History (1996): HDD Shipments Exceed 100 Million Units per Year

One of the world's fastest growing industries through 1996

This is a Press Release edited by StorageNewsletter.com on May 24, 2018 at 2:18 pmThis article comes from the Computer History Museum.

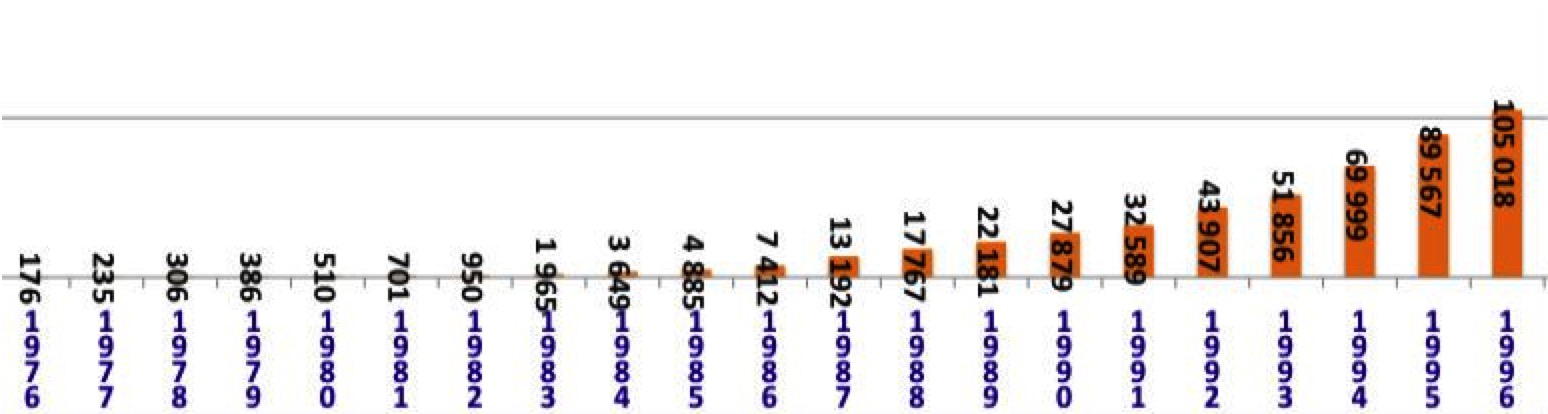

1996: HDD shipments exceed 100 million units/year

One of the world’s fastest growing industries through 1996

HDD shipments reach 105 million units in 1996

Click to enlarge

(Micro-Journal SARL)

Market analyst James N. Porter, principal of Disk/Trend of Mountain View, CA reported that total HDD shipments in 1996 exceeded 100 million units.

This represented a CAGR of 37% since 1956 making HDD manufacturing one of the fastest growing industries in the world.

About 85% of those units were 3.5″ models for desktop and portable computer applications.

Total industry revenue was close to $30 billion with IBM, Seagate, Quantum, Fujitsu, Western Digital (WD) and Maxtor as the top 6 vendors.

The need for increased and lower-cost manufacturing capacity drove much of the HDD assembly industry to Asia, though certain critical operations, e.g., manufacturing of thin film read/write heads, continued to be performed in the U.S.

Due to short product life cycles, volatile boom and bust periods of demand, and intense competition, this growth came with only modest profitability and resulting industry consolidation. The number of vendors, driven largely by spin-outs from IBM, grew to a peak of over 90 in 1985 and declined to less than 20 by the end of the century. By 2015 only two of the top five vendors in 1996, Seagate and WD, remained in business. Toshiba acquired the Fujitsu business in 1999. Maxtor purchased Quantum in 2000 and Seagate acquired Maxtor in 2006. IBM sold its disk drive operation to Hitachi in 2002 and the merged entity operated as Hitachi Global Storage Technologies (HGST) until it was absorbed by WD in 2012.

HDD unit CAGR slowed to around 10% from 1996 through 2010 when, according to Statistica, Inc., unit shipments exceeded 600 million drives.

However, according to Coughlin Associates, the number of storage bytes shipped continued at a 73% CAGR over the same period, and reached 1ZB in 2012.

Industry revenue of $30 billion in 2014 (largely unchanged from the 1996 value) was essentially divided between Seagate (41%), Toshiba (16%) and Western Digital (43%).

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter