Nutanix: Fiscal 1Q18 Financial Results

46% Y/Y revenue growth, reduced but big losses

This is a Press Release edited by StorageNewsletter.com on December 4, 2017 at 2:40 pm| (in $ million) | 1Q17 | 1Q18 | Growth |

| Revenue |

188.6 | 275.6 | 46% |

| Net income (loss) | (140.3) | (61.5) |

Nutanix, Inc. announced financial results for its first quarter of fiscal year 2018, ended October 31, 2017.

First Quarter Fiscal Year 2018 Financial Highlights

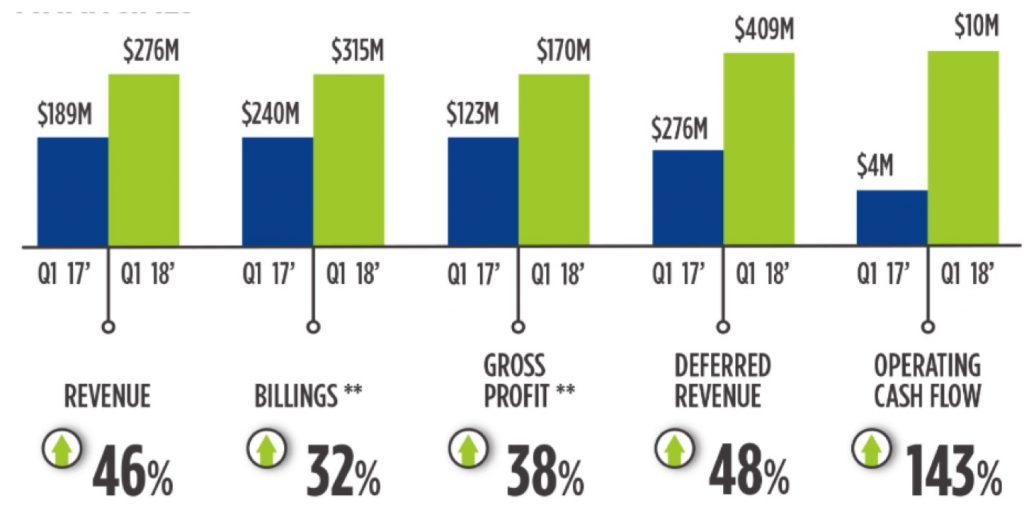

• Revenue: $275.6 million, growing 46% year-over-year from $188.6 million in the first quarter of fiscal 2017

• Billings: $315.3 million, growing yearly 32% from $239.8 million in the first quarter of fiscal 2017

• Net Loss: GAAP net loss of $61.5 million, compared to a GAAP net loss of $140.3 million in the first quarter of fiscal 2017; non-GAAP net loss of $24.7 million, compared to a non-GAAP net loss of $26.0 million in the first quarter of fiscal 2017

• Net Loss Per Share: GAAP net loss per share of $0.39, compared to a GAAP net loss per share of $1.89 and a pro forma GAAP net loss per share of $1.09 in the first quarter of fiscal 2017; non-GAAP net loss per share of $0.16, compared to a pro forma non-GAAP net loss per share of $0.20 in the first quarter of fiscal 2017

• Cash and Short-term Investments: $365.9 million, up 5% from the first quarter of fiscal 2017

• Deferred Revenue: $408.8 million, up 48% from the first quarter of fiscal 2017

• Operating Cash Flow: $10.1 million, compared to $4.2 million in the first quarter of fiscal 2017

• Free Cash Flow: $(7.9) million, compared to $(7.8) million in the first quarter of fiscal 2017

“We’re pleased to start our fiscal 2018 with a strong Q1 and a meaningful and engaging .NEXT conference in Europe,” said Dheeraj Pandey, chairman, founder and CEO. “Over the coming quarters we will thoughtfully adopt a software-centric strategy. Customers will continue to experience the same simple purchasing process and high-quality customer service. With a strong instinct for go-to-market, an imminent and differentiated roadmap for hybrid cloud, and a diverse executive team, I’m very much looking forward to a strong performance in the remainder of fiscal 2018.“

Recent company Highlights

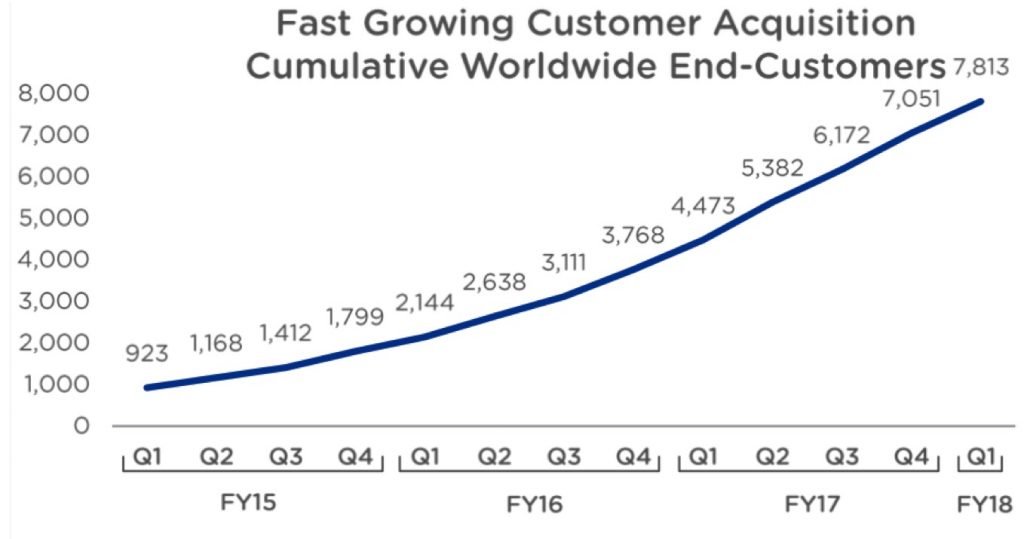

• Continued Customer Growth: Ended 1FQ18 with 7,813 end-customers, adding over 760 new end-customers during the quarter. First quarter customer wins included ConocoPhillips; JLL; Leonardo SpA; Scholastic Inc.; Shinsegae; Toyota Motor North America, Inc. and Trek Bicycle Corporation.

• Increased Number of $1 Million+ Deals: 49 customers with deals over $1 million in the quarter, up 36% YoY.

• Unveiled New Features to Run More Workloads: New services announced at .NEXT Europe 2017 address the needs of the diverse set of applications that enterprises need to deliver in a multi-cloud environment. The new Acropolis Object Storage Service, Acropolis Compute Cloud and Nutanix App Marketplace make it simple for IT teams to develop, test and run nearly any application within their enterprise clouds.

• Strong Participation in 3rd Annual Customer Conference in Europe: Largest-ever number of European attendees, including 1,085 customers and 670+ partners, joined Nutanix in Nice, France for its .NEXT Europe conference to hear more about the company’s vision for the multi-cloud era.

• Bolstered Board of Directors: Industry veterans Sue Bostrom and Craig Conway joined the Nutanix board, bringing with them a wealth of knowledge and expertise from companies including Cisco and Peoplesoft.

• Hired Key Executives: Enhanced the executive team with the addition of Lou Attanasio, chief revenue officer; Tyler Wall, chief legal officer; Inder Sidhu, EVP, global customer success and business operations and Sherry Lautenbach, SVP, Americas sales.

“While we will be focusing even more intently on selling software going forward, it’s worth noting what the past twelve months would have looked like had we chosen not to bill any pass-through hardware-related transactions. Nutanix would have recorded nearly $800 million(1) in pure software and support billings and delivered gross margins above 80%,(2) while continuing to be a leader in very large market,” said Duston Williams, CFO. “Looking forward, we expect continued strong top line growth in the remainder of fiscal 2018.”

For the second quarter of fiscal 2018, Nutanix expects:

• Revenues between $280 and $285 million; assuming the elimination of approximately $12 million in pass-through hardware sales;

• Non-GAAP gross margin between 62.5% and 63.5%;

• Non-GAAP operating expenses of approximately $210 million;

• Non-GAAP net loss per share between $0.20 and $0.22, using 161 million weighted shares outstanding.

(1) Pure software and support billings during the last twelve months of nearly $800 million is calculated as billings, less direct hardware costs of approximately $268 million for the last twelve months.

(2) Pure software and support gross margin of above 80% is calculated using non-GAAP gross profit divided by revenue, adjusted to exclude direct hardware costs for the last twelve months.

Comments

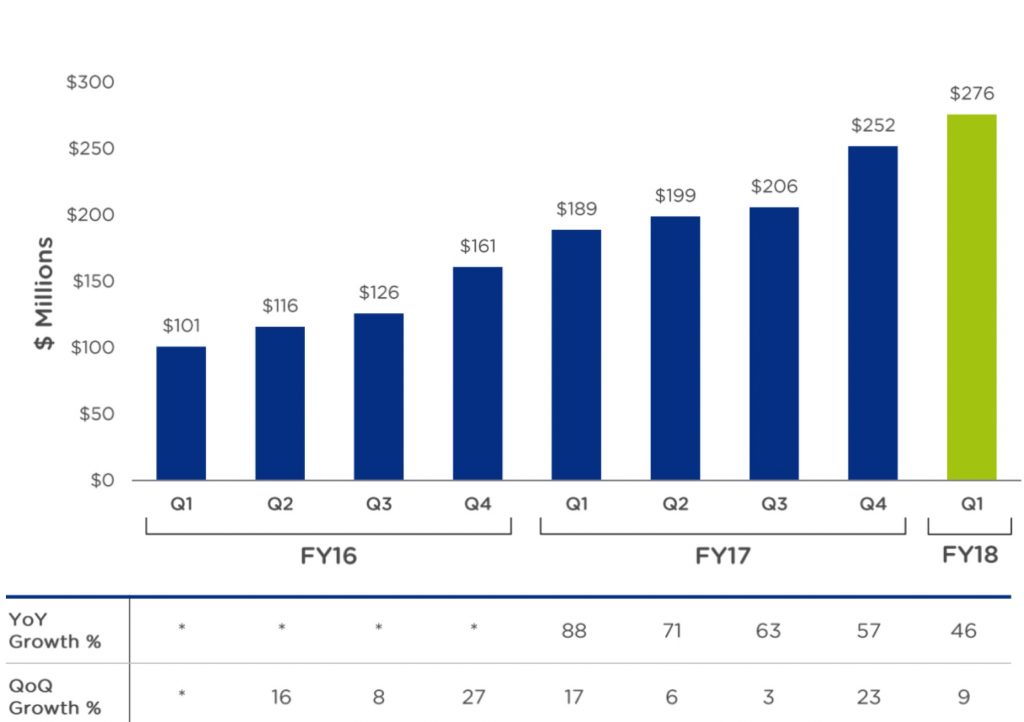

Revenue growth by quarter

1FQ18 results came in a bit better than expected primarily driven by a solid quarter in federal vertical. Revenue was $276 million growing 46% from a year ago and up 9% from the previous three-month period.

Also, as expected, OEM business although had approximately 10% of bookings, waned a bit from the level experienced in 4FQ17.

Performances in geographic regions were in line with what the company would expect. Bookings from international regions were 37% in 1FQ18, up from 34% in 1FQ17. The firm sees continued strength in APAC region, somewhat offset by seasonal declines in North America commercial and EMEA businesses. 1FQ18 revenue was 70% in Americas, 14% in EMEA, and 16% in APJ.

206 customers purchased over $2 million, up 40 from last quarter, 47 over $5 million, and 16 $10 million lifetime to-date. Top three deals in the quarter were all in the federal vertical and together comprise more than $15 million in billings.

Customer acquisition

In the last 12 months, Nutanix ported its software to every major x86 server vendor, IBM powered microprocessor, ruggedized warfare servers and 4x4 inch Intel mini-servers for the IoT edge.

Currently the hardware portion of the business is approximately 26% of total billings.

CFO Duston Williams said: "Going forward, we will add the software content attributable to our base operating system into the total software metrics. Under this new software centric reporting, based on billings for 1Q18, the splits of the business would be as follows; software and support 74% of total billings, and hardware 26%. It is this 26% attributable to the pass-through hardware that will mostly be eliminated overtime."

Company has now 3,009 employees worldwide.

Modest growth revenue, 2%, is expected for 2FQ18.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter