Nvidia Signed a Special Technology Deal with Groq for $20 Billion

Groq and Nvidia enter non-exclusive technology licensing agreement to accelerate AI inference at global scale

This is a Press Release edited by StorageNewsletter.com on December 26, 2025 at 2:02 pmToday, Groq announced that it has entered into a non-exclusive licensing agreement with Nvidia for Groq’s inference technology. The agreement reflects a shared focus on expanding access to high-performance, low cost inference.

The agreement reflects a shared focus on expanding access to high-performance, low cost inference.

As part of this agreement, Jonathan Ross, Groq’s Founder, Sunny Madra, Groq’s President, and other members of the Groq team will join Nvidia to help advance and scale the licensed technology.

Groq will continue to operate as an independent company with Simon Edwards stepping into the role of CEO.

GroqCloud will continue to operate without interruption.

Comments

Boom!!

More remarkable news from Nvidia, which has signed a $20 billion technology partnership with Groq. This is not a traditional acquisition - Jensen Huang, Nvidia’s CEO, confirmed that Nvidia is not buying Groq, which will continue to operate as an independent company. The move is reminiscent of Nvidia’s earlier arrangement with Enfabrica a few months ago. Notably, the deal comes just three months after Groq’s most recent funding round, in which it raised $750 million at a $6.9 billion valuation. At that scale, the agreement raises an interesting question: why pay $20 billion for non-exclusive access to technology? It appears to be a parallel path that, while not an acquisition in name, could be interpreted as one in substance.

This type of deal is particularly interesting because it accelerates access to technology without the delays typically associated with regulatory reviews, legal scrutiny, and conditional approvals. Time-to-market is a critical factor here, and non-exclusive technology access also helps address monopoly concerns. Under this arrangement, Nvidia gains the right to use Groq’s technology and to bring key talent onto its team, without formally acquiring the company.

The deal further underscores the intensifying race in AI inference among leading chip designers and manufacturers, as competitive pressure increases from major players such as Google, Amazon, OpenAI, Meta, and emerging forces in Asia. This competitive dynamic is also reflected in several recent high-profile moves, including Meta’s $14 billion investment in Scale AI, Microsoft’s involvement with Inflection AI, Amazon’s backing of Adept AI, and Google’s investment in Character AI.

Groq is part of a small, highly active group of AI chip companies that also includes SambaNova and Cerebras. Cerebras announced a $1.1 billion Series G funding round last September at an $8.1 billion valuation and is reportedly planning an IPO in the coming months - an event that could catalyze similar modern partnership structures. Meanwhile, SambaNova is reportedly in acquisition talks with Intel at a valuation of $1.6 billion. It remains to be seen whether the Nvidia–Groq deal will influence SambaNova’s valuation. And, of course, AMD continues to be a formidable participant in this competitive landscape.

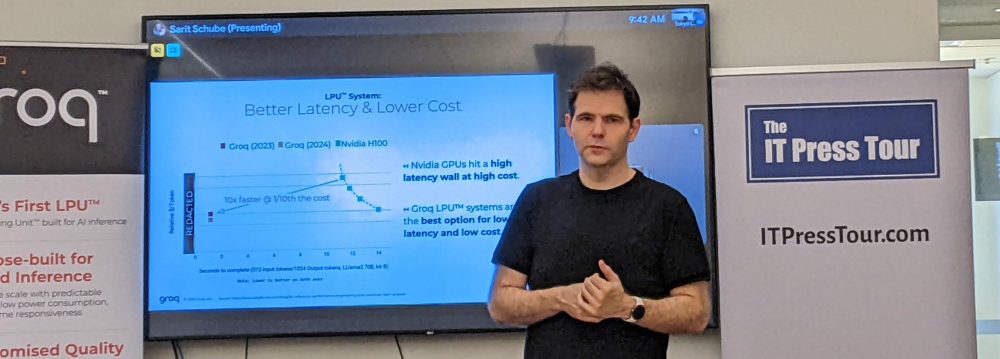

The IT Press Tour visited Groq in January 2024 in Mountain View, California, where it became clear just how strong the foundations, infrastructure, and services are that Jonathan Ross and his team have built - and continue to expand.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter