HP 3par StoreServ 7400 Number One Enterprise Midrange Array

For DCIG

This is a Press Release edited by StorageNewsletter.com on October 31, 2013 at 3:02 pmAs certain as death and taxes, the growing amount of data continues to rise. According to one recent multi-university study of 26 corporations and large non-profits, the volume of data is expanding by 30% to 50% every year, in effect, doubling the data stored rate every two years. Yet, even as noted in the recent study, for many organizations, the budgets to support the growing amount of data continues to decline.

It is with this certainty in mind that end users looking for ways to manage enterprise data growth turn to alternatives for their enterprise storage management needs and select midrange storage solutions.

Like data growth, end user expectations for enterpriseification also continue to rise. With the 2014 Enterprise Midrange Array Buyer’s Guide, midrange arrays more than earn the designation with continuous availability, storage capacity and comprehensive features such as redundancy, data protection, snapshot and replication, at prices that are well within reach of mid-sized organizations.

“I don’t think there’s an end user I speak with that doesn’t confirm that data growth far exceeds the revenue growth plans of their organizations,” said Jerome Wendt, president and lead analyst, DCIG, LLC. “With that kind of pressure in mind, it’s no surprise that users continue to look for ways to get the most out of their data management and protection investments; and why midrange arrays are taking on more and more enterprise features, yet still remaining well within tight budget parameters. Our latest midrange array Buyer’s Guide is the most comprehensive to date, and represents well over 100 specific array models. We know it will be an indispensable aid for users looking to eliminate unnecessary research cycles and best meet their specific needs.”

The guide evaluates more than 50 offerings from 19 companies. After an initial survey containing more than 150 questions was completed, product capabilities were assessed based on data provided by the vendor, prior DCIG research, and information available in the public domain. Products were then evaluated on more than 140 characteristics. After scores were compiled, products were ranked “Best-in-Class,” “Recommended,” “Excellent,” “Good,” or “Basic” across functionality and capability relative to the other products included in guide.

The intent for this guide, as with all DCIG Buyer’s Guides, is to provide an “at-a-glance” comparison from which end users can select the most appropriate solution for their existing needs. This guide also provides perspective on how solutions from less well known midrange array providers compare against established and better known brands.

The 2014 Enterprise Midrange Array Buyer’s Guide top 10 solutions include (in alphabetical order):

- Dell Compellent SC8000;

- Dell EqualLogic PS6100/PS6110;

- EMC VNX7500;

- EMC VNX5700;

- HDS HUS 150;

- HDS HUS VM;

- HP 3PAR StorServ 7400;

- NetApp FAS3250;

- Huawei OceanStor 5800T; and

- Starboard Storage AC4500.

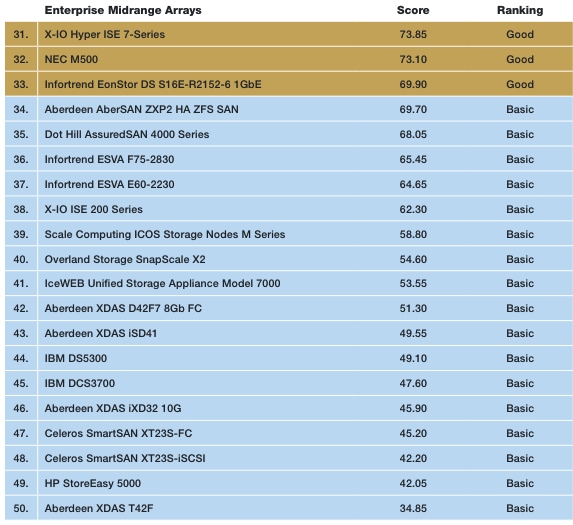

Overall scores and ranking

Overall scores and ranking (continued)

The HP 3PAR StoreServ 7400 brings together the best of what both block and file have to offer: block storage services in the form of its 3PAR StoreServ family and file storage services with its 3PAR StoreServ File Controller earning the “Best-in-Class” distinction.

3PAR StoreServ 7400 stood out in the following ways from other arrays listed in the guide:

- A single array can be scaled out to 4 mesh-active controllers managing up to 864TB of data.

- Offers 3PAR Peer Persistence and Remote Copy software to synchronously replicate data and then implement uninterrupted VM failover and failback without needing to implement a third party appliance or replication software.

- Has “Best-in-Class” features, yet carries a starting list price below $50,000-which puts it within reach of many mid-sized organizations.

The guide achieves the following objectives:

- Provides an objective, third party evaluation of enterprise midrange arrays that evaluates and scores their features from an end user’s perspective.

- Ranks each enterprise midrange array in each scoring category and then presenting these results in an easy to understand table.

- Provides a standardized data sheet for each of the midrange arrays so users may do quick side-by-side comparisons of products.

- Provides insights into what features midrange arrays offer to optimize integration into VMware environments, as well as support for other hypervisors and OSs•

- Provides insight into which features on a midrange array will result in improved performance

- Gives any organization a solid foundation for getting competitive bids from different providers that are based on “apples-to-apples” comparisons.

“Meeting performance and reliability requirements, while keeping within budget, is a must for end users,” added Wendt. “Knowing this, we incorporated data on integrated performance monitoring software and hooks on automation for provisioning and ongoing management of midrange arrays. We also took a hard look at alternative hypervisor support in addition to industry-leading support for VMware. We are seeing a trend gaining traction where organizations are intentionally implementing multiple hypervisors. We remain confident that DCIG Buyer’s Guides can cut cost and time from the purchase process by enabling end users to focus their energy on product evaluations and competitive bid processes versus wasting cycles on determining what solutions may best fit their needs.”

Disclosure and Methodology

DCIG identified 19 companies that provide enterprise midrange arrays, regardless of cost. Each array had to meet the following criteria:

- Support either the FC (FC) or iSCSI block-based protocol

- Scale to support at least 60TBs of raw capacity

- Support two controllers with some method of failover

- Sufficient information available for DCIG to make meaningful decisions

- Shipping as of September 1, 2013

No vendors, whether clients or not, were afforded preferential treatment in the buyer’s guide. All research was based upon information provided directly by vendors, research and analysis by DCIG and other publicly available information.

It is worth noting that each guide is not intended to be a substitute for internal testing. DCIG encourages any organization that is considering the purchase of any solution included in a Buyer’s Guide to do its own in-house testing.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter