Nvidia: Fiscal 3Q26 Financial Results

Generating $57 billion, up 22% QoQ and 62% YoY

This is a Press Release edited by StorageNewsletter.com on November 20, 2025 at 2:02 pmSummary:

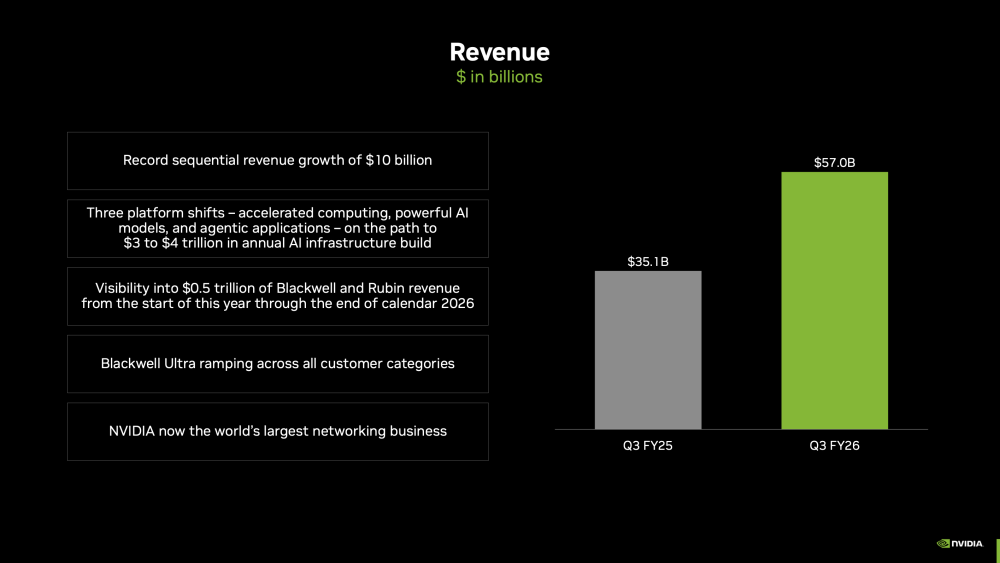

- Record revenue of $57.0 billion, up 22% from Q2 and up 62% from a year ago

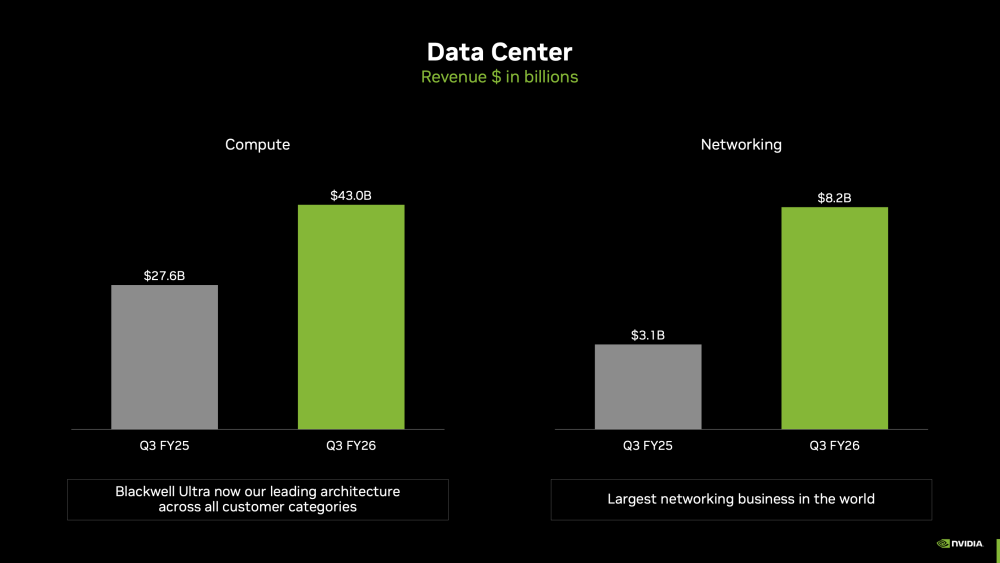

- Record Data Center revenue of $51.2 billion, up 25% from Q2 and up 66% from a year ago

Nvidia Corp. reported record revenue for the third quarter ended October 26, 2025, of $57.0 billion, up 22% from the previous quarter and up 62% from a year ago.![]() For the quarter, GAAP and non-GAAP gross margins were 73.4% and 73.6%, respectively.

For the quarter, GAAP and non-GAAP gross margins were 73.4% and 73.6%, respectively.

For the quarter, GAAP and non-GAAP earnings per diluted share were both $1.30.

“Blackwell sales are off the charts, and cloud GPUs are sold out,” said Jensen Huang, founder and CEO, Nvidia. “Compute demand keeps accelerating and compounding across training and inference – each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast – with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

During the first nine months of fiscal 2026, Nvidia returned $37.0 billion to shareholders in the form of shares repurchased and cash dividends. As of the end of the third quarter, the company had $62.2 billion remaining under its share repurchase authorization.

Nvidia will pay its next quarterly cash dividend of $0.01 per share on December 26, 2025, to all shareholders of record on December 4, 2025.

Q3 Fiscal 2026 Summary

Click to enlarge

Outlook

Nvidia’s outlook for the fourth quarter of fiscal 2026 is as follows:

- Revenue is expected to be $65.0 billion, plus or minus 2%

- GAAP and non-GAAP gross margins are expected to be 74.8% and 75.0%, respectively, plus or minus 50 basis points

- GAAP and non-GAAP operating expenses are expected to be approximately $6.7 billion and $5.0 billion, respectively

- GAAP and non-GAAP other income and expense are expected to be an income of approximately $500 million, excluding gains and losses from non-marketable and publicly-held equity securities

- GAAP and non-GAAP tax rates are expected to be 17.0%, plus or minus 1%, excluding any discrete items

Highlights

Data Center

- Third-quarter revenue was a record $51.2 billion, up 25% from the previous quarter and up 66% from a year ago

- Revealed that Nvidia Blackwell achieved the highest performance and best overall efficiency in the SemiAnalysis InferenceMAX benchmarks, while delivering 10x throughput per megawatt compared with the previous generation

- Announced a strategic partnership with OpenAI to deploy at least 10 gigawatts of Nvidia systems for OpenAI’s next-generation AI infrastructure

- Partnered with industry leaders, including Google Cloud, Microsoft, Oracle and xAI, to build America’s AI infrastructure with hundreds of thousands of Nvidia GPUs

- Announced that, for the first time, Anthropic will run and scale on Nvidia infrastructure, initially adopting 1 gigawatt of compute capacity with Nvidia Grace Blackwell and Vera Rubin systems

- Announced a collaboration with Intel to jointly develop multiple generations of custom data center and PC products with Nvidia NVLink

- Revealed plans to accelerate seven new supercomputers, including with Oracle to build the U.S. Department of Energy’s largest AI supercomputer, Solstice, featuring 100,000 Nvidia Blackwell GPUs, plus another system, Equinox, featuring 10,000 Nvidia Blackwell GPUs

- Celebrated the first Nvidia Blackwell wafer produced on U.S. soil at TSMC’s Arizona facility, representing revitalization of U.S. manufacturing as Blackwell reached volume production.

- Unveiled Nvidia Rubin CPX, a new class of GPU purpose-built for massive-context processing

- Introduced Nvidia NVQLink, an open system architecture for tightly coupling the extreme performance of Nvidia GPU computing with quantum processors, which will be adopted by more than a dozen supercomputing centers globally

- Revealed that Arm is extending its Neoverse platform with Nvidia NVLink Fusion to accelerate AI data center adoption

- Revealed that Meta, Microsoft and Oracle will boost their AI data center networks with Nvidia Spectrum-X Ethernet networking switches

- Introduced Nvidia Omniverse DSX, a comprehensive, open blueprint for designing and operating gigawatt-scale AI factories

- Launched Nvidia BlueField-4, the processor for the operating system of AI factories, with industry leaders including CoreWeave, Dell Technologies, Oracle Cloud Infrastructure, Palo Alto Networks, Red Hat and Vast Data building next-generation BlueField®-accelerated data center platforms

- Partnered with Nokia to add Nvidia-powered AI-RAN products to Nokia’s industry-leading RAN portfolio, enabling communication service providers to launch AI-native 5G-Advanced and 6G networks on Nvidia platforms

- Unveiled the all-American AI-RAN stack to accelerate the path to 6G with industry-leading partners Booz Allen, Cisco, MITRE, ODC and T-Mobile

- Teamed with Palantir Technologies to build a first-of-its-kind integrated technology stack for operational AI

- Set records on the new MLPerf Inference v5.1 benchmark with Nvidia Blackwell Ultra, and won every MLPerf Training v5.1 benchmark

- Revealed that Nvidia is working with partners including CoreWeave, Microsoft and Nscale to build the U.K.’s next generation of AI infrastructure, and announced an investment of £2 billion in the U.K. market

- Launched the world’s first Industrial AI Cloud with Deutsche Telekom to power the AI era of Germany’s industrial transformation

- Announced that Nvidia is working with the South Korea government and industrial leaders, including Hyundai Motor Group, Samsung Electronics, SK Group and NAVER Cloud, to expand the nation’s AI infrastructure with over a quarter-million Nvidia GPUs

Gaming and AI PC

- Third-quarter Gaming revenue was $4.3 billion, down 1% from the previous quarter and up 30% from a year ago

- Launched Borderlands 4, Battlefield 6 and ARC Raiders with Nvidia DLSS 4 with Multi Frame Generation and Nvidia Reflex

- Celebrated 25 years of GeForce with the GeForce Gamer Festival in Seoul, South Korea, a live event including the latest Nvidia RTX announcements

- Unveiled an Nvidia RTX Remix update, adding an advanced path-traced particle system that enables modders to enhance traditional effects

- Released an Nvidia Blueprint for 3D object generation, RTX-optimized NVIDIA TensorRT for Windows ML and performance boosts for leading AI tools on RTX AI PCs

Professional Visualization

- Third-quarter revenue was $760 million, up 26% from the previous quarter and up 56% from a year ago

- Began shipping Nvidia DGX Spark, the world’s smallest AI supercomputer, delivering Nvidia’s AI stack in a compact form factor

Automotive and Robotics

- Third-quarter Automotive revenue was $592 million, up 1% from the previous quarter and up 32% from a year ago

- Introduced the Nvidia DRIVE AGX Hyperion 10 autonomous vehicle development platform, a reference compute and sensor architecture designed to enable automakers and developers to build safe, scalable level 4 fleets

- Partnered with Uber to scale the world’s largest level 4-ready mobility network starting in 2027, targeting 100,000 vehicles

- Revealed that Nvidia and U.S. manufacturing and robotics leaders, including Agility Robotics, Amazon Robotics, Belden, Caterpillar, Foxconn, Figure, Lucid Motors, Skild AI, Toyota, TSMC and Wistron, are driving America’s reindustrialization with physical AI

- Announced that leading industrial solutions providers, including PTC and Siemens, introduced new services that bring Nvidia Omniverse™-powered digital twin workflows to their extensive installed base of customers

- Unveiled Nvidia IGX Thor, a powerful, industrial-grade platform built to bring real-time physical AI directly to the edge

Comments

Once again, Nvidia delivered stellar figures with $57 billion, +$10 billion from previous quarter that means 22% growth QoQ and 62% YoY. The last 6 months passed the $100 billion barrier, the 9 almost touches $150 billion and our estimates of $190-200 billion for the entire year appears low even almost ridiculous as the firm will probably be over by 20% - in the range of $220-230 billion - based on various projections. By different metrics and ratio such as earnings, margins or cash dividends, results are impressive.

The firm participates to a virtuous spiral they feed and even initiates for part of it with investors, AI firms and neoclouds among others.

Clearly training, inference and agentic AI play a significant role in this, meaning that the data center business skyrockets.

Blackwell performance really impresses giving some vertigo to some partners as demands are so high with some difficulties in the production side. And it is reflected in all various flavors of the chip/accelerator family.

Nvidia results confirms also that the decision to acquire Mellanox in 2019 for $6.9 billion was a significant milestone as Nvidia's networking business is among top ones in the world today. Last quarter it generates $7.3 billion and this quarter $8.3 billion.

The SC25 shows, currently in St Louis, MI, finishing today, perfectly illustrates this dynamism, tons of people, lots of new things and product announcements. The AI tsunami swallows everything and masks/hides all over projects and micro-trends. Clearly the IT industry has entered for several quarters, not to say a few years, in a new dimension.

But at the same time, financial results for several companies shows incredible levels of backlogs...

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter