Financial Troubled Imation Once More Restructuring – Last Chance to Survive?

This time with help of Houlihan Lokey Bank

This is a Press Release edited by StorageNewsletter.com on February 17, 2015 at 2:41 pmImation Corp. provided an update on its continuing transformation and has been working with Houlihan Lokey as its financial adviser to explore options to unlock embedded value within its consumer storage and accessories (CSA) and tiered storage and security solutions (TSS) business units.

Strategic transformation has been a multi-year process that has included acquisitions to bolster its mobile security products and storage solutions offerings, a major restructuring and down-sizing that created two distinct business units – consumer-centric and commercial-centric – and the divestiture of certain under-performing and non-core businesses. Throughout the transformation, the company has continued to maintain a strong cash position, which has provided financial flexibility to continue reviewing strategic alternatives from a position of strength.

During the transformation process, the company has worked with external advisors and has had discussions with third-parties to examine a variety of available options. To advise on the next phase of the transformation, Houlihan Lokeyis working with the company to review and explore certain strategic options to maximize the value of each business unit.

“This evaluation is another important milestone in Imation’s ongoing evolution in becoming a global leader in storage and security. The changing industry and competitive landscape affirms that we are on the right path as we continue to seek the best method of maximizing value for each business unit and for our shareholders,” commented Mark Lucas, CEO, Imation. “Enhancing the independence of each business unit may allow each team to focus solely on its own growth and product development.“

“As the board reviews the options available to us, the management team and the rest of the company remain singularly focused on executing our plans in each business, including introducing differentiated, higher margin products, and appropriately investing in our business plan,” concluded Lucas.

There can be no assurance that this process will result in any transaction, or that any transaction, if pursued, will be consummated. The company, which will continue to operate normally during the review process, does not intend to provide any additional information with respect to the process, until the evaluation is complete.

Comments

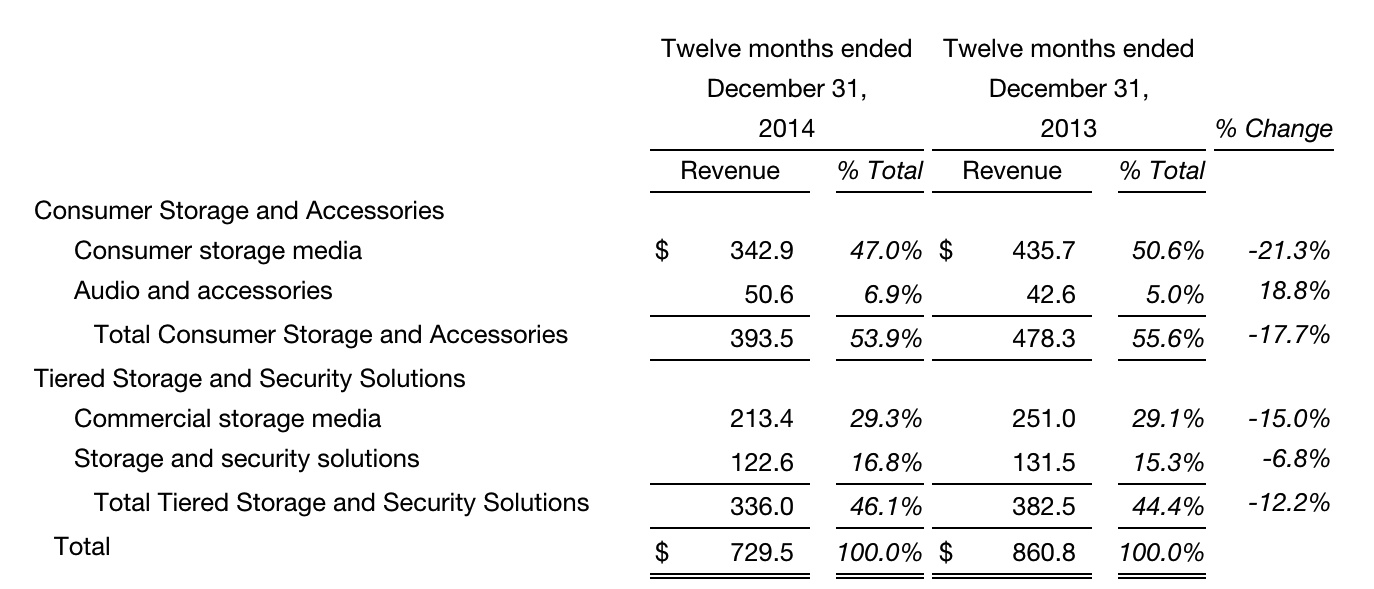

Imation saw revenue decreasing by double digit each year since 2009.

| Fiscal Year | Revenue | Y/Y growth |

| 2006 | 1,585 | NA |

| 2007 | 2,062 | 30% |

| 2008 | 1,981 | -4% |

| 2009 | 1,650 | -17% |

| 2010 | 1,461 | -11% |

| 2011 | 1,290 | -12% |

| 2012 | 1,007 | -22% |

| 2013 | 861 | -15% |

| 2014 | 730 | -15% |

The company tried to diversify from the decreasing market of consumer products and computer media by investing in two fields:

- mobile security products: with acquisition of Encryptx (BeCompliant) and assets of MXI Security in 2011

- storage solutions: acquiring assets of ProStor Systems in 2011 and Nexsan, its biggest investment, that was paid $120 million in 2013.

But the result is far to be brilliant as there is about no synergy between its old and new activities in term of technology and customers.

Apparently without any new ideas, Imation now is hiring the Houlihan Lokey Bank to solve its difficulties.

What is possible to do?

To buy disruptive technologies?

Cash and cash equivalents balance at $114.6 million as of December 31, 2014 is not enough for a big acquisition unless you are lucky to find a cheap nugget.

To separate into several other companies?

There are few relations between the activities of Imation: consumer products (media, audio and accessories) and professional products (media, security solutions and disk arrays) and about all of them decreasing substantially.

To find a buyer?

But at which price a company will acquire a firm with global annual revenue at $730 million in 2014, a figure decreasing 15% Y/Y, and recording a net loss of $115 million? Maybe that's what Imation is looking for its shareholders at as Houlihan Lokey Bank is specialized in mergers and acquisitions. It could be a better idea to sell separately each activity. The security business could attract some competitors. It will also be difficult to find buyer for former Nexsan as there are already hundred of companies, and huge ones, in the world in storage subsystems, and as we dont see today how the products differentiate fundamentally from other offerings. The most recent Nexsan NST4000 HDD/SSD storage appliance a,d E-Series family of storage solutions are up to date but is not alone in the industry, and the firm didn't reveals up to now an all-flash platform to enter into this promising market.

Conclusion: Good luck to Houlihan Lokey Bank and we prefer not to have been hired for this job.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter