Rubrik: Fiscal 3Q26 Financial Results

Delivering $350.2 million, up 13% QoQ and up 48% YoY

This is a Press Release edited by StorageNewsletter.com on December 10, 2025 at 2:02 pmSummary:

- Results exceeded all guided metrics

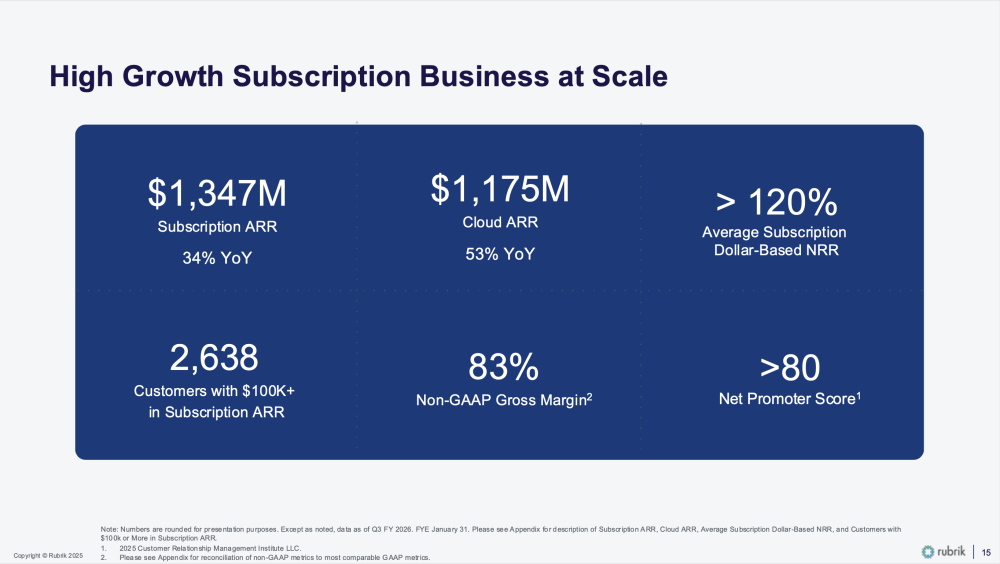

- Third quarter subscription ARR grew 34% YoY to $1.35 billion

- Third quarter revenue grew 48% YoY to $350.2 million

- 2,638 customers with $100K or more in subscription ARR, up 27% YoY

Rubrik, Inc., the Security and AI Operations company, today announced financial results for the third quarter of fiscal year 2026, ended October 31, 2025. “Rubrik had another exceptional quarter, with record net new subscription ARR and free cash flow generation. As the AI transformation unfolds, organizations worldwide are turning to Rubrik to ensure their businesses remain secure and AI ready. Looking ahead, we are committed to leading and pioneering new advancements at the intersection of data protection, cyber resilience, and enterprise AI acceleration,” said Bipul Sinha, CEO, chairman, and co-founder, Rubrik.

“Rubrik had another exceptional quarter, with record net new subscription ARR and free cash flow generation. As the AI transformation unfolds, organizations worldwide are turning to Rubrik to ensure their businesses remain secure and AI ready. Looking ahead, we are committed to leading and pioneering new advancements at the intersection of data protection, cyber resilience, and enterprise AI acceleration,” said Bipul Sinha, CEO, chairman, and co-founder, Rubrik.

Commenting on the company’s financial results, Kiran Choudary, CFO, Rubrik, added, “Q3 was another strong quarter where we exceeded the high end of all of our key performance metrics with 34% YoY growth in subscription ARR and over $76 million in free cash flow. We are pleased to raise our outlook for fiscal 2026 and are looking forward to a strong finish to the year.”

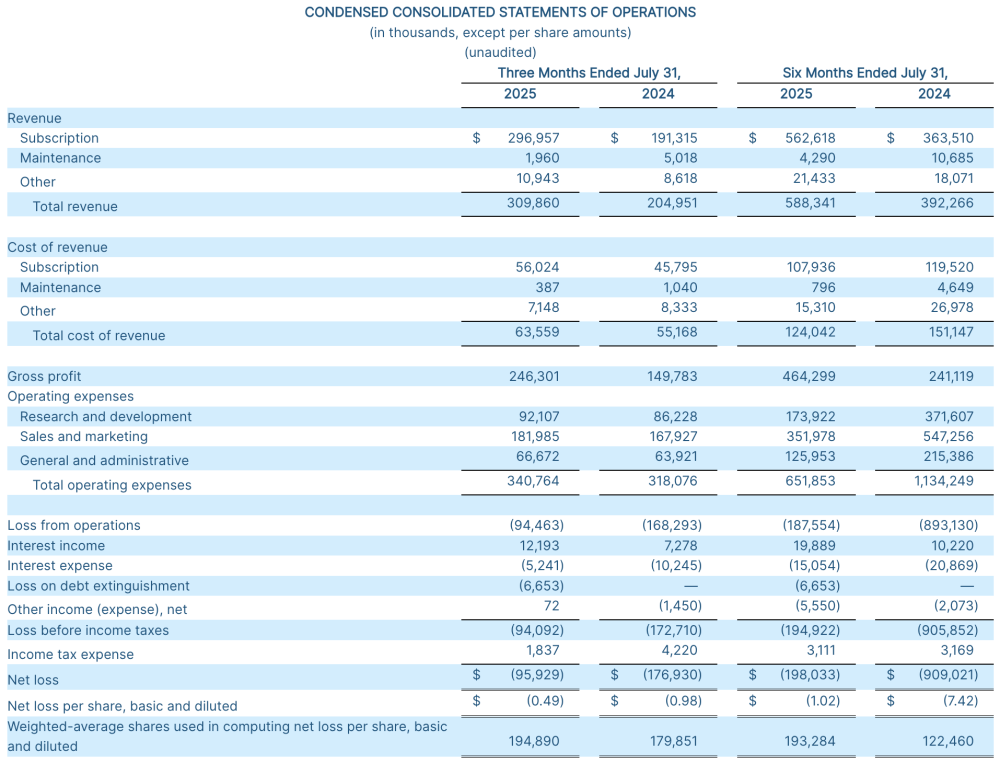

Third Quarter Fiscal 2026 Financial Highlights

- Subscription Annual Recurring Revenue (ARR): Subscription ARR was up 34% year-over-year, growing to $1.35 billion as of October 31, 2025

- Revenue: Subscription revenue was $336.4 million, a 52% increase compared to $221.5 million in the third quarter of fiscal 2025. Total revenue was $350.2 million, a 48% increase compared to $236.2 million in the third quarter of fiscal 2025

- Gross Margin: GAAP gross margin was 80.5%, compared to 76.2% in the third quarter of fiscal 2025. This includes $4.8 million in stock-based compensation expense, compared to $6.0 million in the third quarter of fiscal 2025. Non-GAAP gross margin was 82.8%, compared to 79.2% in the third quarter of fiscal 2025

- Subscription ARR Contribution Margin: Subscription ARR contribution margin was 10.3% compared to (3.3)% in the third quarter of fiscal 2025, reflecting the strong net new subscription ARR in the quarter and an improvement in operating leverage in the business

- Net Loss per Share: GAAP net loss per share was $(0.32), compared to $(0.71) in the third quarter of fiscal 2025. GAAP net loss includes $82.5 million in stock-based compensation expense, compared to $92.5 million in the third quarter of fiscal 2025. Non-GAAP net income per share, diluted, was $0.10, compared to non-GAAP net loss per share, diluted, of $(0.21) in the third quarter of fiscal 2025

- Cash Flow from Operations: Cash flow from operations was $85.5 million, compared to $23.1 million in the third quarter of fiscal 2025. Free cash flow was $76.9 million, compared to $15.6 million in the third quarter of fiscal 2025

- Cash, Cash Equivalents, and Short-Term Investments: Cash, cash equivalents, and short-term investments were $1.60 billion as of October 31, 2025

Recent Business Highlights

- As of October 31, 2025, Rubrik had 2,638 customers with Subscription ARR of $100,000 or more, up 27% YoY

- Launched Rubrik Agent Cloud to manage risk and accelerate Enterprise AI Agent adoption. Rubrik Agent Cloud is designed to monitor and audit agentic actions, enforce real-time guardrails for agentic changes, fine-tune agents for accuracy and undo agent mistakes

- Introduced Rubrik Okta Recovery, a solution for automated, immutable backups and granular recovery of Okta Identity Provider (IdP) environments. This extends Rubrik’s existing identity recovery capabilities for Active Directory and Entra ID, providing protection for all three IdPs

- Expanded our partnership with CrowdStrike to enhance identity security. Rubrik Identity Resilience now integrates with CrowdStrike Falcon Next-Gen Identity Security, allowing customers to reverse malicious identity changes and restore identity providers. This integration provides a complete solution for detecting, adapting to, and reversing identity-based threats, ensuring continued operations in the face of cyberattacks

- Partnered with Cognizant to deliver Business Resilience-as-a-Service (BRaaS), a flexible subscription model for rapid cyber incident and ransomware recovery. This offering integrates Rubrik’s AI-driven cyber resilience with Cognizant’s expertise, shifting clients from reactive recovery to proactive business continuity against expanding AI threats

- Named a leader in the IDC MarketScape: Worldwide Cyber-Recovery 2025 Vendor Assessment1. Rubrik was recognized for strengths in extensive threat detection capabilities, DSPM and identity resilience, ransomware response services included and deep ecosystem integration

Click to enlarge

Click to enlarge

Fourth Quarter and Fiscal Year 2026 Outlook

Rubrik is providing the following guidance for the fourth quarter of fiscal year 2026 and the full fiscal year 2026:

- Fourth Quarter Fiscal 2026 Outlook:

- Revenue of $341 million to $343 million

- Non-GAAP subscription ARR contribution margin of approximately 9%

- Non-GAAP net loss per share of $(0.12) to $(0.10)

- Weighted-average shares outstanding of approximately 201 million

- Full Year 2026 Outlook:

- Subscription ARR between $1,439 million and $1,443 million

- Revenue of $1,280 million to $1,282 million

- Non-GAAP subscription ARR contribution margin of approximately 9%

- Non-GAAP net loss per share of $(0.20) to $(0.16)

- Weighted-average shares outstanding of approximately 197 million

- Free cash flow of $194 million to $202 million

Additional information on Rubrik’s reported results, including a reconciliation of the non-GAAP results to their most comparable GAAP measures, is included in the financial tables below. A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty of expenses that may be incurred in the future, although it is important to note that these factors could be material to Rubrik’s results computed in accordance with GAAP. For example, stock-based compensation-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of Rubrik’s Class A common stock, and Rubrik’s future hiring and retention needs, all of which are difficult to predict and subject to constant change.

Reports Referenced

- IDC MarketScape: Worldwide Cyber-Recovery 2025 Vendor Assessment (doc #US52040125, September 2025)

Comments

Rubrik delivered a strong revenue performance, posting $350 million for the quarter - up 13% sequentially and 48% year over year. Over the first nine months, revenue reached $938.5 million, with momentum continuing at a rapid pace. ARR, representing the trailing 12 months, climbed to nearly $1.2 billion, underscoring a remarkable growth trajectory. This performance fuels strong confidence that Q4 revenue could reach the notable $400 million milestone.

On the product front, Cloud Agent Cloud gained significant traction, further reinforcing Rubrik’s position in the global cyber-resilience landscape. In parallel, a set of carefully selected strategic partnerships enabled the company to enter and expand within new customer accounts, strengthening its recognition as a leading player in the sector.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter