Everspin: Fiscal 2Q25 Financial Results

Revenue Up 25% Y/Y at $13.2 million, expecting $13.5-$14.5 million next quarter

This is a Press Release edited by StorageNewsletter.com on August 12, 2025 at 2:02 pmEverspin Technologies, Inc. announced preliminary unaudited financial results for the second quarter ended June 30, 2025.

![]() “Our consistent financial performance reflects the strength of our product portfolio and ramping design wins,” said Sanjeev Aggarwal, president and CEO. “In order to accelerate both direct revenue monetization and strategic expansion, we have recently expanded our executive team to include a dedicated VP sales and a dedicated VP of Business Development. We believe that this structural change will enable us to better serve our customers and unlock new opportunities.“

“Our consistent financial performance reflects the strength of our product portfolio and ramping design wins,” said Sanjeev Aggarwal, president and CEO. “In order to accelerate both direct revenue monetization and strategic expansion, we have recently expanded our executive team to include a dedicated VP sales and a dedicated VP of Business Development. We believe that this structural change will enable us to better serve our customers and unlock new opportunities.“

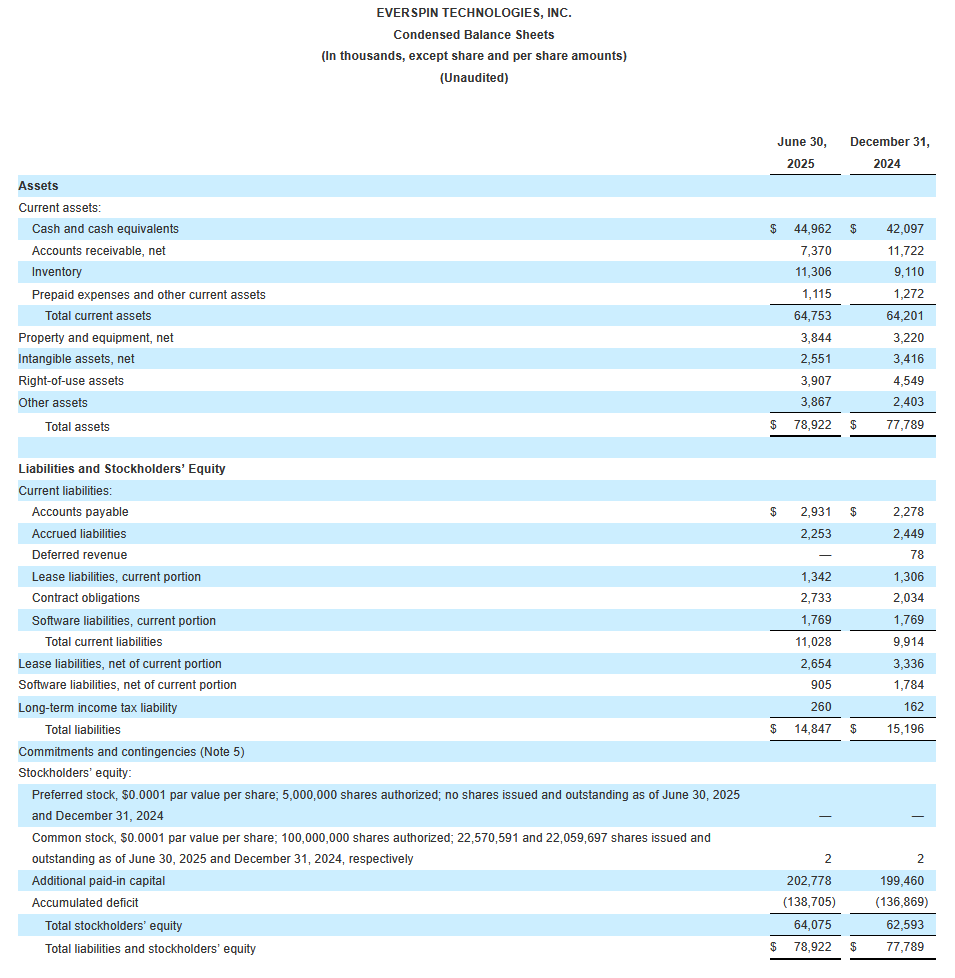

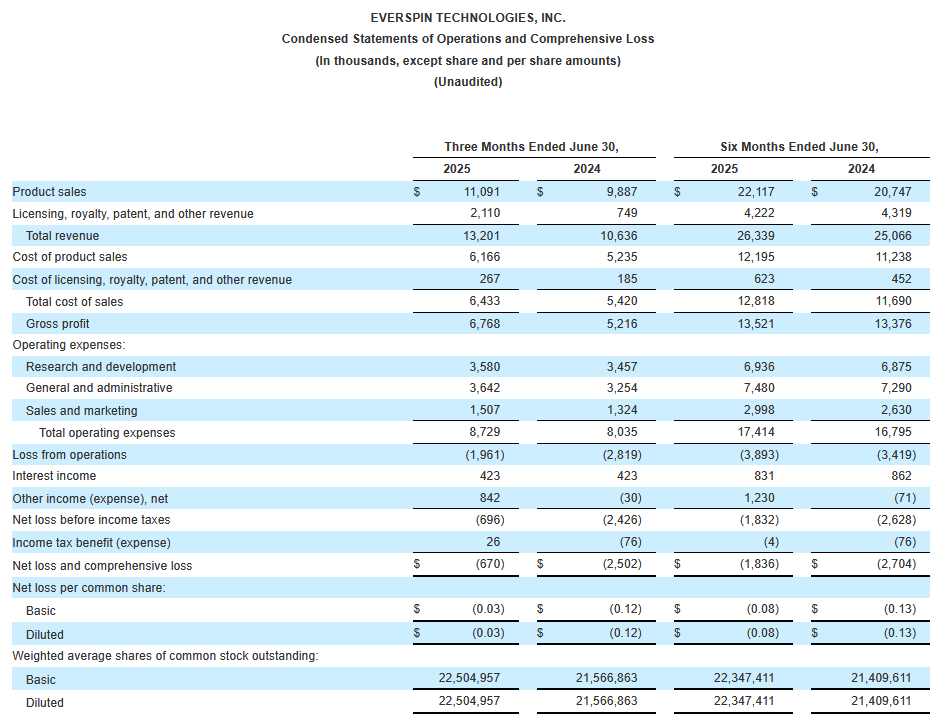

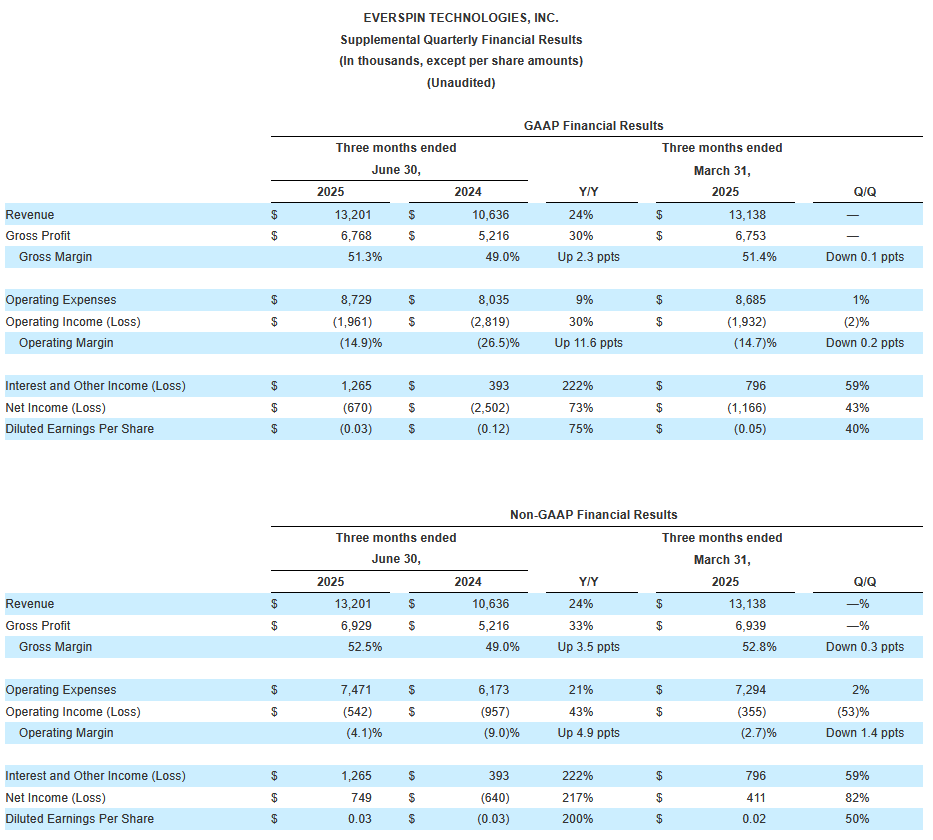

Second Quarter 2025 Results

- Total revenue of $13.2 million, compared to $10.6 million in the second quarter of 2024.

- MRAM product sales, which include both Toggle and STT-MRAM revenue, of $11.1 million, compared to $9.9 million in the second quarter of 2024.

- Licensing, royalty, patent, and other revenue of $2.1 million, compared to $0.7 million in the second quarter of 2024.

- Gross margin of 51.3%, compared to 49.0% in the second quarter of 2024.

- GAAP operating expenses of $8.7 million, compared to $8.0 million in the second quarter of 2024.

- Interest and Other income, net of $1.3 million, compared to $0.4 million in the second quarter of 2024.

- GAAP net loss of $(0.7) million, or $(0.03) per diluted share, compared to net loss of $(2.5) million, or $(0.12) per diluted share, in the second quarter of 2024.

- Non-GAAP net income of $0.7 million, or $0.03 per diluted share, compared to non-GAAP net loss of $(0.6) million, or $(0.03) per diluted share, in the second quarter of 2024.

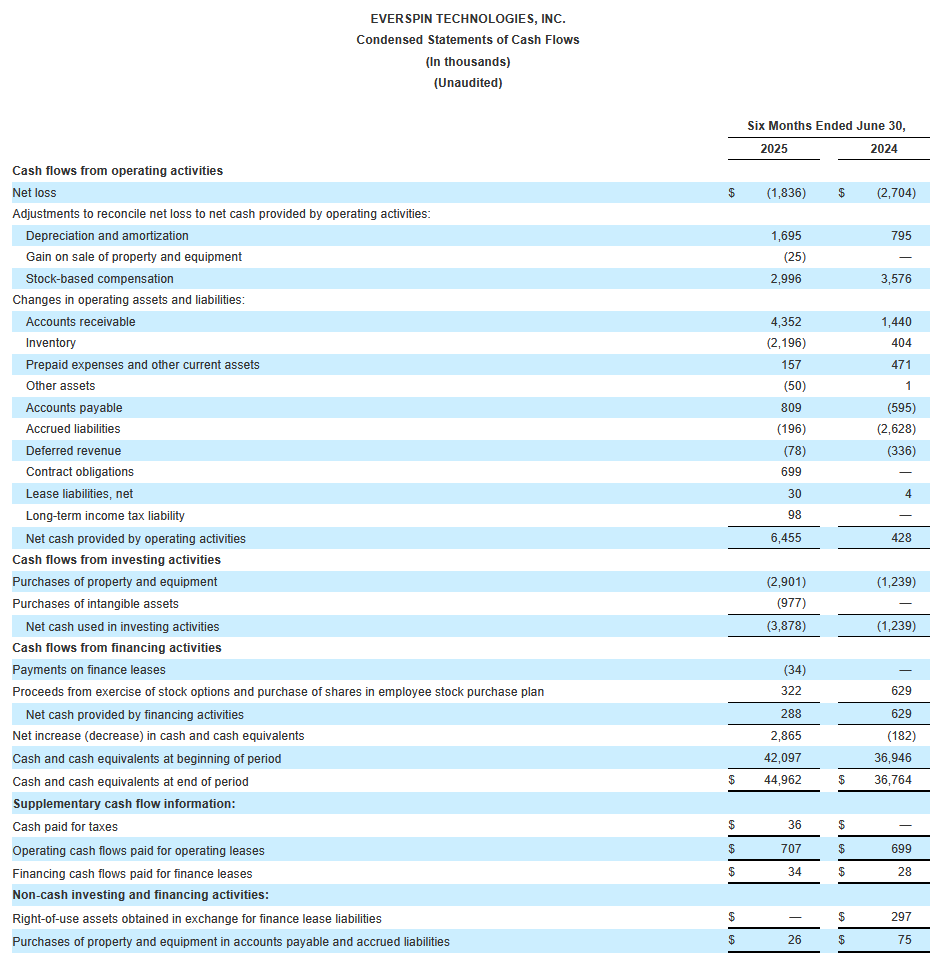

- Cash and cash equivalents as of June 30, 2025, increased by $2.9 million to $45.0 million since December 31, 2024.

“We are pleased with our second quarter results, which came in toward the high end of our expectations, driven by strength across our product portfolio. Our team remains focused on delivering consistent execution combined with prudent expense management,” said Bill Cooper, CFO, Everspin. “We did not experience any tariff related impact on our Q2 results and don’t anticipate any material impact on future results. However, the situation continues to be fluid, and we are monitoring it closely.“

Business Outlook

For the third quarter 2025, Everspin expects total revenue in a range of $13.5 million to $14.5 million and GAAP net (loss) / income per diluted share to be between $(0.05) and $0.00. Non-GAAP net income per diluted share is anticipated to be between $0.02 and $0.07.

A reconciliation of non-GAAP guidance measures to corresponding GAAP guidance measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future. Stock-based compensation-related charges are impacted by the timing of employee stock transactions, the future fair market value of Everspin’s common stock, and Everspin’s future hiring and retention needs, all of which are difficult to predict and subject to constant change. These factors could be material to Everspin’s results computed in accordance with GAAP. This outlook is dependent on Everspin’s current expectations, which may be impacted by, among other things, evolving external conditions, such as public health-related events or outbreaks, local safety guidelines, worsening impacts due to supply chain constraints or interruptions, including recent market volatility, semiconductor downturn and the other risk factors described in Everspin’s filings with the SEC (the “SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, its Quarterly Reports on Form 10-Q filed with the SEC during 2025, as well as in its subsequent filings with the SEC.

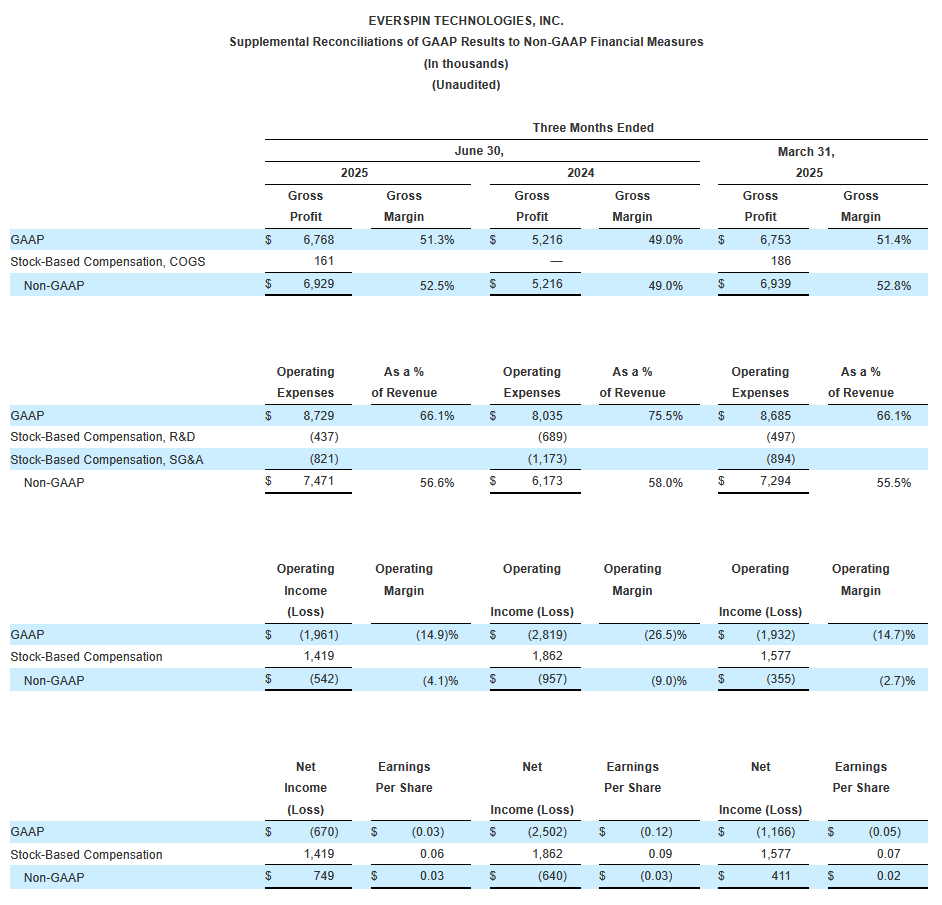

Use of Non-GAAP Financial Measures

Everspin supplements the reporting of its financial information determined under generally accepted accounting principles in the US of America (GAAP) with Non-GAAP financial measures including gross profit, gross margin, operating expenses, operating income (loss), operating margin, net income (loss), and EPS which are defined as the GAAP financial measures excluding the effect of stock-based compensation charges. Everspin’s GAAP tax rate is effectively zero due to NOL carryforwards, thus a Non-GAAP tax rate is not included as a Non-GAAP financial measure.

Everspin’s management and board of directors use these non-GAAP measures to understand and evaluate its operating performance and trends, to prepare and approve its annual budget and to develop short-term and long-term operating and financing plans. Accordingly, Everspin believes that these non-GAAP measures provide useful information for investors in understanding and evaluating its operating results in the same manner as its management and board of directors. These non-GAAP financial measures should be considered in addition to, not as superior to, or as a substitute for, financial measures reported in accordance with GAAP. Moreover, other companies may define these non-GAAP measures differently, which limits the usefulness of this measure for comparisons with such other companies. Everspin encourages investors to review its financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Please see the tables included at the end of this release for the reconciliation of GAAP to non-GAAP results.

Everspin hosted a conference call to discuss its second quarter 2025 results on August 6, 2025. An archived webcast of the conference call is accessible for 12 months.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter