New Backup and Data Protection MQ from Gartner for 2025

Some efforts have been made with still some strange selection

By Philippe Nicolas | July 10, 2025 at 2:02 pmOnce again, Gartner changes the name of this Magic Quadrant (MQ) arguing some market changes needed alignments. It comes from “Enterprise Backup and Recovery Software Solutions” to “Backup and Data Protection Platforms”.

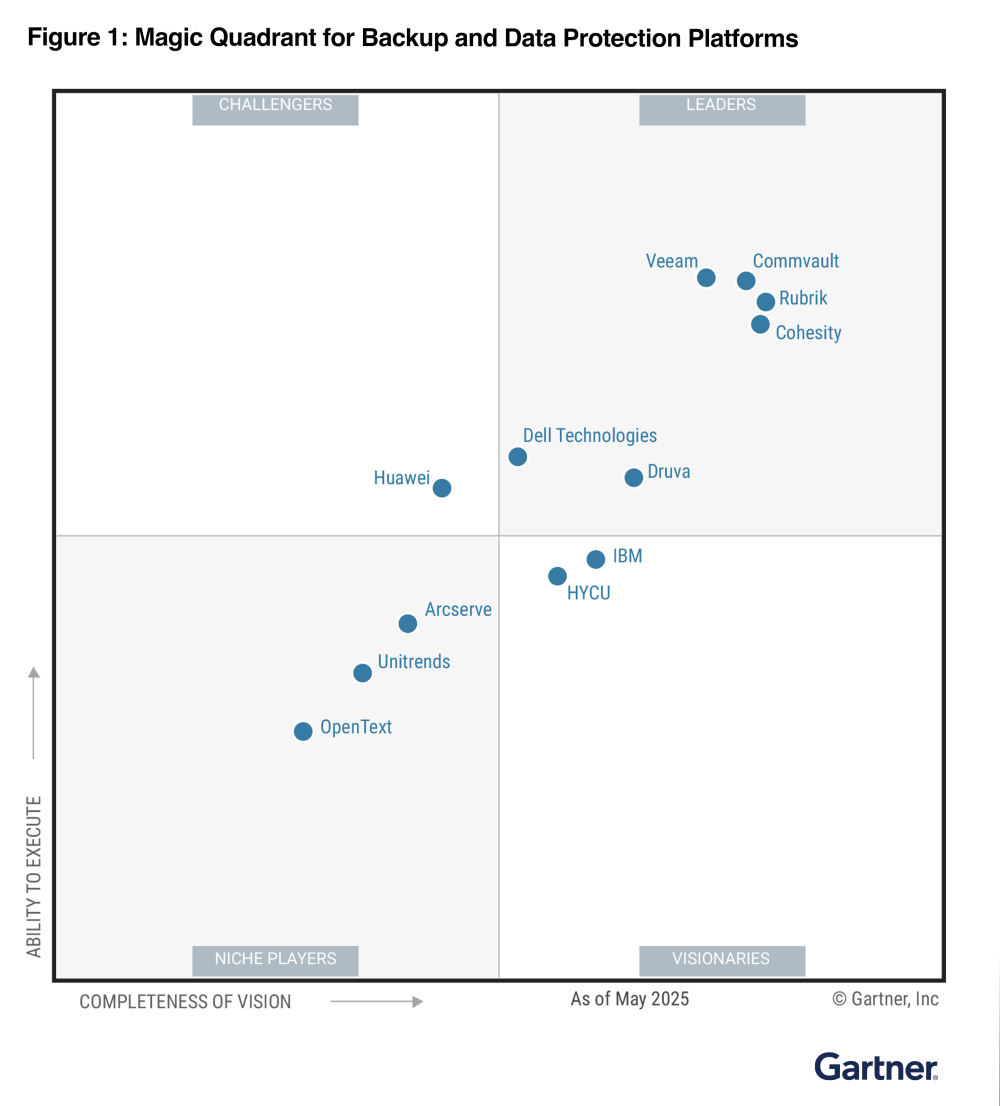

This MQ continues to surf on its past reputation but, as usual, some questions appear on every lips. Several players mentioned in the report offer to download the document after registration, we let you pick your preferred one. Of course the quadrant image itself, the one below, is distributed freely on many websites without any registration need.

The good thing is the consideration of backup software, services and integrated secondary storage and it is well translated in several companies’ portfolio. It is good to see the consideration of some segments convergence in the domain fueled by some key acquisitions like Clumio or Appranix and even before Hedvig for Commvault, Kasten and Alcion by Veeam, Datos.io and Igneous by Rubrik and of course the NEW cohesity entity shaking the market, fueled by Veritas NetBackup product and impressive installed base.

Dell is still a leader, Druva is promoted in this leader group but globally it is a confirmation of positions with Veeam, Commvault, Cohesity and Rubrik, all these 4 leading the pack.

We see Huawei added to the list reflecting their growing market presence. HYCU makes progress and Microsoft disappears. We’re still surprised to not see Kaseya with their Spanning Cloud Apps, Datto and associated Backupify, and Unitrends entities, the latter being the only one present in this report. There is also no remark about NinjaOne especially after the acquisition of the Australian company Dropsuite and their new VC round, probably too recent and too narrow. Where is Acronis and we read a remark about Bacula, very well deployed being an open source solution with a different pricing model, limiting its revenue but not its market penetration.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter