Micron Technology: Fiscal 4Q25 and FY25 Financial Results

Record fiscal Q4 and full-year revenue driven by AI data center growth

This is a Press Release edited by StorageNewsletter.com on September 25, 2025 at 2:02 pmMicron Technology, Inc. announced results for its fourth quarter and full year of fiscal 2025, which ended August 28, 2025.![]() Fiscal Q4 2025 highlights

Fiscal Q4 2025 highlights

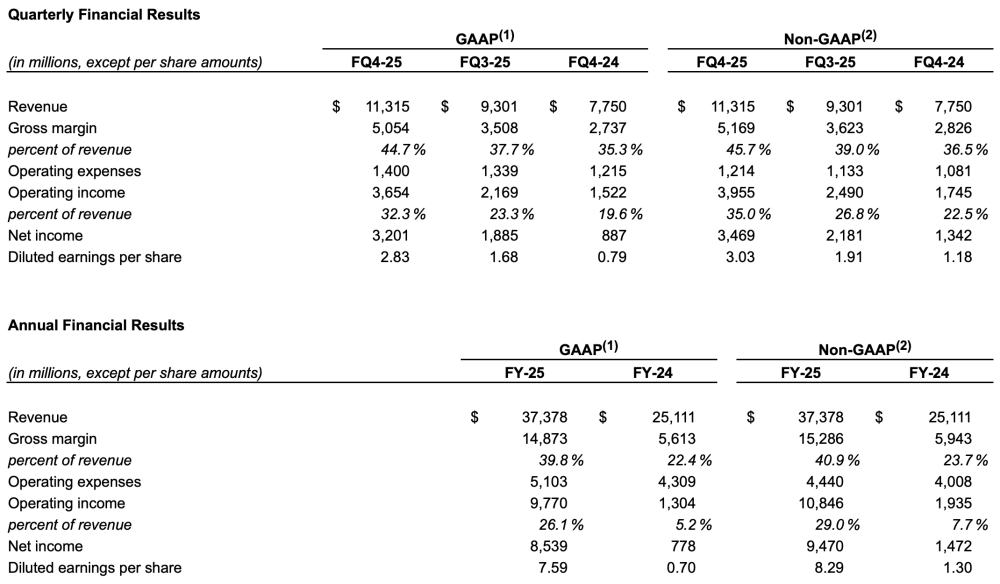

- Revenue of $11.32 billion versus $9.30 billion for the prior quarter and $7.75 billion for the same period last year

- GAAP net income of $3.20 billion, or $2.83 per diluted share

- Non-GAAP net income of $3.47 billion, or $3.03 per diluted share

- Operating cash flow of $5.73 billion versus $4.61 billion for the prior quarter and $3.41 billion for the same period last year

Fiscal 2025 highlights

- Revenue of $37.38 billion versus $25.11 billion for the prior year

- GAAP net income of $8.54 billion, or $7.59 per diluted share

- Non-GAAP net income of $9.47 billion, or $8.29 per diluted share

- Operating cash flow of $17.53 billion versus $8.51 billion for the prior year

“Micron closed out a record-breaking fiscal year with exceptional Q4 performance, underscoring our leadership in technology, products, and operational execution,” said Sanjay Mehrotra, chairman, president and CEO, Micron Technology. “In fiscal 2025, we achieved all-time highs across our data center business and are entering fiscal 2026 with strong momentum and our most competitive portfolio to date. As the only U.S.-based memory manufacturer, Micron is uniquely positioned to capitalize on the AI opportunity ahead.”

Click to enlarge

Investments in capital expenditures, net(2) were $4.93 billion for the fourth quarter of 2025 and $13.80 billion for the full year of 2025. Adjusted free cash flow(2) was $803 million for the fourth quarter of 2025 and $3.72 billion for the full year of 2025. Micron ended the year with cash, marketable investments, and restricted cash of $11.94 billion. On September 23, 2025, Micron’s Board of Directors declared a quarterly dividend of $0.115 per share, payable in cash on October 21, 2025, to shareholders of record as of the close of business on October 3, 2025.

Click to enlarge

(1) GAAP represents U.S. Generally Accepted Accounting Principles.

(2) Non-GAAP represents GAAP excluding the impact of certain activities, which management excludes in analyzing our operating results and understanding trends in our earnings; adjusted free cash flow; investments in capital expenditures, net; and business outlook. Further information regarding Micron’s use of non-GAAP measures and reconciliations between GAAP and non-GAAP measures are included within this press release.

Comments

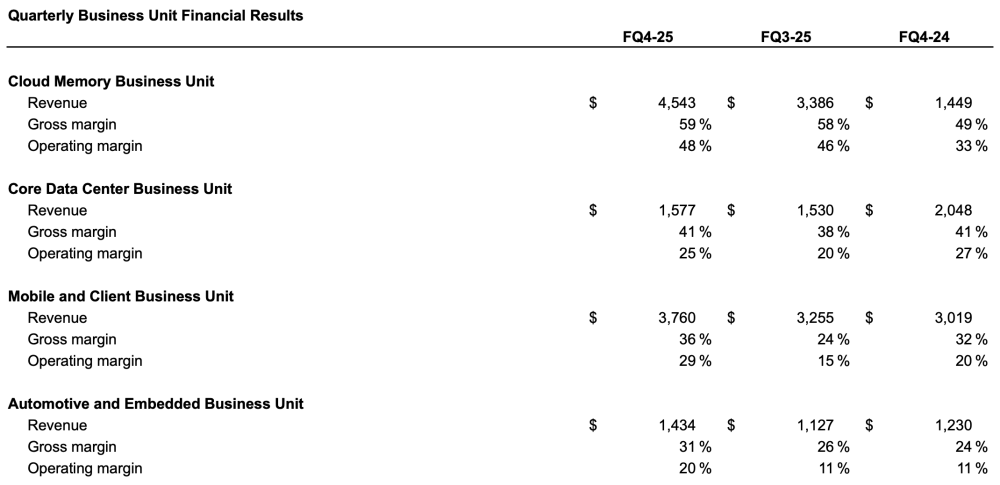

Micron delivers very solid Q4 and annual revenue 2025 at $37.38 billion, up 48.8% YoY from $25.11 billion in 2024, itself up 62% YoY from $15.5 billion in 2023. It means that in 2 sequential years, the company grew by 141% or multiplied by 2.41 its annual revenue !!

This FY25 was exceptional as it was the first year with all quarters above $8 billion, 1 above $9 billion and the last one above $11 billion. Since 2Q23, all quarters generated a positive trajectory, at that time 2Q23 was at $3.7 billion and 4Q25 passed $11.32 billion. 1Q26 guidance appears to be above $12.5 billion.

All memory business represents $10 billion in FY25 so 26.7% and Data Center 56%.

Click to enlarge

It means that it confirms some choices made by the company for a few years, investments and technology directions, but also the adequacy of solutions to the market demand illustrating, if needed, that timing is everything.

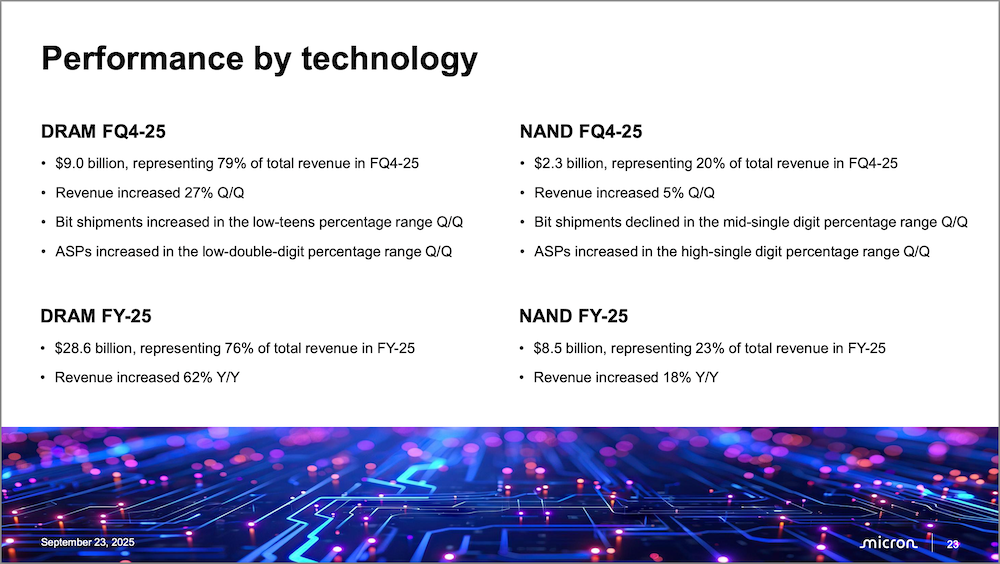

Obviously AI is the key and main driver for such trajectory and results. For the firm, it is associated with memory such as HBM, DIMM, DRAM and storage with TLC and QLC SSDs.

During recent FMS, the company has announced SLC NAND dedicated to special usage such space. Several SSDs iterations have been unveiled such as the 9650 SSD PCIe Gen 6 data center SSD, 6600 ION SSD E3.S 122TB and 245TB data center SSD with 9th NAND generation, and 7600 SSD PCIe Gen 5.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter