Micron: Fiscal 3Q17 Financial Results

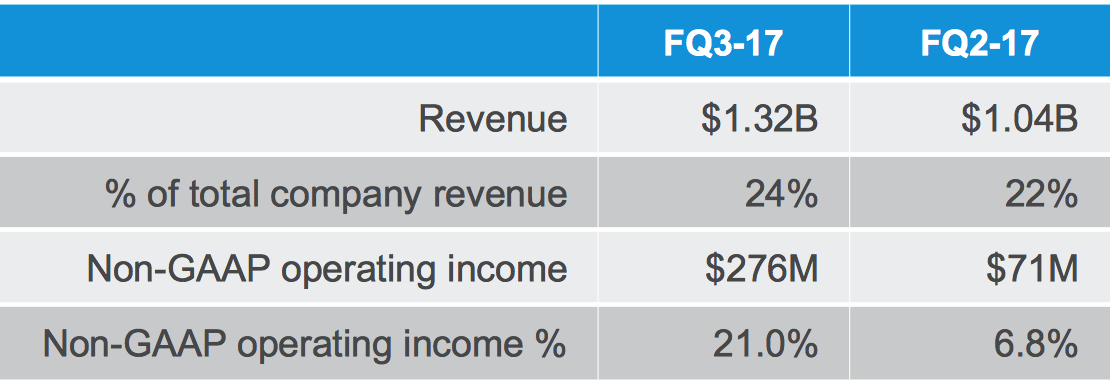

Storage at record $1.32 billion, up 26% Q/Q, 24% of global revenue

This is a Press Release edited by StorageNewsletter.com on June 30, 2017 at 2:28 pm| (in $ million) | 3Q16 | 3Q17 | 9 mo. 16 | 9 mo. 17 |

| Revenues | 2,898 | 5,566 | 9,182 | 14,184 |

| Growth | 92% | 54% | ||

| Net income (loss) | (215) | 1,647 | (106) | 2,721 |

Micron Technology, Inc. announced results of operations for its third quarter of fiscal 2017, which ended June 1, 2017.

Revenues were a record $5.57 billion, 20% higher compared to the second quarter of fiscal 2017 and 92% higher compared to the third quarter of fiscal 2016.

“Micron delivered strong operational performance in the third quarter with free cash flow nearly double last quarter, which enabled us to retire $1 billion in debt. Our results reflect solid execution of our cost reduction plans and ongoing favorable industry supply and demand dynamics,” said president and CEO Sanjay Mehrotra. “The global trends taking shape today, including machine learning and big data analytics, are exciting and create significant opportunities for Micron. We are focused on positioning the company to realize these opportunities by investing in technology and products while also strengthening our balance sheet.”

GAAP Income and Per Share Data – On a GAAP basis, gross margin was 46.9% and net income attributable to shareholders was $1.65 billion, or $1.40 per diluted share, for the third quarter of fiscal 2017 compared to gross margin of 36.7% and net income of $894 million, or $0.77 per diluted share, for the second quarter of fiscal 2017 and gross margin of 17.2% and a net loss of ($215) million, or ($0.21) per diluted share, for the third quarter of fiscal 2016.

Non-GAAP Income and Per Share Data – On a non-GAAP basis, gross margin was 48.0% and net income attributable to shareholders was $1.90 billion, or $1.62 per diluted share, for the third quarter of fiscal 2017 compared to gross margin of 38.5% and net income of $1.03 billion, or $0.90 per diluted share, for the second quarter of fiscal 2017 and gross margin of 18.1% and a net loss of ($29) million, or ($0.03) per diluted share, for the third quarter of fiscal 2016. For a reconciliation of GAAP to non-GAAP results, see the accompanying financial tables and footnotes.

The fiscal third quarter revenue increase of 20% compared to the previous quarter was due primarily to a 14% increase in DRAM ASPs and a 17% increase in trade NAND sales volumes.

The company’s overall consolidated gross margin for the third quarter of fiscal 2017 was approximately 10 percentage points higher compared to the previous quarter primarily due to increases in DRAM ASPs and manufacturing cost reductions for both NAND and DRAM.

Investments in capital expenditures, net of amounts funded by partners, were $1.27 billion for the third quarter of fiscal 2017. The company ended the third quarter of fiscal 2017 with cash, marketable investments, and restricted cash of $4.90 billion.

Comments

Micron had record sales in all business units this quarter, nearly doubling the company level Y/Y revenue performance.

Storage Business Unit

- ◊ Record revenue up 26% Q/Q driven by 33% growth in SSDs

- ◊ SSD sales to cloud customers doubled Q/Q and sales to cloud and enterprise customers exceeded client sales in SSDs

- ◊ SSD sales in the quarter were driven primarily by SATA SSD solutions using 32-layer TLC 3D NAND

- ◊ First revenue shipments of 8TB enterprise class SSDs

- ◊ Continuing to increase sales of TLC 3D NAND solutions

- ◊ OEM and hyperscale customer qualifications underway for SATA drives

- ◊ Many mobile OEM customers prefer MCPs in their design implementation to address their memory and storage requirements, as MCPs provide a single source for DRAM memory and NAND storage, simplifying system design, validation and supply chain considerations

- ◊ Continuing to sample 32-layer MLC and TLC 3D NAND MCP, discrete UFS and e.MMC devices to both chipset partners and handset OEMs.

Trade NAND

- ◊ Revenue increased 21% compared to the prior year quarter, reflecting a 17% increase in bit shipments and a 3% increase in ASPs

- ◊ Represented 31% of Micron total revenue in 3FQ17

- ◊ Consumer represented approximately 40%: consists primarily of component sales to partners and customers

- ◊ Mobile was in the mid-teens percentage range: includes managed NAND solutions and the majority of our MCPs

- ◊ SSDs were in the mid-20% range

- ◊ Automotive, industrial, and other embedded applications were in the high-teens percentage range

- ◊ Over the 12-month period ending in fiscal Q3, bit output has been above industry average for trade NAND and cost per bit has declined approximately 30% in those technologies respectively

Technology and industry outlook

- ◊ Ramping 64-layer 3D NAND and 1x DRAM and technologies: expect to achieve meaningful output by end of FY17; initial revenue shipments recognized

- ◊ 3rd generation 3D NAND will be based on CMOS-under-array architecture

- ◊ In calendar year 2018, plan to introduce NVMe PCIe offerings using 64-layer TLC 3D NAND

- ◊ NAND industry bit supply growth of high 30% to low 40% in CY17

- ◊ Expect healthy industry demand to persist into 2018

4FQ17 guidance

Revenue between $5.70 and $6.10 billion

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter