History 2004: +12% HDDs Shipped Y/Y in 2003

Record of 244 million units

By Jean Jacques Maleval | March 20, 2024 at 2:00 pm2003 was a good year for the HDD market, with 244.4 million units shipped, according to Trendfocus, a figure 12.8% better than forecasted.

The market research company exclusively focused on the HDD and components industry, has revealed its most recent data for 2003. The numbers are good, much better than in 2002, since growth in units shipped was 11.8% from 2002 to 2003, for a historic record of 244.4 million drives shipped, compared to 5.8% growth from 2001 to 2002.

The research firm predicts a nearly identical gain for 2004: +11.9%.

Manufacturers enjoyed a significant rise in demand, not to mention relative price stability, despite an end of 2003 that was plagued by inventory problems, a traditional and cyclical issue in the industry.

Another positive factor: a slow-down in the growth of areal density on magnetic platters, which means a longer lifespan for the basic platforms, and thus greater return on investment.

This trend led to profitability in 2003 for all companies except HGST, at least among those that publicly disclose their financials.

In the PC segment, all companies more or less hit 80GB per platter, and haven’t budged, except for Seagate, alone in its foray of 100GB per disk, while the competition seems inclined to move directly to 120GB per platter this year.

In the 2.5-inch segment, the standard is also stable, this time at 40GB per disk.

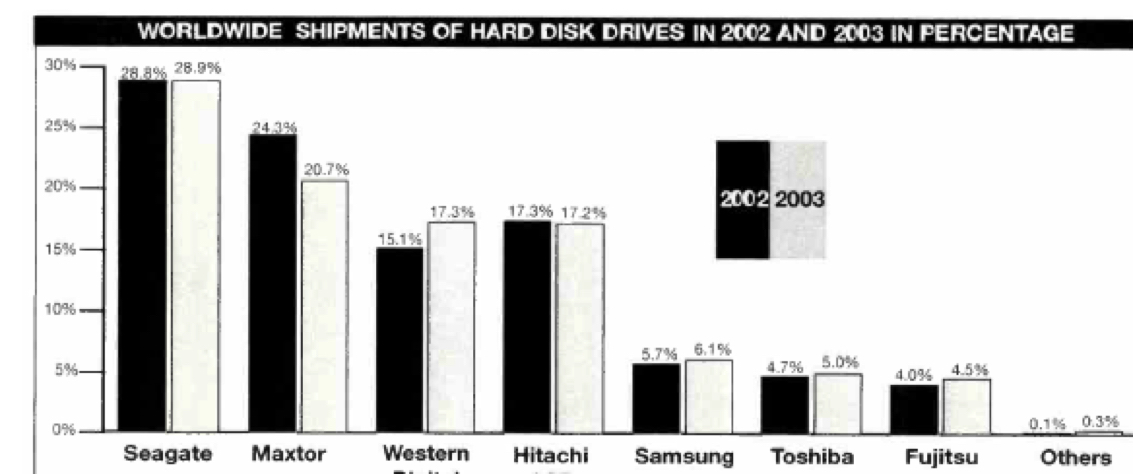

The positions of the seven sole remaining players in the industry (excluding newcomers Cornice and GS-MagicStor) have shifted very little. Their final ranking hardly changes, with Seagate still on top, retaining virtually the same market share, ahead of Maxtor, in slight decline, and Western Digital, gaining. Hitachi GST lost its place to WD, but it has had to endure the difficulties that always come with restructuring in the aftermath of an acquisition, in this case Hitachi’s of IBM’s HDD activity, back on January 1, 2003.

Those 5 companies alone account for 84.1% of the total market, followed by 3 more companies that cover only a segment of the drive market: Samsung exclusively in PC drives (although it just entered 2.5-inch), Toshiba only in 2.5-inch or lower form factors and Fujitsu, without desktop units.

Two events marked 2003: the first was the entrance of Seagate in notebook drives, with genuine success; the second was the real arrival of HDDs in consumer products, be they 1.8-inch and smaller drives, due to demand from camera and portable audio device makers, or 3.5-inch devices which have come home to roost in the exploding market for PVRs, set-top boxes and most importantly, gaming consoles.

The 3.5-inch form factor still dominates, accounting for 78.6% of all units shipped, ahead of 2.5-inch (21.1%), with the leftover (0,3%) in smaller formats.

But historically, the trend has always progressed towards smaller form factors, which will eventually lead to stagnation in sales volumes for 3.5-inch disk, in favor of 2.5-inch units for PC and enterprise systems.

What’s more, the notebook market is growing more quickly than the desktop PC market.

Another historic trend has been the steady shift towards ever faster rotational speeds. For PCs, drives at 5,400rpm will gradually disappear, in favor of 7,200rpm models. Meanwhile, the enterprise drive market is currently splitting in two: at one end, high-capacity 10,000rpm fat disks, at the other, 15,000rpm fast disks with lower capacity.

The push to increase capacities has been a natural trend since the birth of HDDs. Trendfocus estimates that the average capacity of units shipped was 74GB for PC drives and 41GB for notebook drives at the end of 2003, and projected 100GB and 51GB, respectively, for the end of 2004.

The major technological revolution yet to come will be the shift from horizontal to perpendicular recording, which everyone has been developing in the pursuit of even greater capacities in the future.

Basically, the magnetic HDD still has some good years ahead of it. There’s still no serious threat of competition, even if flash cards are getting slightly pesky in low capacities, while optical discs, slow and lower in capacity, have the major advantage of removability.

We’ve even seen cases where HDDs have begun to infringe on tape drive territory for backup applications.

The future of the HDD is certain for a few years to come, with the help also of new interfaces now arriving (SATA, serial SCSI) along with new consumer products creating more demand, even if PC users’ appetite for capacity has been somewhat appeased.

This article is an abstract of news published on issue 194 on March 2004 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter