Marvell: Fiscal 3Q24 Financial Results

Q3 Net Revenue: $1.516 billion, grew by 7% YoY

This is a Press Release edited by StorageNewsletter.com on December 12, 2024 at 2:01 pmMarvell Technology, Inc. reported financial results for the 3rd quarter of fiscal year 2025.

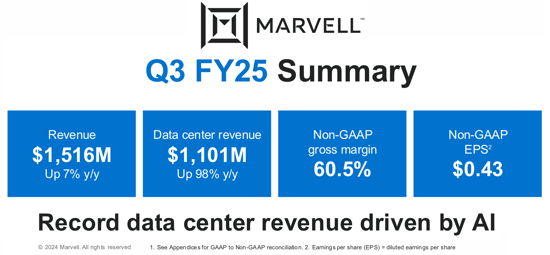

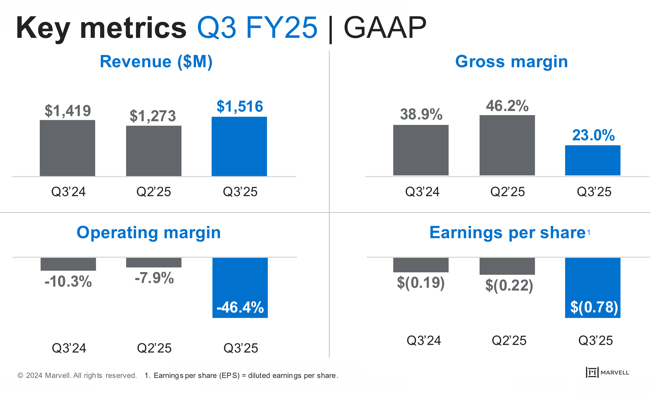

Net revenue for the 3rd quarter of fiscal 2025 was $1.516 billion, $66.0 million above the mid-point of the company’s guidance provided on August 29, 2024. GAAP net loss for the 3rd quarter of fiscal 2025 was $(676.3) million, or $(0.78) per diluted share. Non-GAAP net income for the 3rd quarter of fiscal 2025 was $373.0 million, or $0.43 per diluted share. Cash flow from operations for the 3rd quarter was $536.3 million.

“Marvell’s fiscal 3rd quarter 2025 revenue grew 19% sequentially, well above the mid-point of our guidance, driven by strong demand from AI. For the 4th quarter, we are forecasting another 19% sequential revenue growth at the midpoint of guidance, while YoY, we expect revenue growth to accelerate significantly to 26%, marking the beginning of a new era of growth for Marvell,” said Matt Murphy, chairman and CEO, Marvell. “The exceptional performance in the 3rd quarter, and our strong forecast for the 4th quarter, are primarily driven by our custom AI silicon programs, which are now in volume production, further augmented by robust ongoing demand from cloud customers for our market-leading interconnect products. We look forward to a strong finish to this fiscal year and expect substantial momentum to continue in fiscal 2026.”

4th Quarter of Fiscal 2025 Financial Outlook

- Net revenue is expected to be $1.800 billion +/- 5%.

- GAAP gross margin is expected to be approximately 50%.

- Non-GAAP gross margin is expected to be approximately 60%.

- GAAP operating expenses are expected to be approximately $710 million.

- Non-GAAP operating expenses are expected to be approximately $480 million.

- Basic weighted-average shares outstanding are expected to be 867 million.

- Diluted weighted-average shares outstanding are expected to be 877 million.

- GAAP diluted net income per share is expected to be $0.16 +/- $0.05 per share.

- Non-GAAP diluted net income per share is expected to be $0.59 +/- $0.05 per share.

GAAP diluted EPS is calculated using basic weighted-average shares outstanding when there is a GAAP net loss, and calculated using diluted weighted-average shares outstanding when there is a GAAP net income. Non-GAAP diluted EPS is calculated using diluted weighted-average shares outstanding.

Comments

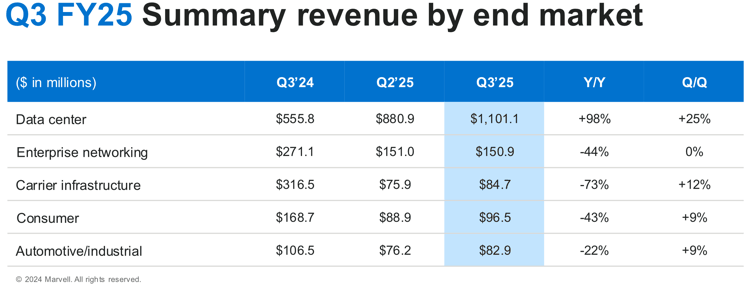

| End market | Customer products and applications |

| Data center | Cloud and on-premise Artificial intelligence (AI) systems |

| Cloud and on-premise ethernet switching | |

| Cloud and on-premise network-attached storage (NAS) | |

| Cloud and on-premise AI servers | |

| Cloud and on-premise general-purpose servers | |

| Cloud and on-premise storage area networks | |

| Cloud and on-premise storage systems | |

| Data center interconnect (DCI) | |

| Enterprise networking | Campus and small medium enterprise routers |

| Campus and small medium enterprise ethernet switches | |

| Campus and small medium enterprise wireless access points (WAPs) | |

| Network appliances (firewalls, and load balancers) | |

| Workstations | |

| Carrier infrastructure | Broadband access systems |

| Ethernet switches | |

| Optical transport systems | |

| Routers | |

| Wireless radio access network (RAN) systems | |

| Consumer | Broadband gateways and routers |

| Gaming consoles | |

| Home data storage | |

| Home wireless access points (WAPs) | |

| Personal Computers (PCs) | |

| Printers | |

| Set-top boxes | |

| Automotive/industrial | Advanced driver-assistance systems (ADAS) |

| Autonomous vehicles (AV) | |

| In-vehicle networking | |

| Industrial ethernet switches | |

| United States military and government solutions | |

| Video surveillance |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter