HPE: Fiscal 2Q25 Financial Results

Revenue of $7.6 billion, up 6% Y/Y, expecting $8.2-8.5 billion next quarter and 7-9% growth for the full FY25

This is a Press Release edited by StorageNewsletter.com on June 5, 2025 at 2:02 pmHewlett Packard Enterprise Development LP (HPE) announced financial results for the second quarter ended April 30, 2025.

“We delivered a solid performance, achieving yet another quarter of Y/Y revenue growth with strength in each of our product segments,” said Antonio Neri, president and CEO, Hewlett Packard Enterprise. “In a very dynamic macro environment, we executed our strategy with discipline. We remain focused on bringing breakthrough innovation to our customers while increasing profitability and enhancing shareholder value.“

“We drove higher revenue Y/Y in Q2 across Server, Intelligent Edge, and Hybrid Cloud, and, importantly in Server, we improved margin performance over the course of the quarter,” said Marie Myers, executive VP and CFO, Hewlett Packard Enterprise. “We are maintaining our focus on achieving efficiencies and streamlining operations across our businesses to position HPE for the future and deliver financial results aligned with our fiscal 2025 outlook.“

Second Quarter Fiscal 2025 Financial Results

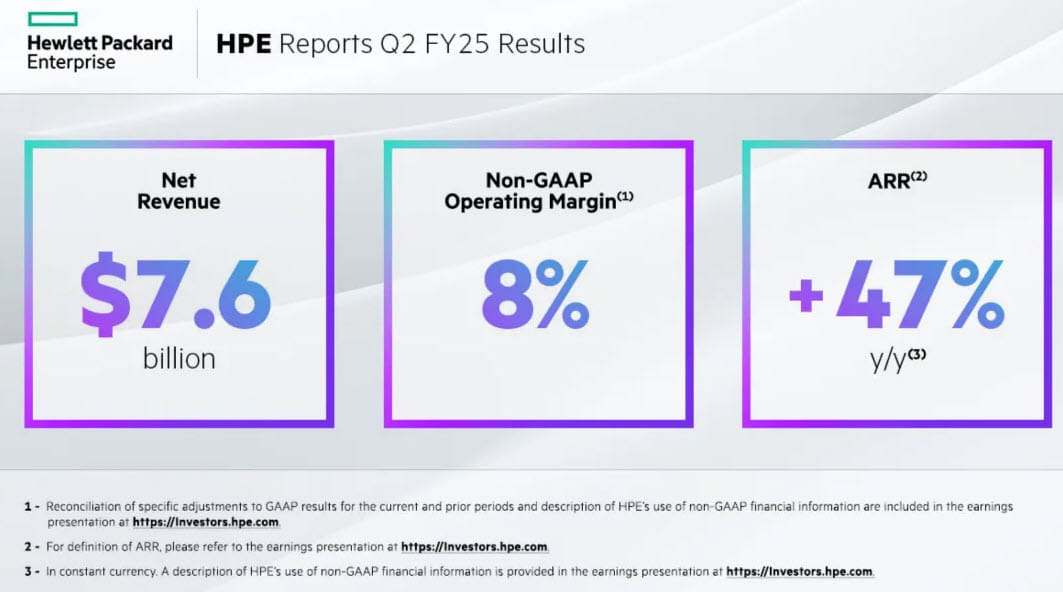

- Revenue: $7.6 billion, up 6% from the prior-year period in actual dollars and 7% in constant currency (1)

- Annualized revenue run-rate (ARR) (2): $2.2 billion, up 46% from the prior-year period in actual dollars and 47% in constant currency (1)

- Gross margins:

- GAAP of 28.4%, down 460 basis points from the prior-year period and down 80 basis points sequentially

- Non-GAAP (1) of 29.4%, down 370 basis points from the prior-year period and flat sequentially

- Diluted net (loss) earnings per share (EPS):

- GAAP of $(0.82), compared to $0.24 in the prior-year period, includes non-cash impairment of legacy goodwill impacting GAAP diluted net EPS by $1.03

- Non-GAAP (1) of $0.38, down 10% from the prior-year period and down 22% sequentially, above our guidance range of $0.28 – $0.34

- Cash flow from operations: $(461) million, a decrease of $1,554 million from the prior-year period

- Free cash flow (“FCF”) (1) (3): $(847) million, a decrease of $1,457 million from the prior-year period

- Capital returns to common shareholders: $221 million in the form of dividends and share repurchases

Second Quarter Fiscal 2025 Segment Results

- Server revenue was $4.1 billion, up 6% from the prior-year period in actual dollars and up 7% in constant currency(1), with 5.9% operating profit margin, compared to 11.0% from the prior-year period.

- Intelligent Edge revenue was $1.2 billion, up 7% from the prior-year period in actual dollars and 8% in constant currency(1), with 23.6% operating profit margin, compared to 21.8% from the prior-year period.

- Hybrid Cloud revenue was $1.5 billion, up 13% from the prior-year period in actual dollars and 15% in constant currency(1), with 5.4% operating profit margin, compared to 1.0% from the prior-year period.

- Financial Services revenue was $856 million, down 1.3% from the prior-year period in actual dollars and up 1% in constant currency(1), with 10.4% operating profit margin, compared to 9.3% from the prior-year period. Net portfolio assets of $13.3 billion, up 0.9% from the prior-year period and flat in constant currency(1). The business delivered return on equity of 17.5%, down 0.5 points from the prior-year period.

Dividend

The HPE Board of Directors declared a regular cash dividend of $0.13/share on the company’s common stock, payable on or about July 17, 2025, to stockholders of record as of the close of business on June 18, 2025.

Fiscal 2025 Third Quarter Outlook

HPE estimates revenue to be in the range of $8.2 billion and $8.5 billion. HPE estimates GAAP diluted net EPS to be in the range of $0.24 to $0.29 and non-GAAP diluted net EPS (1) to be in the range of $0.40 to $0.45. Fiscal 2025 third quarter non-GAAP diluted net EPS estimate excludes net after-tax adjustments of approximately $0.16 per diluted share primarily related to stock-based compensation expense, acquisition, disposition and other charges, the cost reduction program, and amortization of intangible assets.

Fiscal 2025 Outlook

HPE estimates fiscal 2025 revenue growth of 7% to 9%, in constant currency (1)(5), and fiscal 2025 GAAP operating profit growth to be in the range of negative 81% to negative 72% (6) and non-GAAP operating profit (1)(4) growth to be negative 7% to 0%. HPE estimates GAAP diluted net EPS to be in the range of $0.30 and $0.42(6) and non-GAAP diluted net EPS (1) to be in the range of $1.78 to $1.90. Fiscal 2025 non-GAAP diluted net EPS estimate excludes net after-tax adjustments of approximately $1.48 per diluted share, primarily related to impairment of goodwill, stock-based compensation expense, the cost reduction program, acquisition, disposition and other charges, amortization of intangible assets, and H3C divestiture related severance costs. HPE estimates free cash flow (1)(3)(5) of approximately $1 billion.

Download the Q2 FY25 full financial tables

(1) A description of HPE’s use of non-GAAP financial information is provided below under “Use of non-GAAP financial information and key performance metrics.“

(2) Annualized Revenue Run-Rate (ARR) is a financial metric used to assess the growth of the Consumption Services offerings. ARR represents the annualized revenue of all net HPE GreenLake cloud services revenue, related financial services revenue (which includes rental income from operating leases and interest income from finance leases), and software-as-a-Service, software consumption revenue, and other as-a-Service offerings, recognized during a quarter and multiplied by four. We use ARR as a performance metric. ARR should be viewed independently of net revenue and is not intended to be combined with it.

(3) Free cash flow represents cash flow from operations, less net capital expenditures (investments in property, plant & equipment (PP&E) and software assets less proceeds from the sale of PP&E), and adjusted for the effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash.

(4) FY25 non-GAAP operating profit excludes costs of approximately $2.5 billion primarily related to impairment of goodwill, stock-based compensation expense, the cost reduction program, acquisition, disposition and other charges, amortization of intangible assets, and H3C divestiture related severance costs.

(5) Hewlett Packard Enterprise provides certain guidance on a non-GAAP basis. In reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, Hewlett Packard Enterprise is unable to provide a reconciliation to the most directly comparable GAAP financial measure without unreasonable efforts, as the Company cannot predict some elements that are included in such directly comparable GAAP financial measure. These elements could have a material impact on the Company’s reported GAAP results for the guidance period. Refer to the discussion of non-GAAP financial measures below for more information.

(6) Includes the impact of $1.4 billion impairment of goodwill recorded in Q2 of fiscal 2025.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter