CoreWeave to Acquire Core Scientific

Owning its underlying data centers to streamline operations, reduce costs, and enhance scalability for AI and HPC workloads

This is a Press Release edited by StorageNewsletter.com on July 14, 2025 at 2:02 pmCoreWeave, Inc., an AI Hyperscaler, and Core Scientific, Inc., a data center infrastructure provider, announced that they have signed a definitive agreement under which CoreWeave will acquire Core Scientific in an all-stock transaction.

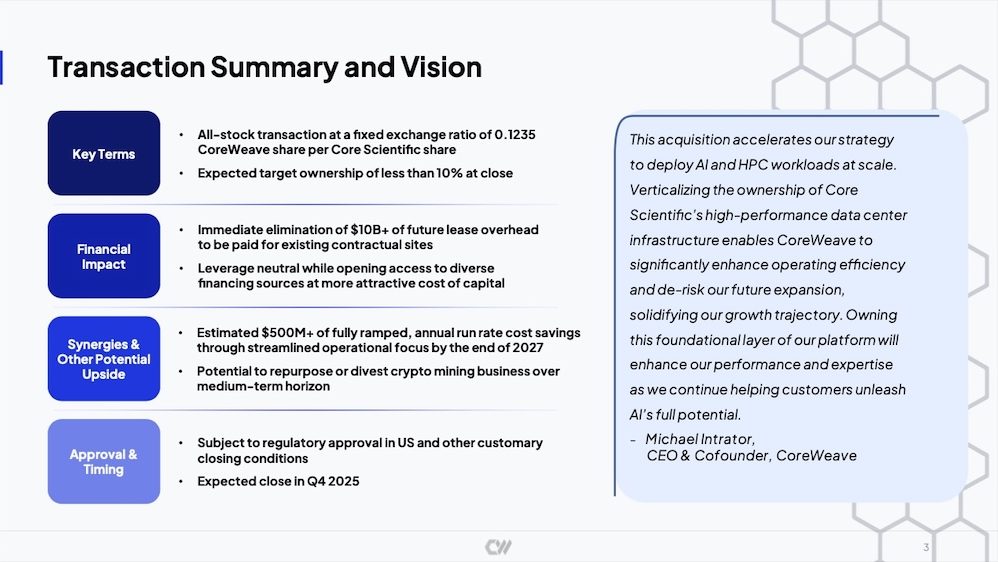

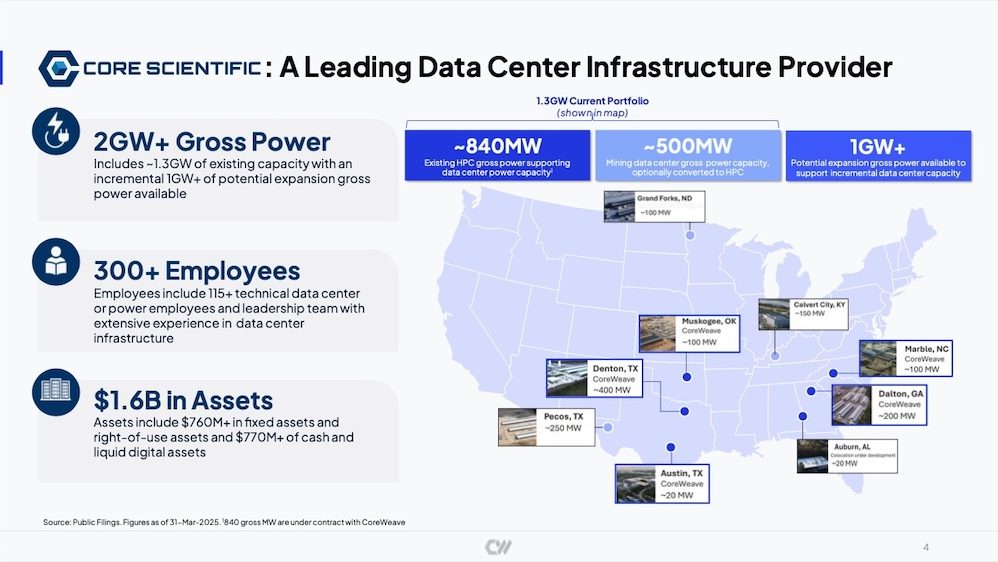

Under the terms of the merger agreement, Core Scientific stockholders will receive 0.1235 newly issued shares of CoreWeave Class A common stock for each share of Core Scientific common stock based on a fixed exchange ratio. Following CoreWeave’s successful IPO in March 2025, this acquisition will help CoreWeave verticalize its data center footprint to future-proof revenue growth and enhance profitability. Through this acquisition, CoreWeave will own approximately 1.3 GW of gross power across Core Scientific’s national data center footprint (1) with an incremental 1 GW+ of potential gross power available for expansion.

Under the terms of the merger agreement, Core Scientific stockholders will receive 0.1235 newly issued shares of CoreWeave Class A common stock for each share of Core Scientific common stock based on a fixed exchange ratio. Following CoreWeave’s successful IPO in March 2025, this acquisition will help CoreWeave verticalize its data center footprint to future-proof revenue growth and enhance profitability. Through this acquisition, CoreWeave will own approximately 1.3 GW of gross power across Core Scientific’s national data center footprint (1) with an incremental 1 GW+ of potential gross power available for expansion.

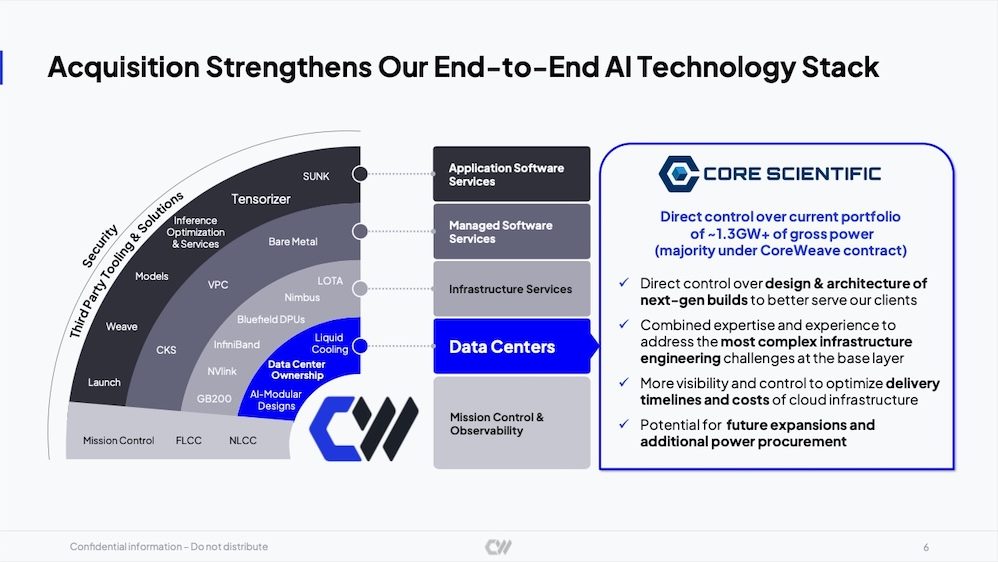

“This acquisition accelerates our strategy to deploy AI and HPC workloads at scale,” said Michael Intrator, CEO, COB and co-founder, CoreWeave. “Verticalizing the ownership of Core Scientific’s high-performance data center infrastructure enables CoreWeave to enhance operating efficiency and de-risk our future expansion, solidifying our growth trajectory. Owning this foundational layer of our platform will enhance our performance and expertise as we continue helping customers unleash AI’s .”

Strategic Benefits of CoreWeave’s Acquisition

- Operational Efficiency: CoreWeave expects to generate significant cost savings through streamlining business operations and eliminating lease overhead.

- Greater Financing Flexibility: CoreWeave can pursue infrastructure financing strategies to finance committed capital expenditures, reducing its overall cost of capital.

- Power Ownership and Optionality: CoreWeave will gain greater control over a critical power footprint and optionality for future power capacity.

- Expanded Expertise: Core Scientific’s data center development capabilities complement and augment CoreWeave’s extensive expertise in power procurement, construction, and site management for infrastructure assets.

“As our longstanding partner, CoreWeave has experienced firsthand the operational excellence we deliver and the value of the services we provide,” said Adam Sullivan, president and CEO, Core Scientific. “Together with CoreWeave, we will be well-positioned to accelerate the availability of world-class infrastructure for companies innovating with AI while delivering the greatest value for our shareholders, who will be able to participate in the tremendous upside potential of the combined company.”

Transaction Details

The transaction is expected to close in the fourth quarter of 2025, subject to customary closing conditions, including regulatory approval and approval by Core Scientific stockholders. Upon closing and under the terms of the agreement, which has been approved by the board of directors of each company, Core Scientific stockholders will receive 0.1235 newly issued shares of CoreWeave Class A common stock for each share of Core Scientific common stock held. As of July 3, 2025, the agreed-upon exchange ratio implies a total equity value of approximately $9.0 billion. This is calculated on a fully diluted basis and based on CoreWeave’s 5-day VWAP. The final value will be determined at the time of transaction close. Upon close, CoreWeave expects Core Scientific’s stockholders’ ownership of the combined company will be less than 10%.

Financial Impact

Immediate elimination of over $10 billion of cumulative future lease overhead to be paid for existing contractual sites over the next 12 years.

Leverage neutral impact to CoreWeave while opening access to diverse financing sources at a more attractive cost of capital.

Including the elimination of the lease overhead, this deal adds $500 million of estimated fully ramped, annual run rate cost savings by the end of 2027 through streamlined operational focus.

Potential to repurpose toward HPC usage or divest crypto mining business over the medium-term horizon.

(1) Represents ~840 existing gross MW power supporting CoreWeave’s HPC contracts and ~500 gross MW crypto mining data center power capacity

Comments

CoreWeave, one the highly visible GPU-as-a-Service provider, confirmed the hype around this area and to accelerate its market footprint finally acquired its cloud partner and co-host.

With Bitcoin mining relegated to the background with AI pressure, this deal could appear as a good deal for both companies for different reasons.

For CoreWeave, the future power capacity is essential to sustain the demand and in this case it is significant. The second point is related to the ownership of its AI infrastructure in a very competitive market climate with direct competition but also "classic" with cloud service providers and other AI firms.

Click to enlarge

Click to enlarge

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter