Off-Season Slowdown and Inventory Pressure Drive Over 20% Q/Q Revenue Drop

For top five NAND flash brands in 1Q25, says TrendForce

This is a Press Release edited by StorageNewsletter.com on June 4, 2025 at 2:02 pmLatest findings from TrendForce Corp. reveal that the top NAND Flash suppliers faced mounting inventory pressure and weakening end-market demand in the first quarter of 2025.

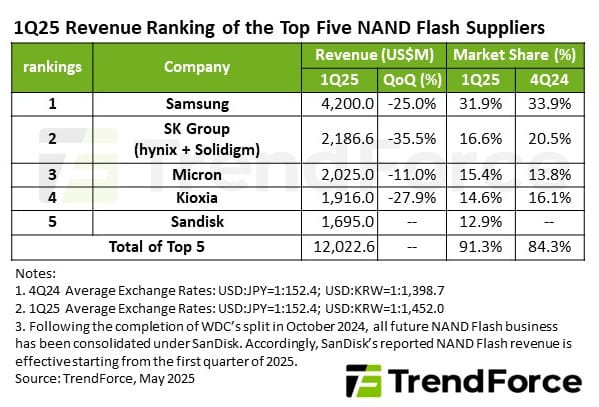

Consequently, the industry saw a 15% Q/Q decline in ASP and a 7% drop in shipment volume. Although some product prices rebounded by the end of the quarter, boosting demand, the combined revenue of the top 5 NAND flash brands still fell sharply to $12.02 billion – a nearly 24% Q/Q decline.

Looking ahead to Q2, TrendForce expects brand revenues to increase by around 10% Q/Q as end buyers gradually bring inventory back to health levels and NAND Flash prices rebound from the bottom, coupled with US tariffs driving some buyers to accelerate procurement.

A breakdown of key supplier performance in the first quarter reveals that Samsung retained the top position, with quarterly revenue dropping around 25% to $4.2 billion due to sluggish enterprise SSD demand. However, the rebound in NAND flash wafer prices in March helped improve profitability, and with NVIDIA’s new product shipments ramping up, Samsung’s revenue is expected to recover steadily in the coming quarters.

SK Group (including SK hynix and Solidigm) ranked second overall. As a supplier of large-capacity products in 2024, the company faced seasonal headwinds and challenges clearing 30TB SSD inventories, which dragged down both shipment bits and ASP and brought revenue down to $2.19 billion.

Micron Technology, Inc. benefited from increased shipment bits in Q1. Quarterly revenue reached $2.03 billion (-11% Q/Q) despite a decline in ASP, allowing it to rise to third place in quarterly revenue rankings for the first time.

Kioxia Corporation slipped to fourth place, with both shipment bits and ASP declining due to weak off-season demand. This resulted in Q1 revenue of $1.92 billion.

SanDisk Corp. (post-split from WDC) recorded slight declines in shipment bits and ASP to post Q1 revenue of $1.7 billion. The company is planning to ramp up shipments of QLC products to optimize profitability

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter