IBM to Acquire Confluent to Create Smart Data Platform for Enterprise Generative AI

Confluent has entered into a definitive agreement to be acquired by IBM

This is a Press Release edited by StorageNewsletter.com on December 16, 2025 at 2:02 pmSummary:

- $11B acquisition to deliver end-to-end data platform for businesses to connect, process and govern data for applications and AI agents

- Transaction expected to be accretive to adjusted EBITDA within the first full year, and free cash flow in year two, post close

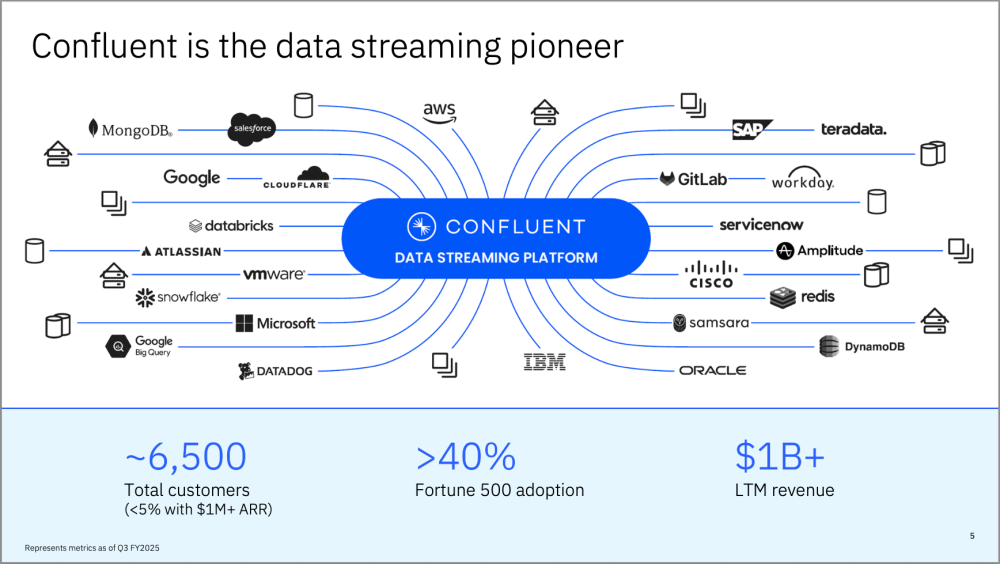

IBM and Confluent Inc., a data streaming pioneer, announced they have entered into a definitive agreement under which IBM will acquire all of the issued and outstanding common shares of Confluent for $31 per share, representing an enterprise value of $11 billion.![]() Confluent provides a leading open-source enterprise data streaming platform that connects, processes and governs reusable and reliable data and events in real time, foundational for the deployment of AI.

Confluent provides a leading open-source enterprise data streaming platform that connects, processes and governs reusable and reliable data and events in real time, foundational for the deployment of AI.

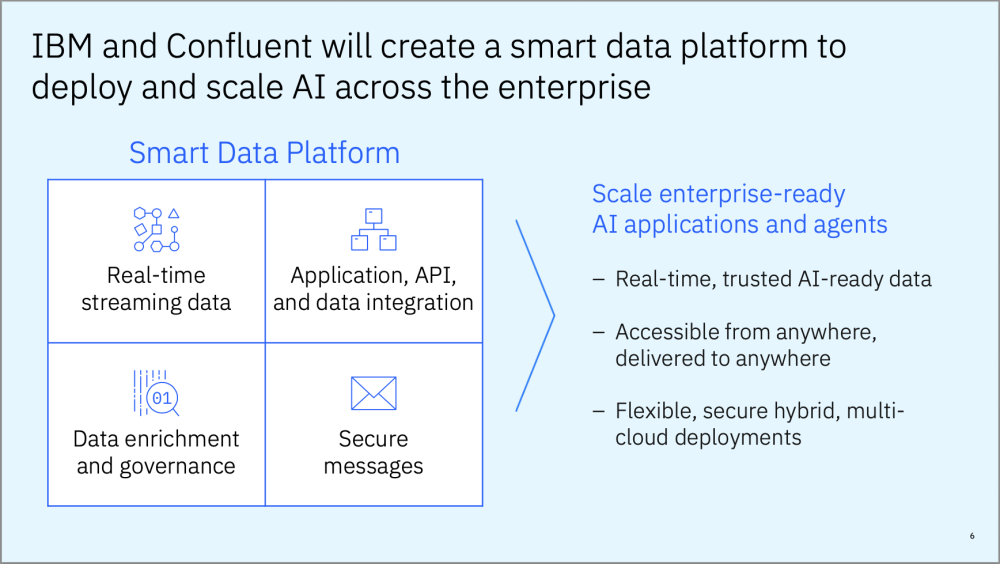

IDC estimates that more than one billion new logical applications will emerge by 2028, reshaping technology architectures across industries. To fuel meaningful outcomes and drive productivity in operations, these applications, as well as AI agents, need access to connected and trusted data – in real time. IBM and Confluent will enable end-to-end integration of applications, analytics, data systems and AI agents to drive intelligence and resilience in hybrid cloud environments.

“IBM and Confluent together will enable enterprises to deploy generative and agentic AI better and faster by providing trusted communication and data flow between environments, applications and APIs. Data is spread across public and private clouds, datacenters and countless technology providers,” said Arvind Krishna, chairman, president and CEO, IBM. “With the acquisition of Confluent, IBM will provide the smart data platform for enterprise IT, purpose-built for AI.”

“Since its founding, Confluent has helped organizations unlock the of their data, driving innovation in an increasingly complex IT landscape. We are extremely proud of the work we’ve done in providing clients with a real-time data streaming platform for the next era of technology, including generative and agentic AI,” said Jay Kreps, CEO & co-founder, Confluent. “We are excited by the potential to join IBM and to accelerate our strategy with IBM’s go-to-market expertise, global scale and extensive portfolio. I look forward to the future we will build together as Confluent becomes part of IBM.”

The real-time nature of Confluent’s platform is critical for organizations as they leverage data living across all IT environments. Confluent addresses the challenges of today’s technology and data landscape. Confluent excels at preparing data for AI, keeping it clean and connected across systems and applications, eliminating silos inherent in agentic AI. In the last four years alone, Confluent’s total addressable market (TAM) has doubled from $50 billion to $100 billion in 2025. Confluent’s real-time data and event streaming capabilities, combined with IBM’s AI infrastructure software and Automation offerings, will better position the companies to capture this opportunity.

Transaction Rationale

- Strategic Fit: Confluent is a natural fit for IBM, consistent with the company’s hybrid cloud and AI strategy. Data and applications are experiencing dramatic growth – by 2028, global data will more than double, and over one billion new applications will emerge. This exponential growth will be amplified by the continued adoption of AI, increasing demands on IT departments. Organizations around the world turn to IBM to simplify, automate and integrate disparate systems. The addition of Confluent will complement IBM’s existing capabilities in its Data and Automation portfolio. Additionally, the acquisition of Confluent represents further commitment to IBM’s 25-year history of open-source innovation and investment, building on the acquisitions of open-source leaders like Red Hat and HashiCorp

- Strong Synergy Opportunities: The acquisition of Confluent is expected to drive substantial product synergies across IBM’s portfolio – including AI products and services, Automation, Data and Consulting – and accelerate revenue growth by leveraging IBM’s go-to-market reach. The acquisition is also expected to result in significant operational efficiencies through IBM’s scale and best-in-class productivity actions

- Attractive Financial Profile: The acquisition of Confluent is expected to accelerate IBM’s growth over time. IBM also anticipates that the transaction will be accretive to adjusted EBITDA within the first full year and free cash flow in year two, post close

Click to enlarge

Confluent is HQed in Mountain View, CA and currently has more than 6,500 clients across major industries – more than 40% of the Fortune 500. The company partners and integrates across the technology industry with leaders like Anthropic, AWS, GCP, Microsoft, Snowflake and more. This is consistent with IBM’s approach to deep industry partnership and working across a broad and open technology ecosystem of application providers, ISVs and hyperscalers.

Confluent is built on Apache Kafka, an open-source data and event streaming platform for data in motion. Apache Kafka enables fast, reliable and scalable data streaming capabilities for analytics, monitoring and event-driven architectures. Confluent’s platform includes Data Streaming, Connectors, Stream Governance, Stream Processing, Tableflow, Confluent Intelligence and Streaming Agents. The platform has flexible deployment options, including:

- Confluent Cloud: A fully managed deployment of Confluent’s data streaming platform. Its serverless Apache Kafka engine powers the most efficient way to deploy and scale real-time data streams in the cloud

- Confluent Platform: The self-managed deployment of Confluent’s data streaming platform, powered by a cloud-native, enterprise-grade distribution of Apache Kafka

- WarpStream: A hybrid Bring Your Own Cloud (BYOC) deployment model with the ease of use of a fully cloud hosted solution, but the cost profile, security and data sovereignty of a self-hosted deployment

- Confluent Private Cloud: Brings a cloud‑native, managed‑service experience to self‑managed, private environments, applying Confluent Cloud’s Kora innovations to on‑prem and private cloud Kafka workloads

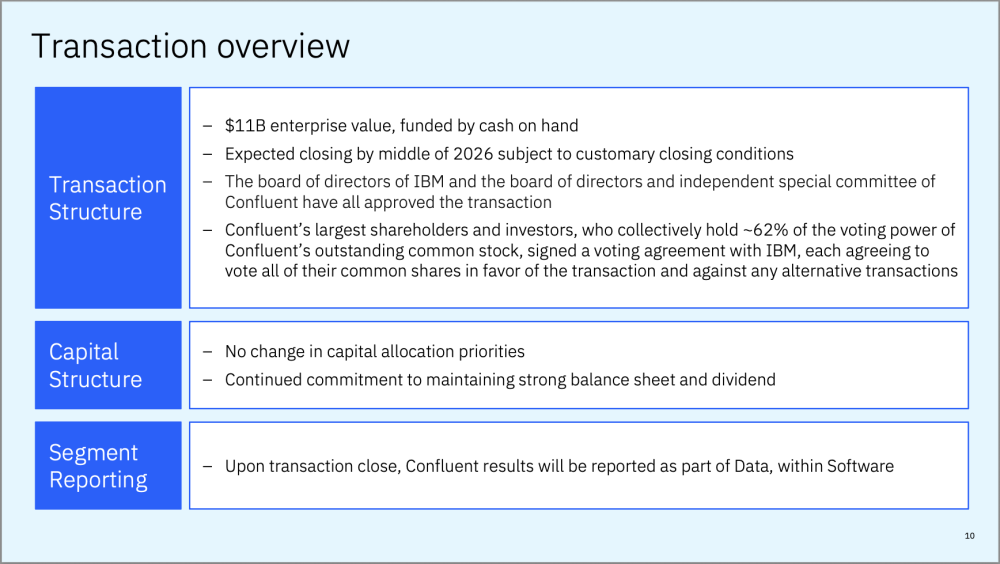

Transaction Details

Under the terms of the agreement, IBM will acquire all of the issued and outstanding common shares of Confluent for $31 per share in cash, representing an enterprise value of $11 billion. Confluent will be acquired with available cash on hand.

The board of directors of IBM and the board of directors and independent special committee of Confluent have each approved the transaction. The acquisition is subject to approval by Confluent shareholders, regulatory approvals and other customary closing conditions.

Confluent’s largest shareholders and investors, who collectively hold approximately 62% of the voting power of Confluent’s outstanding common stock, entered into a voting agreement with IBM pursuant to which each has agreed to vote all of their common shares in favor of the transaction and vs. any alternative transactions.

The transaction is expected to close by the middle of 2026.

Comments

This pending acquisition initially caught the market somewhat off guard, yet it ultimately reinforces IBM’s broader strategy while also exposing gaps in its current portfolio that prompted this move. Time to market is a decisive factor, especially as AI accelerates change across virtually every segment of the industry.

Like many large technology players, IBM has long believed it could rely on internal capabilities to develop the products needed to meet customer demand. History suggests otherwise. The situation echoes the VMware acquisition saga, when EMC, Veritas Software, and IBM competed aggressively. Veritas ultimately withdrew after valuations exceeded its threshold, while IBM’s internal teams argued they could build comparable solutions in-house. The outcome is well known: VMware went on to dominate virtualization, while IBM struggled to establish a comparable market position.

In analytics, IBM followed a similar path but has shown a more pragmatic evolution. The company acquired StreamSets in 2024 for roughly $600 million from Software AG, and is now moving decisively with a definitive agreement to acquire Confluent. The strategic objective is clear: tightly connect applications and orchestrate data flows and pipelines at scale, an area where this acquisition significantly strengthens IBM’s credibility.

Valued at $11 billion in an all-cash transaction priced at $21 per share, this deal ranks among the largest software acquisitions in recent years. By the time the transaction closes in the second half of 2026, Confluent’s revenue is expected to reach approximately $1.1 billion, implying a valuation multiple of about 10× revenue.

Click to enlarge

Confluent reported nearly $300 million in revenue for 3Q25, reflecting 5.7% quarter-over-quarter growth and 19.3% year-over-year growth. Annual recurring revenue has already surpassed $1.11 billion, underscoring the company’s strong momentum.

Based on the recent sequential growth rate, revenue in 4Q25 is expected to exceed the $300 million mark, further reinforcing Confluent’s sustained expansion trajectory.

Click to enlarge

IBM has long aspired to deliver an intelligent data platform for enterprise IT, a goal made more urgent as AI accelerates customer expectations and increases competitive pressure on Big Blue. The company positions Confluent as a natural strategic fit, which raises an obvious question: why make this move only now, when the acquisition price could have been significantly lower in earlier years?

This decision also reflects the intense competition shaping the real-time data landscape. On one side are data streaming platforms built on Apache Kafka, focused on real-time pipelines and distributed messaging; on the other are distributed processing engines such as Apache Spark, championed by players like Cloudera and Databricks. Within this context, Confluent clearly complements IBM’s earlier acquisition of StreamSets, strengthening its end-to-end data pipeline story.

In 2025 alone, IBM completed seven acquisitions, investing close to $20 billion. This includes the $6+ billion acquisition of HashiCorp, alongside notable earlier deals such as Apptio, acquired in 2023 for $4.6 billion.

Through these moves, IBM is reaffirming its deep commitment to open source—a strategy already well established through assets such as Red Hat, HashiCorp, Ceph, and DataStax with its Apache Cassandra platform.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter