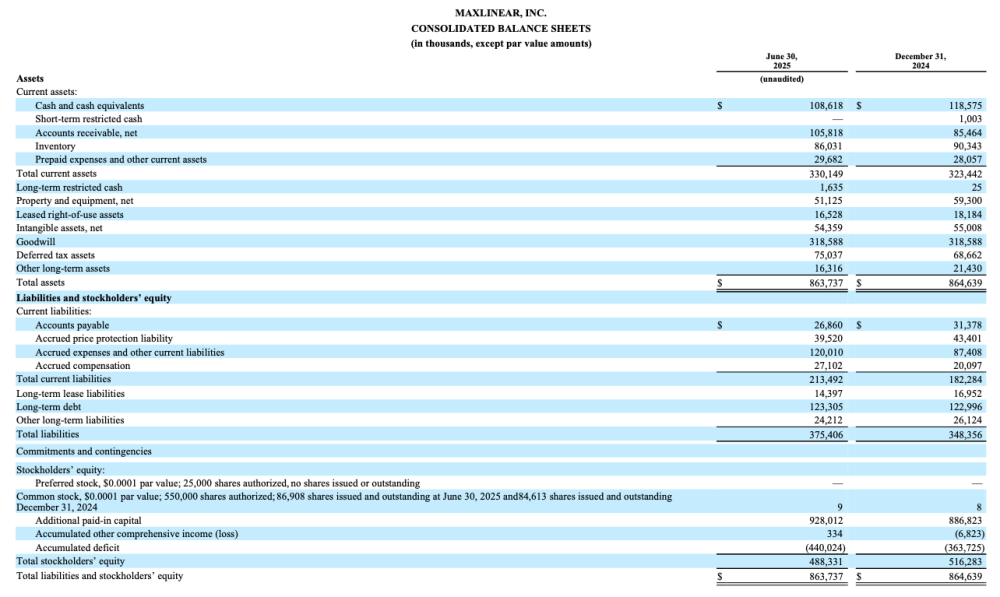

The full presentation is available here. Results for 2Q25 reached $108.8, +13% QoQ and +18% YoY that appeared to be in a positive trajectory. FY2024 net revenue was $360 million and FY2023 at $693 million, down 48%.

Click to enlarge

Click to enlarge

MaxLinear announced recently the Panther V Storage Accelerator and demonstrated this new iteration at FMS. It delivers ultra-low latency, 450Gb throughput, 12:1 data reduction, and PCIe Gen5 x 16 interface connectivity. More info here.

The company has tried to merge with Silicon Motion 2 years ago.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter