Pure Storage: Fiscal 4Q19 Financial Results

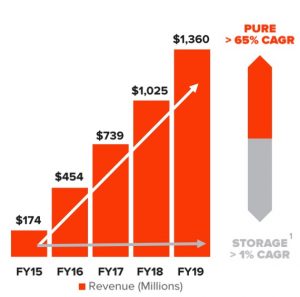

Weaker-than-expected revenue but up 33% Y/Y at $1.36 billion, poor guidance for next quarter

This is a Press Release edited by StorageNewsletter.com on March 4, 2019 at 2:26 pm| (in $ million) | 4Q18 | 4Q19 | FY18 | FY19 |

| Revenue | 339.9 | 422.2 | 1,025 | 1,360 |

| Growth | 24% | 33% | ||

| Net income (loss) | (14.9) | (27.8) | (159.9) | (178.4) |

Pure Storage, Inc. reported its fourth quarter and full year fiscal 2019 results ended January 31, 2019.

FY19

- revenue $1.36 billion, up 33% Y/Y

- GAAP gross margin 66.4%; non-GAAP gross margin 67.6%

- GAAP operating margin -12.5%; non-GAAP operating margin +3.7%

4FQ19

- revenue of $422 million, up 24% Y/Y

- GAAP gross margin 66.5%; non-GAAP gross margin 67.6%

- GAAP operating margin -5.9%; non-GAAP operating margin +7.4%

Following the quarter close, Pure signed a more than $100 million-dollar deal over approximately two years with a leading global systems integrator.

As part of Pure’s Cloud Data Services, the company announced ObjectEngine, redefining data protection to rapid restoration built for modern enterprises.

In addition, it launched DirectFlash Fabric for end-to-end NVMe and NVMe-oF support, enabling customers to improve performance of mission-critical applications and web-scale applications that traditionally have relied on DAS.

“We finished a strong FY19, growing annual revenue 33% year over year, to over $1.3 billion, and we are excited about our ability to continue to deliver strong growth,” said Charles Giancarlo, chairman and CEO. “Looking ahead, we expect to drive industry leading growth, expand our product portfolio, and increase our lead in customer delight.”

While Q4 results fell below guided ranges, they were directly impacted by two distinct items. First, a process breakdown at one of Pure’s contract manufacturers prevented a number of orders from shipping in the quarter. Second, Pure exceeded its expectations in selling their ES2 subscription offering, which ultimately drives positive long-term economics for the company, but resulted in lower revenue recognized in the quarter.

Outlook for FY20

• Revenue in the range of $1.735 billion to $1.805 billion, 30% Y/Y growth at the midpoint

• Non-GAAP gross margin in the range of 65.0% to 68.0%

• Non-GAAP operating margin in the range of 3.0% to 7.0%

1FQ20 guidance:

• Revenue in the range of $327 million to $339 billion, 30% Y/Y growth at the midpoint

• Non-GAAP gross margin in the range of 65.0% to 68.0%

• Non-GAAP operating margin in the range of -8.5% to -4.5%

Comments

Revenue growth

Pure Storage's shares plunged 7.3% in the extended session last Thursday after the company reported weaker-than-expected earnings and revenue.

Fourth quarter sales fell well short of estimates and below the company's guided ranges. Wall Street was looking for $443.3 million with a non-GAAP profit of 18 cents a share.

The firm is definitively a $1 billion company in term of revenue but also in net loss. The company never was able to be profitable and records net loss each quarter since inception. It accumulated global net losses of more than $1 billion since FY13 and this trend is not going to stop as they even increased here yearly for the quarter and the year. Not being profitable since 10 years - like Nutanix - is probably a record in the storage industry.

For the quarter, sales hampered by manufacturing issues. There was a process breakdown at one of firm's contract manufacturers. This resulted in a number of orders that were expected to ship in the quarter, and not shipping until the days following quarter end but company has now addressed these deficiencies.

Pure records a number of $1 million expansion deals this quarter. More recently, it signed a deal valued at over $100 million spread out over two years.

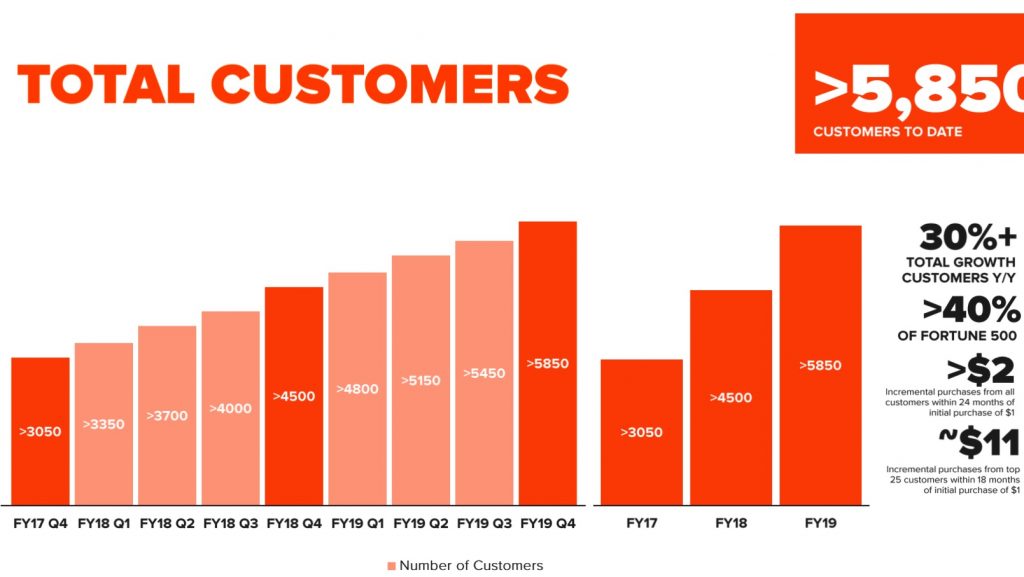

The AFA maker finished the year with 5,850 total customers, with 400 additions in the quarter.

Product revenue grew 19.7% Y/Y to $340 million and support revenue grew yearly 47% year-on-year to $82 million.

Cloud customers continue to contribute more than 30% of total business.

Geographically, 71% of sales came from USA and 29% came from international markets for the quarter. Non US revenue grew from 26% in FY18 to 28% in FY19.

In the more recent quarter, operating profit was positive $31.1 million or positive 7.4% of revenue and compares to an operating profit of $24.9 million or positive 7.3% in the year-ago quarter.

Pure Q4 finished 4FQ19 with cash and investments of $1.2 billion, an increase of $53 million from the previous quarter

For next quarter of fiscal 2020, it expects revenue in the range of only between $327 million to $339 million or 30% Y/Y growth, but bad Q/Q figures, between -20% and -23%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter