Penguin Solutions: Fiscal 3Q25 Financial Results

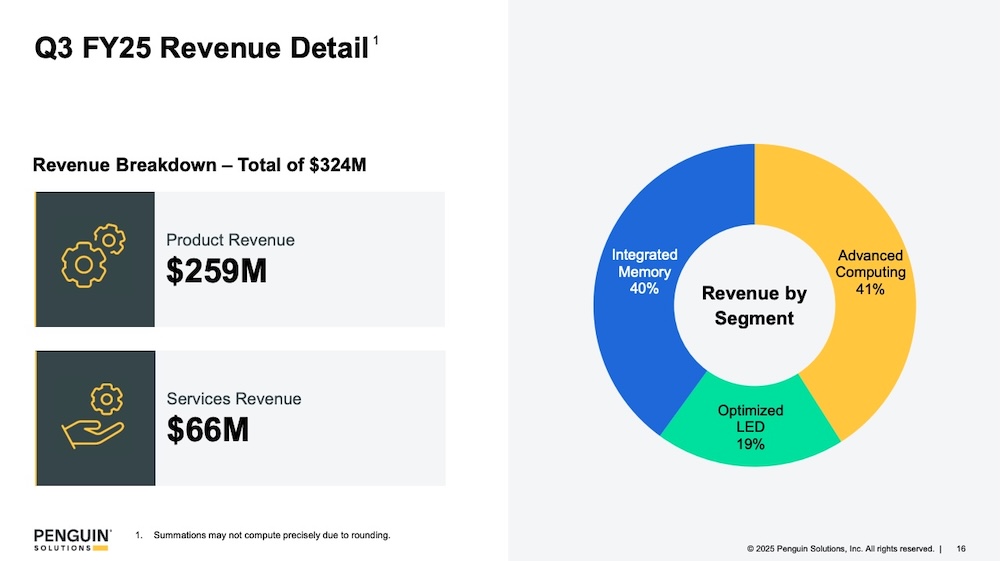

Net sales of $324 million, Up 7.9% Y/Y, 17% growth expected for the full year

This is a Press Release edited by StorageNewsletter.com on July 11, 2025 at 2:02 pmPenguin Solutions, Inc. reported financial results for the third quarter of fiscal 2025.

Third Quarter Fiscal 2025 Highlights

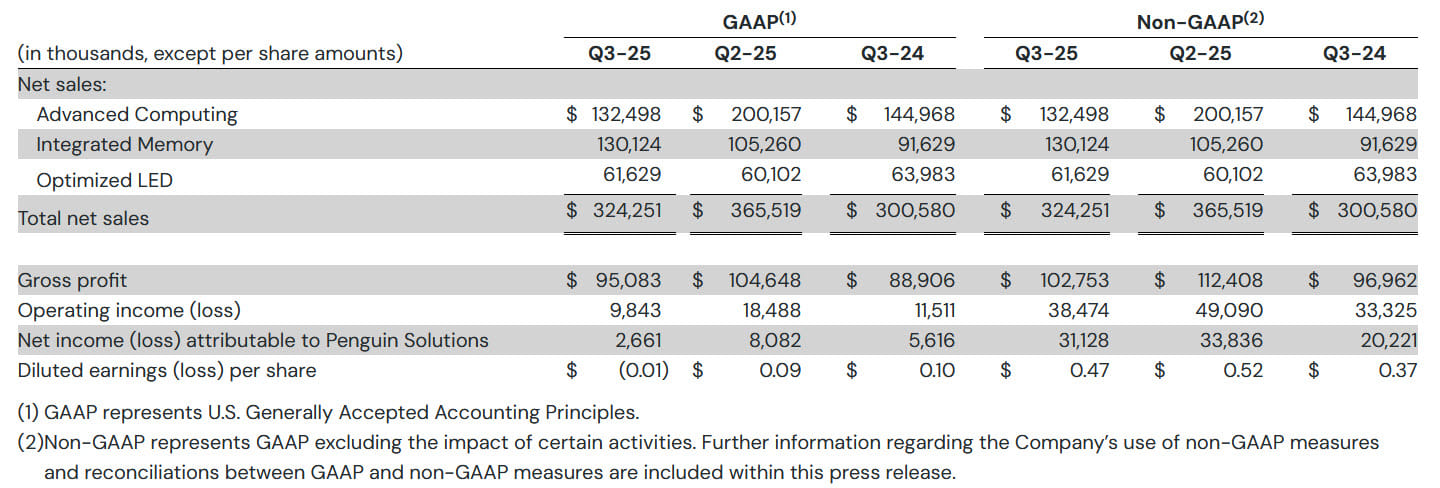

- Net sales of $324 million, up 7.9% the year-ago quarter

- GAAP gross margin of 29.3%, down 30 basis points the year-ago quarter

- Non-GAAP gross margin of 31.7%, down 60 basis points the year-ago quarter

- GAAP diluted EPS of $(0.01) $0.10 in the year-ago quarter

- Non-GAAP diluted EPS of $0.47 $0.37 in the year-ago quarter

“We delivered solid third quarter results while executing vs. our strategic objectives,” said Mark Adams, CEO, Penguin Solutions. “We also strengthened our balance sheet through a refinancing after the close of Q3, and we remain focused on developing our AI software and services capabilities, expanding go-to-market resources, and driving long-term value for our stockholders.“

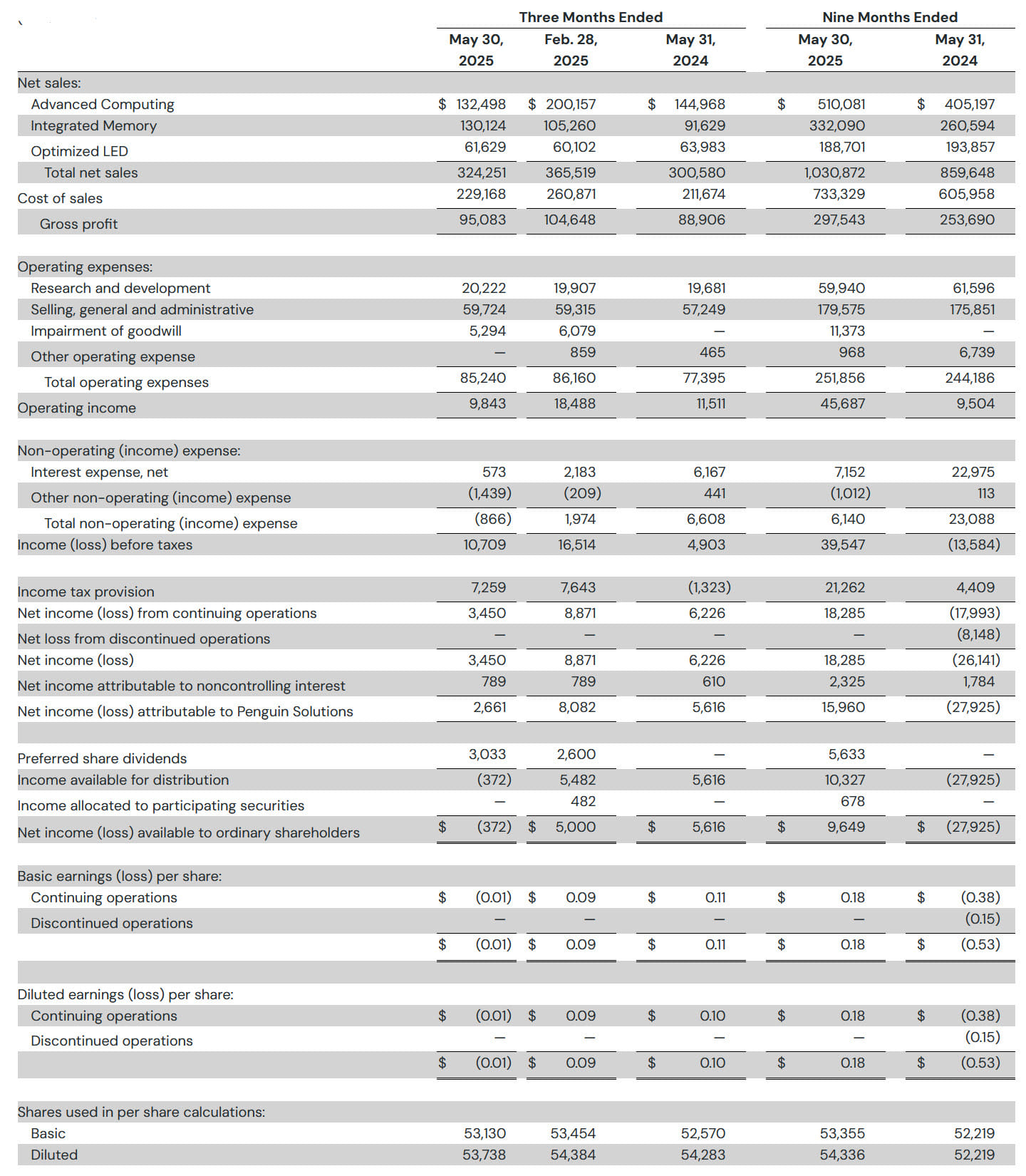

Quarterly Financial Results

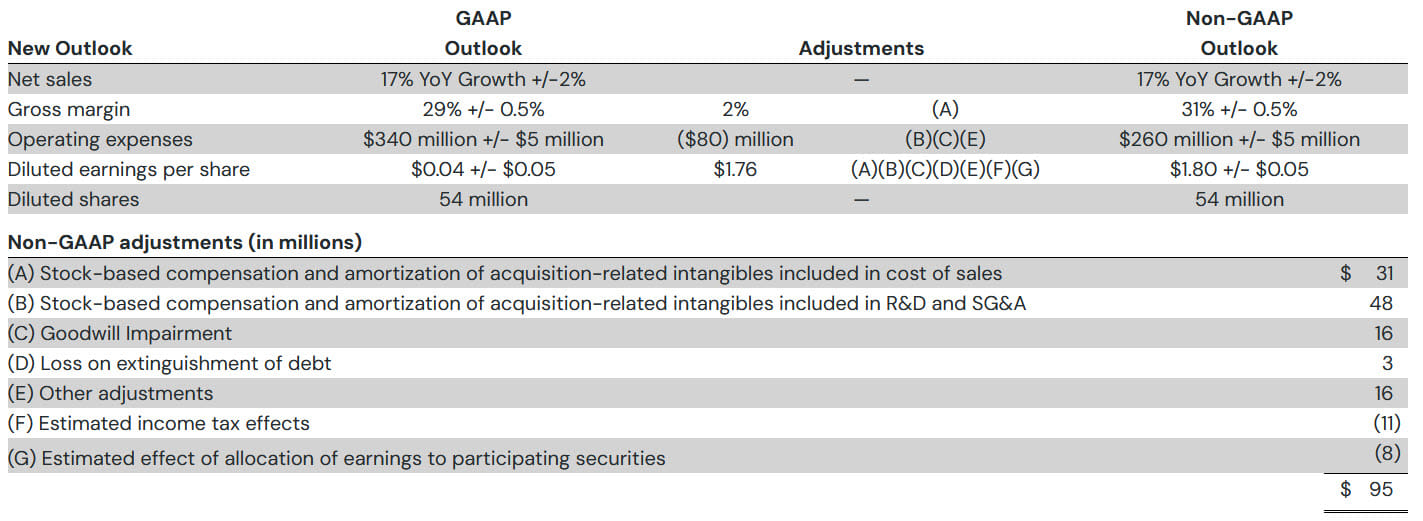

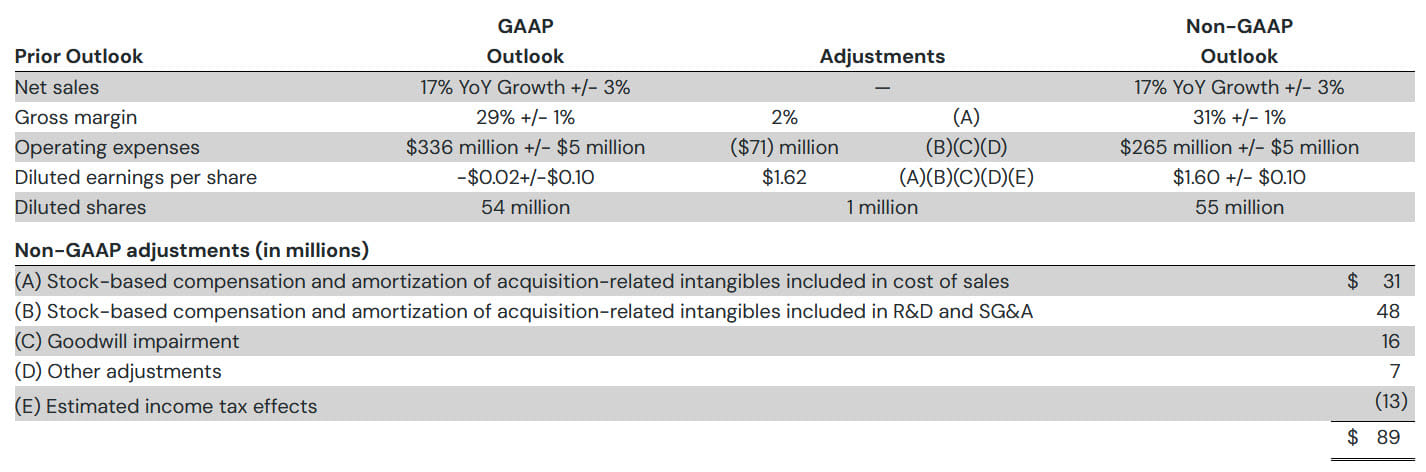

Business Outlook

As of July 8, 2025, Penguin Solutions is providing the following financial outlook for fiscal year 2025:

Penguin Solutions held a conference call to discuss the third quarter of fiscal 2025 results and related matters on July 8, 2025. A webcast will remain available for approximately one year.

Penguin Solutions held a conference call to discuss the third quarter of fiscal 2025 results and related matters on July 8, 2025. A webcast will remain available for approximately one year.

Use of Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995 that are not historical in nature, that are predictive or that depend upon or refer to future events or conditions. These statements may include, but are not limited to, statements concerning or regarding future events and the future financial and operating performance of Penguin Solutions; statements regarding the extent and timing of and expectations regarding Penguin Solutions’ future net sales and expenses; statements regarding Penguin Solutions’ strategic objectives and development of our services and capabilities; statements regarding long-term effective tax rates; statements regarding the business and financial outlook for fiscal year 2025 described under “Business Outlook” above; and statements regarding our liquidity.

These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipate,” “target,” “expect,” “estimate,” “intend,” “plan,” “goal,” “believe,” “could,” and other words of similar meaning. Forward-looking statements provide our current expectations or forecasts of future events, circumstances, results or aspirations and are subject to a number of significant risks, uncertainties and other factors, many of which are outside of our control, including but not limited to: global business and economic conditions, including the impact on the financial condition of our customers, particularly in challenging macroeconomic environments, growth trends in technology industries (including trends and markets related to AI), our customer markets and various geographic regions; uncertainties in the geopolitical environment; the ability to manage our cost structure; disruptions in our operations or supply chain as a result of global pandemics or otherwise; changes in trade regulations and tariffs or adverse developments in international trade relations and agreements; changes in currency exchange rates; overall IT spending, including changes in customer spending on our products and services; appropriations for government spending; the success of our strategic initiatives including the US Domestication (as defined below) and our ability to realize the anticipated benefits thereof, our rebranding and related strategy, any existing or potential collaborations and additional investments in new products and additional capacity; acquisitions of companies or technologies and the failure to successfully integrate and operate them or customers’ negative reactions to them; issues, delays or complications in integrating the operations of Stratus Technologies; failure to achieve the intended benefits of the sale of SMART Brazil and its business; the impact of and expected timing of winding down the manufacturing and discontinuing the sale of products offered through our Penguin Edge business; limitations on or changes in the availability of supply of materials and components; fluctuations in material costs; the temporary or volatile nature of pricing trends in memory or elsewhere; deterioration in customer relationships; our dependence on a select number of customers, and the timing and volume of customer orders and renewals; the impact of customer churn rates, including discounting and churn of significant customers from whom we derive a significant percent of our revenue; production or manufacturing difficulties; competitive factors; technological changes; difficulties with, or delays in, the introduction of new products; slowing or contraction of growth in the memory market, LED market or other markets in which we participate; changes to applicable tax regimes or rates; changes to the valuation allowance for our deferred tax assets, including any potential inability to realize these assets in the future; prices for the end products of our customers; strikes or labor disputes; deterioration in or loss of relations with any of our limited number of key vendors; the inability to maintain or expand government business; and the continuing availability of borrowings under revolving lines of credit or other debt arrangements and our ability to raise capital through debt or equity financings.

These and other risks, uncertainties and factors are described in greater detail under the sections titled “Risk Factors,” “Critical Accounting Estimates,” “Results of Operations,” “Quantitative and Qualitative Disclosures About Market Risk” and “Liquidity and Capital Resources” contained in the Annual Report on Form 10-K for the fiscal year ended August 30, 2024 filed prior to the US Domestication by our predecessor Penguin Solutions Cayman (as defined below), as updated by the risk factors contained in our Quarterly Reports on Form 10-Q and in our other filings with the US SEC (the “SEC”). Such risks, uncertainties and factors as outlined above and in such filings could cause our actual results to be materially different from such forward-looking statements. Accordingly, investors are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements that we make in this press release speak only as of the date of this press release. Except as required by law, we do not undertake to update the forward-looking statements contained in this press release to reflect the impact of circumstances or events that may arise after the date that the forward-looking statements were made.

Statement Regarding Use of Non-GAAP Financial Measures

This press release and the accompanying tables contain the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP effective tax rate, non-GAAP net income, non-GAAP weighted-average shares outstanding, non-GAAP diluted earnings per share and adjusted EBITDA. Penguin Solutions’ management uses these non-GAAP measures to supplement Penguin Solutions’ financial results under GAAP. Management uses these measures to analyze its operations and make decisions as to future operational plans and believes that this supplemental non-GAAP information is useful to investors in analyzing and assessing the Company’s past and future operating performance. These non-GAAP measures exclude certain items, such as share-based compensation expense; amortization of acquisition-related intangible assets (consisting of amortization of developed technology, customer relationships and trademarks/trade names acquired in connection with business combinations); cost of sales-related restructuring; diligence, acquisition and integration expense; redomiciliation costs; restructuring charges; impairment of goodwill; changes in the fair value of contingent consideration; (gains) losses from changes in foreign currency exchange rates; amortization of debt issuance costs; (gain) loss on extinguishment or prepayment of debt; other infrequent or unusual items and related tax effects and other tax adjustments. While amortization of acquisition-related intangible assets is excluded, the revenues from acquired companies are reflected in the Company’s non-GAAP measures and these intangible assets contribute to revenue generation. Management believes the presentation of operating results that exclude certain items provides useful supplemental information to investors and facilitates the analysis of the Company’s core operating results and comparison of operating results across reporting periods. Management also uses adjusted EBITDA, which represents GAAP net income (loss), adjusted for net interest expense; income tax provision (benefit); depreciation expense and amortization of intangible assets; share-based compensation expense; cost of sales-related restructuring; diligence, acquisition and integration expense; redomiciliation costs; impairment of goodwill; restructuring charges; loss on extinguishment of debt and other infrequent or unusual items.

In the third quarter of fiscal 2025, for our non-GAAP reporting, we reduced our long-term projected non-GAAP effective tax rate from 28% to 25%, which includes the tax impact of pre-tax non-GAAP adjustments and reflects currently available information as well as other factors and assumptions. This reduction was due to changes in the geographic earnings mix. While we expect to use this normalized non-GAAP effective tax rate through fiscal 2025, this long-term non-GAAP effective tax rate may be subject to change for a variety of reasons, including the rapidly evolving global tax environment, significant changes in our geographic earnings mix or changes to our strategy or business operations. Our GAAP effective tax rate can vary significantly from quarter to quarter based on a variety of factors, including, but not limited to, discrete items which are recorded in the period they occur, the tax effects of certain items of income or expense, significant changes in our geographic earnings mix or changes to our strategy or business operations. We are unable to predict the timing and amounts of these items, which could significantly impact our GAAP effective tax rate, and therefore we are unable to reconcile our forward-looking non-GAAP effective tax rate measure to our GAAP effective tax rate.

Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP, as they exclude important information about Penguin Solutions’ financial results, as noted above. The presentation of these adjusted amounts varies from amounts presented in accordance with GAAP and therefore may not be comparable to amounts reported by other companies. In addition, adjusted EBITDA does not purport to represent cash flow provided by, or used for, operating activities in accordance with GAAP and should not be used as a measure of liquidity. Investors are encouraged to review the “Reconciliation of GAAP to Non-GAAP Measures” tables below.

Explanatory Note

Subsequent to the end of the third quarter, on June 30, 2025, we completed the redomiciliation of the parent company of our corporate group, Penguin Solutions, Inc., a Cayman Islands exempted company (“Penguin Solutions Cayman”), from the Cayman Islands to the State of Delaware in the US, resulting in Penguin Solutions, Inc., a Delaware corporation (“Penguin Solutions Delaware”), becoming our publicly traded parent company (the “US Domestication”). Penguin Solutions Delaware is the successor issuer to Penguin Solutions Cayman. The US Domestication was approved by the shareholders of Penguin Solutions Cayman and effected via a court-sanctioned scheme of arrangement under Cayman Islands law, pursuant to which each ordinary share of Penguin Solutions Cayman was exchanged for one share of common stock of Penguin Solutions Delaware, and each convertible preferred share of Penguin Solutions Cayman was exchanged for one share of convertible preferred stock of Penguin Solutions Delaware. Additional information about the US Domestication was included in Penguin Solutions Cayman’s definitive proxy statement on Schedule 14A, filed with the SEC on April 2, 2025. As used in this press release, unless stated otherwise or the context requires otherwise, the terms “Penguin Solutions,” “Company,” “we,” “our,” “us” or similar terms (i) for periods prior to the consummation of the US Domestication, refer to Penguin Solutions Cayman and its consolidated subsidiaries and (ii) for periods at or after the consummation of the US Domestication, refer to Penguin Solutions Delaware and its consolidated subsidiaries. Throughout this press release, we refer to our equity securities (i) for periods prior to the consummation of the US Domestication, as ordinary shares and/or convertible preferred shares and (ii) for periods at or after the consummation of the US Domestication, as shares of common stock and/or shares of convertible preferred stock.

Penguin Solutions, Inc.

Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

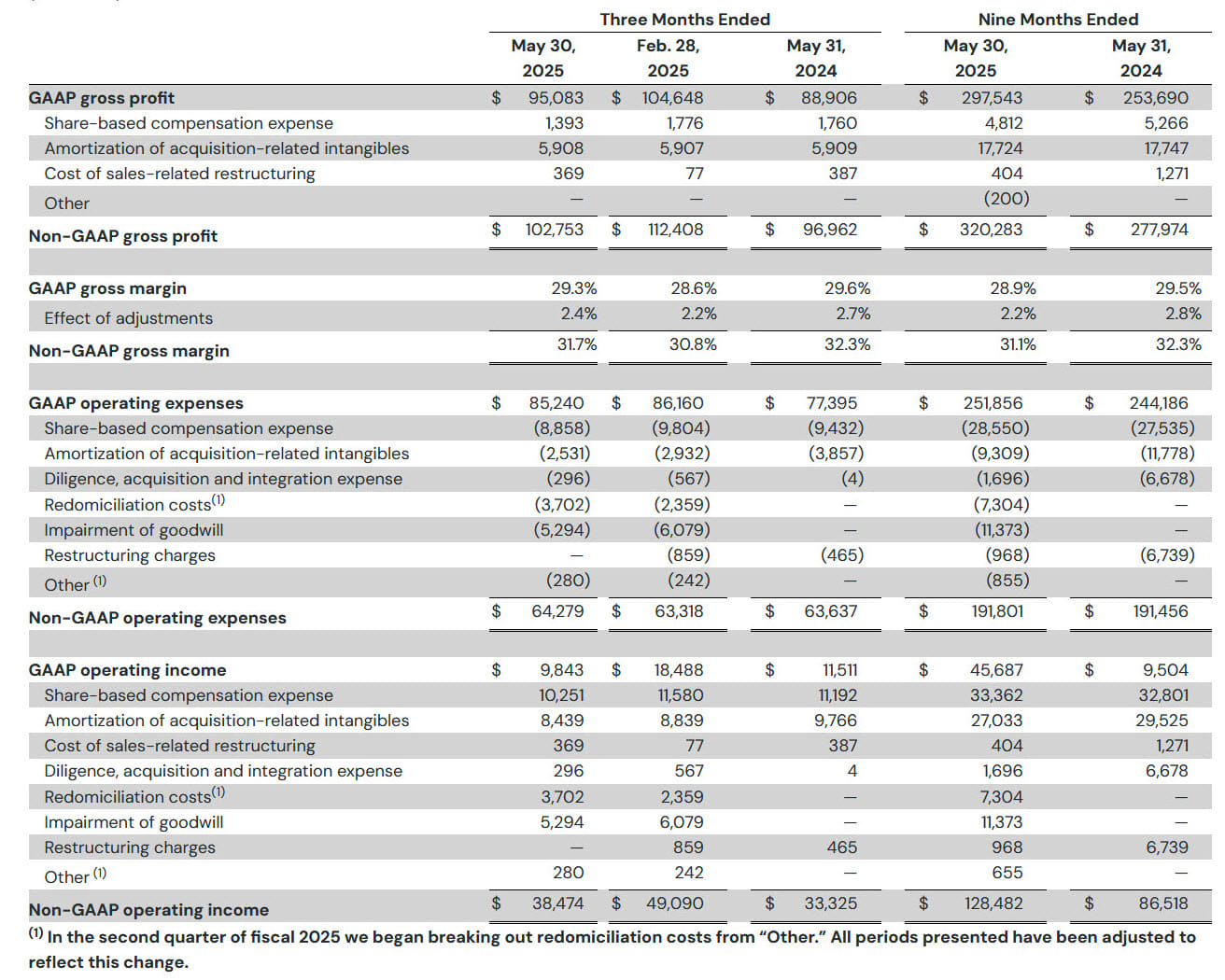

Penguin Solutions, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(In thousands, except percentages)

(Unaudited)

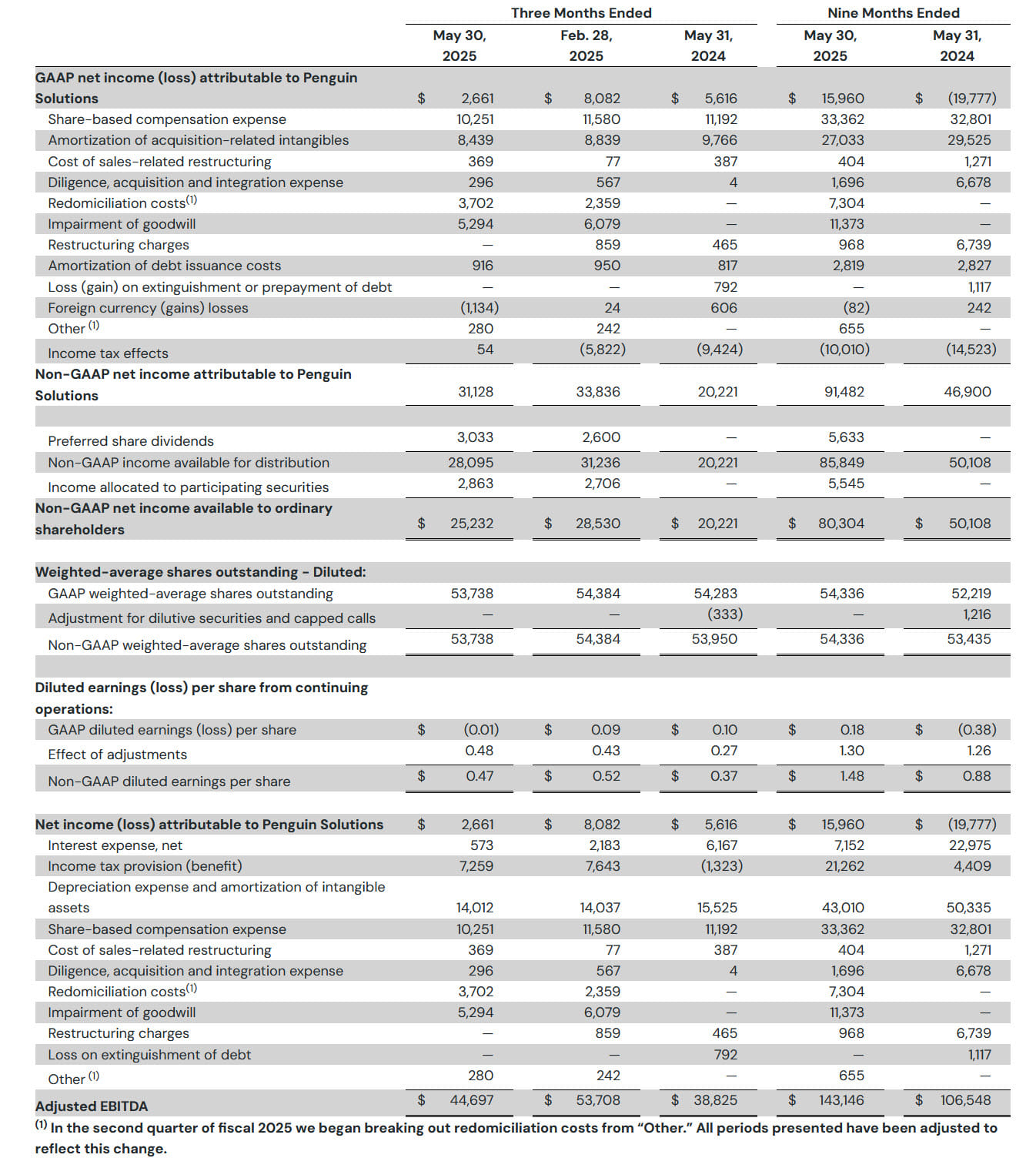

Penguin Solutions, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(In thousands, except per share amounts)

(Unaudited)

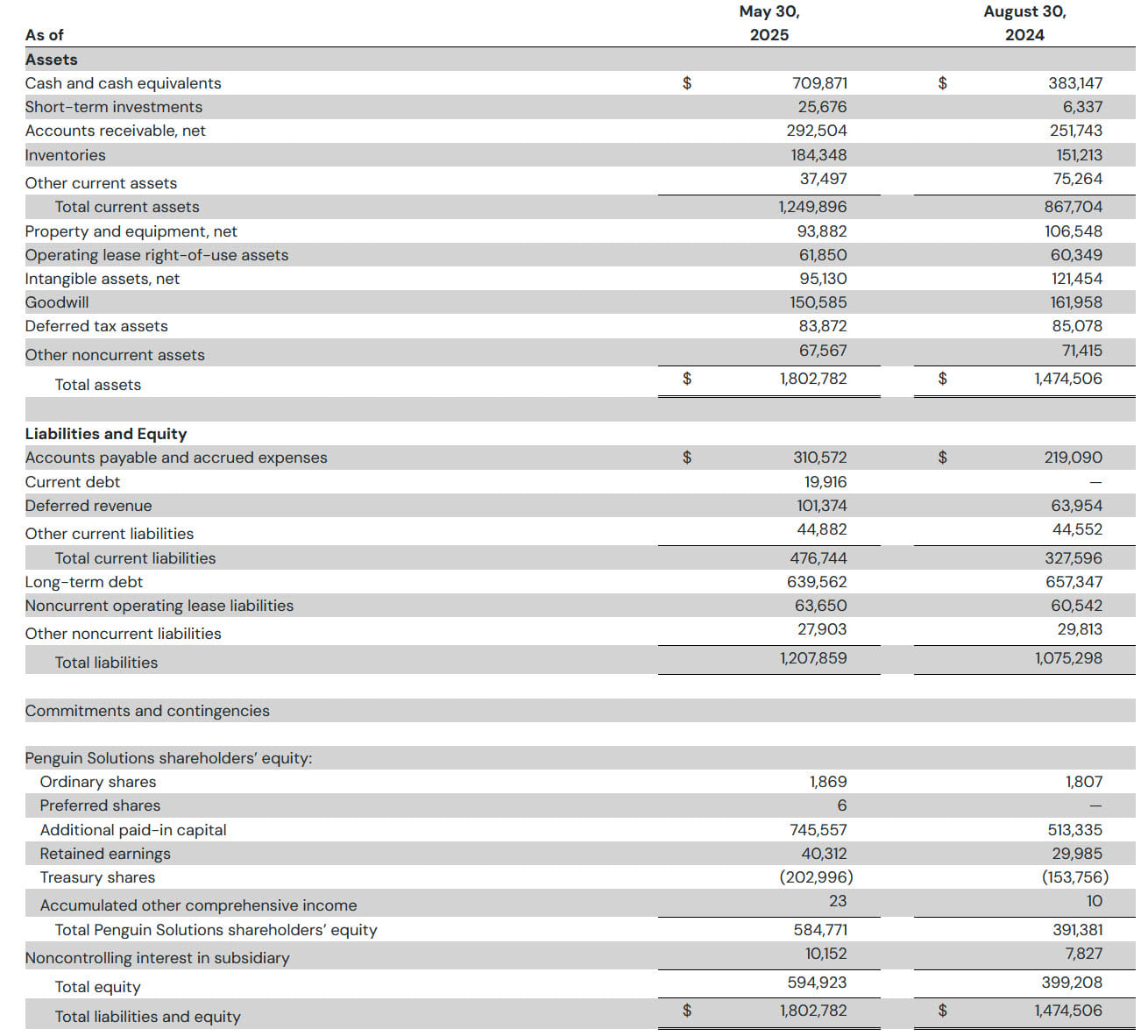

Penguin Solutions, Inc.

Consolidated Balance Sheets

(In thousands)

(Unaudited)

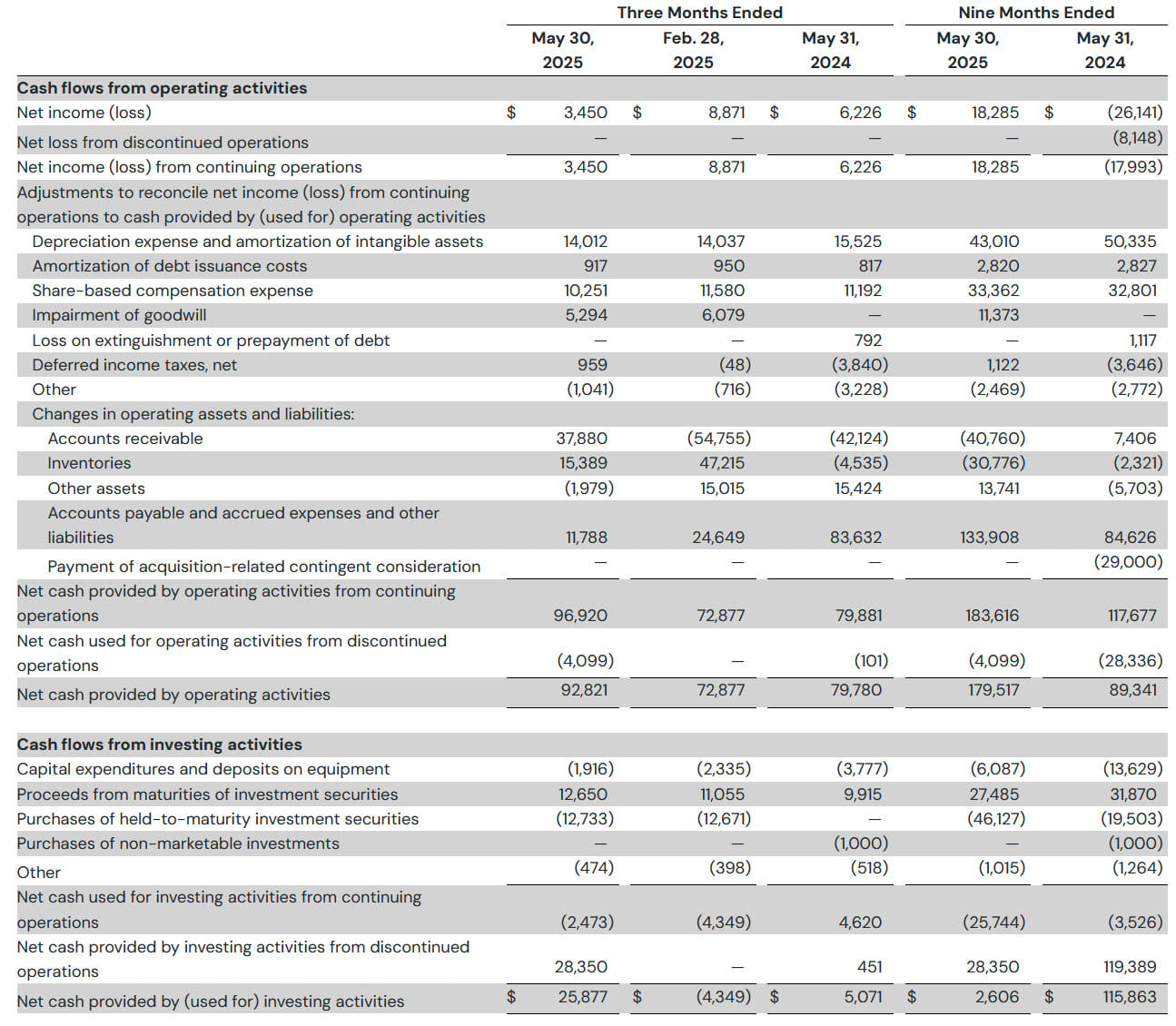

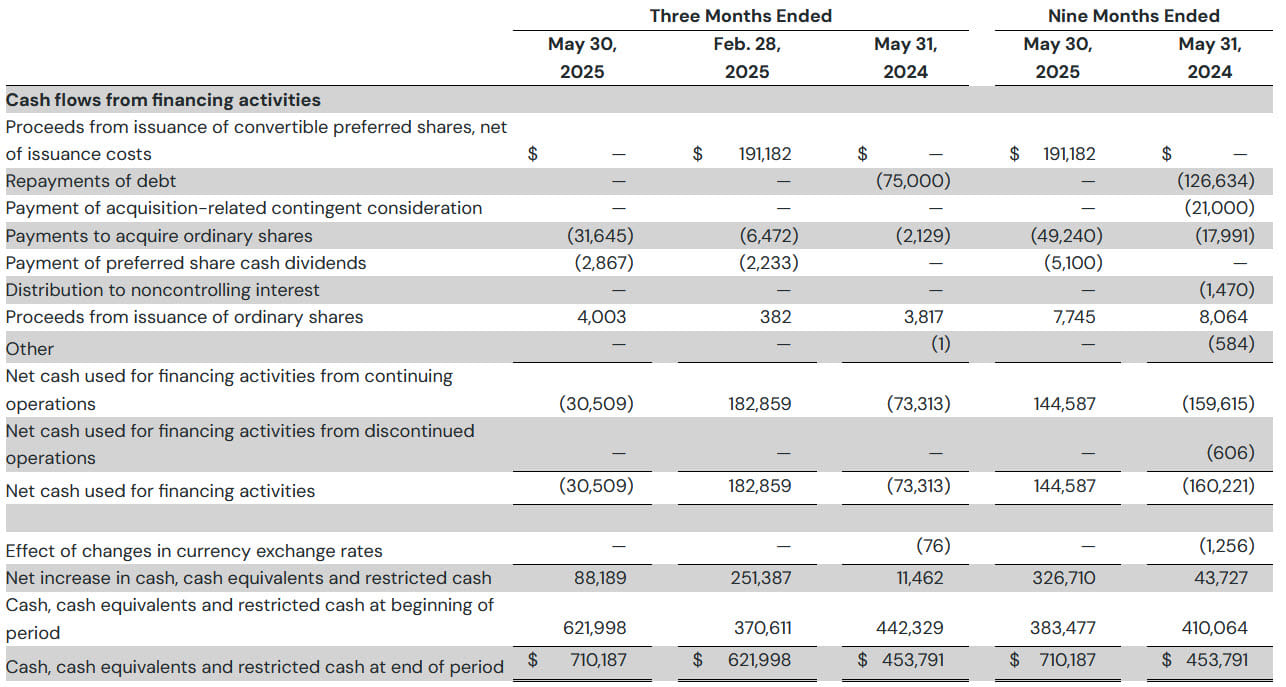

Penguin Solutions, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

Penguin Solutions, Inc.

Consolidated Statements of Cash Flows, Continued

(In thousands)

(Unaudited)

Comments

The company has generated $1.34 billion for the last 12 months which represents +14.09% year-over-year. It also translated in $500k per employee.

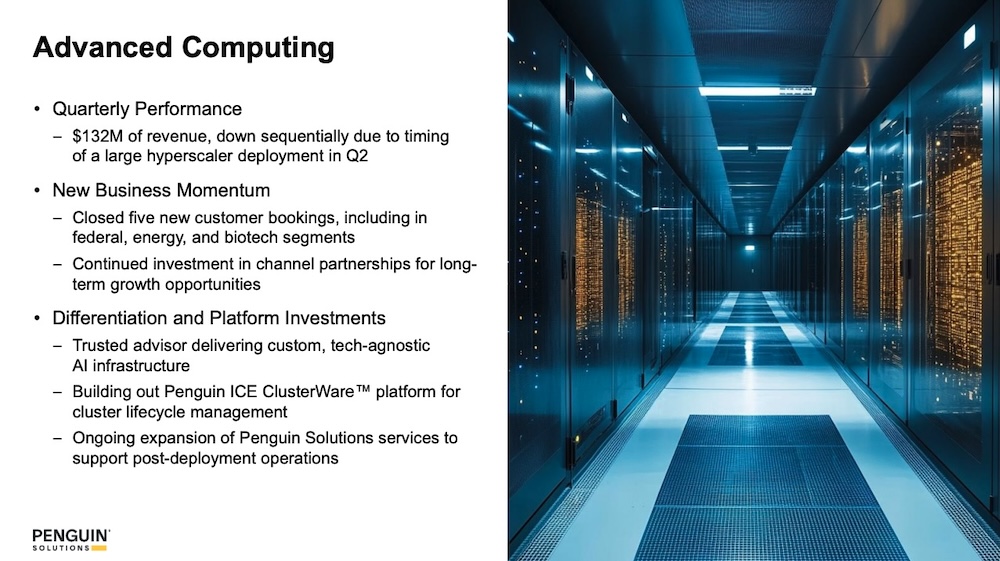

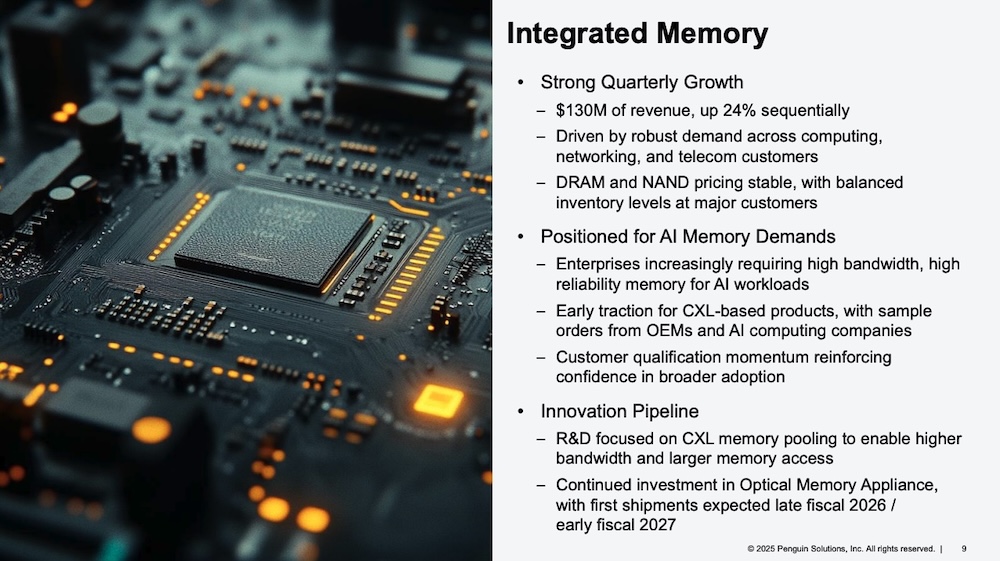

The Advanced Computing activity has been impacted coming from $200 million the previous quarter down to $132 million, the 2 others areas make progress, respectively the Integrated memory jumped to $130 million from $105 million and Optimized LED from $60 million to $62 million.

With some conservative approach and recent Q4 years, let's pick a revenue of $300 million, which will mean a projected revenue of $1.33 billion for the fiscal year 2025 aligned with the current rolling annual revenue.

The market cap is approx. $1.25 billion which is lower than the annual revenue mentioned above and even the projected one. Slides below is an extract from the financial presentation and illustrate the last quarter business activities.

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter