Nutanix: Fiscal 4Q25 and FY25 Financial Results

Reports 18% YoY Revenue Growth at $2.54 Billion

This is a Press Release edited by StorageNewsletter.com on September 12, 2025 at 2:02 pmNutanix, Inc., a active player in hybrid multicloud computing, announced financial results for its fourth quarter and fiscal year ended July 31, 2025.

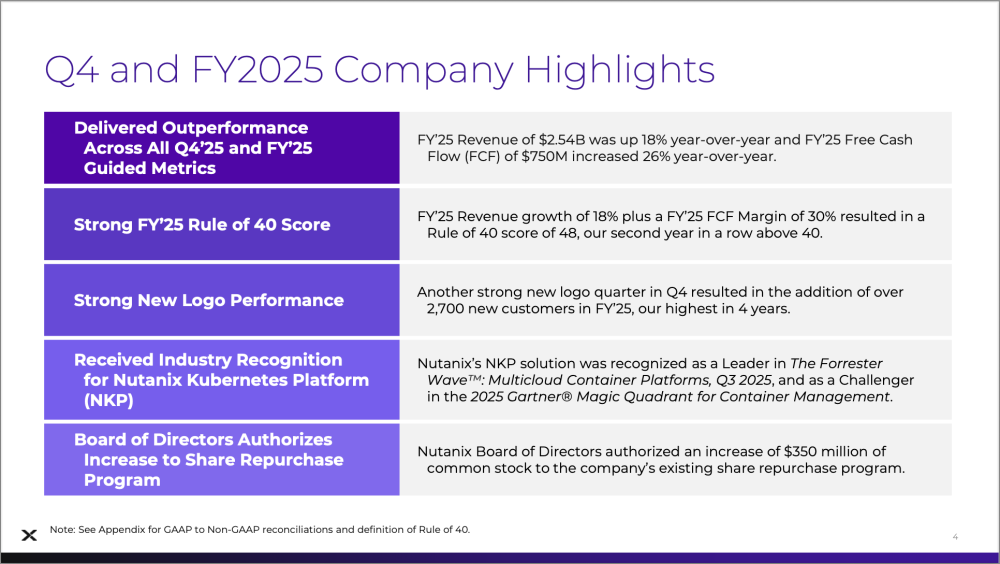

“Our fourth quarter was a good finish to a fiscal year in which we delivered high-teens top line growth and added over 2,700 new customers,” said Rajiv Ramaswami, president and CEO, Nutanix. “In fiscal 2025, we also made progress with respect to partnerships, signing new or enhanced agreements with AWS, Pure Storage, NVIDIA and Google, and continued to innovate across our cloud platform, including modern applications and AI.”

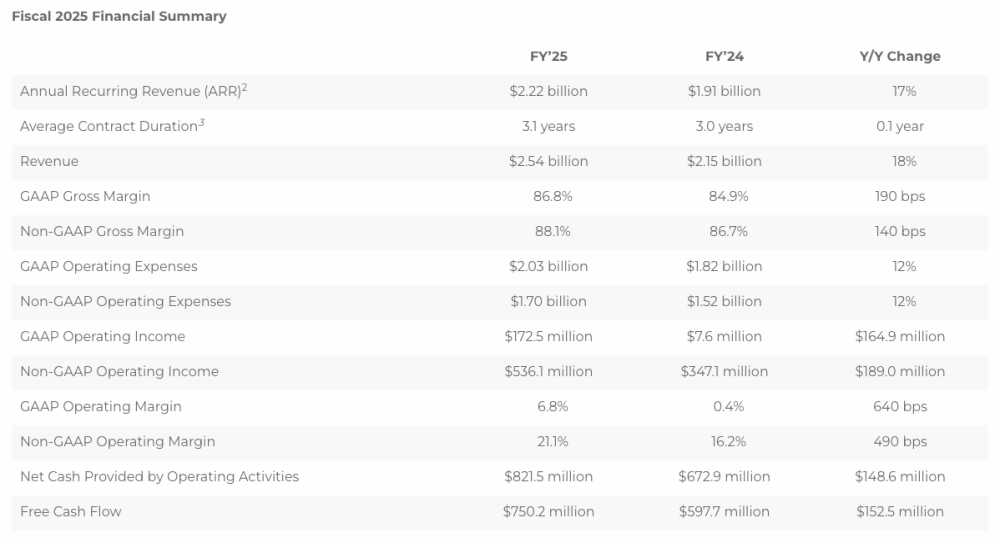

“Our fiscal 2025 results demonstrated a good balance of top and bottom line performance with 18% year-over-year revenue growth and strong free cash flow generation,” said Rukmini Sivaraman, CFO, Nutanix. “These results drove a Rule of 401 score of 48, our second year in a row above 40.”

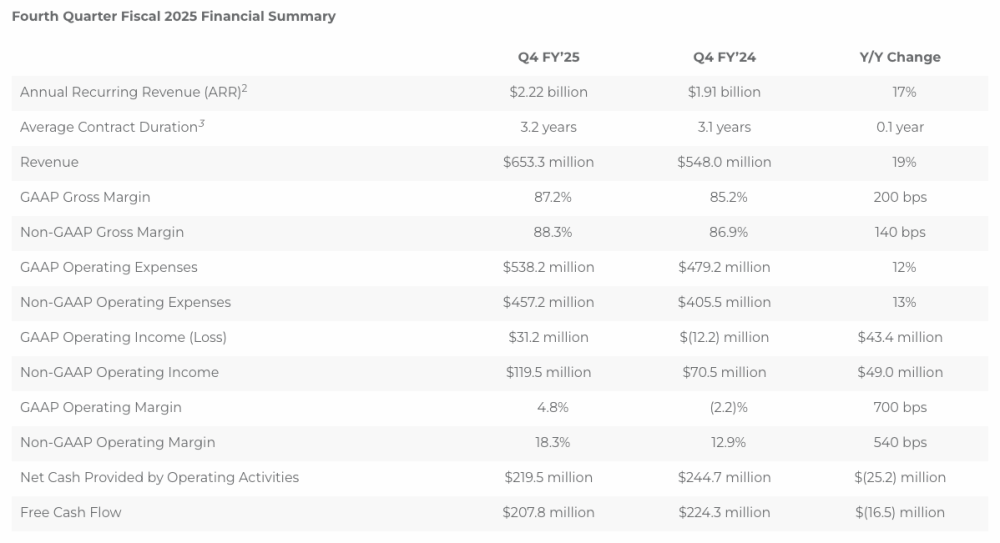

Click to enlarge

Click to enlarge

Reconciliations between GAAP and non-GAAP financial measures and key performance measures, to the extent available, are provided in the tables of this press release.

Recent Company Highlights

- Nutanix is Named a Leader in Multicloud Container Platforms Evaluation: Nutanix announced it has been positioned as a Leader in The Forrester Wave: Multicloud Container Platforms, Q3 2025, following the launch of its Nutanix Kubernetes Platform (NKP) solution at the company’s annual .NEXT conference last year.

- Nutanix is Named a Challenger in the 2025 Gartner Magic Quadrant for Container Management: Nutanix announced it has been recognized as a Challenger in the 2025 Gartner Magic Quadrant for Container Management following the launch of its NKP solution, marking the company’s first recognition in this Magic Quadrant.

- Finanz Informatik Signs Long-Term Contract with Nutanix: Nutanix announced that Finanz Informatik, the digitalization partner of the German Savings Bank Finance Group and one of the largest banking-IT service providers in Europe, has entered into a strategic collaboration with Nutanix and signed a long-term contract.

- Nutanix Announces Increase to Share Repurchase Authorization: Nutanix announced that its Board of Directors has authorized an increase of $350 million of common stock to the company’s existing share repurchase program.

Supplementary materials to this press release, including our fourth quarter and fiscal 2025 earnings presentation, can be found at https://ir.nutanix.com/financial/quarterly-results.

Footnotes

1Rule of 40 is defined as the sum of revenue growth rate and free cash flow margin for the period.

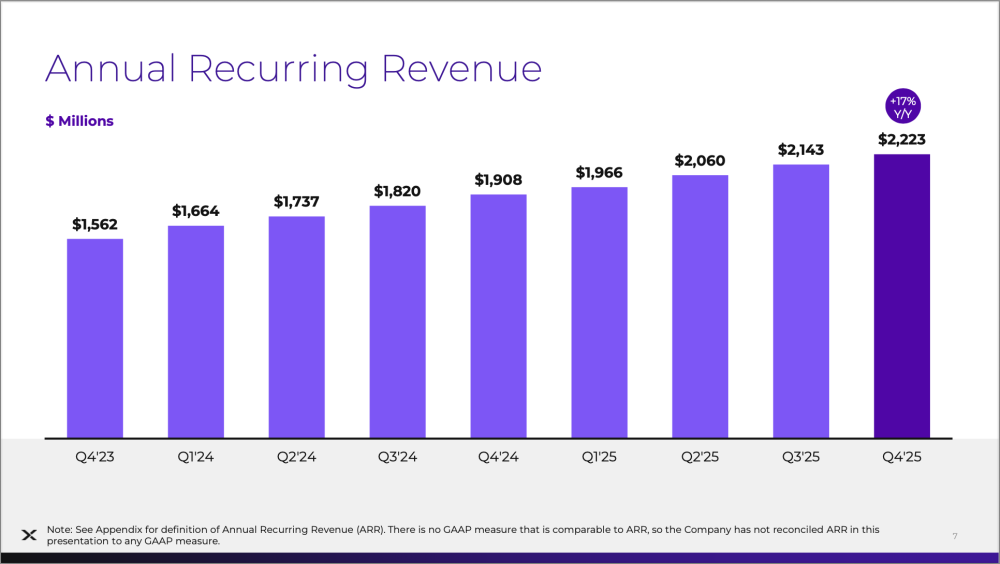

2Annual Recurring Revenue, or ARR, for any given period, is defined as the sum of ACV for all subscription contracts in effect as of the end of a specific period. For the purposes of this calculation, we assume that the contract term begins on the date a contract is booked, unless the terms of such contract prevent us from fulfilling our obligations until a later period, and irrespective of the periods in which we would recognize revenue for such contract. Excludes all life-of-device contracts. ACV is defined as the total annualized value of a contract. The total annualized value for a contract is calculated by dividing the total value of the contract by the number of years in the term of such contract. Excludes amounts related to professional services and hardware. Our methodology for calculating ARR will be updated prospectively beginning with the first quarter of fiscal year ending July 31, 2026 to align it more closely with the timing of when licenses are made available to customers. For more information, please see the Appendix section of our earnings presentation found on our Investor Relations website at ir.nutanix.com.

3Average Contract Duration represents the dollar-weighted term, calculated on a billings basis, across all subscription contracts, as well as our limited number of life-of-device contracts, using an assumed term of five years for life-of-device licenses, executed in the period.

4Weighted average share count used in computing diluted non-GAAP net income per share.

Comments

Nutanix delivered a very solid quarter, being the 3rd in a row above $600 million and even 1Q25 was just a few millions below. It was indeed a very good year for the company by the numbers. At the same time Q4 number is below Q2.

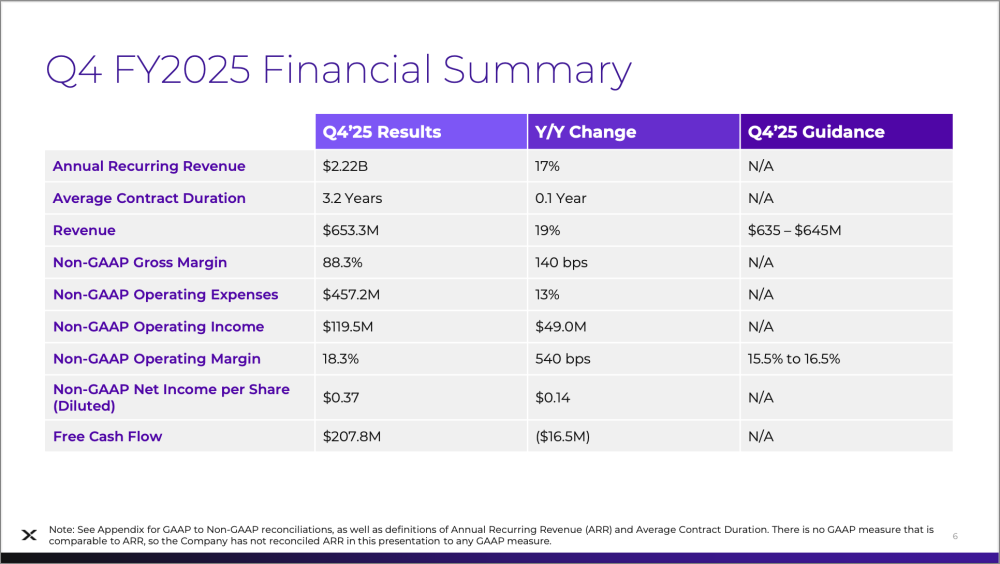

Click to enlarge

The business appears to be strong fueled by the still present Broadcom / VMware story that invited end-user to reconsider, at least rethink, some alternatives. And Nutanix, like a few others, received business from this impacting positively the previous trajectory before this big merger. The growth is regular but not so impressive if you check the ARR curve even if the growth rate is positive. The installed base approached 30k customers. The company tried to surf and leverage the AI opportunity and it appears to work in some cases.

Click to enlarge

Click to enlarge

The recent Nutanix conference confirms that Nutanix is a generic IT player delivering a consolidation of workloads. Nutanix is not a storage player, neither a computing player but more an infrastructure actor for unification of data processing. The fact that they announced the support of Pure Storage confirmed, if needed that. In other words, we never saw in a RFP an end-user selecting Nutanix for file storage and block storage or even S3 storage to connect to an existing servers farm.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter