Broadcom: Fiscal 3Q25 Financial Results

Confirming growth trajectory with $15.95 billion up 22% YoY and 6% QoQ

This is a Press Release edited by StorageNewsletter.com on September 10, 2025 at 2:02 pmSummary:

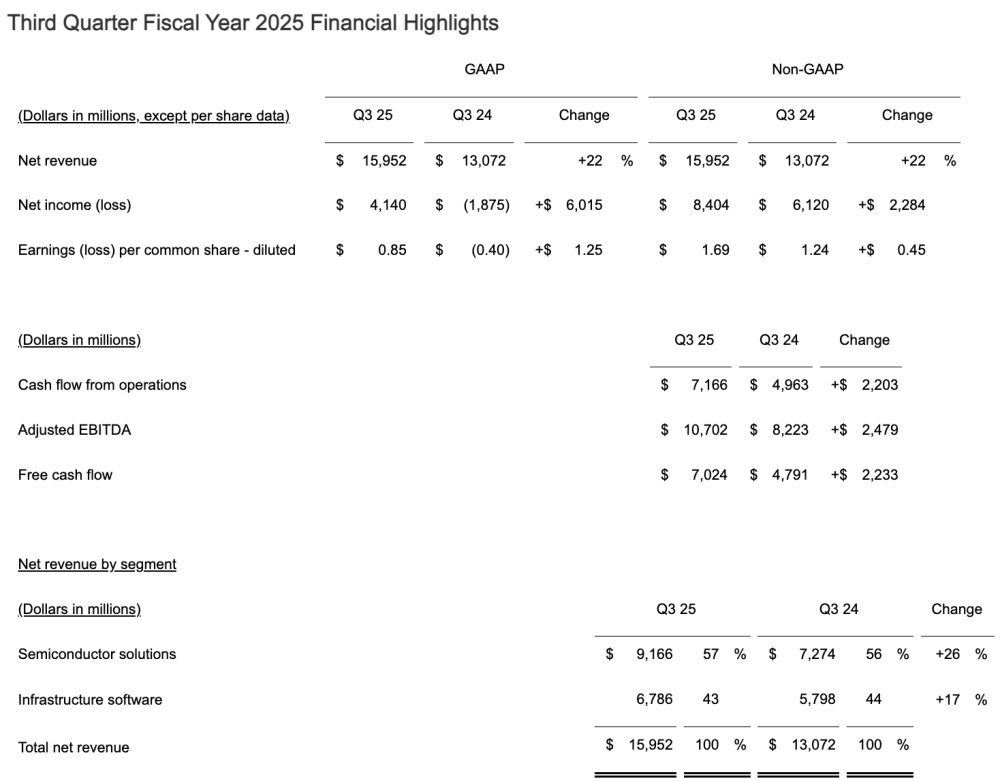

- Revenue of $15,952 million for the third quarter, up 22 percent from the prior year period

- GAAP net income of $4,140 million for the third quarter; Non-GAAP net income of $8,404 million for the third quarter

- Adjusted EBITDA of $10,702 million for the third quarter, or 67 percent of revenue

- GAAP diluted EPS of $0.85 for the third quarter; Non-GAAP diluted EPS of $1.69 for the third quarter

- Cash from operations of $7,166 million for the third quarter, less capital expenditures of $142 million, resulted in $7,024 million of free cash flow, or 44 percent of revenue

- Quarterly common stock dividend of $0.59 per share

- Fourth quarter fiscal year 2025 revenue guidance of approximately $17.4 billion, an increase of 24 percent from the prior year period

- Fourth quarter fiscal year 2025 Adjusted EBITDA guidance of 67 percent of projected revenue(1)

Broadcom Inc., a global technology player that designs, develops and supplies semiconductor and infrastructure software solutions, reported financial results for its third quarter of fiscal year 2025, ended August 3, 2025, provided guidance for its fourth quarter of fiscal year 2025 and announced its quarterly dividend.

“Broadcom achieved record third quarter revenue on continued strength in custom AI accelerators, networking and VMware. Q3 AI revenue growth accelerated to 63% YoY to $5.2 billion,” said Hock Tan, president and CEO, Broadcom Inc. “We expect growth in AI semiconductor revenue to accelerate to $6.2 billion in Q4, delivering eleven consecutive quarters of growth, as our customers continue to strongly invest.”

“Consolidated revenue grew 22% YoY to a record $16.0 billion. Adjusted EBITDA increased 30% YoY to $10.7 billion reflecting strong operating leverage,” said Kirsten Spears, CFO, Broadcom. “Free cash flow was a record $7.0 billion, up 47% YoY. Consistent with our commitment to return excess cash to shareholders, we returned $2.8 billion to shareholders in the third quarter through cash dividends.”

Click to enlarge

The Company’s cash and cash equivalents at the end of the fiscal quarter were $10,718 million, compared to $9,472 million at the end of the prior fiscal quarter.

During the third fiscal quarter, the Company generated $7,166 million in cash from operations and spent $142 million on capital expenditures, resulting in $7,024 million of free cash flow.

On June 30, 2025, the Company paid a cash dividend of $0.59 per share, totaling $2,786 million.

The differences between the Company’s GAAP and non-GAAP results are described generally under “Non-GAAP Financial Measures” below and presented in detail in the financial reconciliation tables attached to this release.

Fourth Quarter Fiscal Year 2025 Business Outlook

Based on current business trends and conditions, the outlook for the fourth quarter of fiscal year 2025, ending November 2, 2025, is expected to be as follows:

- Fourth quarter revenue guidance of approximately $17.4 billion; and

- Fourth quarter Adjusted EBITDA guidance of 67 percent of projected revenue.

The guidance provided above is only an estimate of what the Company believes is realizable as of the date of this release. The Company is not readily able to provide a reconciliation of projected Adjusted EBITDA to projected net income without unreasonable effort. Actual results will vary from the guidance and the variations may be material. The Company undertakes no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law.

Quarterly Dividends

The Company’s Board of Directors has approved a quarterly cash dividend of $0.59 per share. The dividend is payable on September 30, 2025 to stockholders of record at the close of business (5:00 p.m. Eastern Time) on September 22, 2025.

(1) The Company is not readily able to provide a reconciliation of the projected non-GAAP financial information presented to the relevant projected GAAP measure without unreasonable effort.

Comments

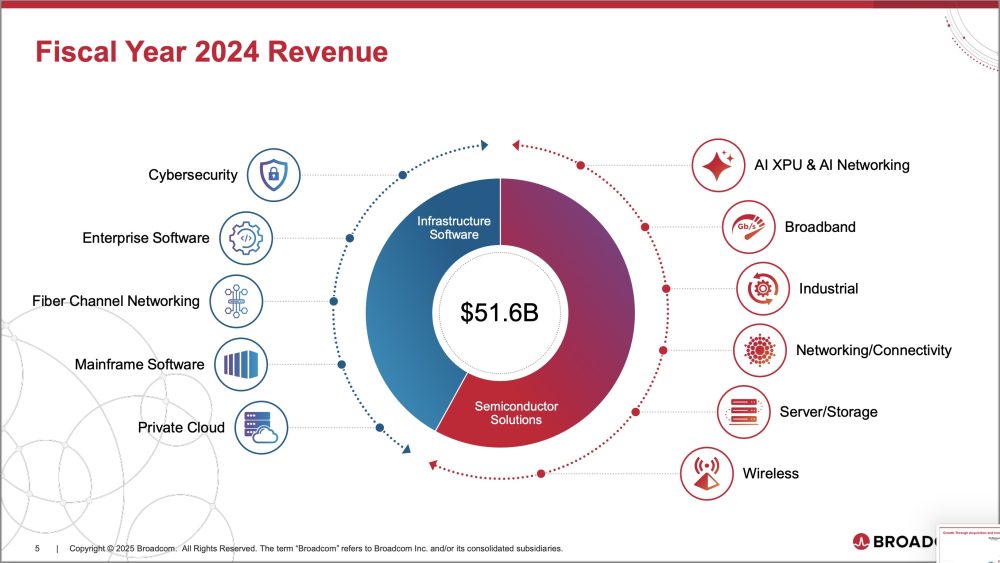

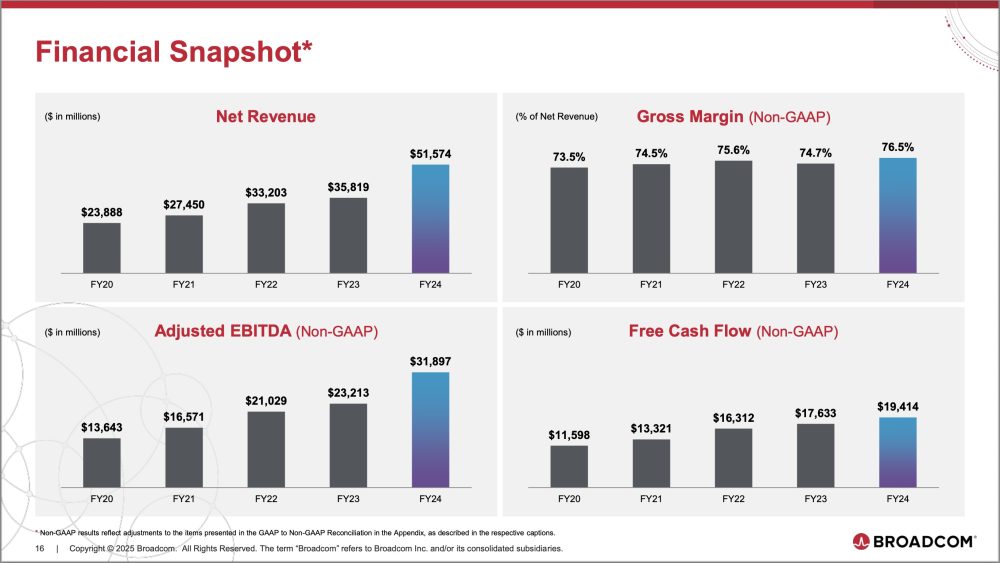

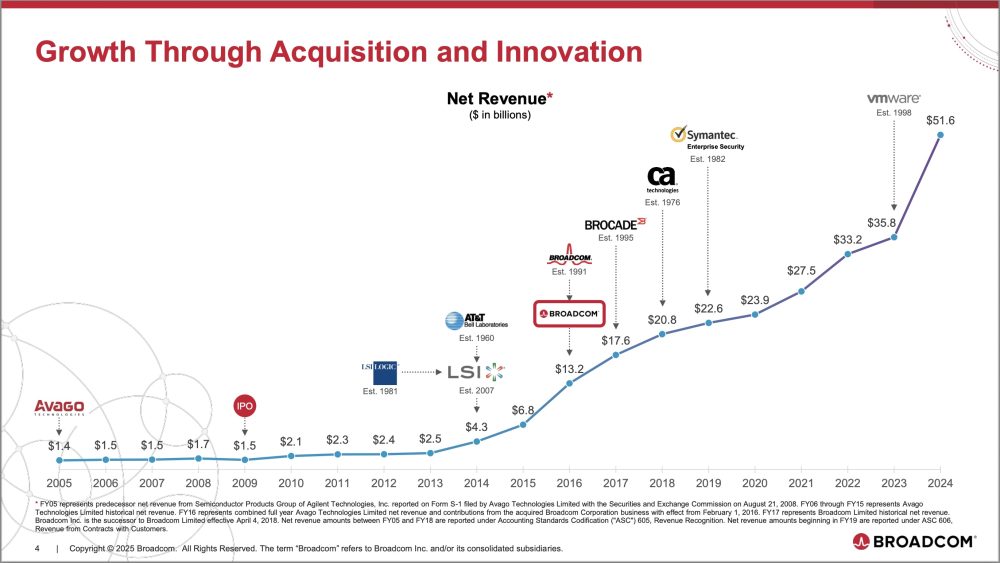

Broadcom revenue trajectory continues on a positive curve with almost $16 billion for 3Q25 for a total of $43.4 billion for the first 9 months FY25. The last quarter shows a growth of 22% YoY and 6% QoQ. FY23 and FY24 generated respectively $35.8 billion and $51.6 billion with 44% growth.

Click to enlarge

The ARR reaches $57 billion and conservative forecast could be around $73-75 billion for FY25.

Click to enlarge

Click to enlarge

It appears that some choices made by the management especially on the software domain, generated expected results even with some pressure from users. Also as a key player in fast and open connectivity, the firm seems to be in a good position to address and solve some I/O challenges at scale with high demanding AI workloads.

Click to enlarge

The last information is the signature of a deal between Broadcom and OpenAI for a new AI chip scheduled for 2026.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter