Pure Storage: Fiscal 1Q26 Financial Results

Revenue at $778.5 million, up 12% Y/Y, CFO Kevan Krysler to leave the company

This is a Press Release edited by StorageNewsletter.com on May 29, 2025 at 2:01 pmPure Storage, Inc. announced financial results for its 1st quarter fiscal year 2026 ended May 4, 2025.

“Pure continues to demonstrate the superiority of our technology and strategy through our steady growth and the expansion of our products and services,” said Charles Giancarlo, CEO and chairman, Pure Storage. “Pure’s platform enables customers to unify, virtualize and modernize their data footprints, across all workloads, over the entire range of performance, capacity and formats, and all with our single, advanced Purity Operating Environment.“

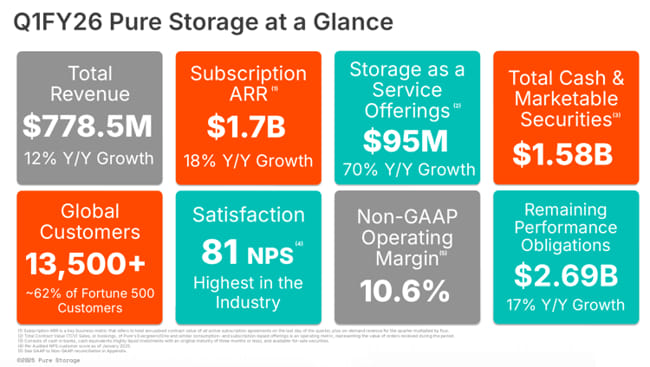

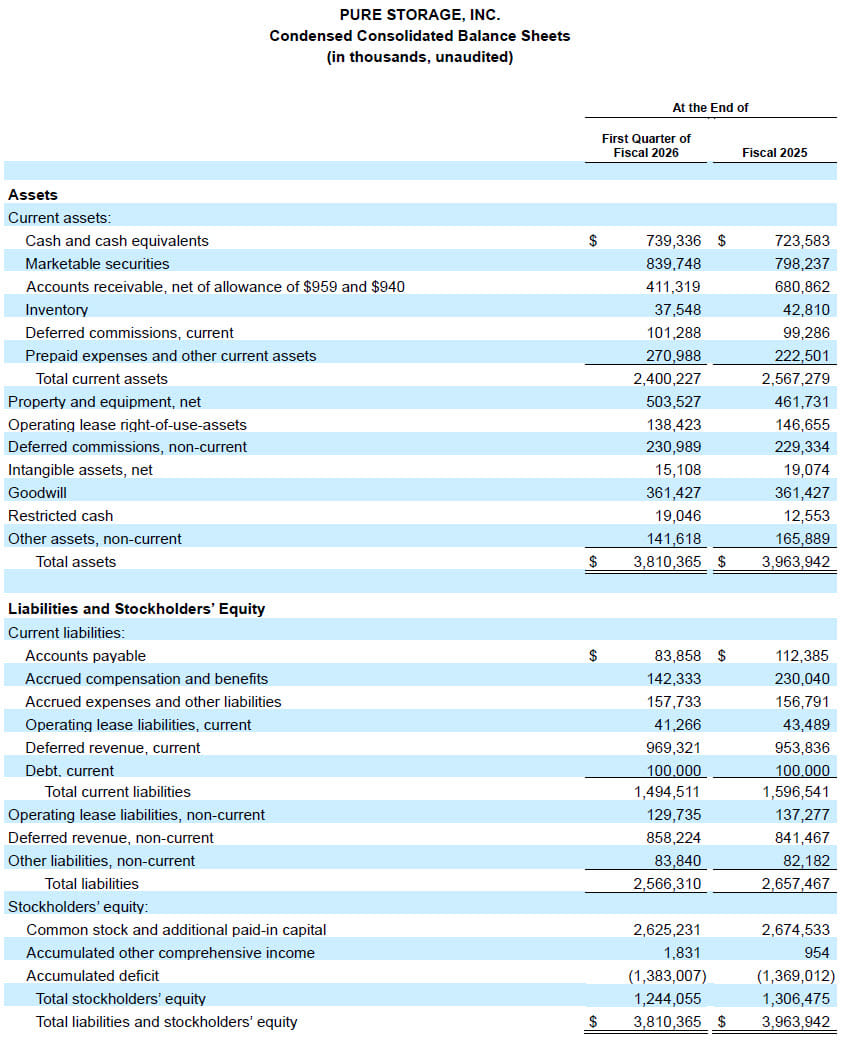

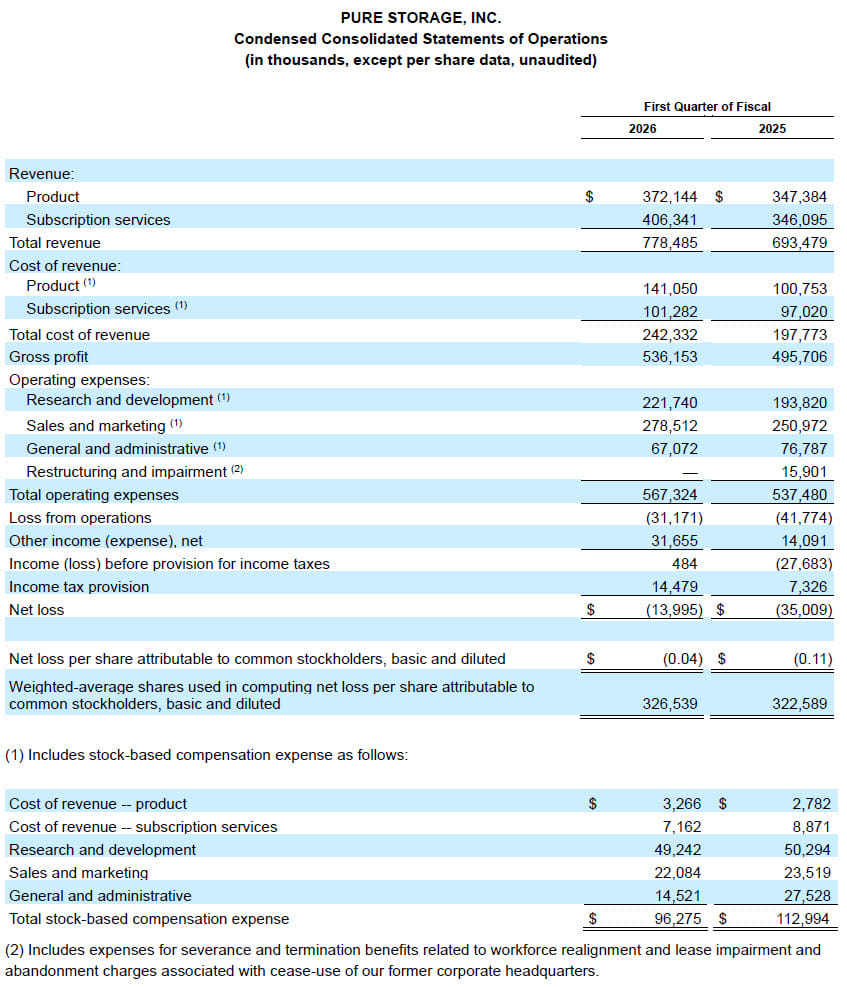

First Quarter Financial Highlights

- Revenue $778.5 million, up 12% Y/Y

- Subscription services revenue $406.3 million, up 17% Y/Y

- Subscription annual recurring revenue (ARR) $1.7 billion, up 18% Y/Y

- Remaining performance obligations (RPO) $2.7 billion, up 17% Y/Y

- GAAP gross margin 68.9%; non-GAAP gross margin 70.9%

- GAAP operating loss $(31.2) million; non-GAAP operating income $82.7 million

- GAAP operating margin (4.0%); non-GAAP operating margin 10.6%

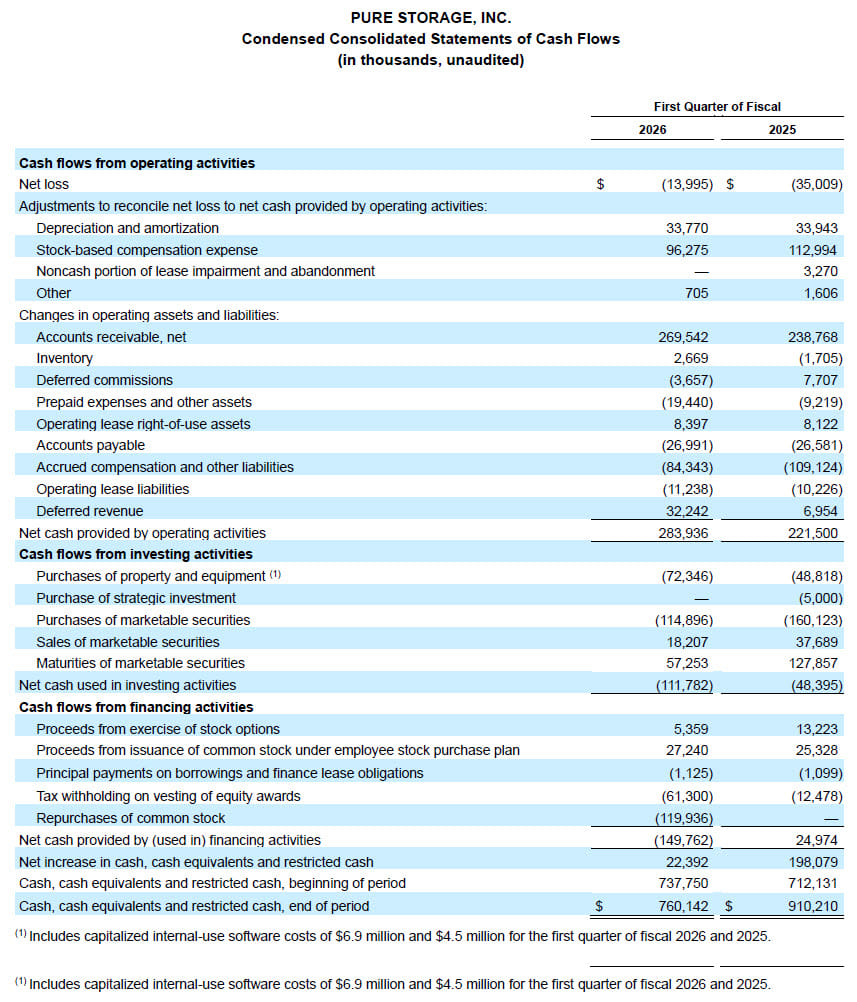

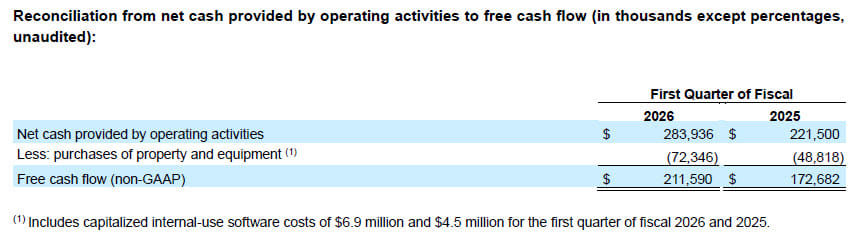

- Operating cash flow $283.9 million; free cash flow $211.6 million

- Total cash, cash equivalents, and marketable securities $1.6 billion

- Returned approximately $120 million to stockholders through share repurchases of 2.5 million shares.

“Q1 FY26 was a solid start to the year, with strong revenue growth,” said Kevan Krysler, CFO, Pure Storage. “Looking ahead, we remain committed to executing on our strategic priorities, driving growth, and maintaining the flexibility to navigate evolving market conditions.“

Leadership Update

Pure also announced that Kevan Krysler has decided to leave the company after more than 5 years of service. Krysler will remain at Pure Storage until a successor has been named.

“I want to thank Kevan for his partnership, dedication and loyal service to Pure. Of his numerous contributions to the company, he helped grow the business to over $3 billion in revenue and led our transition to subscriptions, which are now roughly 50% of our revenue,” Giancarlo continued.

First Quarter Company Highlights

- Accelerating Innovation Through Product Advancements

- Introduced the FlashBlade//EXA platform, the industry storage platform, designed to meet the rigorous demands of AI and HPC, delivering performance, scalability, and metadata management.

- Launched Portworx Enterprise 3.3, an enterprise-grade container data management platform that aims to support VM workloads at an enterprise.

- Strengthening Leadership with Deepened Industry Collaborations

- Announced a partnership with Nutanix to provide a joint, integrated solution to provide customers with a seamless way to deploy and manage virtual workloads on a scalable, modern infrastructure.

- Integrated the NVIDIA AI Data Platform reference design into its FlashBlade line, cementing Pure Storage’s position as a leader in enterprise storage.

- Achieved certifications from NVIDIA, including recognition as a performing storage platform for NVIDIA Partner Network Cloud Partners; also secured NVIDIA-Certified Storage Partner approval at both the Foundation and Enterprise levels.

- Delivering Cyber Resilience and Performance

- Expanded its partnership with Rubrik to deliver a comprehensive solution to securely manage unstructured data at scale, providing bolstered protection vs. advanced threats, improved management capabilities, and exponential data efficiency.

- Industry Recognition and Accolades

- Amy Fowler, GM, Commercial Line of Business, and Hope Galley, VP, Americas Partner Sales, were recognized as 2025 Women of the Channel by CRN.

- Recognized as part of CRN’s AI 100, Data Center 50, and 50 Coolest Software-Defined Storage Vendors for 2025.

- Awarded for Storage Excellence as part of ITPro’s Excellence Awards.

Second Quarter and FY26 Guidance

| Q2F26 | |

| Revenue | $845M |

| Revenue Y/Y Growth Rate | 10.6 % |

| Non-GAAP Operating Income | $125M |

| Non-GAAP Operating Margin | 14.8 % |

| FY26 | |

| Revenue | $3.515B |

| Revenue Y/Y Growth Rate | 11 % |

| Non-GAAP Operating Income | $595M |

| Non-GAAP Operating Margin | 17 % |

These statements are forward-looking and actual results may differ materially. Refer to the Forward Looking Statements section below for information on the factors that could cause our actual results to differ materially from these statements. Pure has not reconciled its guidance for non-GAAP operating income and non-GAAP operating margin to their most directly comparable GAAP measures because certain items that impact these measures are not within Pure’s control and/or cannot be reasonably predicted. Accordingly, reconciliations of these non-GAAP financial measures guidance to the corresponding GAAP measures are not available without unreasonable effort.

Conference Call Information

Pure will host a teleconference to discuss the first quarter fiscal 2026 results at 2:00 pm PT today, May 28, 2025. A live audio broadcast of the conference call will be available on the Pure Storage Investor Relations website. Pure will also post its earnings presentation and prepared remarks to this website concurrent with this release.

A replay will be available following the call on the Pure Storage Investor Relations website or for two weeks at 1-800-770-2030 (or 1-647-362-9199 for international callers) with passcode 5667482.

Additionally, Pure is scheduled to participate at the following investor conferences:

William Blair’s 45th Annual Growth Stock Conference

Date: Tuesday, June 3, 2025

Time: 6:00 a.m. PT / 9:00 a.m. ET

CTO Rob Lee

Bank of America 2025 Global Tech Conference

Date: Tuesday, June 3, 2025

Time: 11:00 a.m. PT / 2:00 p.m. ET

chairman and CEO Charles Giancarlo and CFO Kevan Krysler

The presentations will be webcast live and archived on Pure’s Investor Relations website at investor.purestorage.com.

Updated Date and Location for Product & Technology-Focused Meeting for Financial Analysts at Pure//Accelerate 2025 in New York

Date: Thursday, September 25, 2025

Join us at Pure//Accelerate 2025 in New York on September 25, 2025, as we make history, changing the future of storage and the industry. Pure Storage executives – including Pure Storage CEO, Charles Giancarlo – and partners will share insights, strategies, and their vision for the future.

The financial analyst meeting presentation will be webcast live and archived on the Pure Storage Investor Relations website at investor.purestorage.com.

Forward Looking Statements

This press release contains forward-looking statements regarding our products, business and operations, including but not limited to our views relating to our opportunity relating to hyperscale and AI environments, our ability to meet hyperscalers’ performance and price requirements, our ability to meet the needs of hyperscalers for the entire spectrum of their online storage use cases, the timing and magnitude of large orders, including sales to hyperscalers, the timing and amount of revenue from hyperscaler licensing and support services, future period financial and business results, demand for our products and subscription services, including Evergreen//One, the relative sales mix between our subscription and consumption offerings and traditional capital expenditure sales, our technology and product strategy, specifically customer adoption of FlashBlade//EXA, Pure Fusion and priorities around sustainability and energy saving benefits to our customers of using our products, our ability to perform during current macro conditions and expand market share, our sustainability goals and benefits, the impact of inflation, tariffs, economic or supply chain disruptions, our expectations regarding our product and technology differentiation, new technology investments and partnerships, and other statements regarding our products, business, operations and results. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements.

Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption “Risk Factors” and elsewhere in our filings and reports with the US SEC, which are available on our Investor Relations website at investor.purestorage.com and on the SEC website at www.sec.gov. Additional information is also set forth in our Annual Report on Form 10-K for the fiscal year ended February 2, 2025. All information provided in this release and in the attachments is as of May 28, 2025, and Pure undertakes no duty to update this information unless required by law.

Key Performance Metrics

Subscription ARR is a key business metric that refers to total annualized contract value of all active subscription agreements on the last day of the quarter, plus on-demand revenue for the quarter multiplied by four.

Total Contract Value (TCV) Sales, or bookings, of Pure’s Evergreen//One and similar consumption- and subscription-based offerings is an operating metric, representing the value of orders received during the period.

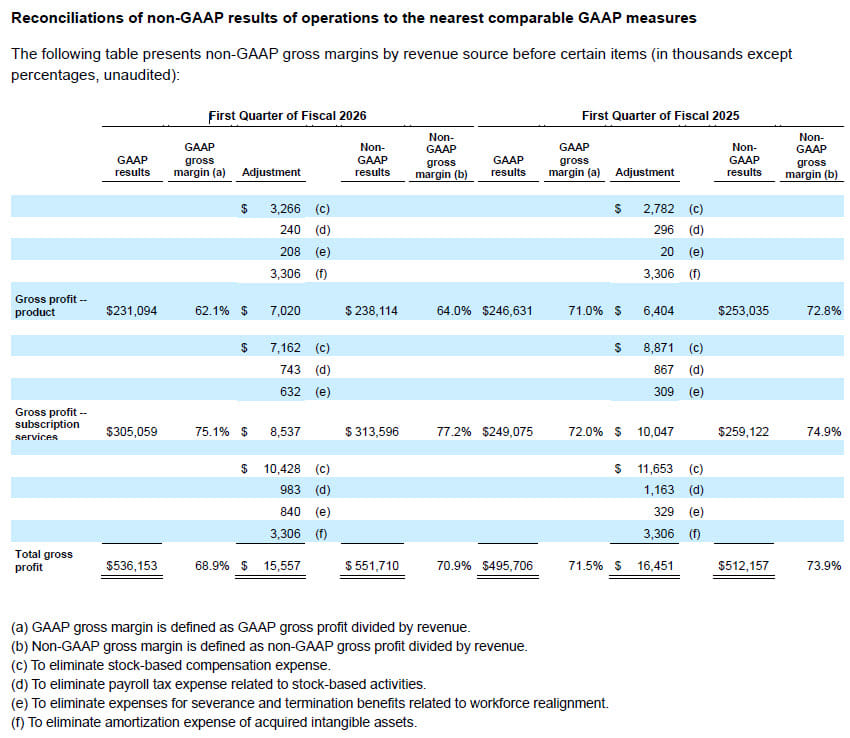

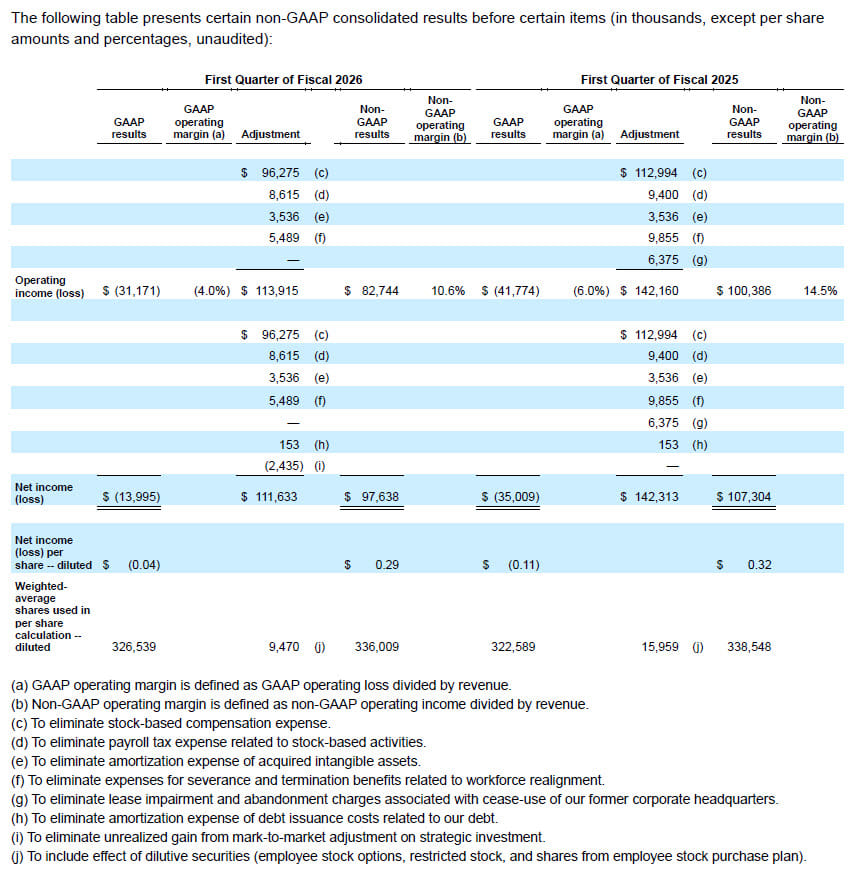

Non-GAAP Financial Measures

To supplement our unaudited condensed consolidated financial statements, which are prepared and presented in accordance with GAAP, Pure uses the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net income (loss) per share, and free cash flow.

We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Our management believes that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain expenses such as stock-based compensation expense, payroll tax expense related to stock-based activities, amortization of debt issuance costs related to debt, amortization of intangible assets acquired from acquisitions, restructuring costs related to severance and termination benefits, costs associated with the impairment and early exit of certain leased facilities, and unrealized gains and losses from mark-to-market adjustments on strategic investments that may not be indicative of our ongoing core business operating results. Pure believes that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when analyzing historical performance and liquidity and planning, forecasting, and analyzing future periods. The presentation of these non-GAAP financial measures is not meant to be considered in isolation or as a substitute for our financial results prepared in accordance with GAAP, and our non-GAAP measures may be different from non-GAAP measures used by other companies.

For a reconciliation of these non-GAAP financial measures to GAAP measures, please see the tables captioned Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures and Reconciliation from net cash provided by operating activities to free cash flow, included at the end of this release.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter