3Q25 NAND Flash Contract Prices Projected to Rise 5-10%

Weak smartphone demand limits eMMC and UFS growth, says TrendForce

This is a Press Release edited by StorageNewsletter.com on July 16, 2025 at 2:02 pmLatest investigations from TrendForce Corp find that the NAND flash market has seen significant improvement in supply-demand balance following production cuts and inventory reduction in the first half of 2025. As suppliers shift production capacity toward higher-margin products, the overall supply in circulation has tightened.

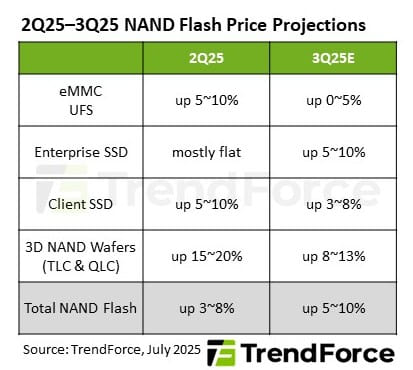

On the demand side, increased enterprise investment in AI and mass shipments of NVIDIA’s next-gen Blackwell chips have provided strong support. Looking ahead to the third quarter, average NAND flash contract prices are projected to rise by 5% to 10%. However, due to an uncertain outlook for smartphone demand in the second half of the year, price increases for eMMC and UFS products are expected to be more modest.

Client SSDs benefit from restocking as enterprise SSD supply lags behind surging orders

TrendForce reports that the client SSD market is set to experience strong restocking momentum in 3Q25, following better-than-expected inventory clearance by OEMs and ODMs in the first half of the year. Several factors are driving this rebound, including the end of Windows 10 support, increased replacement demand spurred by new CPU launches, and surging interest in China’s DeepSeek all-in-one PCs. In addition, suppliers are actively promoting high-capacity QLC products, further accelerating shipment volumes. As a result, client SSD contract prices are projected to rise by 3% to 8% in the third quarter.

Shipments of NVIDIA’s Blackwell platform are increasing each quarter, while general-purpose server demand is expanding in North America. Strong order momentum from top-tier Chinese clients is also expected to continue into the second half of the year, further driving enterprise SSD demand.

However, due to a surge in orders, some supply chain vendors are struggling to meet delivery deadlines. Coupled with capacity reductions implemented by suppliers earlier this year, enterprise SSD contract prices are projected to climb by 5% to 10% in 3Q25.

Flat eMMC and UFS demand; wafer supply faces constraints

In the mobile sector, although China’s consumer electronics subsidy policy remains in place for the second half of the year, most consumer demand has already been satisfied. In addition, the pull-in effect driven by US tariffs has weakened, resulting in lukewarm eMMC demand in Q3.

While supply is relatively abundant compared to other product categories, suppliers have reduced production of low-end models and raised wafer prices. This has led to higher costs for module makers, dampening their shipment momentum and causing inventories to rise. Consequently, eMMC contract prices in 3Q25 are expected to rise by 0% to 5%.

Smartphone demand remains uncertain, and the automotive market is still in the early stages of UFS adoption. This has led to a ‘subdued peak season’ in Q3. The UFS supply remains constrained since the NAND flash supply chain is prioritizing profit margins in capacity allocation. Accordingly, UFS contract prices are forecast to increase by 0% to 5% for the third quarter.

TrendForce notes that in the second quarter, suppliers prioritized end-market applications, squeezing module makers and causing wafer inventories to rise. Some module makers are taking a more conservative approach to wafer procurement in Q3, given softening demand for consumer-grade NAND flash in end markets.

On the supply side, overall NAND flash output is declining, with suppliers focusing on high-margin products and cutting wafer supply. As a result, wafer prices are expected to rise by 8% to 13% in the third quarter.

Comments

With one of the industry annual rendez-vous around the corner, FMS with its 2025 edition early August in Santa Clara, CA, and the pressure put by HPC and obviously AI on infrastructure and vendors, we expect several announcements and progress in various areas.

If you remember, in 2023, at the show, Solidigm unveiled its 61.44TB SSD, in 2024 at various events, we saw several vendors announcing 122-128TB SSD so we can reasonably think of news about 240-250TB SSD from some of exhibitors.

It also means several news around PCIe Gen 5 and 6 and new controllers capabilities such as security for instance, more parallelism, data integrity and protection, different form factors with client, server and data center models, density with new number of layers, NAND type and die size and we saw a few iterations of SLC, of course TLC and QLC, NVMe with FDP, DPU and offloads engines, CXL and memory with new DDR and HBM and other developments around power consumption and globally performance.

The exhibitors list is quite impressive with some companies organizing side events and (re)new participation from DDN, Hammerspace, Infinidat, Nimbus Data, Pliops or Pure Storage.

As a tradition, FMS always delivered its train of good news.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter