Supermicro: Fiscal 4Q25 and FY25 Financial Results

Quarter revenue Up 26% Q/Q at $5.8 billion, Up 47% at $22.0 billion for FY25, at least $33.0 billion expected for FY26

This is a Press Release edited by StorageNewsletter.com on August 8, 2025 at 2:02 pmSuper Micro Computer, Inc. announced unaudited financial results for its fourth quarter and full fiscal year ended June 30, 2025.

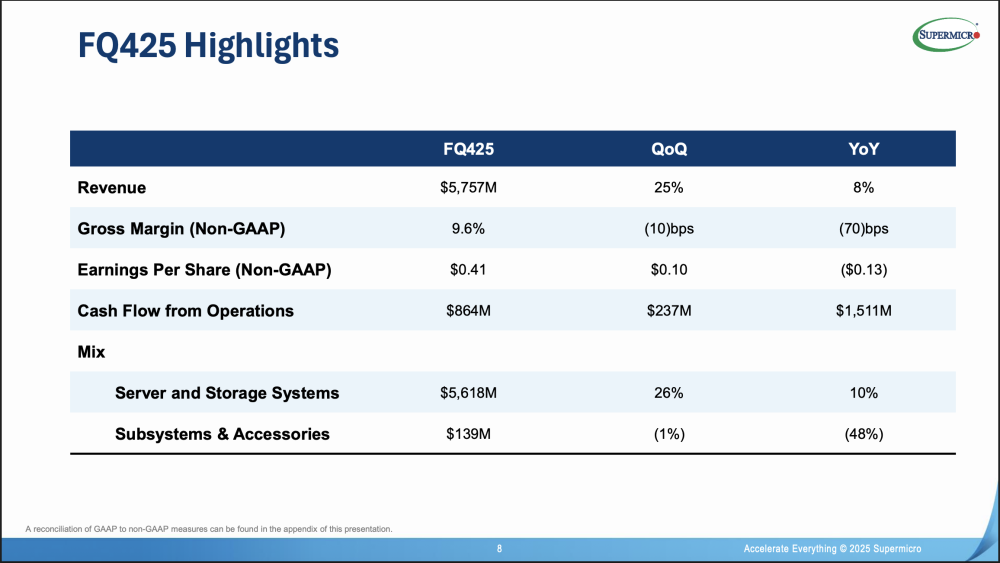

Fourth Quarter Fiscal Year 2025 Highlights

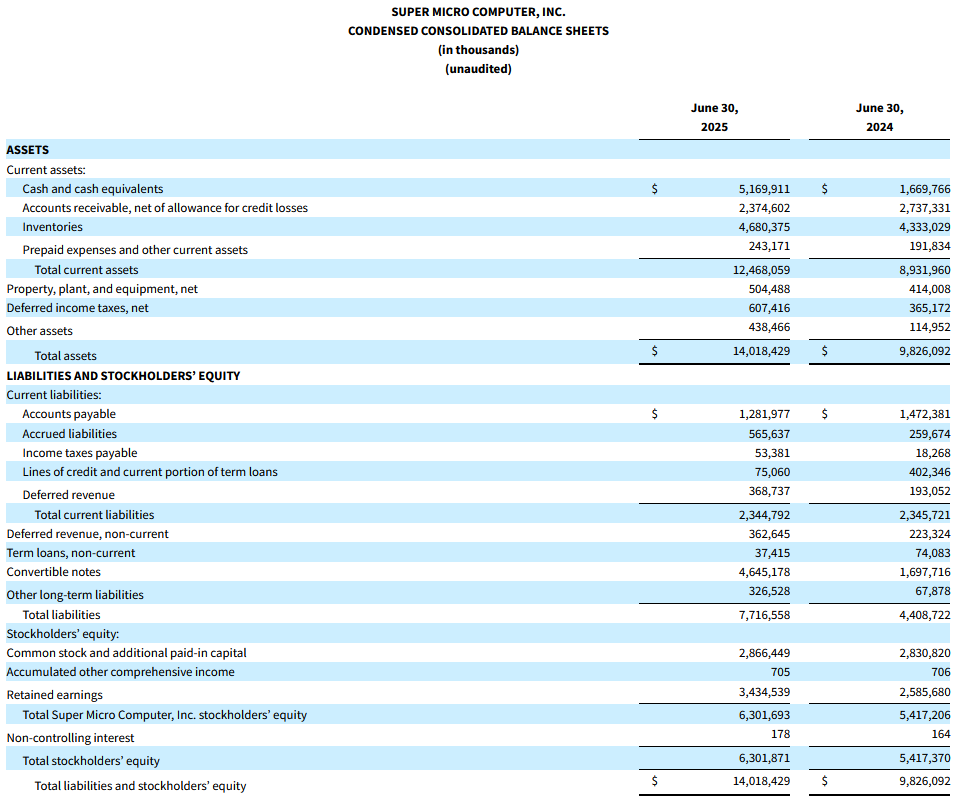

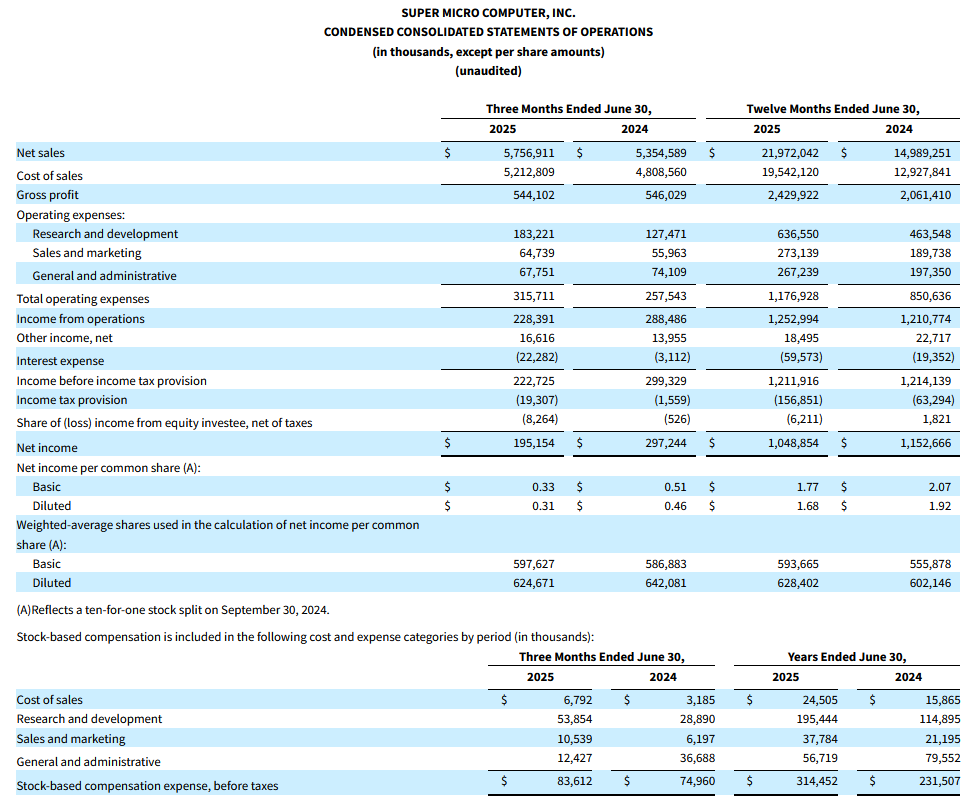

- Net sales of $5.8 billion vs. $4.6 billion in Q3’25 and $5.4 billion in Q4’24.

- Gross margin of 9.5% vs. 9.6% in Q3’25 and 10.2% in Q4’24.

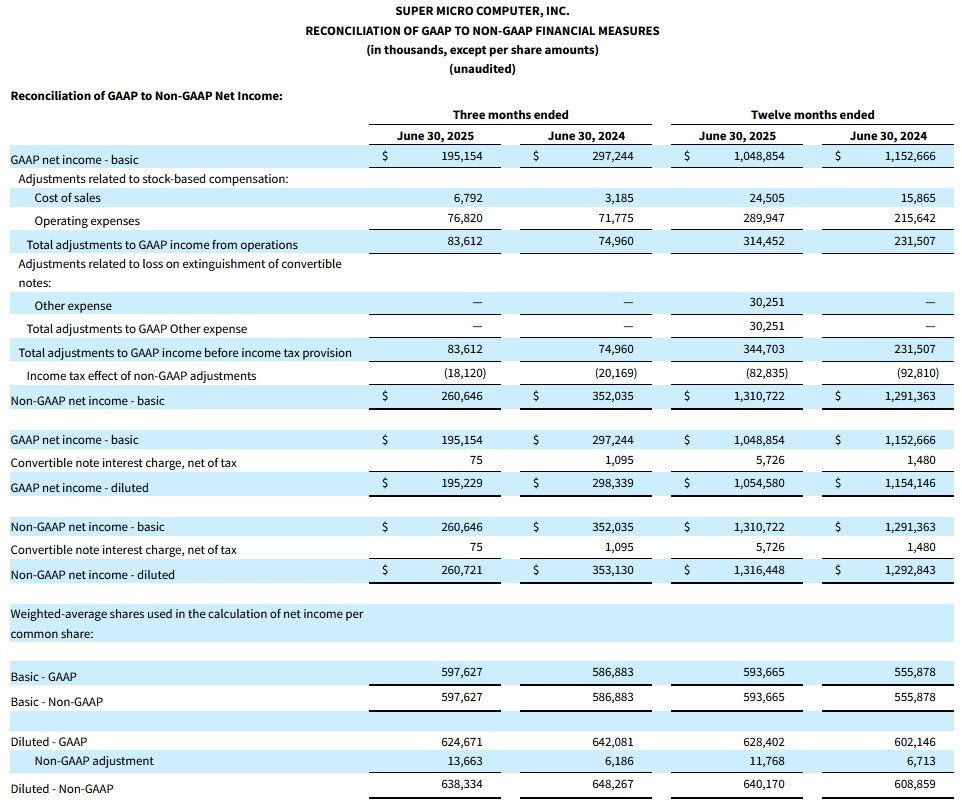

- Net income of $195 million vs. $109 million in Q3’25 and $297 million in Q4’24.

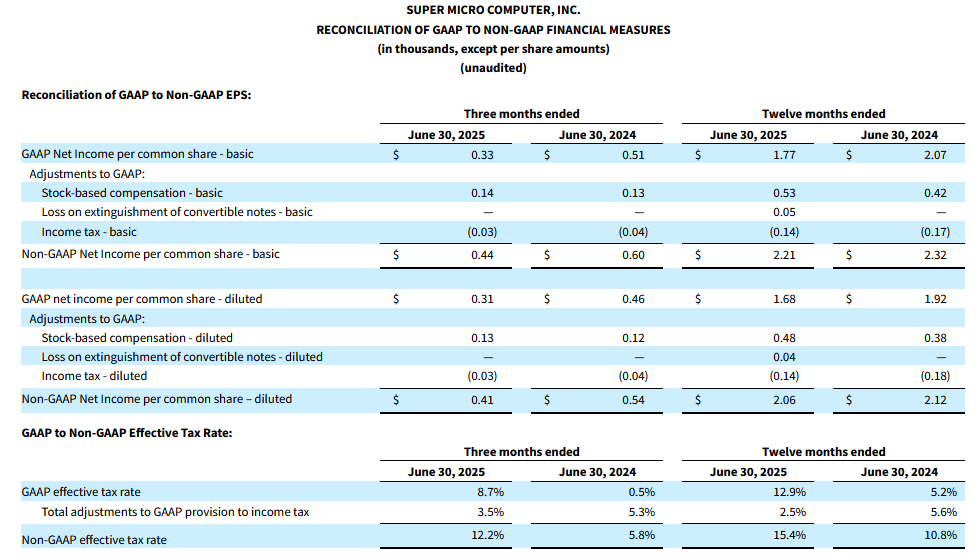

- Diluted net income per common share of $0.31 vs. $0.17 in Q3’25 and $0.46 in Q4’24.

- Non-GAAP diluted net income per common share of $0.41 vs. $0.31 in Q3’25 and $0.54 in Q4’24.

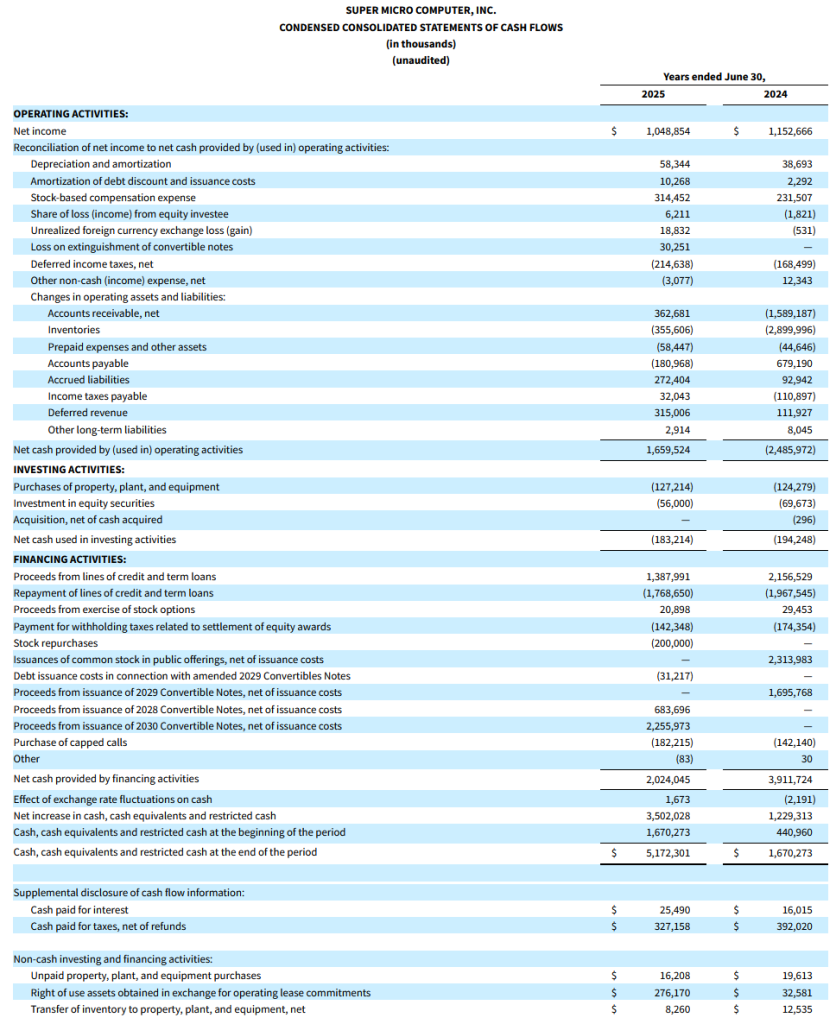

- Cash flow provided by operations for Q4’25 of $864 million and capital expenditures and investments of $79 million.

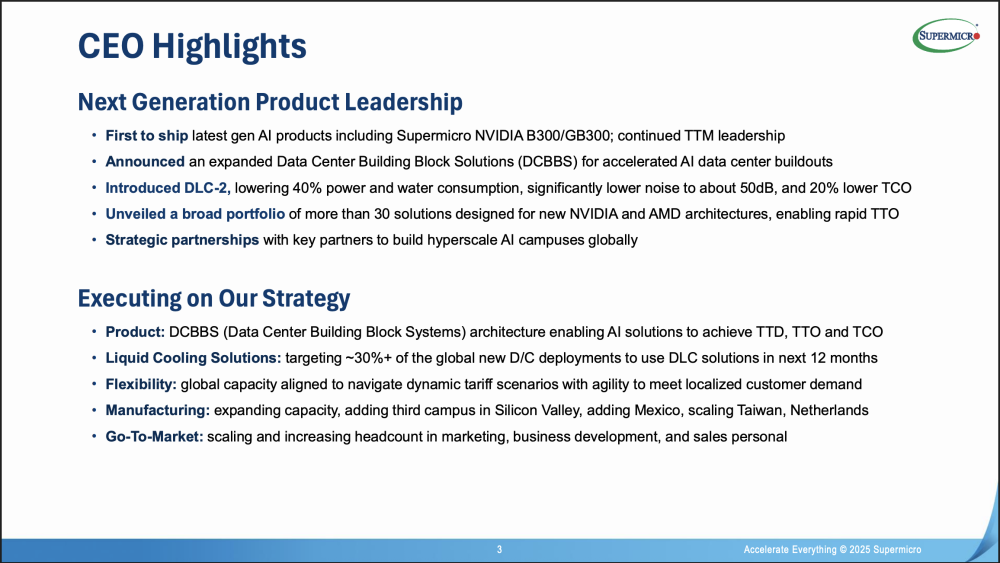

“We made solid progress in FY25 by growing our AI solution leadership in Neoclouds, CSPs, Enterprises, and Sovereign entities, which fueled our 47% annual growth,” said Charles Liang, founder, president and CEO, Supermicro. “I’m especially excited about our new Datacenter Building Block Solutions (DCBBS), which offer exceptional value to customers seeking faster datacenter deployment and time-to-online advantages. With support from our expanding global operations that help mitigate tariffs and regional costs, combined with a growing enterprise customer base, AI product innovations, and robust DCBBS-powered total solutions, we’re on track to grow more large-scale datacenter customers from 4 in FY25 to 6 to 8 in FY26.“

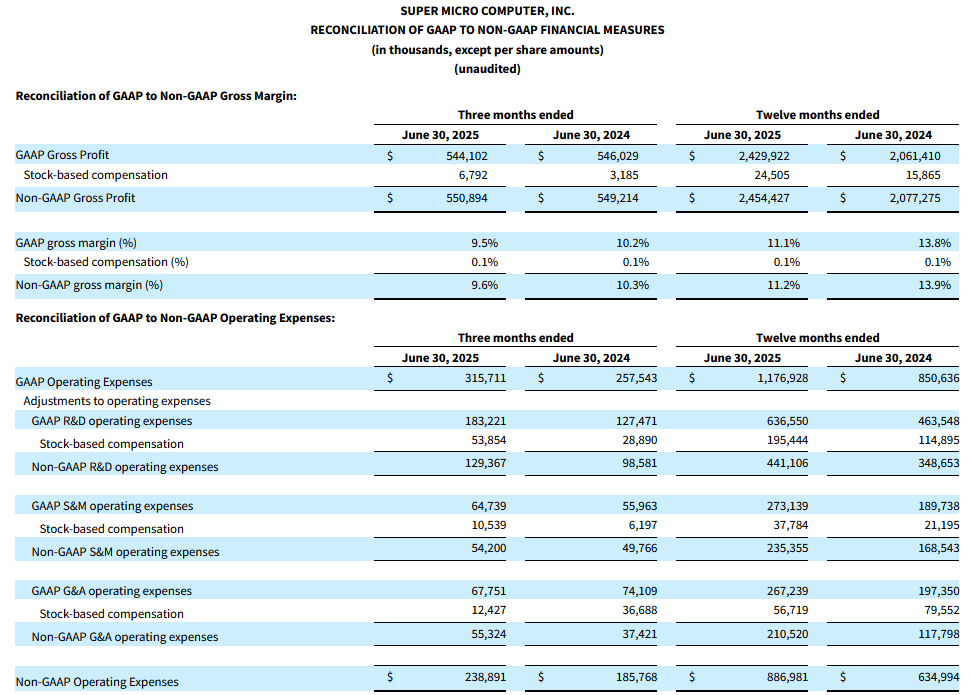

The Non-GAAP gross margin for the fourth quarter of fiscal year 2025 was 9.6% with adjustments for stock-based compensation expenses of $7 million. The Non-GAAP diluted net income per common share for the fourth quarter of fiscal year 2025 was $0.41.

Fiscal Year 2025 Summary

Net sales for the fiscal year ended June 30, 2025, were $22.0 billion vs. $15.0 billion for the fiscal year ended June 30, 2024. Net income for fiscal year 2025 was $1.0 billion, or $1.68 per diluted share, vs. $1.2 billion, or $1.92 per diluted share, for fiscal year 2024.

For the full fiscal year ended 2025, the Non-GAAP gross margin was 11.2% with adjustments for stock-based compensation expenses of $25 million. Non-GAAP net income for fiscal year 2025 was $1.3 billion, or $2.06 per diluted share, vs. $1.3 billion, or $2.12 per diluted share, for fiscal year 2024. This non-GAAP net income includes adjustments for stock-based compensation expenses and the loss on extinguishment of convertible notes of $239 million and $23 million, which are net of the related tax effect of $75 million and $8 million for fiscal year 2025.

As of June 30, 2025, total cash and cash equivalents was $5.2 billion and total bank debt and convertible notes were $4.8 billion.

Business Outlook

The Company expects net sales of $6.0 billion to $7.0 billion for the first quarter of fiscal year 2026 ending September 30, 2025, GAAP net income per diluted share of $0.30 to $0.42 and non-GAAP net income per diluted share of $0.40 to $0.52. The Company’s projections for GAAP and non-GAAP net income per diluted share assume a tax rate of approximately 13.0% and 15.5%, respectively, and a fully diluted share count of 631 million shares for GAAP and fully diluted share count of 644 million shares for non-GAAP. The outlook for first quarter of fiscal year 2026 GAAP net income per diluted share includes approximately $69 million in expected stock-based compensation, net of related tax effects of $20 million that are excluded from non-GAAP net income per diluted share.

For fiscal year 2026, the Company expects net sales of at least $33.0 billion.

Supermicro hosted a live audio webcast of a conference call to review its fourth quarter and full-year fiscal 2025 financial results on August 5, 2025. A replay of the webcast is available with subscription.

SUPER MICRO COMPUTER, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(in thousands, except per share amounts)

(unaudited)

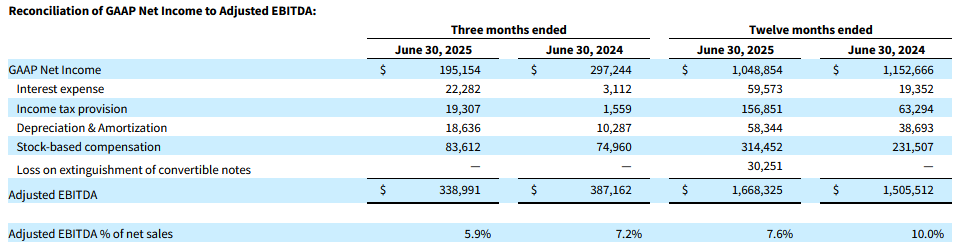

Use of Non-GAAP Financial Measures

To supplement its condensed consolidated financial results presented in accordance with United States Generally Accepted Accounting Principles (“GAAP”), the Company uses non-GAAP measures that are adjusted for certain items from the most directly comparable GAAP measures. The specific non-GAAP measures presented below are: gross margin; operating expenses; net income; net income per common share; diluted net income; diluted net income per common share; and effective tax rate. Management believes these non-GAAP measures provide useful information to investors by offering a consistent basis for comparing the Company’s performance across periods, excluding items that are not reflective of our core operating results. These non-GAAP measures are not prepared in accordance with GAAP or intended to be a replacement for GAAP financial data; and therefore, should be reviewed together with the GAAP measures and are not intended to serve as a substitute for results under GAAP, and may be different from non-GAAP measures used by other companies.

We exclude the following adjustments from our non-GAAP financial measures:

Non-GAAP Adjustments

- Stock-based compensation: Stock-based compensation relates primarily to our equity incentive awards. Stock-based compensation is a non-cash expense that is dependent on market forces that are difficult to predict. We believe that this adjustment for stock-based compensation provides investors with a basis to measure the company’s core performance, including compared with the performance of other companies, without the period-to-period variability created by stock-based compensation.

- Loss on extinguishment of convertible notes: We exclude the loss on extinguishment of debt related to our convertible notes from our non-GAAP results, as it is a non-recurring, financing-related charge that does not reflect our underlying operating performance in the period incurred. We believe it is appropriate to exclude this loss – and to present it separately – to provide investors with greater insight, as it is a non-recurring financing activity and is not reflective of ongoing operating results.

- Adjusted EBITDA adjustments: When calculating Adjusted EBITDA, in addition to the adjustments described above, we exclude the impact of Interest expense, Income tax (provision) benefit, and Depreciation and amortization during the period.

Pursuant to the requirements of SEC Regulation G, please see the tables below for the reconciliations of GAAP to Non-GAAP measures. These should be read together with the preceding financial statements prepared in accordance with GAAP.

Comments

Supermicro confirms being one of the leading independent server and other components market players with a rich ecosystem having understood that partnership and validation are key to penetrate the market and maintain market shares. Company's results are a perfect illustration of the impacts of AI on financial, being at the same time the new el dorado for IT vendors and a very aggressive period.

The Q4FY25 just grew by 7.5% YoY but the FY2025 by 47%. FY2025 generates $22 billion versus $15.0 for last 2024 and the firm plans $33 billions for 2026 which means that it will be more than double in 2 years, +120% exactly, a real ambitious number confirming the trajectory of the company and AI as a key contribution factor.

Click to enlarge

Click to enlarge

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter