Qualstar: Fiscal 3Q25 Financial Results

Revenue of $2 million, up 41% QoQ and up 49% YoY

This is a Press Release edited by StorageNewsletter.com on November 18, 2025 at 2:02 pmSummary:

- Quarterly revenue up 49% YoY

- Positioned to capitalize on tape storage resurgence and data growth megatrend

- Debt-free, profitable, and uplisting-ready with expanding strategic opportunities

Qualstar Corp., a trusted provider of scalable data storage and high-efficiency power solutions, reported financial results for the third quarter ended September 30, 2025.![]() The third quarter of 2025 reflected strong execution and accelerating demand for Qualstar’s tape-storage systems. With no debt, consistent profitability, and growing visibility across global customers and partners, Qualstar is well-positioned to scale both organically and through strategic initiatives as the data-storage industry enters a new era of growth.

The third quarter of 2025 reflected strong execution and accelerating demand for Qualstar’s tape-storage systems. With no debt, consistent profitability, and growing visibility across global customers and partners, Qualstar is well-positioned to scale both organically and through strategic initiatives as the data-storage industry enters a new era of growth.

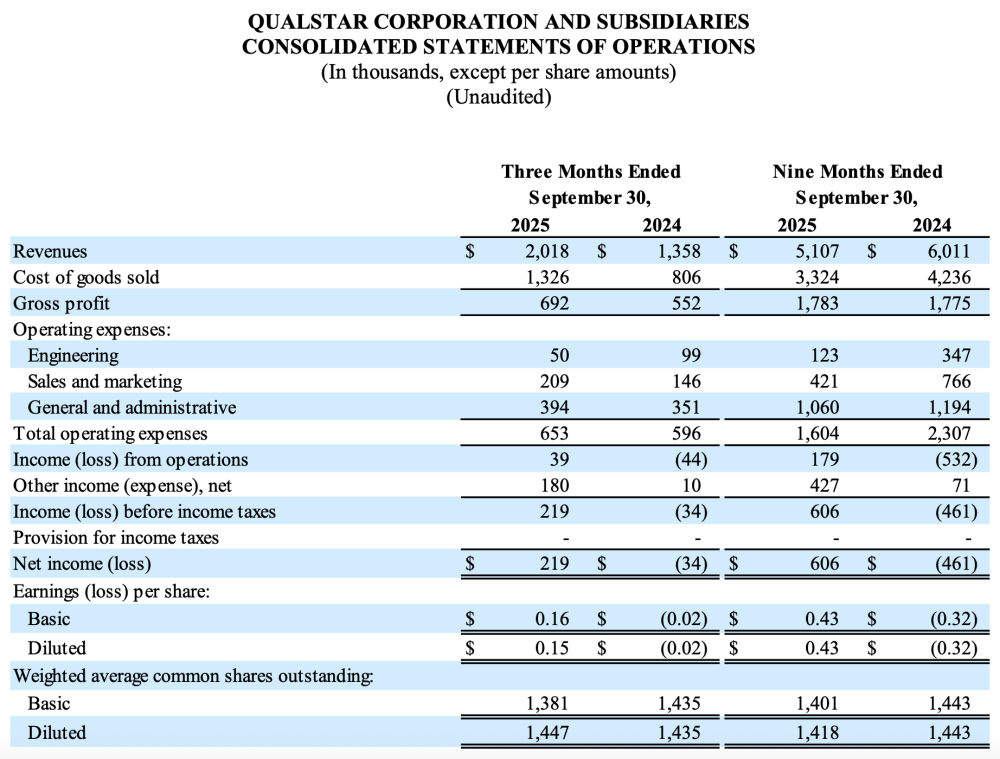

Third Quarter 2025 Financial Highlights

- Revenue increased 49% to $2.0 million, driven by higher sales of automated tape-library systems

- Gross profit up 25% to $692,000, reflecting a balanced product mix and disciplined cost control

- Net income improved to $219,000, or $0.15 per share, compared to a net loss in Q3 2024

- Adjusted EBITDA was $69,000, versus a loss of $(52,000) in Q3 2024

Management Commentary

“The third quarter demonstrated the strength of our core business and the powerful tailwinds reshaping the data-storage industry,” said Steven N. Bronson, chairman, president, and CEO, Qualstar. “As global data creation accelerates, organizations are rediscovering the essential role of tape as the most secure, cost-efficient, and sustainable solution for long-term data preservation.”

“We’re capturing this momentum through a growing base of customers across media, government, and enterprise markets that value our reliability, speed of delivery, and technical expertise. With a debt-free balance sheet, consistent profitability, and disciplined execution, Qualstar is well-positioned to advance its uplisting initiatives, broaden software and distribution partnerships, and pursue strategic acquisitions that enhance scale and reach.”

“The long-term opportunity ahead is significant, and we remain focused on building a modern, profitable data-storage platform that creates lasting value for both customers and shareholders.”

Consolidated Financial Results (Unaudited)

(Amounts in thousands except per share data and percentages)

Revenue increased 49% YoY to $2.0 million, driven by higher sales of data-storage products. For the first nine months of 2025, revenue decreased 15% compared to the same period in 2024, reflecting lower shipments of power-supply products.

Gross margin was 34.3%, consistent with Q2 2025 but down from 40.6% in the prior-year quarter due to product-mix shifts. For the first nine months of 2025, gross margin improved to 34.9%, compared to 29.5% in the prior-year period, primarily reflecting a more favorable mix of products, services, and customers.

Net income for the three- and nine-month periods included gains on marketable securities of $158,000 and $303,000, respectively.

Adjusted EBITDA improved to $69,000, compared to a loss of $(52,000) in the prior-year period. For the first nine months of 2025, Adjusted EBITDA was $124,000, versus $(158,000) in the same period of 2024.

The Company ended the quarter with $2.3 million in cash and cash equivalents and no debt.

Industry Backdrop: Tape’s Resurgence Amid Explosive Data Growth

According to Fortune Business Insights, the global data-storage market is projected to grow from $255 billion in 2025 to $774 billion by 2032, representing a compound annual growth rate (CAGR) of 17.2%. More than 80% of the world’s data qualifies as “cold” storage, referring to archival information that must be retained securely for years. This makes tape an increasingly vital component of the global data-infrastructure stack.

Tape has re-emerged as the optimal medium for long-term data management due to its air-gapped security, decades-long reliability, and lowest total cost of ownership among available storage technologies.

As enterprises face escalating cloud-retrieval costs, mounting cybersecurity risks, and tightening sustainability mandates, Qualstar’s tape-based systems provide a proven, eco-efficient, and cost-effective foundation for meeting today’s and tomorrow’s data-storage requirements.

Business Outlook

Qualstar continues to execute on its strategy to position the Company for scalable growth. Key priorities include:

- Strategic partnerships, including its recently announced CMS Distribution collaboration;

- Expansion into enterprise-scale tape systems and integrated software offerings guided by new CTO Jeff Sengpiehl;

- Targeted M&A to broaden product breadth and recurring-revenue streams; and

- Uplisting to a major U.S. exchange to enhance institutional visibility and access to capital.

Qualstar makes available its annual financial statements, quarterly financial statements, and other significant reports and amendments to such reports, free of charge, on its website as soon as reasonably practicable after such reports are prepared. Please visit www.qualstar.com to view the Company’s financial results in more detail.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter