History (1998): Compaq Uncontested Leader of WW Windows NT Storage

With acquisition of Digital Equipment for $9.6 billion

By Jean Jacques Maleval | December 24, 2021 at 2:00 pmMost commentators have neglected to mention, in reporting Compaq’s acquisition of Digital Equipment, that the 2 WW businesses combined enjoy a new stronghold in storage alone, and even a leadership position in the Windows NT environment, as well as a better overall placement in storage subsystems in general, from PCs to mainframes.

Following Compaq’s purchase of Digital Equipment for $9.6 billion, the largest in the annals of the computer industry, most of the news commentary has focused on the future of the Alpha microprocessor, VMS and Unix machines, different clusters, the strength of the newly-formed $37.5 billion company (approaching that of Hewlett-Packard at $42.9 billion), the future of competitor Sun Microsystems, and so on.

Yet no one is mentioning the question of storage systems. One of the rare allusions is no less bizarre: “Analysts also are betting [Compaq] will fold Digital’ s lackluster notebook and PC operations, and sell off some businesses, such as Digital’s storage unit, to recoup a part of its purchase price,” (Business Week, February 9, 1998).

52% of the NT storage world

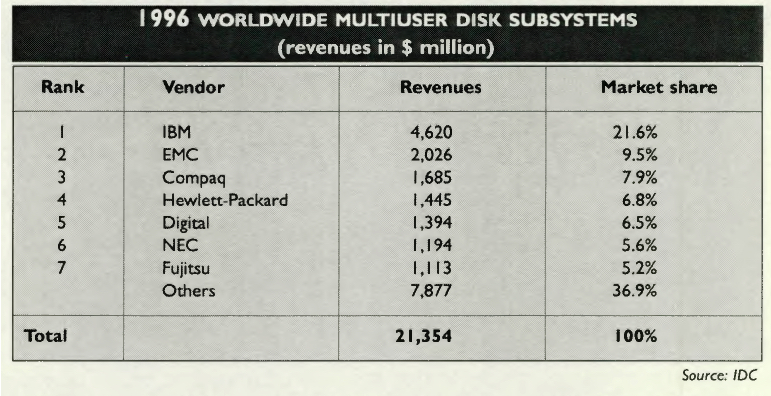

It would be a strategic error for Compaq not to capitalize on the newly strengthened position the 2 firms combined now command in storage subsystems. In a recent study, IDC estimates (see table) that, the new duo represented 16% of the WW market in 1996, for all OSs, from PCs to mainframes, ahead of EMC and just a few strides behind IBM.

Taking into account only storage subsystems revenues in the Windows NT environment, where current growth, incidentally, is strongest, the addition of Compaq’s market share to that of DEC yields 51.9%, with the runner-up, Intergraph, at only 13.1%.

These footholds could easily be shaken, with the massive efforts of companies, EMC and IBM in particular, to get in on the act.

It would thus be rather surprising if the ≠1 PC manufacturer gave up so strategic an activity, particularly one with such a promising future.

IDC calculated that in 1996, 17TB of capacity were delivered (excluding OEMs) in storage subsystems for Europe alone, and predicted 250,000TB TB for 2001, which amounts to a CAGR of 91%!

From PC to mainframe

The union of the 2 American firms also enables them to cover virtually all storage markets. Compaq already benefited from a considerable installed base of PC servers. The acquisition of Tandem opened up the world of clusters. Now, with the addition of Digital, Compaq gains a substantial high-end Unix and NT customer base, along with what remains in the realm of proprietary VMS.

Thanks to a fairly recent accord between Hitachi and Digital, Compaq can even cover storage subsystems ranging from PC to glass house. Basically, DEC will integrate Hitachi’s 7700MP and 6700 Scalable array into its StorageWorks solution, with the 7,700 supporting mainframe storage in addition to NT and Unix.

According to Harry Copperman, SVP and group executive, Digital products division: “Our storage business generates more than $2 billion in revenues annually.“

Compaq is quite likely to exceed $2 billion, more probably close to $3 billion. Three main frontrunners are breaking out in multi-disk subsystems: IBM, Compaq/Digital and EMC. HP is in the second pack, where places are only now beginning to be disputed. The shoving match is between StorageTek, Sun (which just launched a major offensive with its purchase of Encore), Unisys, DG/Clariion, Gateway 2000 (with ALR), Bull, etc., for placement in the overall storage market WW, recently evaluated by Sun at $28 billion, and expected to grow to more than $35 billion in 2001.

This article is an abstract of news published on issue 121 on February 1998 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter