Seagate Technology: Fiscal 1Q26 Financial Results

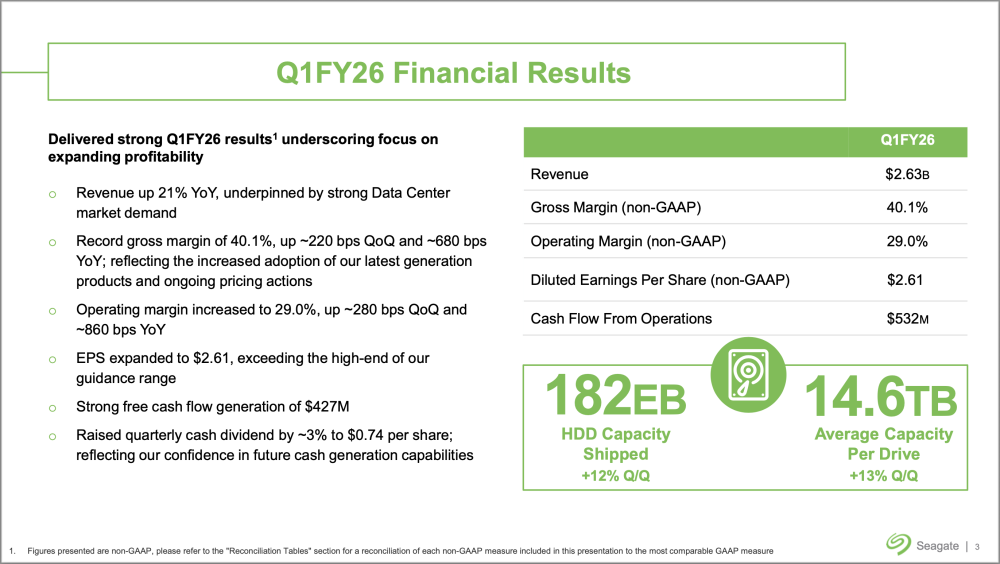

Revenue of $2.63 billion, up 21.8% YoY and up 7.8% QoQ

This is a Press Release edited by StorageNewsletter.com on October 30, 2025 at 2:02 pmFiscal Q1 2026 Highlights:

- Revenue of $2.63 billion

- GAAP gross margin of 39.4%; non-GAAP gross margin of 40.1%, both at record levels

- GAAP diluted earnings per share (EPS) of $2.43; non-GAAP diluted EPS of $2.61

- Cash flow from operations of $532 million and free cash flow of $427 million

- Returned $182 million to shareholders through dividends and the repurchase of ordinary shares; increased quarterly cash dividend by approximately 3% to $0.74 per share

Seagate Technology Holdings plc, a reference and innovator of mass-capacity data storage, reported financial results for its fiscal first quarter ended October 3, 2025.

Click to enlarge

“Seagate delivered strong September quarter results, with revenue growth of 21% year-over-year and non-GAAP EPS exceeding the high end of our guided range. Our performance underscores the team’s strong execution and robust customer demand for our high-capacity storage products,” said Dave Mosley, chair and CEO, Seagate.

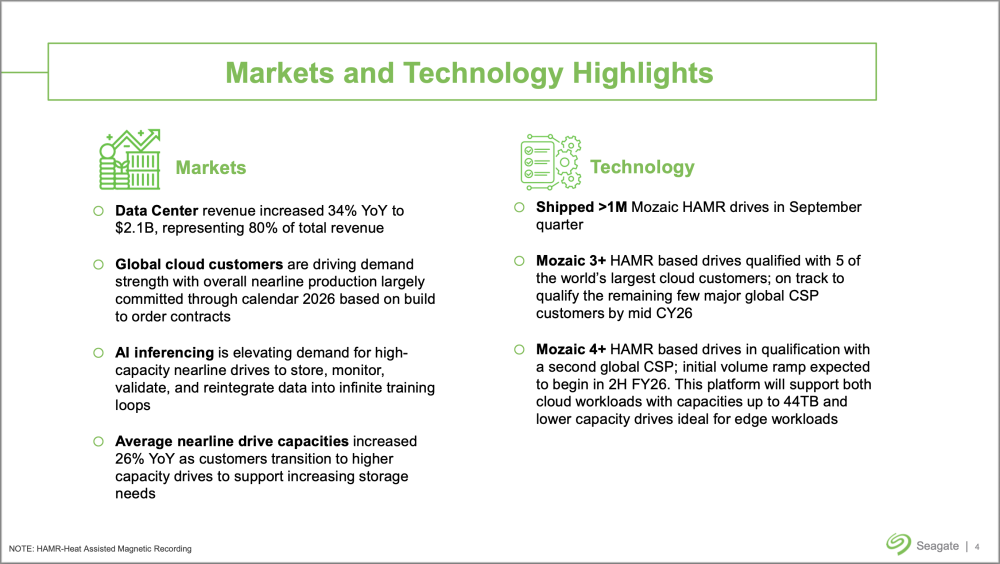

“With clear visibility into sustained demand strength, we are ramping shipments of our areal density-leading Mozaic HAMR products, which are now qualified with five of the world’s largest cloud customers. These products address customers’ performance, durability and TCO needs at scale to continue supporting demand for existing use cases such as social media video platforms as well as growth driven by new AI applications. AI is transforming how content is being consumed and generated, increasing the value of data and storage and Seagate is well positioned for continued profitable growth,” Mosley concluded.

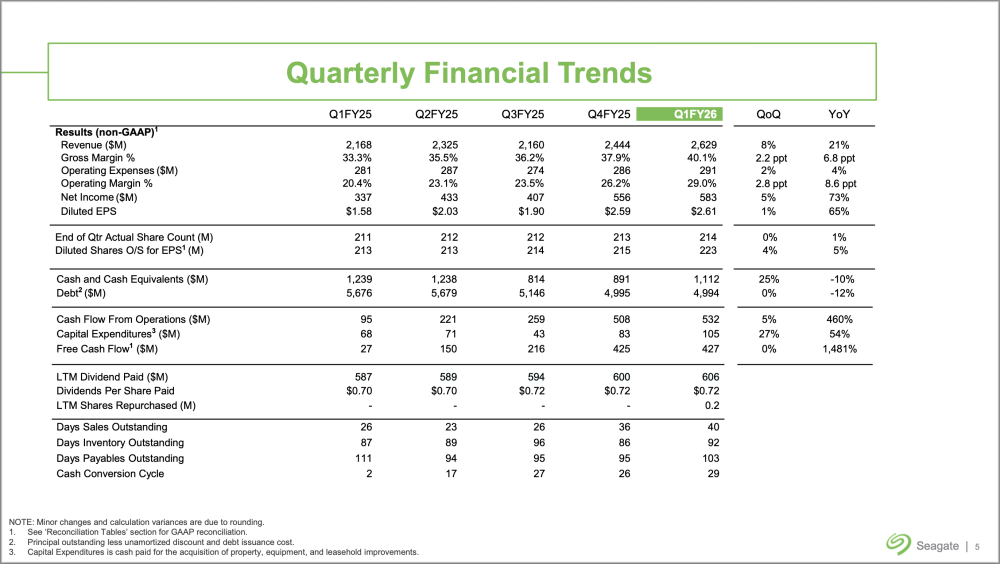

Quarterly Financial Results

Click to enlarge

Click to enlarge

For definitions and a detailed reconciliation of GAAP to non-GAAP results, see accompanying financial tables.

During the fiscal first quarter, the Company generated $532 million in cash flow from operations and $427 million in free cash flow. Seagate’s balance sheet remains healthy, and during the fiscal first quarter, the Company paid cash dividends of $153 million and repurchased 153 thousand ordinary shares for $29 million. As of the end of the quarter, cash and cash equivalents totaled $1.1 billion, and there were 214 million ordinary shares issued and outstanding.

Seagate has issued a Supplemental Financial Information document, which is available on Seagate’s Investor Relations website at investors.seagate.com.

Quarterly Cash Dividend

The Board of Directors of the Company (the “Board”) declared a quarterly cash dividend of $0.74 per share, which will be payable on January 9, 2026 to shareholders of record as of the close of business on December 24, 2025. The payment of any future quarterly dividends will be at the discretion of the Board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the Board.

Business Outlook

The business outlook for the fiscal second quarter 2026 is based on our current assumptions and expectations; actual results may differ materially as a result of, among other things, the important factors discussed in the Cautionary Note Regarding ForwardLooking Statements section of this release.

The Company is providing the following guidance for its fiscal second quarter 2026:

- Revenue of $2.70 billion, plus or minus $100 million

- Non-GAAP diluted EPS of $2.75, plus or minus $0.20

Our fiscal second quarter guidance includes:

- The estimated impact from the Pillar Two framework for the global minimal tax that is effective starting fiscal year 2026 in major jurisdictions in which the Company operates;

- The estimated net dilutive impact from the Exchangeable Senior Notes due 2028; and

- Minimal expected impact from global tariff policies announced as of the date of this release.

Guidance regarding non-GAAP diluted EPS excludes known pre-tax charges related to estimated share-based compensation expenses of $0.24 per share.

We have not reconciled our non-GAAP diluted EPS guidance for fiscal second quarter 2026 to the most directly comparable GAAP measure, other than estimated share-based compensation expenses, because material items that may impact these measures are out of our control and/or cannot be reasonably predicted, including, but not limited to, net (gain) loss from debt transactions, strategic investment losses (gains) or impairment charges, income tax adjustments on these measures, and other charges or benefits that may arise. The amounts of these measures are not currently available but may be material to future results. A reconciliation of our historical non-GAAP financial measures to their nearest GAAP equivalent is contained in this release.

Comments

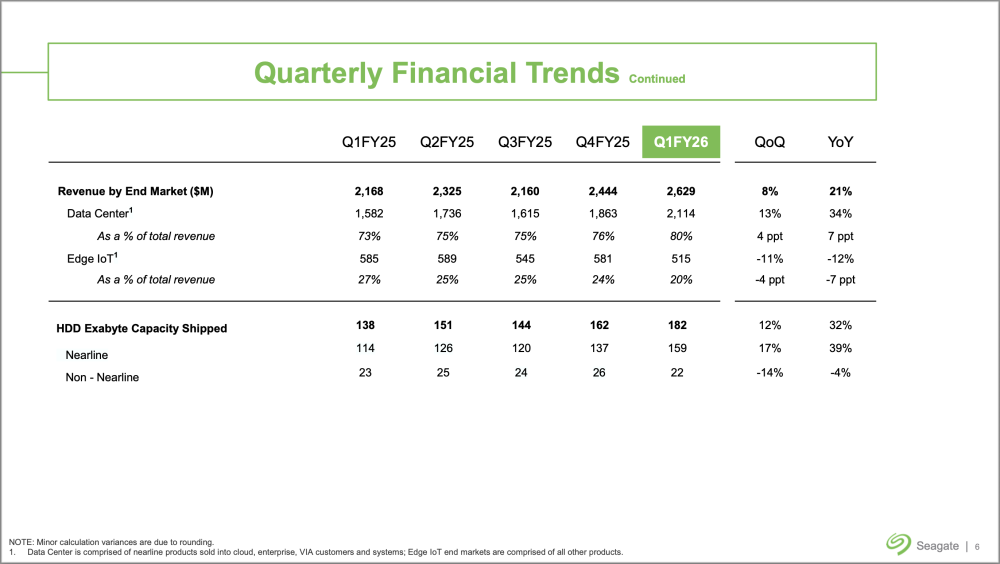

Quarterly revenue continues to grow and even approaches to $3 billion like end of 2021 with 2 quarters above that famous threshold. Last year, all quarters passed $2 billion, with a surprise for 3Q25 below 2Q25, and the year before, 2024, revenue was between 1 and 2 billion dollars for each quarter again.

This quarter, the revenue grew almost 8% sequentially and almost 22% vs. same quarter last year. Clearly there is a positive dynamic for Seagate with the last 6 months above $5 billion vs. last year just above $4 billion. It means that the annual revenue should pass the $10 billion value confirming that data center business is strong and the big contributor with 80% at $2.1 billion.

Cloud providers and hyperscalers continue to buy HDDs in large volume to support various workloads associated with unstructured data and the HDD density plus $/TB, representing 2 key factors for them. In other words, in the same footprint they store more data. Also, Mozaic3+/4+ and HAMR demonstrated real interests and validated the model Seagate chose a few years ago.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter