Transition Between DRAM Generations Drives Diverging 3Q25 Price Trends

Consumer DDR4 prices expected to surge over 40%, says TrendForce

This is a Press Release edited by StorageNewsletter.com on July 9, 2025 at 2:00 pmLatest findings from TrendForce Corp. show that the 3 major DRAM suppliers are shifting capacity toward high-end products and have begun announcing end-of-life (EOL) plans for PC and server-grade DDR4 and mobile LPDDR4X.

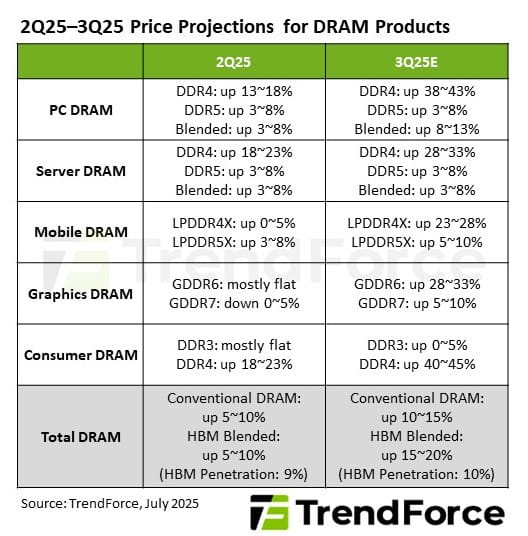

This has triggered aggressive restocking of legacy-generation products, further fueled by traditional peak-season demand. Consequently, average contact prices for conventional DRAM are projected to rise by 10% to 15% in 3Q25. Including HBM, overall DRAM prices are expected to increase by 15% to 20%.

TrendForce notes that DDR4 demand remains strong in 3Q25, and suppliers are aiming to raise prices more aggressively. As Taiwanese manufacturers currently lack the capacity and product specs to fully meet market needs, DDR4 supply is expected to remain tight in the short term. Moreover, DDR4 output is being prioritized for server applications, leaving limited availability for consumer-grade user.

Combined with smaller order volumes from consumer markets and the buyers’ weak bargaining power, consumer DDR4 contract prices are forecast to surge by 40% to 45% in the third quarter. In contrast, next gen DDR5, with more concentrated production capacity, will see relatively moderate price increases-marking a clear divergence in pricing trends between legacy and new-generation products.

PC DRAM prices rise sharply; some suppliers postpone server DDR4 EOL

Amid potential hikes in US import tariffs following the expiration of reciprocal tariff exemptions, major PC OEMs are urging ODMs to ramp up system assembly and continue building DRAM inventories. On the supply side, capacity shifts by the top 3 DRAM makers toward server DRAM have constrained the availability of both DDR5 and DDR4 for PC applications. PC DDR4 supply is further squeezed by EOL policies and strong procurement of server DDR4 by CSPs. As a result, PC DRAM contract prices are expected to rise by 8% to 13% in the third quarter.

In the sever DRAM market, CSP data center deployments are driving growing demand for DDR5, while the announcement of DDR4 EOL has spurred early restocking. Suppliers initially planned an accelerated transition to DDR5 with sharp DDR4 capacity cuts, but surging DDR4 demand in Q2 has prompted some to postpone their EOL timelines, disrupting product transition schedules. This has created a short-term supply gap.

Looking to the third quarter, server DRAM demand will continue to be supported by data center expansion, new platforms, and AI server deployments, with prices expected to rise by 3% to 8%.

LPDDR4X prices soar; GDDR6 in short supply drives up prices

TrendForce reports that since April, major Korean and US suppliers have announced plans to reduce or halt LPDDR4X supply for smartphones and laptops starting next year. However, market panic-buying has intensified as compatible processor chips have yet to be upgraded in tandem.

As a result, LPDDR4X contract prices are expected to surge by 23% to 28% in the third quarter. LPDDR5X supply is tight due to seasonal restocking, and suppliers are also aiming to narrow the price gap with other memory products. As such, LPDDR5X contract prices are expected to rise by 5% to 10%.

Graphics DRAM demand in the third quarter will be primarily driven by restocking for NVIDIA’s next gen GPUs, with PC OEMs also beginning to replenish inventories. However, overall pull-in momentum remains cautious due to subdued gaming market demand.

Additionally, the 3 major suppliers are gradually reallocating capacity to GDDR7 in preparation for NVIDIA’s next gen GPUs. Still, mid- to entry-level GPUs from NVIDIA and other vendors like AMD continue to rely on GDDR6, leading to a short-term supply shortage. As a whole, graphics DRAM prices are set for strong gains in Q3, with GDDR6 seeing the most pronounced increases.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter