Backblaze: Fiscal 3Q25 Financial Results

28% Revenue Growth in B2 Cloud Storage, 14% Revenue Growth Overall in Q3 2025

This is a Press Release edited by StorageNewsletter.com on December 9, 2025 at 2:01 pmBackblaze, Inc., a high-performance cloud storage platform for the AI era, announced results for its third quarter ended September 30, 2025.![]() “I am pleased with our third quarter financial results exceeding the high end of our revenue and Adjusted EBITDA guidance and expanding gross margin by ~700 bps YoY to 62%. We remain on track to be free-cash-flow positive in Q4. B2 Cloud Storage grew 28% YoY and we won another seven-figure expansion with an existing customer, reinforcing the value of our price-performance and open platform,” said Gleb Budman, CEO, Backblaze. “As customers build AI and data-intensive workflows, they need high performance, predictable costs, and S3-compatibility without lock-in, a combination that sets Backblaze apart.”

“I am pleased with our third quarter financial results exceeding the high end of our revenue and Adjusted EBITDA guidance and expanding gross margin by ~700 bps YoY to 62%. We remain on track to be free-cash-flow positive in Q4. B2 Cloud Storage grew 28% YoY and we won another seven-figure expansion with an existing customer, reinforcing the value of our price-performance and open platform,” said Gleb Budman, CEO, Backblaze. “As customers build AI and data-intensive workflows, they need high performance, predictable costs, and S3-compatibility without lock-in, a combination that sets Backblaze apart.”

Third Quarter 2025 Financial Highlights:

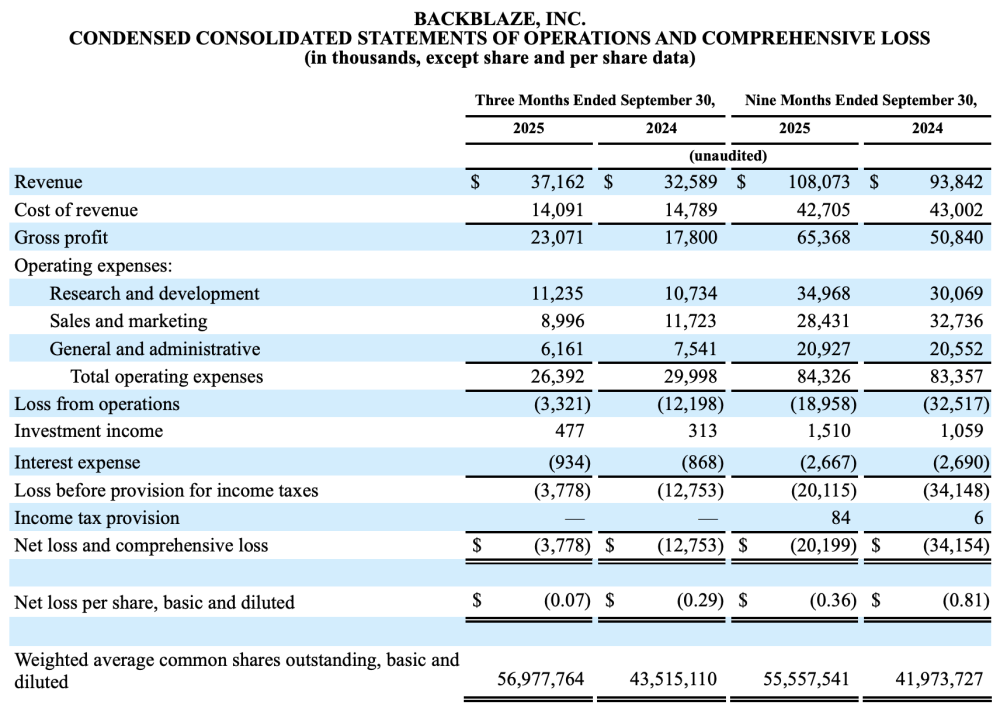

- Revenue of $37.2 million, an increase of 14% YoY

- B2 Cloud Storage revenue was $20.7 million, an increase of 28% YoY

- Computer Backup revenue was $16.5 million, flat YoY

- Gross profit of $23.1 million, or 62% of revenue, compared to $17.8 million, or 55% of revenue, in Q3 2024

- Adjusted gross profit of $29.4 million, or 79% of revenue, compared to $25.5 million or 78% of revenue in Q3 2024

- Net loss was $3.8 million compared to a net loss of $12.8 million in Q3 2024

- Net loss per share was $0.07 compared to a net loss per share of $0.29 in Q3 2024

- Adjusted EBITDA was $8.4 million, or 23% of revenue, compared to $3.7 million or 12% of revenue in Q3 2024

- Non-GAAP net income of $1.9 million compared to non-GAAP net loss of $4.1 million in Q3 2024

- Non-GAAP net income per share of $0.03 compared to a non-GAAP net loss per share of $0.10 in Q3 2024

- Cash flow from operations during the nine months ended September 30, 2025 was $14.2 million, compared to $10.3 million during the nine months ended September 30, 2024

- Adjusted free cash flow during the nine months ended September 30, 2025 was $(9.5) million, compared to $(15.6) million in the nine months ended September 30, 2024

- Cash, cash equivalents, and marketable securities totaled $50.3 million as of September 30, 2025

Third Quarter 2025 Operational Highlights:

- Annual recurring revenue (ARR) was $147.2 million, an increase of 13% YoY

- B2 Cloud Storage ARR was $81.8 million, an increase of 26% YoY

- Computer Backup ARR was $65.4 million, flat YoY

- Net revenue retention rate (NRR) was 106% compared to 118% in Q3 2024

- B2 Cloud Storage NRR was 110% compared to 128% in Q3 2024

- Computer Backup NRR was 101% compared to 109% in Q3 2024

- Gross customer retention rate was 91% in Q3 2025 compared to 90% in Q3 2024

- B2 Cloud Storage gross customer retention rate was 89% in both Q3 2025 and Q3 2024

- Computer Backup gross customer retention rate was 90% in both Q3 2025 and Q3 2024

Click to enlarge

Recent Business Highlights:

- Signed a 7-figure TCV Expansion Deal: A high growth AI-powered video surveillance customer significantly expanded its B2 Cloud Storage footprint, showcasing the value customers see and expansion opportunity in our customer base

- Record Non-GAAP Net Income and Adjusted EBITDA Margin: Achieved new highs in profitability, marking key milestones on our path to Free Cash Flow generation and continued financial discipline

- Recipient of Cloud Computing Security Excellence Award: Validating Backblaze’s commitment to supporting customers in an era of escalating cyber threats with Backblaze B2 Object Lock

- Announced Executive & Director Stock Ownership Policy: Strengthening the leadership equity ownership requirements to further align with shareholders’ interest to drive long-term success

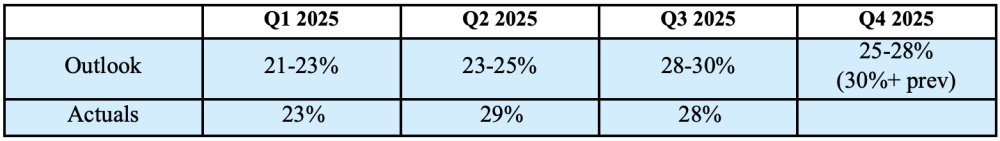

Financial Outlook:

Based on information available as of the date of this press release,

For the fourth quarter of 2025, we expect:

- Revenue between $37.3 million to $37.9 million

- Adjusted EBITDA margin between 20% to 22%

- Basic weighted average shares outstanding of 58.0 million to 58.2 million shares

For full-year 2025, we expect:

- Revenue between $145.4 million to $146.0 million, narrowed from $145.0 million to $147.0 million

- Adjusted EBITDA margin range of 18%-20%, raised from 17%-19%

- For YoY growth in our B2 business, refer to table below

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter