HPE: Fiscal 4Q25 and FY25 Financial Results

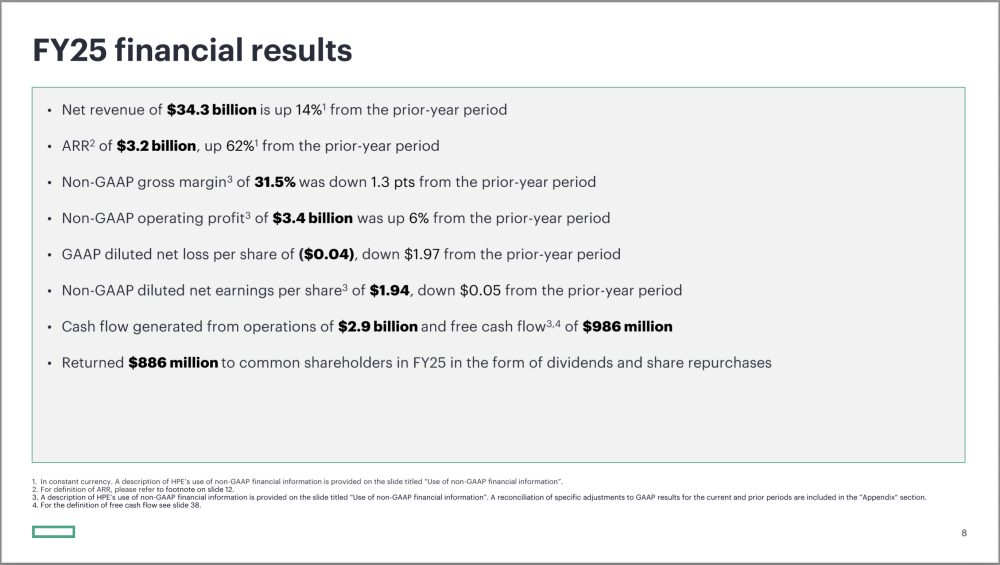

Delivering $9.7 billion for the quarter, up 6% QoQ and up 14% YoY; $34.3 billion for the year up 14% YoY

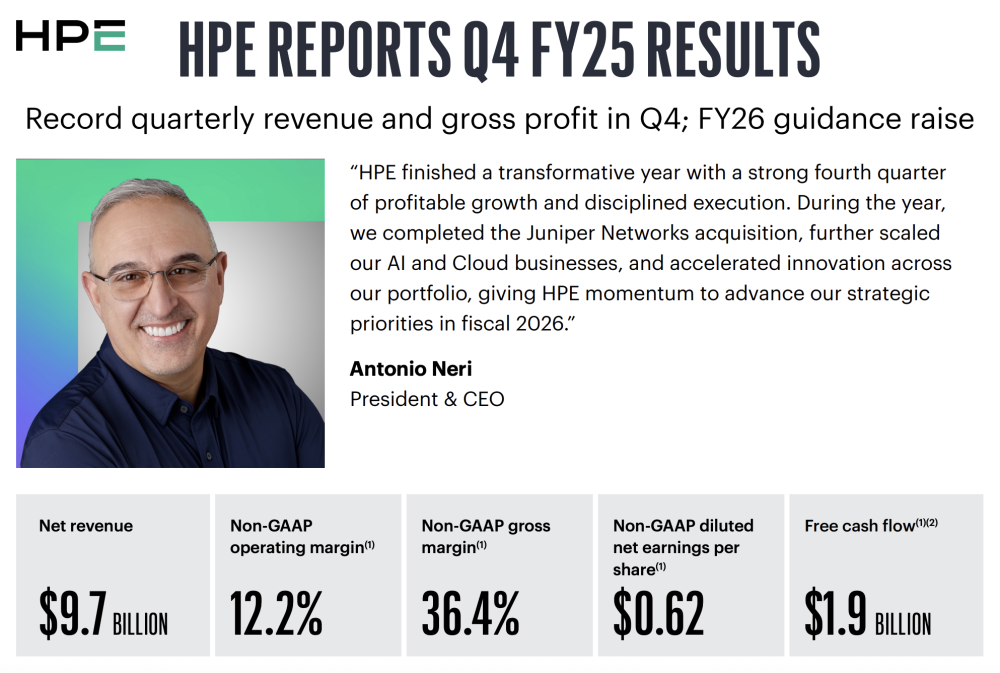

This is a Press Release edited by StorageNewsletter.com on December 9, 2025 at 2:02 pmHPE announced financial results for the fourth quarter ended October 31, 2025.![]() “HPE finished a transformative year with a strong fourth quarter of profitable growth and disciplined execution,” said Antonio Neri, president and CEO, HPE. “During the year, we completed the Juniper Networks acquisition, further scaled our AI and Cloud businesses, and accelerated innovation across our portfolio, giving HPE momentum to advance our strategic priorities in fiscal 2026.”

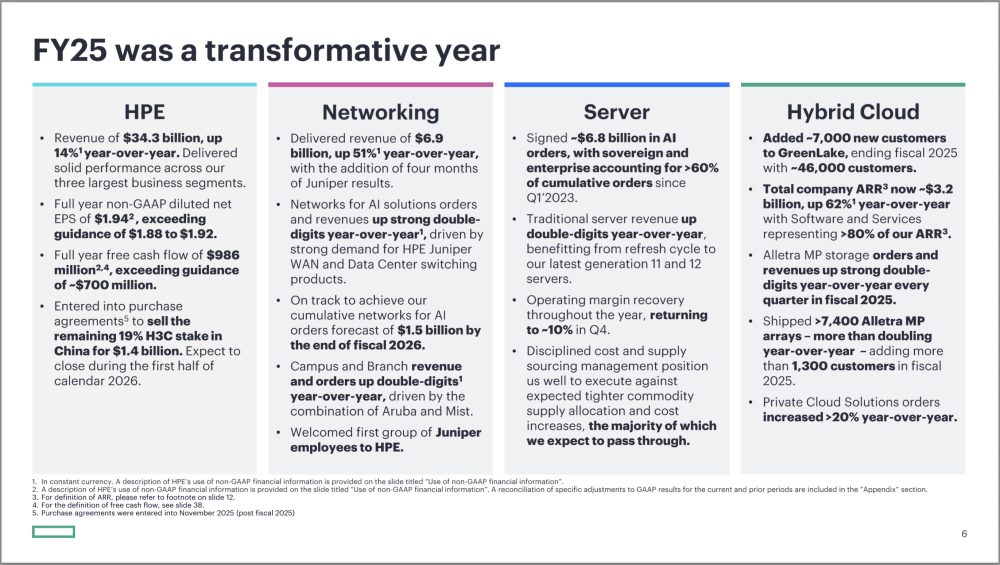

“HPE finished a transformative year with a strong fourth quarter of profitable growth and disciplined execution,” said Antonio Neri, president and CEO, HPE. “During the year, we completed the Juniper Networks acquisition, further scaled our AI and Cloud businesses, and accelerated innovation across our portfolio, giving HPE momentum to advance our strategic priorities in fiscal 2026.”

“HPE continued to drive operational discipline in Q4, resulting in record gross profit and robust non-GAAP operating profit as well as free cash flow generation that exceeded our outlook,” said Marie Myers, EVP and CFO, HPE. “Our focus on disciplined spending, portfolio simplification, and ongoing structural cost management initiatives gives us the confidence to raise our FY26 diluted net earnings per share guidance and the midpoint of our FY26 free cash flow guidance.”

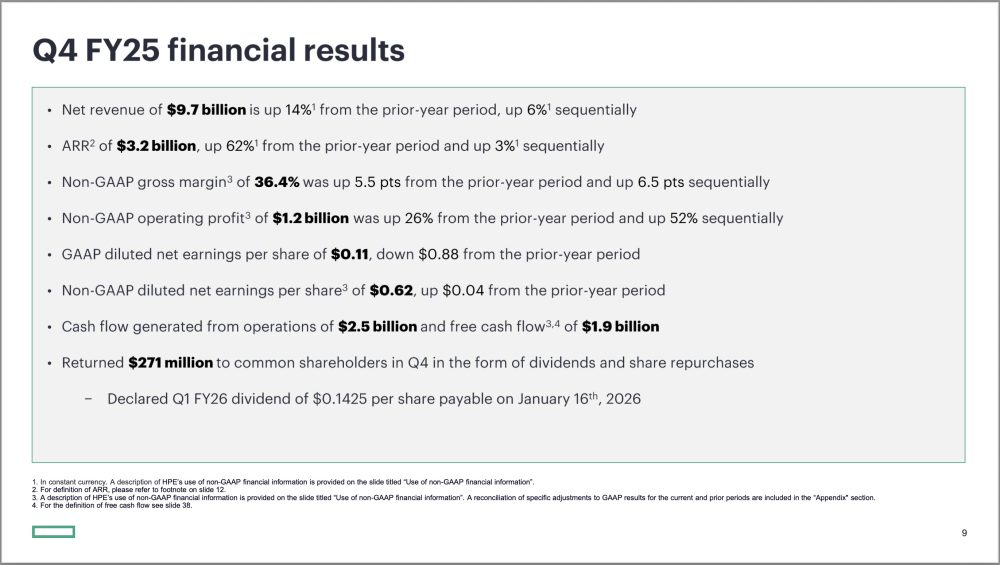

Fourth Quarter Fiscal 2025 Financial Results

- Revenue: $9.7 billion, up 14% from the prior-year period in actual dollars and in constant currency(1)

- Annualized revenue run-rate (“ARR”)(2): $3.2 billion, up 63% from the prior-year period in actual dollars and 62% in constant currency(1)

- Gross margins:

- GAAP of 33.5%, up 270 basis points from the prior-year period and up 430 basis points sequentially

- Non-GAAP(1) of 36.4%, up 550 basis points from the prior-year period and up 650 basis points sequentially

- Diluted net earnings per share (“EPS”):

- GAAP of $0.11, down $0.88 from the prior-year period

- Non-GAAP(1) of $0.62, up $0.04 from the prior-year period and above our outlook range of $0.56 – $0.60

- Cash flow from operations: $2.465 billion, an increase of $435 million from the prior-year period

- Free cash flow (“FCF”)(1)(3): $1.92 billion, an increase of $420 million from the prior-year period

- Capital returns to common shareholders: $271 million in the form of dividends and share repurchases

Click to enlarge

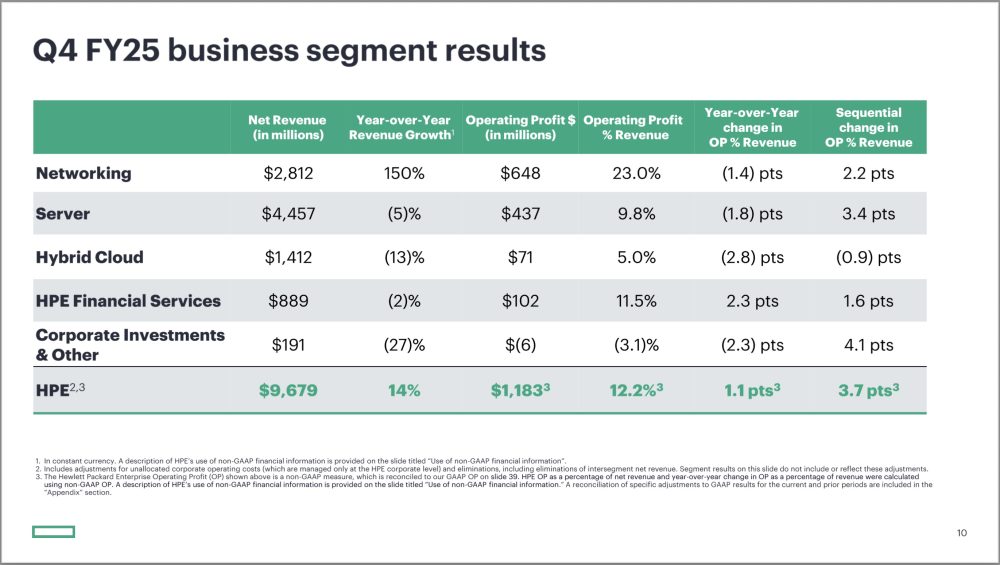

Fourth Quarter Fiscal 2025 Segment Results

- Server revenue was $4.5 billion, down 5% from the prior-year period in actual dollars and in constant currency(1), with 9.8% operating profit margin, compared to 11.6% from the prior-year period

- Networking revenue was $2.8 billion, up 150% from the prior-year period in actual dollars and in constant currency(1), with 23% operating profit margin, compared to 24.4% from the prior-year period

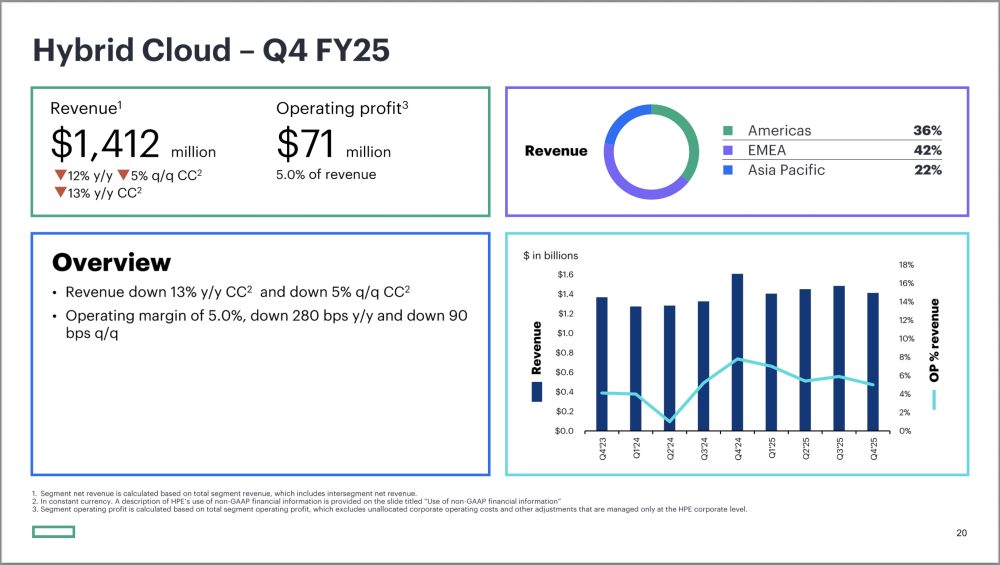

- Hybrid Cloud revenue was $1.4 billion, down 12% from the prior-year period in actual dollars and 13% in constant currency(1), with 5% operating profit margin, compared to 7.8% from the prior-year period

- Financial Services revenue was $889 million, flat from the prior-year period in actual dollars and down 2% in constant currency(1), with 11.5% of operating profit margin, compared to 9.2% from the prior-year period. Net portfolio assets of $13.2 billion, down 3% from the prior-year period and 5% in constant currency(1). The business delivered return on equity of 20.8%, up 3.8 points from the prior-year period

Click to enlarge

Dividend

The HPE Board of Directors declared a regular cash dividend of $0.1425 per share on the company’s common stock, payable on or about January 16, 2026, to stockholders of record as of the close of business on December 19, 2025.

Fiscal 2026 First Quarter Outlook

HPE estimates revenue to be in the range of $9 billion to $9.4 billion. HPE estimates GAAP diluted net EPS to be in the range of $0.09 to $0.13 and non-GAAP diluted net EPS(1) to be in the range of $0.57 to $0.61. Fiscal 2026 first quarter non-GAAP diluted net EPS estimate excludes net after-tax adjustments of approximately $0.48 per diluted share, primarily related to amortization of intangible assets, acquisition, disposition and other charges, stock-based compensation expense, and cost reduction program.

Fiscal 2026 Full Year Outlook

HPE is reaffirming its FY26 revenue outlook range of 17% to 22%, as previously provided at our Securities Analyst Meeting. HPE estimates non-GAAP operating profit growth between 32% to 40%(1)(4) and GAAP operating profit growth to be 455% to 520%. HPE is raising both GAAP diluted net EPS to be in the range of $0.62 to $0.82 and non-GAAP diluted net EPS(1) to be in the range of $2.25 to $2.45. Fiscal 2026 full year non-GAAP diluted net EPS estimate excludes net after-tax adjustments of approximately $1.63 per diluted share, primarily related to amortization of intangible assets, stock-based compensation expense, acquisition, disposition and other charges, and cost reduction program. HPE is also raising the midpoint of its free cash flow(1)(3)(5) guidance, now expected to be in the range of $1.7 billion to $2 billion.

1 A description of HPE’s use of non-GAAP financial information is provided below under “Use of non-GAAP financial information and key performance metrics.”

2 Annualized Revenue Run-Rate (“ARR”) is a financial metric used to assess the growth of the Consumption Services offerings. ARR represents the annualized revenue of all net HPE GreenLake cloud services revenue, related financial services revenue (which includes rental income from operating leases and interest income from finance leases), and software-as-a-Service, software consumption revenue, and other as-a-Service offerings, by taking such revenue recognized during a quarter and multiplying by four. To better align the calculation of ARR with Juniper Networks’ business and offerings, beginning with the quarter ended July 31, 2025, we also included revenue from software licenses support and maintenance in our ARR calculation, and will continue to do so going forward. The impact of this change was not material to the current and prior periods presented. We use ARR as a performance metric. ARR should be viewed independently of net revenue and is not intended to be combined with it.

3 Free cash flow represents cash flow from operations, less net capital expenditures (investments in property, plant & equipment (“PP&E”) and software assets less proceeds from the sale of PP&E), and adjusted for the effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash.

4 FY26 non-GAAP operating profit excludes costs of approximately $2.9 billion primarily related to amortization of intangible assets, stock-based compensation expense, acquisition, disposition and other charges, and cost reduction program.

5 Hewlett Packard Enterprise provides certain guidance on a non-GAAP basis. In reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, Hewlett Packard Enterprise is unable to provide a reconciliation to the most directly comparable GAAP financial measure without unreasonable efforts, as the Company cannot predict some elements that are included in such directly comparable GAAP financial measure. These elements could have a material impact on the Company’s reported GAAP results for the guidance period. Refer to the discussion of non-GAAP financial measures below for more information.

In addition, Antonio Neri, CEO, HPE, wrote a blogpost titled “HPE enters FY2026 with momentum and accelerated innovation” available here.

Comments

Hewlett Packard Enterprise delivered a solid quarter with revenue approaching $10 billion, reflecting meaningful market penetration despite softness in certain product segments. For the full fiscal year, the company generated $34.3 billion in revenue, up from $30.1 billion - a healthy 14% YoY increase and another strong double-digit growth result. That said, to put this performance into perspective, HPE’s annual revenue represents roughly one-sixth of Nvidia’s.

Overall, it was a very solid quarter and a strong year for HPE.

The acquisition of Juniper Networks was finally completed, and the associated revenue contribution surged sharply, showing impressive growth. This performance, however, tends to mask the underlying trends in HPE’s legacy networking business. Meanwhile, servers and hybrid cloud faced a more challenging environment amid intense competition, yet still delivered resilient results - particularly supported by continued demand for AI-driven workloads.

Click to enlarge

Other recent product initiatives also gained traction, largely driven by partner-led solutions. In parallel, the company has been communicating more actively about these developments, highlighting several new and expanded HPC deployments. Once again, it is worth noting that Hewlett Packard Enterprise has effectively leveraged past acquisitions to strengthen and accelerate its HPC portfolio.

Click to enlarge

This strategy has long been part of Hewlett Packard Enterprise’s DNA and remains so today, as illustrated by acquisitions such as Aruba Networks, Juniper Networks, Cray, Zerto, SimpliVity, Nimble Storage, and Silicon Graphics (SGI), to name just a few. Some of us also remember earlier acquisitions like PolyServe, IBRIX, Transoft, or StorageApps - raising the question of where those technologies ultimately landed.

HPE was long recognized as a champion for OEM partner solutions seeking to ship on its hardware platforms, particularly in the storage software space. Recent decisions to discontinue the distribution of some partner solutions in favor of internally developed offerings signal a clear strategic shift. This change is likely to have a significant revenue impact on partners, many of whom derive a substantial portion of their annual turnover from the HPE ecosystem.

The Alletra MP initiative clearly demonstrated HPE’s willingness to make bold, structural decisions. Subsequent block and object storage iterations have validated this direction. The remaining open question is file storage, an area where HPE has acquired multiple companies, partnered with others, and pursued internal development efforts. How these strands will ultimately converge remains to be seen.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter