Marvell: Fiscal 1Q26 Financial Results

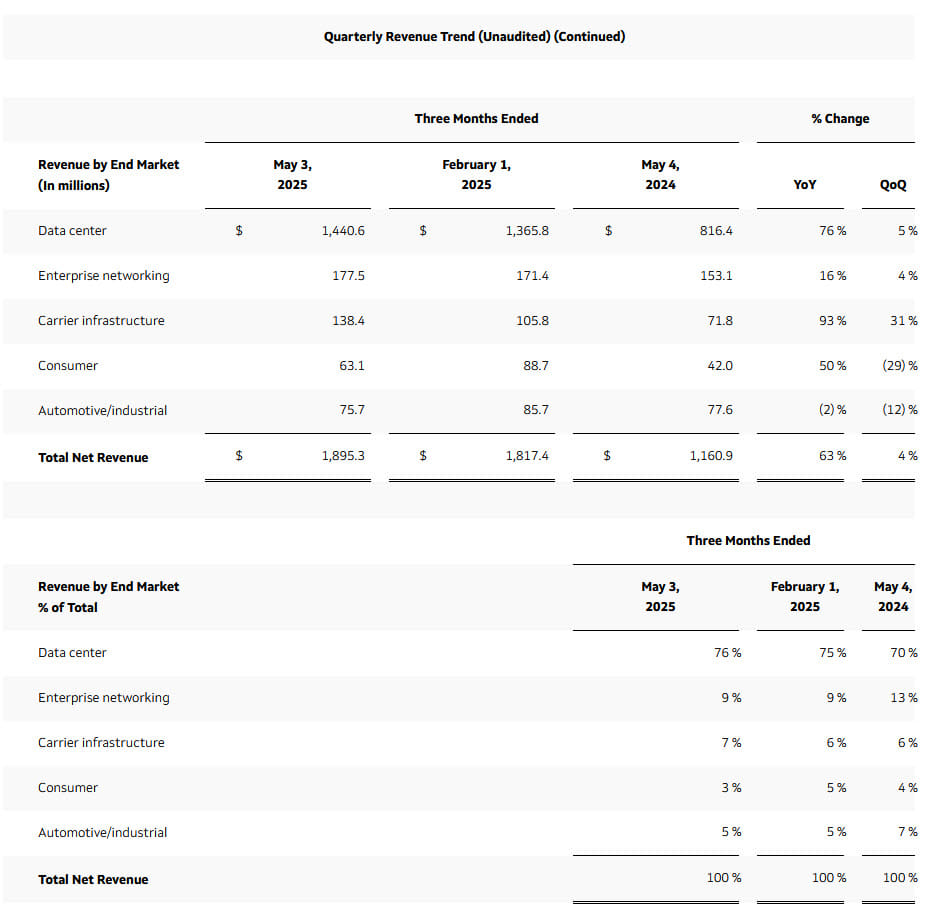

Net revenue at $1.895 billion, up 63% Y/Y and $2 billion +/- 5%, expected for next quarter

This is a Press Release edited by StorageNewsletter.com on June 6, 2025 at 2:02 pmSummary:

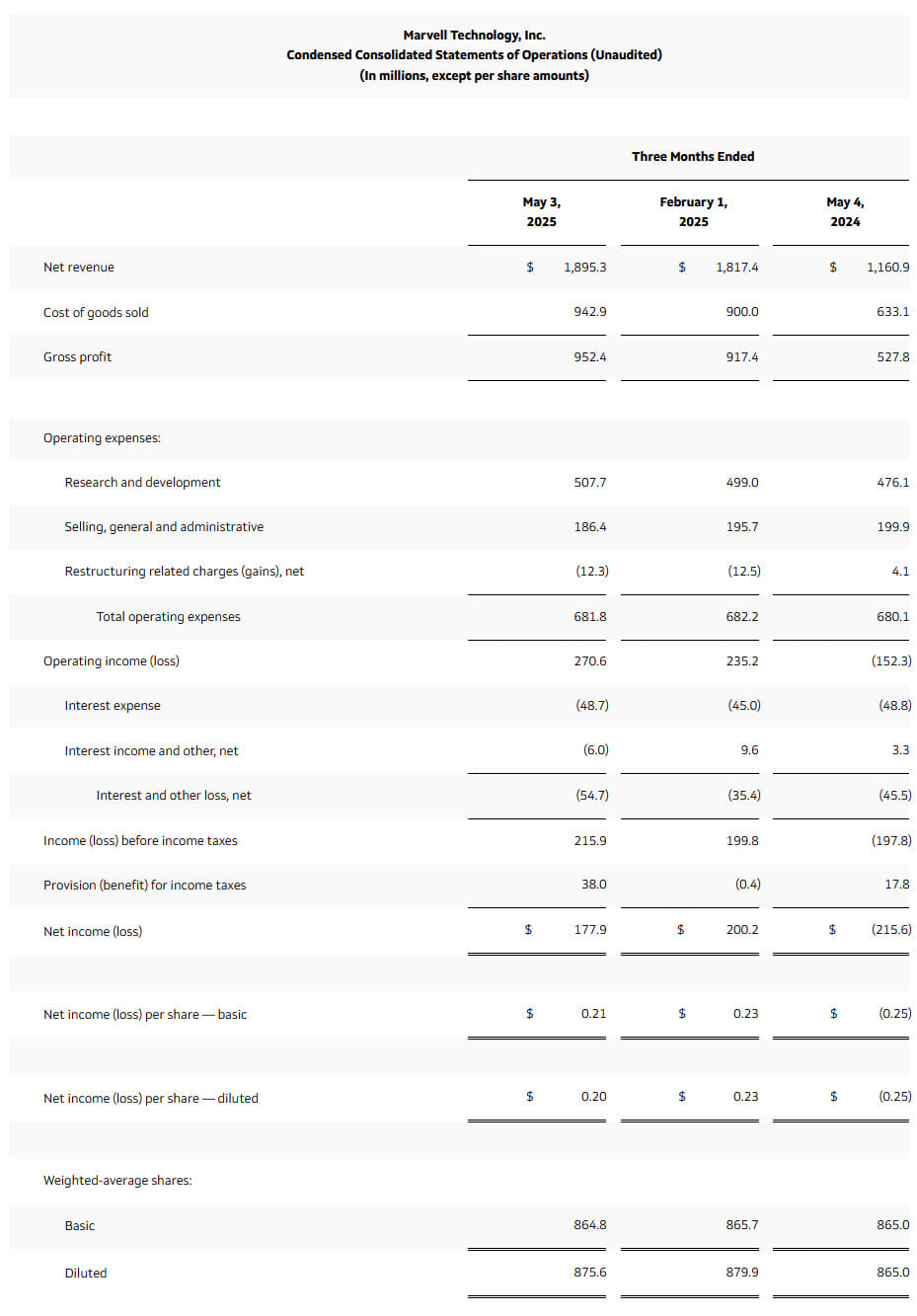

- Q1 Net Revenue: $1.895 billion, a new record, grew by 63% year-on-year

- Q1 Gross Margin: 50.3% GAAP gross margin; 59.8% non-GAAP gross margin

- Q1 Diluted income per share: $0.20 GAAP diluted income per share; $0.62 non-GAAP diluted income per share

Marvell Technology, Inc. reported financial results for the first quarter of fiscal year 2026.

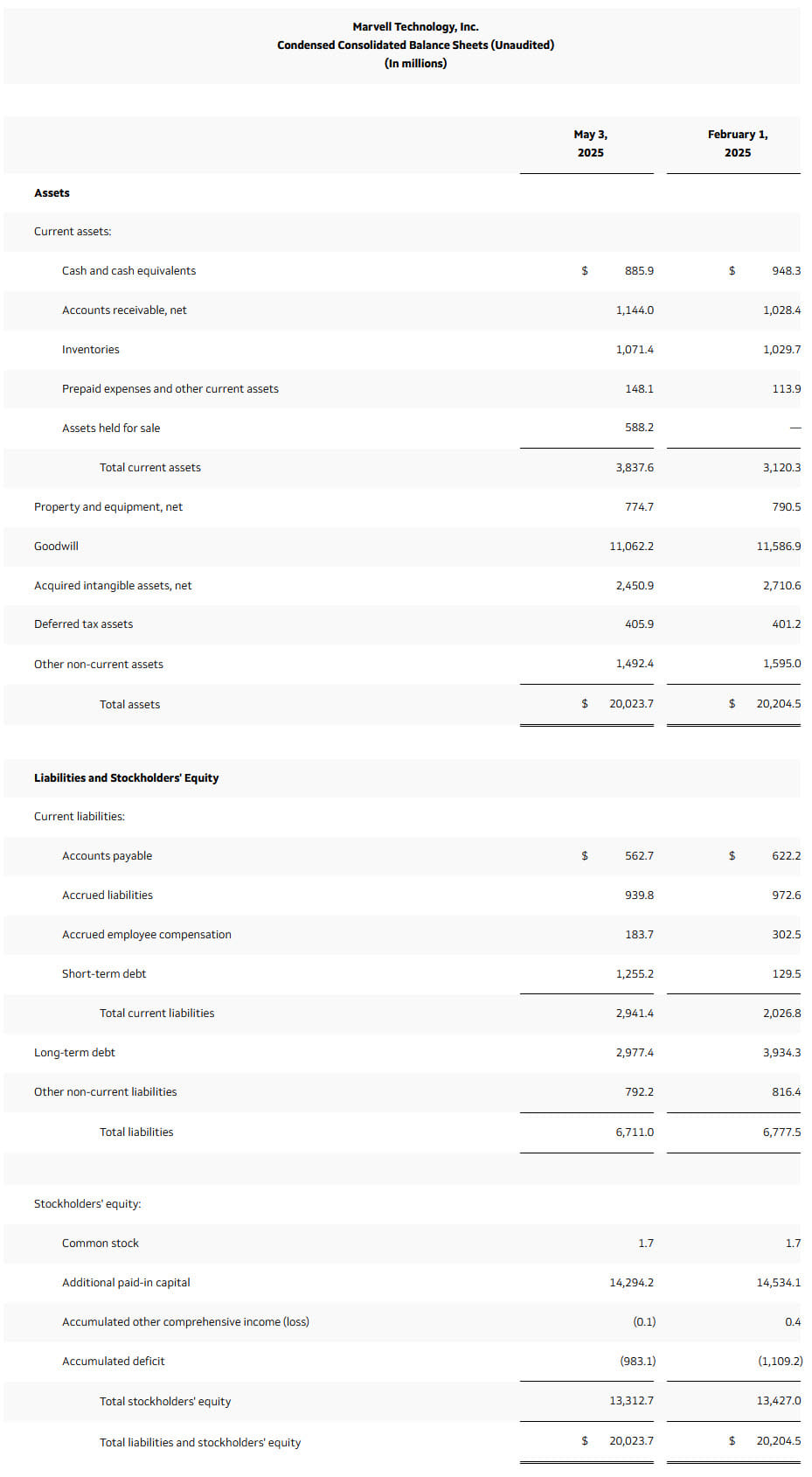

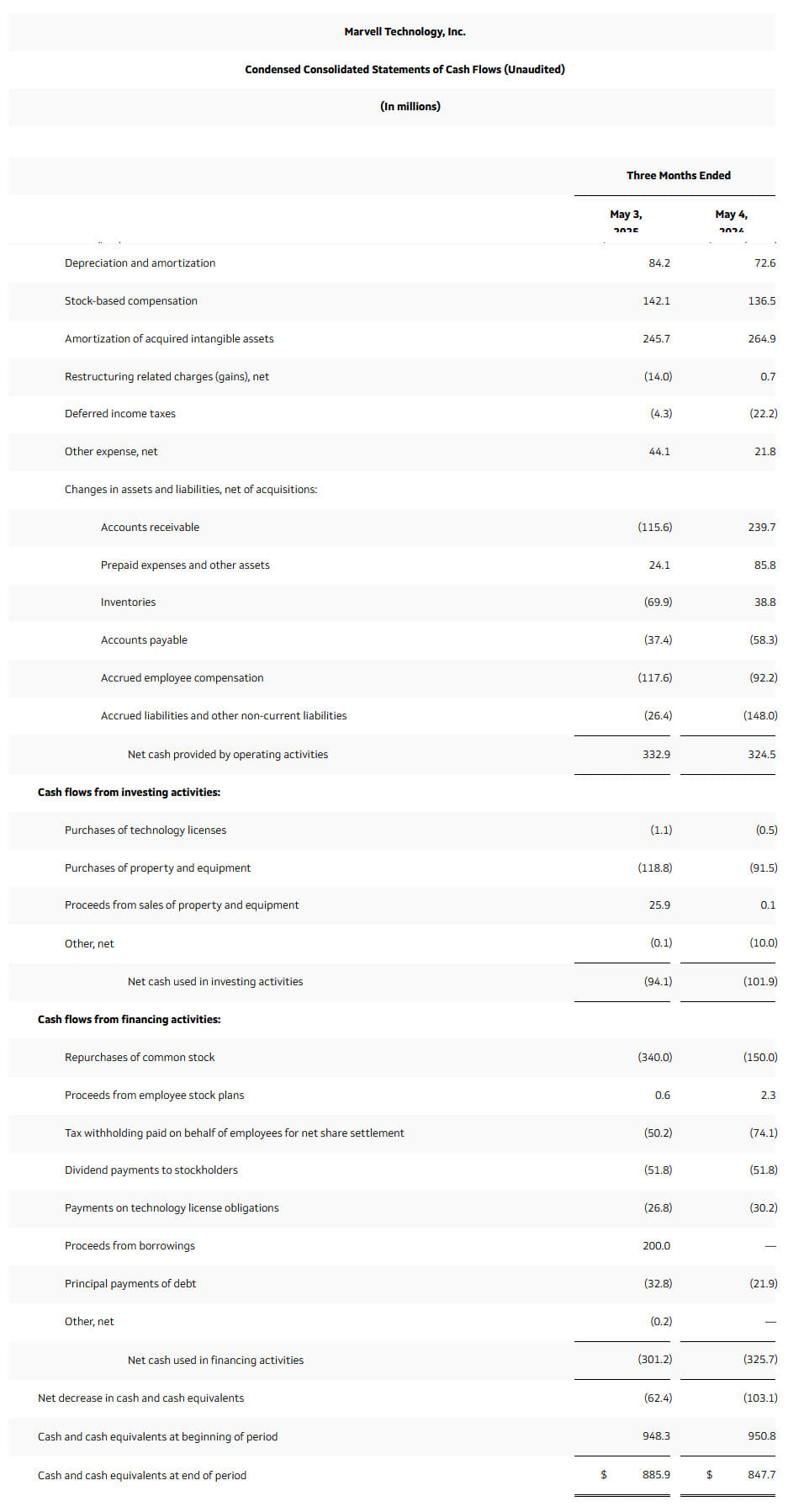

Net revenue for the first quarter of fiscal 2026 was $1.895 billion, $20.0 million above the mid-point of the Company’s guidance provided on May 6, 2025. GAAP net income for the first quarter of fiscal 2026 was $177.9 million, or $0.20 per diluted share. Non-GAAP net income for the first quarter of fiscal 2026 was $540.0 million, or $0.62 per diluted share. Cash flow from operations for the first quarter was $332.9 million.

“Marvell delivered record revenue in the first quarter of $1.895 billion, a 63% Y/Y increase, and we are forecasting continued strong growth into the second quarter. This momentum is being fueled by strong AI demand in the data center end market, where our revenue is benefiting from the rapid scaling of our custom silicon programs and robust shipments of our electro-optics products,” said Matt Murphy, chairman and CEO, Marvell. “As the industry continues to move toward building custom AI infrastructure, Marvell is uniquely positioned at the center of this transformation. We see our custom silicon business driving strong growth in the second quarter and beyond. We’re excited to showcase these developments and our expanding opportunity at our upcoming custom AI investor event on June 17th.“

Custom AI Investor Event – June 17, 2025

As previously announced on May 6, 2025, Marvell will host a Custom AI Investor Event, streamed live on June 17, 2025, beginning at 10:00 a.m. Pacific Time. This special event will feature presentations from chairman and CEO Matt Murphy, members of the executive team, and a broad cross-section of Marvell’s engineering leaders. The program will highlight advances in Marvell’s technology platform, which is enabling the next gen of custom AI infrastructure. In addition to a deep dive into the technology, the event will include a market-focused section with updates on the expanding opportunity for custom silicon, including Marvell’s long-term market share goals.

Following the presentations, a live Q&A session will provide investors and analysts the opportunity to engage directly with company leadership. Questions can be submitted in real time using the “submit questions” link within the live event window.

The live webcast will be accessible via the Events section of Marvell’s Investor Relations website . A replay will be made available following the event.

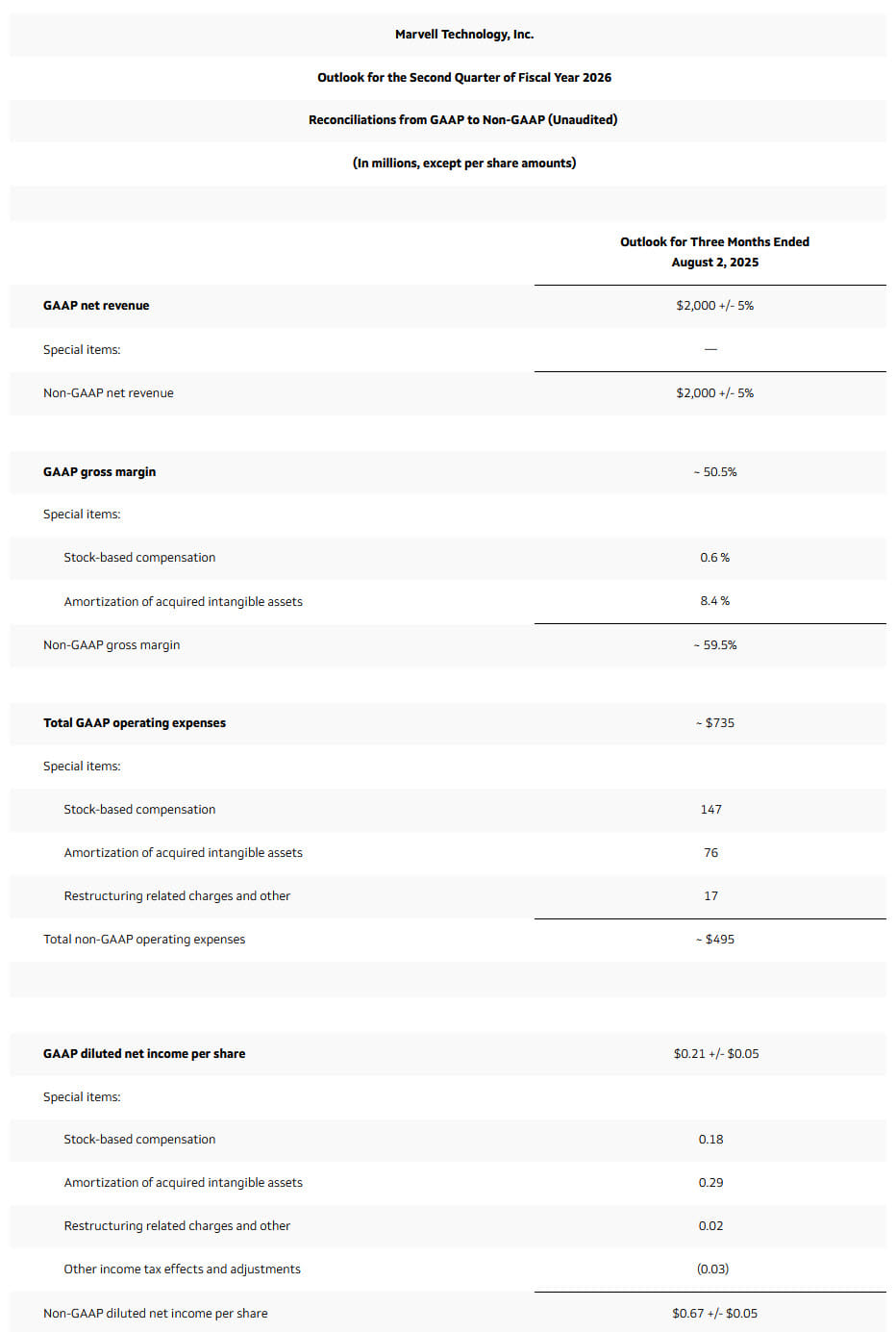

Second Quarter of Fiscal 2026 Financial Outlook

- Net revenue is expected to be $2.000 billion +/- 5%.

- GAAP gross margin is expected to be 50% to 51%.

- Non-GAAP gross margin is expected to be 59% to 60%.

- GAAP operating expenses are expected to be approximately $735 million.

- Non-GAAP operating expenses are expected to be approximately $495 million.

- Basic weighted-average shares outstanding are expected to be 864 million.

- Diluted weighted-average shares outstanding are expected to be 874 million.

- GAAP diluted net income per share is expected to be $0.21 +/- $0.05 per share.

- Non-GAAP diluted net income per share is expected to be $0.67 +/- $0.05 per share.

GAAP diluted EPS is calculated using basic weighted-average shares outstanding when there is a GAAP net loss, and calculated using diluted weighted-average shares outstanding when there is a GAAP net income. Non-GAAP diluted EPS is calculated using diluted weighted-average shares outstanding.

Marvell hosted a conference call on Thursday, May 29, 2025. A replay of the call can be accessed by dialing 1-888-660-6345 or 1-646-517-4150, passcode 40410# until Thursday, June 5, 2025.

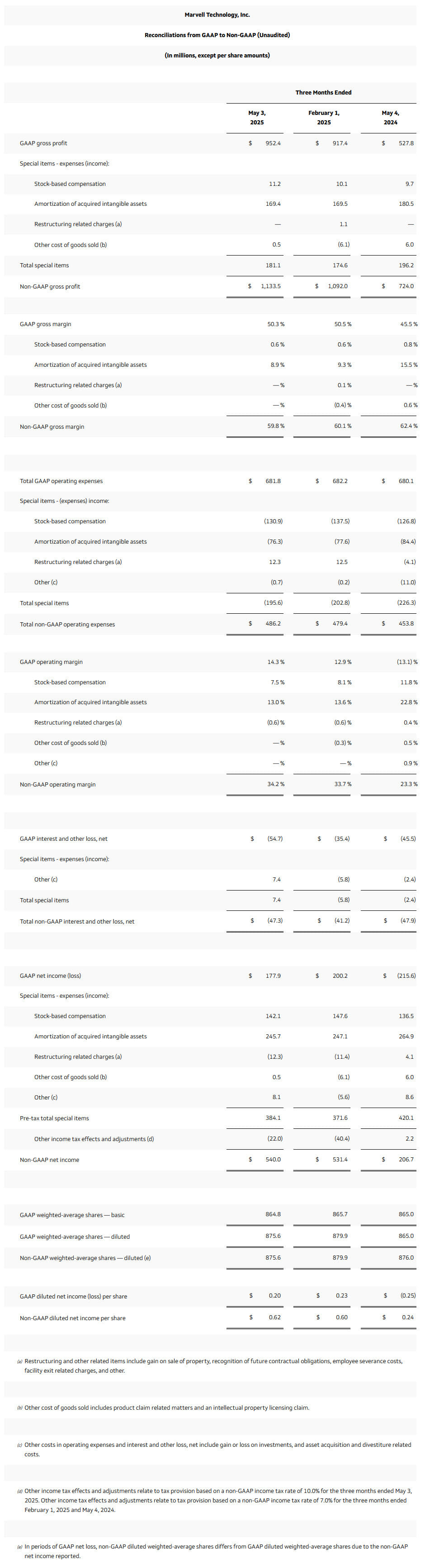

Discussion of Non-GAAP Financial Measure

Non-GAAP financial measures exclude the effect of stock-based compensation expense, amortization of acquired intangible assets, acquisition and divestiture related costs, restructuring and other related charges (including, but not limited to, asset impairment charges, recognition of future contractual obligations, employee severance costs, and facility exit related charges), resolution of legal matters, and certain expenses and benefits that are driven primarily by discrete events that management does not consider to be directly related to Marvell’s core business. Although Marvell excludes the amortization of all acquired intangible assets from these non-GAAP financial measures, management believes that it is important for investors to understand that such intangible assets were recorded as part of purchase price accounting arising from acquisitions, and that such amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Investors should note that the use of intangible assets contributed to Marvell’s revenues earned during the periods presented and are expected to contribute to Marvell’s future period revenues as well.

Marvell uses a non-GAAP tax rate to compute the non-GAAP tax provision. This non-GAAP tax rate is based on Marvell’s estimated annual GAAP income tax forecast, adjusted to account for items excluded from Marvell’s non-GAAP income, as well as the effects of significant non-recurring and period specific tax items which vary in size and frequency, and excludes tax deductions and benefits from acquired tax loss and credit carryforwards and changes in valuation allowance on acquired deferred tax assets. Marvell’s non-GAAP tax rate is determined on an annual basis and may be adjusted during the year to take into account events that may materially affect the non-GAAP tax rate such as tax law changes; acquisitions; significant changes in Marvell’s geographic mix of revenue and expenses; or changes to Marvell’s corporate structure. For the first quarter of fiscal 2026, a non-GAAP tax rate of 10.0% has been applied to the non-GAAP financial results.

Marvell believes that the presentation of non-GAAP financial measures provides important supplemental information to management and investors regarding financial and business trends relating to Marvell’s financial condition and results of operations. While Marvell uses non-GAAP financial measures as a tool to enhance its understanding of certain aspects of its financial performance, Marvell does not consider these measures to be a substitute for, or superior to, financial measures calculated in accordance with GAAP. Consistent with this approach, Marvell believes that disclosing non-GAAP financial measures to the readers of its financial statements provides such readers with useful supplemental data that, while not a substitute for GAAP financial measures, allows for greater transparency in the review of its financial and operational performance.

Externally, management believes that investors may find Marvell’s non-GAAP financial measures useful in their assessment of Marvell’s operating performance and the valuation of Marvell. Internally, non-GAAP financial measures are used in the following areas:

GAAP financial measures are used in the following areas:

- Management’s evaluation of Marvell’s operating performance;

- Management’s establishment of internal operating budgets;

- Management’s performance comparisons with internal forecasts and targeted business models; and

- Management’s determination of the achievement and measurement of certain types of compensation including Marvell’s annual incentive plan and certain performance-based equity awards (adjustments may vary from award to award).

Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of Marvell’s business as determined in accordance with GAAP. As a result, you should not consider these measures in isolation or as a substitute for analysis of Marvell’s results as reported under GAAP. The exclusion of the above items from our GAAP financial metrics does not necessarily mean that these costs are unusual or infrequent.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter