New Enterprise Storage Platforms MQ from Gartner for 2025

With strange results as usual

By Philippe Nicolas | September 18, 2025 at 2:02 pmA few weeks ago Gartner published a new report about storage and this one is named Enterprise Storage Platforms as the analyst firm as to go beyond primary storage as it didn’t reflect completely the market reality.

The definition is important we think and Gartner mentions that an enterprise storage platform should offer block, file and object. It is not or but and. It has to support structured and unstructured content supporting various workloads and usages and can be deployed on-premises and hybrid cloud approach. Products according to Gartner again must be appliances or SDS or data management and other data storage services. The definition is pretty large indeed.

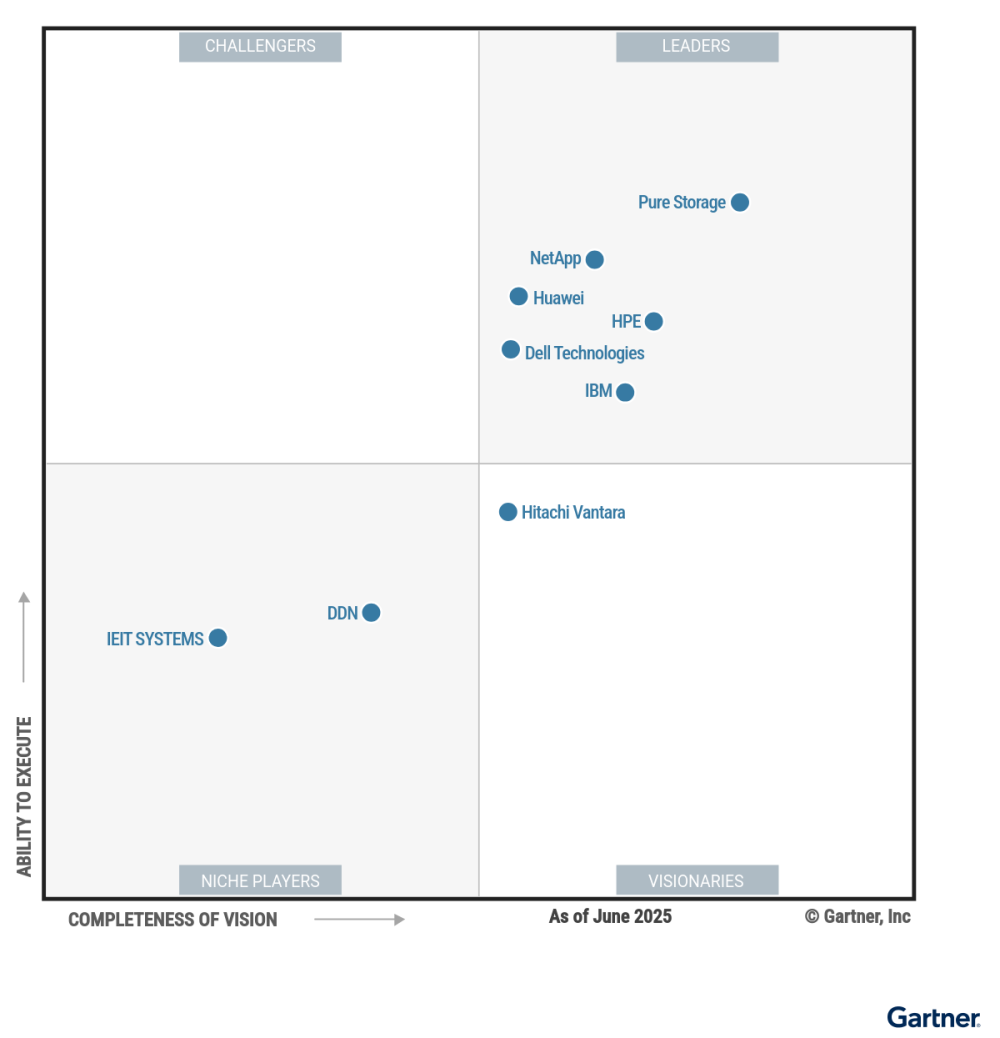

But in the mandatory features, the analyst firm put an or in the access methods which open the solutions to be less “unified”. It appears that Gartner doesn’t consider structured applications running on file storage and we wonder why container management is mandatory. We notice the details about QLC NVMe support which should be really out of the scope here especially for SDS solutions. The analyst firm selects 9 players for this MQ with 6 leaders, by alpha order they’re Dell Technologies, HPE, Huawei, IBM, NetApp and Pure Storage. And the 3 followers are DDN, Hitachi Vantara and IEIT Systems.

The analyst firm selects 9 players for this MQ with 6 leaders, by alpha order they’re Dell Technologies, HPE, Huawei, IBM, NetApp and Pure Storage. And the 3 followers are DDN, Hitachi Vantara and IEIT Systems.

The first remark is about the flavor of solutions these vendors promote. Many of them not to say all of them develop software but sell hardware inviting us to think where are SDS players in this. Are they too small, do they disappear from the market, they’re no longer eligible…?

If we consider enterprise storage platforms, why remarks about AI integration and Nvidia support are so important as enterprises are looking for consolidation of workloads and harmonization of solutions.

We’re surprised to see DDN and Hitachi Vantara at that place while we see other elsewhere. Why HPE is a leader especially if we consider file and object storage considering that their own solution is very recent? Why IEIT Systems is still listed? In that case, what about…? Some very recent products are mentioned as positive arguments but are they all available and deployed with enough return of experience and installed base?

The revenue minimum barrier of $325 million is a bit bizarre, why not 350 or 380? or just a rounded number? Why does block storage has more weight in the criteria than file or object when you see minimum 500 references for block and a minimum of 200 for file or object? But this MQ shows some progress.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter