Seagate: Fiscal 4Q25 and FY2025 Financial Results

Revenue of $2.44 billion, Up 30% Y/Y, $9.10 billion for full year 2025, Up 39%

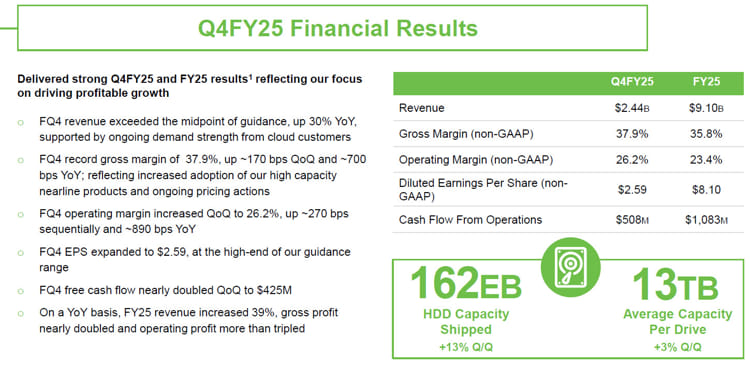

This is a Press Release edited by StorageNewsletter.com on July 31, 2025 at 2:02 pmFiscal Q4 2025 Highlights

- Revenue of $2.44 billion

- GAAP diluted earnings per share (EPS) of $2.24; non-GAAP diluted EPS of $2.59

- Cash flow from operations of $508 million and free cash flow of $425 million

- Declared cash dividend of $0.72 per share

Fiscal Year 2025 Highlights

- Revenue of $9.10 billion

- GAAP diluted EPS of $6.77; non-GAAP diluted EPS of $8.10

- Cash flow from operations of $1.1 billion and free cash flow of $818 million

- Returned $600 million to shareholders through dividends

Seagate Technology Holdings plc reported financial results for its fiscal fourth quarter and fiscal year ended June 27, 2025.

“Seagate’s strong FQ4 performance underscores our commitment to profitable growth, marked by a 30% Y/Y revenue increase, record gross margin, and non-GAAP EPS expanding to the top of our guidance range. These achievements reflect the structural enhancements we’ve implemented in our business and ongoing demand strength from cloud customers for our high-capacity drives,” said Dave Mosley, Seagate’s CEO.

“We continue to execute our areal density-leading HAMR product qualifications and ramp plans, positioning Seagate to address customer demand growth for mass storage across the cloud and at the edge. We are confident in our ability to create exceptional value for our customers and shareholders over the long-term,” Mosley concluded.

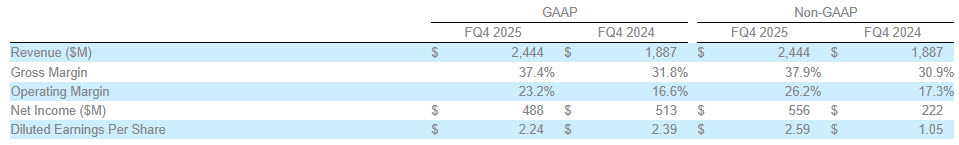

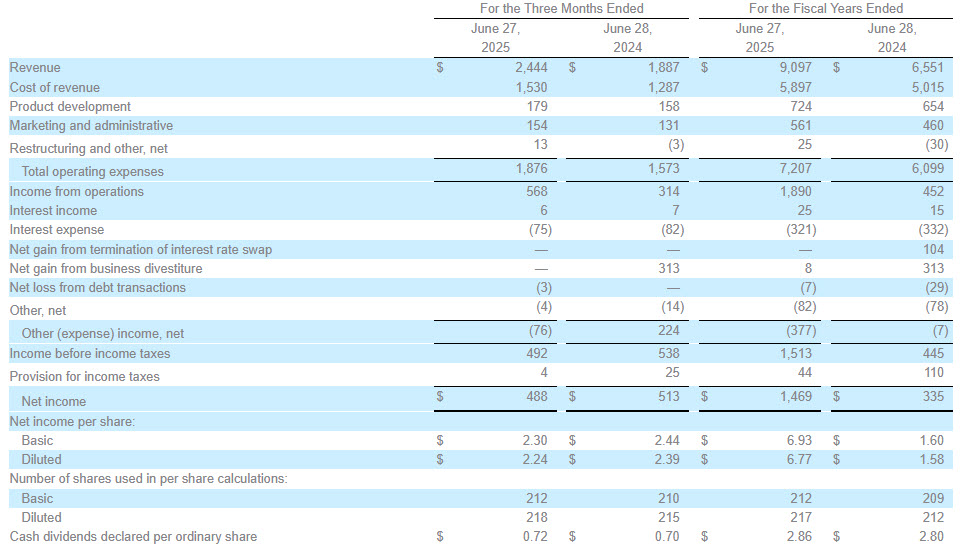

Quarterly Financial Results

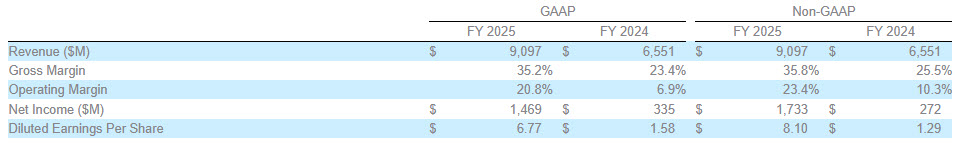

Annual Financial Results

For a detailed reconciliation of GAAP to non-GAAP results, see accompanying financial tables.

For a detailed reconciliation of GAAP to non-GAAP results, see accompanying financial tables.

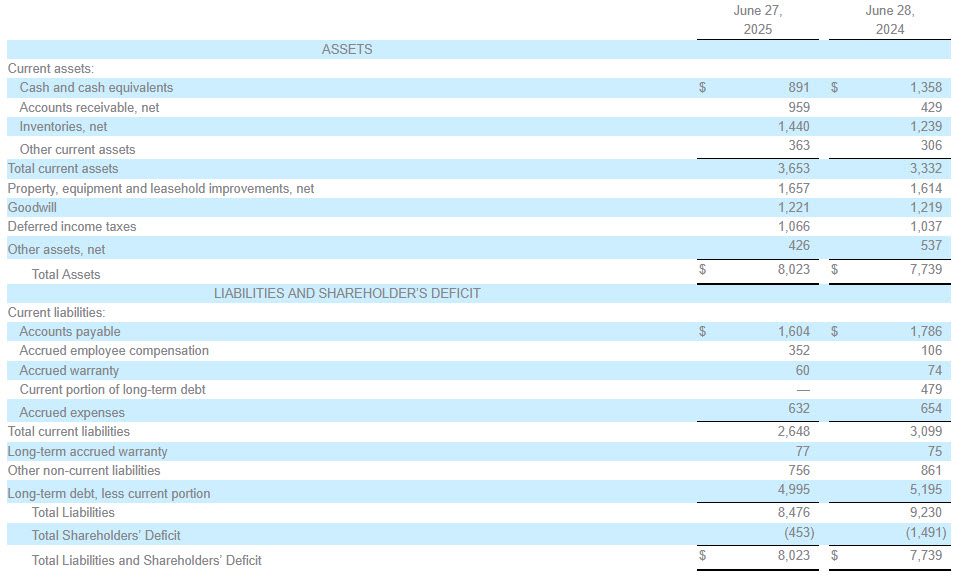

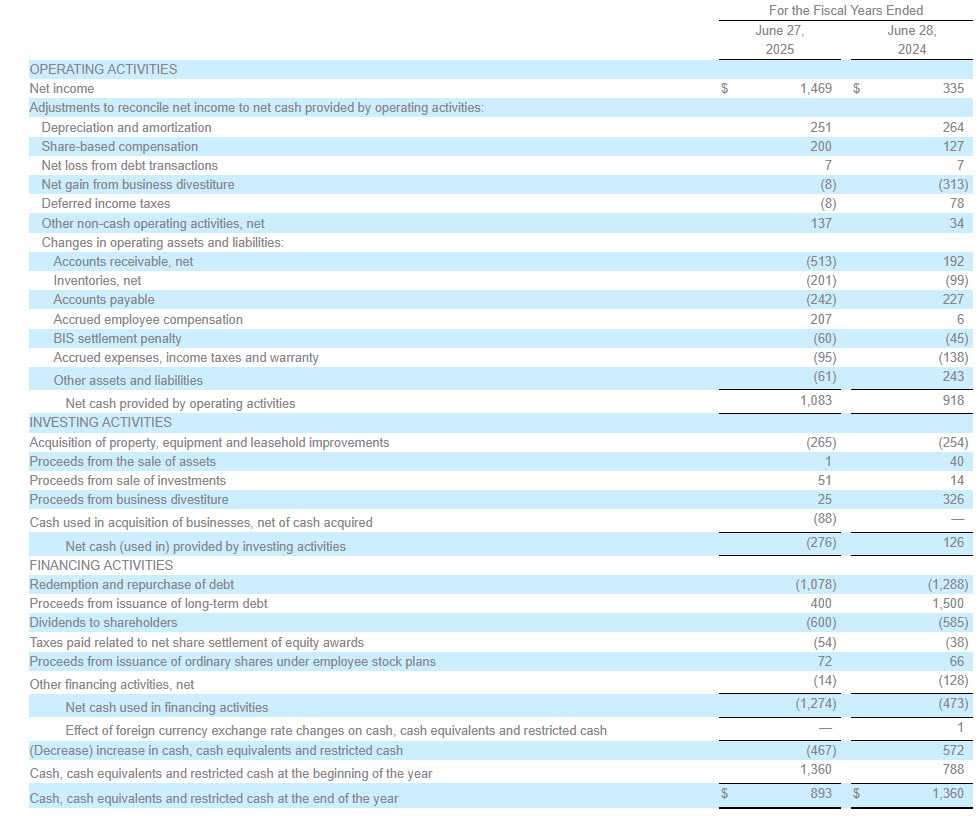

During the fiscal fourth quarter, the Company generated $508 million in cash flow from operations, $425 million in free cash flow and paid cash dividends of $153 million. For fiscal year 2025, the Company generated $1.1 billion in cash flow from operations, $818 million in free cash flow and returned $600 million of capital to shareholders through its quarterly dividend. Additionally, the Company strengthened its balance sheet position, reducing its overall debt by approximately $147 million during the fiscal fourth quarter and $684 million during fiscal year 2025, exiting the fiscal year with total debt of $5.0 billion. As of the end of the fiscal year, cash and cash equivalents totaled $891 million, and there were 213 million ordinary shares issued and outstanding.

Seagate has issued a Supplemental Financial Information document.

Quarterly Cash Dividend

The Board of Directors of the Company declared a quarterly cash dividend of $0.72 per share, which will be payable on October 9, 2025 to shareholders of record as of the close of business on September 30, 2025. The payment of any future quarterly dividends will be at the discretion of the Board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the Board.

The Company is providing the following guidance for its fiscal first quarter 2026:

- Revenue of $2.50 billion, plus or minus $150 million

- Non-GAAP diluted EPS of $2.30, plus or minus $0.20

Our fiscal first quarter guidance includes:

- The estimated impact from the Pillar Two framework for the global minimal tax that is effective starting fiscal year 2026 in major jurisdictions that the Company operates;

- The estimated net dilutive impact from the Exchangeable Senior Notes due 2028; and

- Minimal expected impact from global tariff policies announced as of the date of this release.

Guidance regarding non-GAAP diluted EPS excludes known pre-tax charges related to estimated share-based compensation expenses of $0.23 per share.

We have not reconciled our non-GAAP diluted EPS guidance for fiscal first quarter 2026 to the most directly comparable GAAP measure, other than estimated share-based compensation expenses, because material items that may impact these measures are out of our control and/or cannot be reasonably predicted, including, but not limited to, net (gain) loss from debt transactions, purchase order cancellation fees, strategic investment losses (gains) or impairment charges, income tax adjustments on these measures, and other charges or benefits that may arise. The amounts of these measures are not currently available but may be material to future results. A reconciliation of the non-GAAP diluted EPS guidance for fiscal first quarter 2026 to the corresponding GAAP measures is not available without unreasonable effort. A reconciliation of our historical non-GAAP financial measures to their nearest GAAP equivalent is contained in this release.

Seagate management held a public webcast on July 29th. An archived audio webcast of this event is available on Seagate’s Investor Relations website at investors.seagate.com

SEAGATE TECHNOLOGY HOLDINGS PLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

SEAGATE TECHNOLOGY HOLDINGS PLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per share data)

SEAGATE TECHNOLOGY HOLDINGS PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

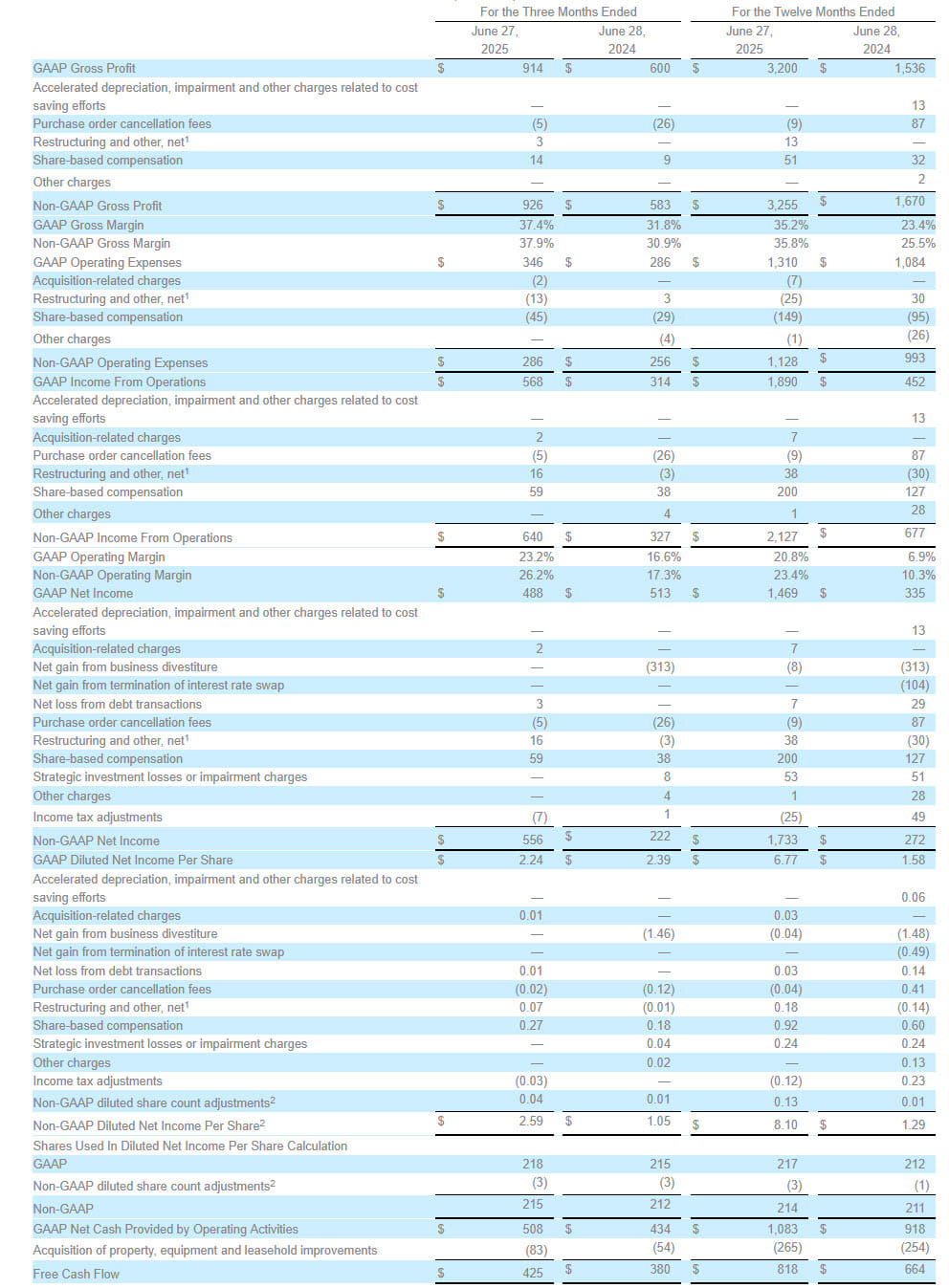

Use of non-GAAP financial information

The Company uses non-GAAP measures of gross profit, gross margin, operating expenses, income from operations, operating margin, net income, diluted EPS, free cash flow, EBITDA, adjusted EBITDA and last twelve months adjusted EBITDA, which are adjusted from results based on GAAP to exclude certain benefits, expenses, gains and losses. These non-GAAP financial measures are used by management to evaluate the business and provided to enhance the user’s overall understanding of the Company’s current financial performance and its prospects for the future. Specifically, the Company believes non-GAAP results provide useful information to investors as these non-GAAP results exclude certain benefits, expenses, gains and losses that the Company believes are not part of the Company’s ongoing operations and not indicative of its core operating results.

These non-GAAP financial measures are some of the measurements management uses to assess the Company’s performance, allocate resources and plan for future periods. Reported non-GAAP results should only be considered as supplemental to results prepared in accordance with GAAP, and not considered as a substitute or replacement for, or superior to, GAAP results. These non-GAAP measures may differ from the non-GAAP measures reported by other companies in its industry.

SEAGATE TECHNOLOGY HOLDINGS PLC

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

(In millions, except per share amounts, gross margin and operating margin)

(Unaudited)

(1) The Company recorded $16 million of restructuring charges in the three months ended June 27, 2025, of which $3 million was recorded to Cost of revenue and $13 million was recorded to Restructuring and other, net, within Operating expenses. During fiscal year 2025, the Company recorded $38 million of restructuring charges, of which $13 million was recorded to Cost of revenue and $25 million was recorded to Restructuring and other, net, within Operating expenses.

(2) For the three and twelve months ended June 27, 2025, and the three and twelve months ended June 28, 2024, non-GAAP shares used in diluted net income per share calculation excluded approximately 3 million, 3 million, 3 million and 1 million shares, respectively, that are issuable upon conversion of our 2028 exchangeable senior notes using the if-converted method. This is because these dilutive effects are expected to be offset partially or in full by the capped call transactions entered by the Company in conjunction with the issuance of our 2028 exchangeable senior notes in order to reduce the potential dilution to the Company’s ordinary shares upon the conversion.

The Company’s Non-GAAP measures are adjusted for the following items:

Accelerated depreciation, impairment and other charges related to cost saving efforts

These expenses are excluded in the non-GAAP measures due to the inconsistency in amount and frequency, and they are not normal operating expenses or indicative of the Company’s operating performance. Exclusion of these amounts provides a supplemental view of the Company’s operating performance to investors to enable them to evaluate the Company’s current operating performance compared to the past periods’ operating performance.

Acquisition-related charges

Acquisition-related charges are primarily related to transaction and integration costs. These expenses are excluded in the non-GAAP measures due to the inconsistency in amount and frequency, and they are not normal operating expenses or indicative of the Company’s operating performance. Exclusion of these amounts provides a supplemental view of the Company’s operating performance to investors to enable them to evaluate the Company’s current operating performance compared to the past periods’ operating performance.

Net gain from business divestiture

From time to time, the Company records net gains from the sale of businesses. The pre-tax net gain of $313 million recorded during the quarter ended June 28, 2024 was related to the sale of System-on-Chip Operations. These net gains are excluded in the non-GAAP measures because they are not indicative of the Company’s operating performance. The Company excludes these amounts to provide a supplemental view to investors to evaluate the Company’s current operating performance compared to the past periods’ operating performance.

Net gain/loss from debt transactions and termination of interest rate swap

From time to time, the Company incurs gains, losses and fees from the early redemption and repurchase of certain long-term debt instruments and termination of related interest rate swap agreements. The amount of these charges may be inconsistent in size and varies depending on the timing of the early redemption of debt and/or termination of interest rate swap. The Company does not believe these are part of its normal operating performance. Exclusion of these amounts provides a supplemental view of the Company’s operating performance to investors to enable them to evaluate the Company’s current operating performance compared to the past periods’ operating performance.

Purchase order cancellation fees

Purchase order cancellation fees are the costs incurred to cancel certain purchase commitments made with the Company’s suppliers for component and equipment purchases that will not be received due to change in forecasted demand. These charges are inconsistent in amount and frequency. The Company does not believe these are part of its normal operating expenses. Exclusion of these amounts provides a supplemental view to investors to evaluate the Company’s current operating performance compared to the past periods’ operating performance.

Restructuring and other, net

Restructuring and other, net are costs associated with restructuring plans that are primarily related to costs associated with reduction in the Company’s workforce, exiting certain facilities, inventory write down related to discontinued product lines and other related costs, as well as charges or gains from sale of properties. These costs or benefits do not reflect the Company’s normal or ongoing operating performance and consequently the Company excludes these expenses to provide a supplemental view to investors to evaluate the Company’s current operating performance compared to the past periods’ operating performance.

Share-based compensation

These expenses consist primarily of expenses for employee share-based compensation. Given the variety of equity awards used by companies, the varying methodologies for determining share-based compensation expense, the subjective assumptions involved in those determinations, and the volatility in valuations that can be driven by market conditions outside the Company’s control, the Company believes excluding share-based compensation expense enhances the ability of management and investors to understand and assess the underlying performance of its business over time and compare it against the Company’s peers, a majority of whom also exclude share-based compensation expense from their non-GAAP results.

Strategic investment gains, losses and impairment charges

From time to time, the Company incurs gains, losses or impairment charges from strategic investments that are measured and accounted at fair value, under the equity method of accounting, as available-for-sale debt securities or adjust for downward or upward adjustments to the carrying value under the measurement alternative if an impairment or observable price adjustment is recognized in the current period that are not considered normal operating expenses or gains. The resulting expense, gain or impairment loss is inconsistent in amount and frequency and the Company excludes these amounts to provide a supplemental view to investors to evaluate the Company’s current operating performance compared to the past periods’ operating performance.

Other charges

The other charges primarily include IT transformation costs. These charges are inconsistent in amount and frequency and are excluded to provide a supplemental view to investors to evaluate the Company’s current operating performance compared to past periods’ operating performance.

Income tax adjustments

Provision or benefit for income taxes represents the tax effects of non-GAAP adjustments determined using a hybrid with and without method and effective tax rate for the applicable adjustment and jurisdiction.

Non-GAAP diluted share count adjustments

Using the if-converted method, diluted net income per share is calculated assuming that the excess value above the principal of the 2028 exchangeable notes were converted solely into shares of common stock at the beginning of the reporting period, unless the result would be anti-dilutive. Non-GAAP shares used in diluted net income per share calculation excluded certain dilutive shares, which are expected to be offset partially or in full by the capped call transactions entered by the Company in conjunction with our 2028 exchangeable senior notes in order to reduce the potential dilution to the Company’s ordinary shares upon the conversion.

Free cash flow

Free cash flow is a non-GAAP measure defined as net cash provided by operating activities less acquisition of property, equipment and leasehold improvements. Free cash flow does not reflect non-cash items, net cash used or provided by financing activities and net cash used or provided by investing activities, other than acquisition of property, equipment and leasehold improvements. This non-GAAP financial measure is used by management to assess the Company’s sources of liquidity, capital structure and operating performance.

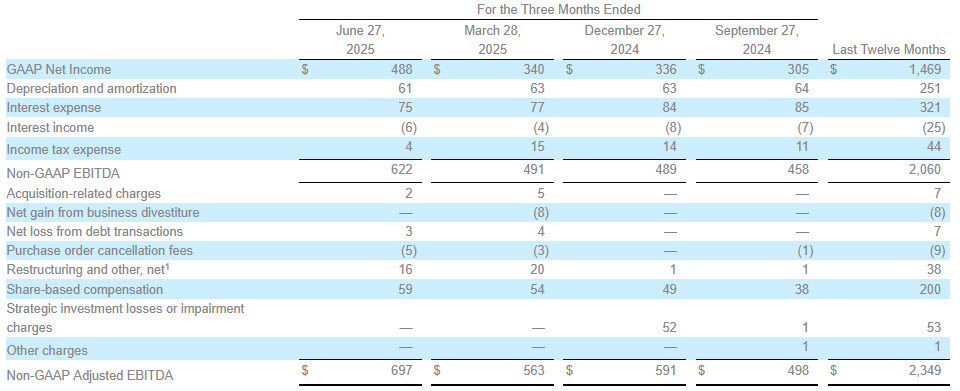

EBITDA, adjusted EBITDA and last twelve months (LTM) adjusted EBITDA

EBITDA is defined as net income (loss) before income tax expense, interest expense, interest income, depreciation and amortization. Adjusted EBITDA excludes certain expenses, gains and losses that the Company believes are not indicative of its core operating results. These adjustments primarily include impairment and other charges related to cost saving efforts, net loss (gain) from debt transactions, net gain from termination of interest rate swap, net gain from business divestiture, purchase order cancellation fees, restructuring and other, net, share-based compensation, strategic investment losses or impairment charges, other extraordinary charges such as factory underutilization charges. LTM adjusted EBITDA is defined as the total of last twelve months adjusted EBITDA. These non-GAAP financial measures are used by management to evaluate the Company’s debt portfolio and structure to comply with its financial debt covenants.

Comments

Back to basics we can say for Seagate demonstrating its strong historic savoir-faire in HDD and some choices made that delivered good results. $9.1 billion for the 2024 annual revenue signs the return in positive trajectory with +59% YoY, after 2 years of negative ones since 2022 at $11.6 billion. The Net Income also is largely positive at $1.46 billion coming from $335 million.

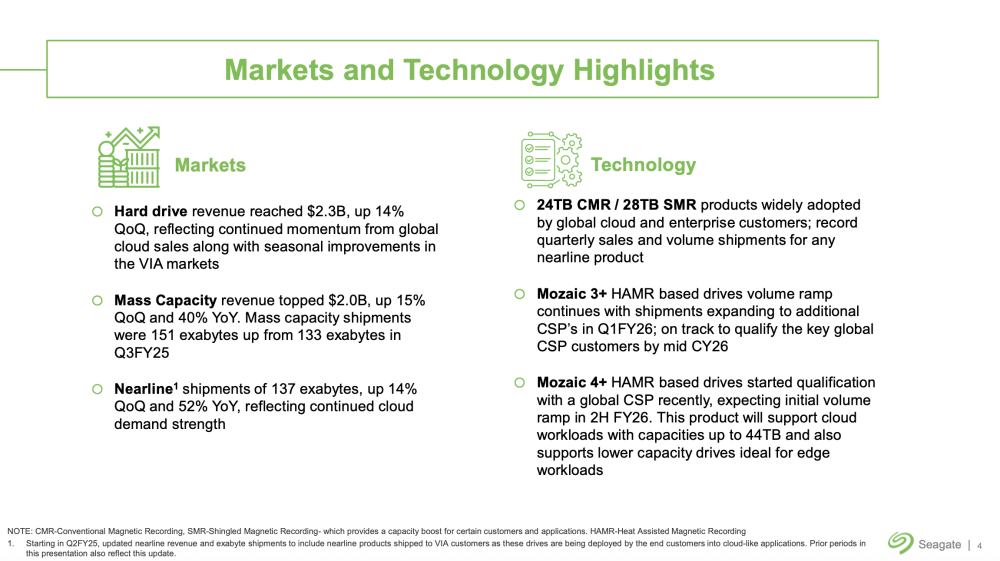

Among the clever decision, CMR, SMR, Mozaic and HAMR plus MACH.2 appear to have been the right ones. Mozaic 3+ is out with product shipped, Mozaic 4 is scheduled for 2026 and the 5th generation still is announced for 2028 with a density by platter of 5TB. There is no detail about Lyve Cloud in the news. Projects like Cortx has been stopped as well and it is always strange to see such initiative at a company of this profile.

At the same time, Western Digital announced also similar trajectory and numbers at $9.52 billion with a growth of 51% YoY.

With security, AI and globally a boom of data, we see the 3 major storage technologies announcing a growth of their storage footprint, it was the case for the LTO program a few days ago, now Seagate and Western Digital and obviously the flash segment as well.

As a pure HDD player, Seagate is not present at FMS even if they signed an agreement with Phison for Nytro SSD product line some time ago but it appears that this activity is anecdotic for them.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter