Micron Technology: Fiscal 1Q26 Financial Results

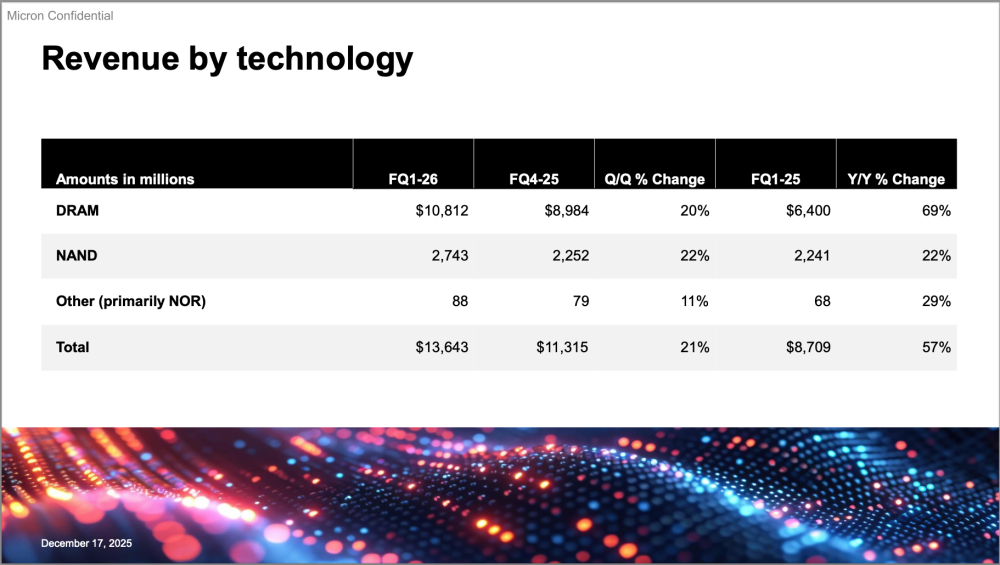

Generating $13.6 billion, up 21% QoQ and up 57% YoY

This is a Press Release edited by StorageNewsletter.com on December 18, 2025 at 2:02 pmMicron Technology, Inc. announced results for its first quarter of fiscal 2026, which ended November 27, 2025.![]() Fiscal Q1 2026 highlights

Fiscal Q1 2026 highlights

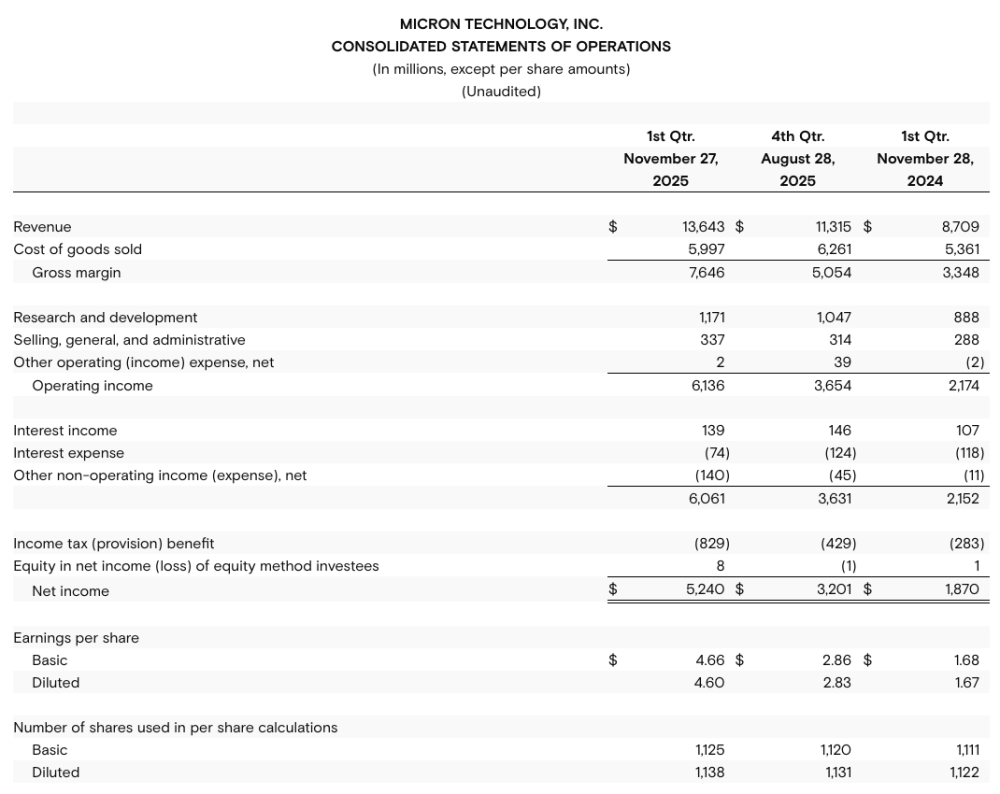

- Revenue of $13.64 billion versus $11.32 billion for the prior quarter and $8.71 billion for the same period last year

- GAAP net income of $5.24 billion, or $4.60 per diluted share

- Non-GAAP net income of $5.48 billion, or $4.78 per diluted share

- Operating cash flow of $8.41 billion versus $5.73 billion for the prior quarter and $3.24 billion for the same period last year

“In fiscal Q1, Micron delivered record revenue and significant margin expansion at the company level and also in each of our business units,” said Sanjay Mehrotra, chairman, president and CEO, Micron Technology. “Our Q2 outlook reflects substantial records across revenue, gross margin, EPS and free cash flow, and we anticipate our business performance to continue strengthening through fiscal 2026. Micron’s technology leadership, differentiated product portfolio, and strong operational execution position us as an essential AI enabler, and we are investing to support our customers’ growing need for memory and storage.”

Quarterly Financial Results

Click to enlarge

For the first quarter of 2026, investments in capital expenditures, net were $4.5 billion and adjusted free cash flow was $3.9 billion. Micron ended the year with cash, marketable investments, and restricted cash of $12.0 billion. On December 17, 2025, Micron’s Board of Directors declared a quarterly dividend of $0.115 per share, payable in cash on January 14, 2026, to shareholders of record as of the close of business on December 29, 2025.

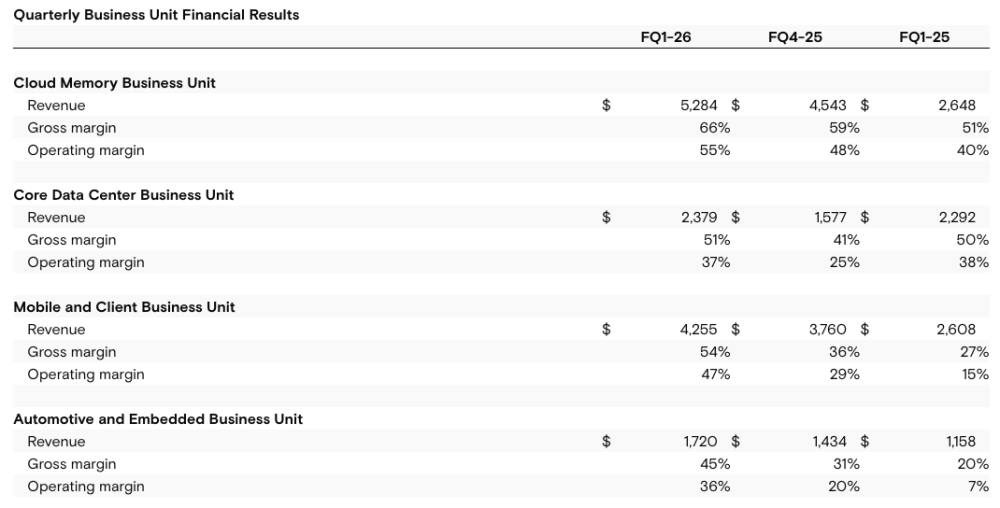

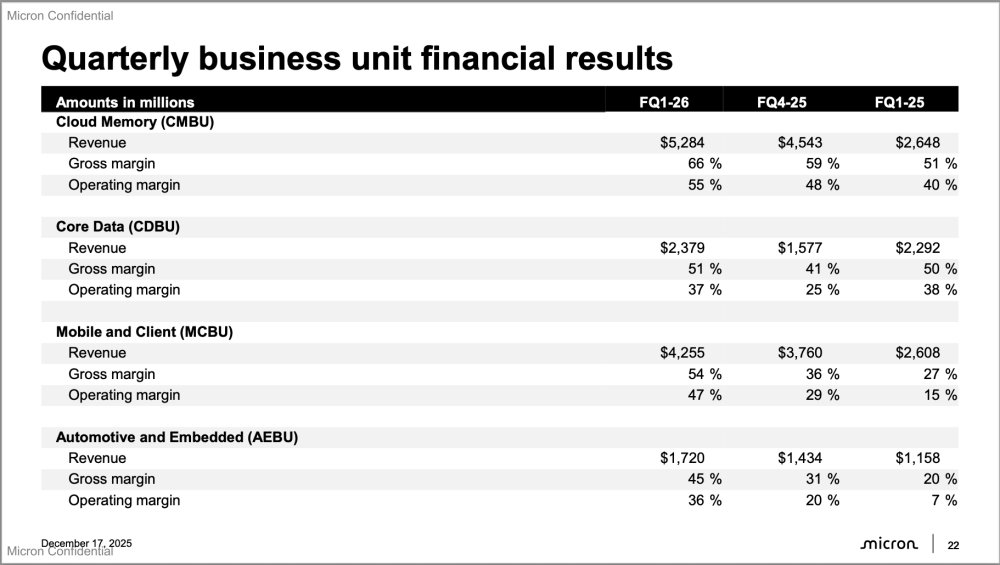

Quarterly Business Unit Financial Results

Click to enlarge

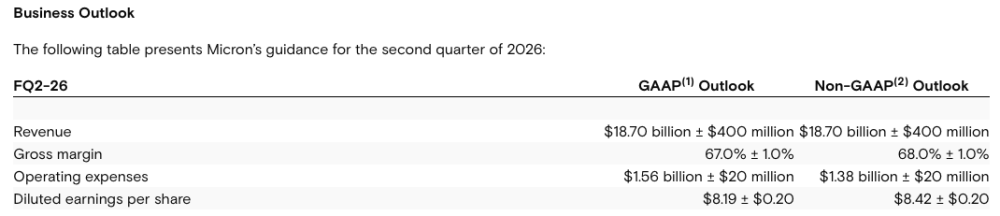

Business Outlook

Click to enlarge

Comments

Micron Technology reported another strong quarter for the first three months of FY26, posting revenue of $13.64 billion—above prior guidance—and delivering 21% sequential growth and 57% year-over-year growth. These results reflect well-timed and effective strategic decisions aligned with evolving memory demand and market dynamics.

Over the past six months, the company has generated nearly $25 billion in revenue, matching its full-year total for 2024. Annualized run rate has now exceeded $42 billion, already about $5 billion higher than total FY25 revenue. Looking ahead, the outlook for 2Q26 stands at $18 billion, suggesting full-year FY26 revenue in the $70–80 billion range—more than double that of FY25. This performance highlights both the momentum of the memory sector and the intensifying competition among leading players.

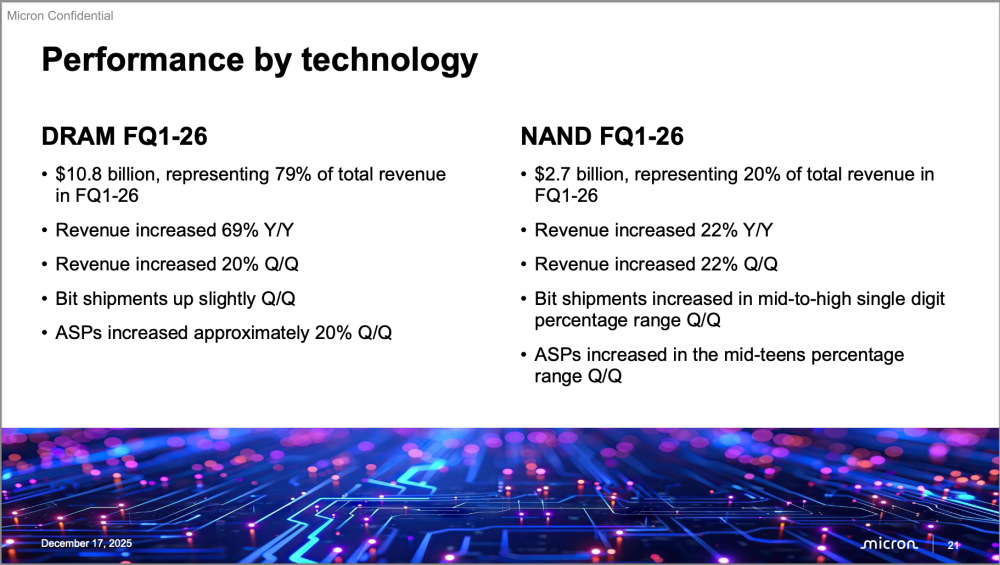

Click to enlarge

From a product mix perspective, DRAM overwhelmingly dominates the revenue profile, accounting for nearly 80% (79%) of total sales at $10.8 billion. This segment grew 20% quarter over quarter and surged 69% year over year. NAND contributed the remaining 20%, generating $2.7 billion, with growth of 22% both sequentially and year over year. By contrast, the NOR business remains marginal, with revenue of just $88 million.

Across multiple segments - including DRAM, NAND, HBM, and data center offerings - Micron Technology achieved record revenue levels, underscoring the broad-based strength of its product portfolio.

Click to enlarge

As AI continues to fuel demand across the memory market, the total addressable market for HBM is now projected to approach $100 billion by 2028. Micron Technology is positioning itself as a key enabler of AI platforms, with a clear ambition to strengthen its footprint in the U.S. market.

To focus resources on this massive and strategic opportunity, the company recently announced the discontinuation of its Crucial consumer activities, redirecting its efforts toward data center and enterprise requirements, where competitive pressure and demand intensity are highest. In the months ahead, manufacturing capacity and pricing dynamics will be critical factors. Market analysts are closely monitoring both, as they will directly influence financial performance, data center and neo-cloud operators, and ultimately end-user projects.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter