One Stop Systems: 1Q25 Financial Results

Revenue at $12.3 million (-3.1% Q/Q), gross margin at 32.6% compared to 29.4% in the prior year quarter, Company anticipates $59-$61 million revenue for the full year of 2025

This is a Press Release edited by StorageNewsletter.com on May 12, 2025 at 2:01 pmFinancial highlight

- First quarter of 2025 consolidated gross margin increased 320 basis points Y/Y to 32.6%, on consolidated revenue of $12.3 million

- OSS segment gross margin of 45.5%, on OSS segment revenue of $5.2 million

- OSS segment experienced strong first-quarter bookings of $10.4 million

- Management continues to expect double-digit consolidated revenue growth in 2025 and consolidated EBITDA break even for the year

One Stop Systems, Inc. reported results for the quarter ended March 31, 2025. Comparisons for the quarters are to the same year-ago periods unless otherwise noted.

“Our OSS segment achieved strong bookings during the first quarter of 2025, driven by growing demand from both new and existing commercial and defense customers. This positive trend highlights increased interest in our Enterprise Class compute solutions and validates our strategic focus on building multi-year, predictable revenue streams. Higher OSS segment orders are particularly encouraging amid ongoing uncertainty in business and government spending. Momentum remains strong, as the programs we are pursuing closely align with our customers’ evolving priorities on AI, ML, autonomy and sensor processing at the Edge,” stated Mike Knowles, president and CEO, OSS.

“As expected, our consolidated gross margin improved Y/Y and from the fourth quarter of 2024, supported by a 45.5% gross margin at our OSS segment, associated with a more profitable mix of products. While near-term market conditions affected the timing of certain OSS segment orders anticipated for the first and second quarters of 2025, we remain on track to achieve our 2025 annual guidance. In addition, we expect bookings to remain strong throughout the year within our OSS segment and support profitable revenue growth in the second half of 2025 and into 2026,” concluded Mr. Knowles.

2025 First-Quarter Financial Summary

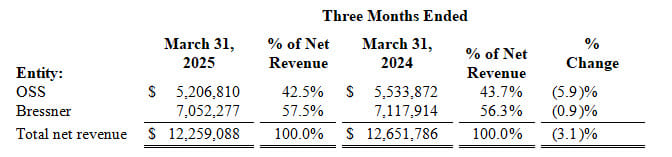

Consolidated revenue was $12.3 million, compared to $12.7 million in the first quarter of 2024. OSS segment revenue decreased 5.9%, as compared to the same period in 2024, primarily due to lower volume of shipments to a commercial aerospace customer, partially offset by higher volume of shipments to a defense customer. Bressner segment revenue decreased $65,637, or 0.9%, as compared to the same period in 2024.

The following table sets forth net revenue by segment for the 3 months ended March 31, 2025, and March 31, 2024 (Dollars may not calculate due to rounding):

Consolidated gross margin percentage was 32.6% for the 3 months ended March 31, 2025, compared to 29.4% in the prior year quarter. On a segment basis, the OSS segment had a gross margin of 45.5%, an increase of 11.3 percentage points as compared to the prior year of 34.2%. The increase in OSS segment gross margin was primarily due to higher volume of certain higher margin storage units and componentry shipped in the quarter. The Company’s Bressner segment had a gross margin percentage of 23.1%, compared to 25.7% in the same period last year, due to product mix.

Total operating expenses increased 19.2% to $5.9 million. This increase was predominantly attributable to higher marketing and selling costs due to an increase in personnel costs from the additions in headcount made during 2024 as well as an increase in R&D costs driven by higher engineering labor to support new product development.

The Company reported a net loss of $2.0 million, or $(0.09) per share, as compared to a net loss of $1.3 million, or $(0.06) per share, in the prior year period.

Adjusted EBITDA, a non-GAAP metric, was a loss of $1.1 million, compared to adjusted EBITDA loss of $500,452 in the prior year period.

As of March 31, 2025, the Company reported cash and short-term investments of $9.1 million and total working capital of $23.1 million, compared to cash and short-term investments of $10.0 million and total working capital of $24.0 million at December 31, 2024.

2025 Full Year Outlook

OSS is executing a strategic plan targeting both commercial and defense markets, aiming to provide integrated solutions and establish OSS as a platform incumbent on large, multi-year programs. This approach is expected to drive long-term value by increasing predictable, recurring revenue and building a strong, multi-year backlog.

As a result of OSS’ multi-year strategy, the Company continues to anticipate consolidated revenue of $59 to $61 million for the full year of 2025. This includes expected OSS segment revenue of approximately $30 million, representing over 20% Y/Y growth. In addition, the Company expects to be EBITDA break-even for the full year of 2025. Management expects revenue and profitability to improve at a higher rate in the second half of 2025 based on current trends and the Company’s expanding sales pipeline.

OSS held a conference call to discuss its results for the first quarter of 2025 on May 7, 2025. A replay of the call is available until May 21, 2025.

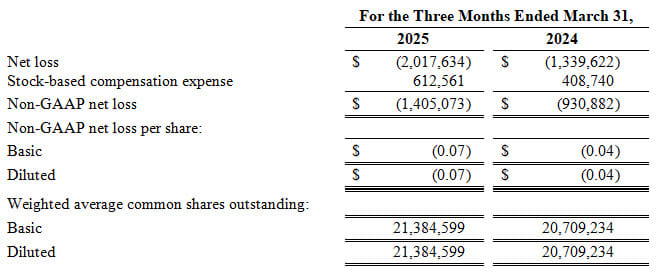

Non-GAAP Financial Measures

We believe that the use of adjusted earnings before interest, taxes, depreciation and amortization, or adjusted EBITDA, is helpful for an investor to assess the performance of the Company. The Company defines adjusted EBITDA as income (loss) before interest, taxes, depreciation, amortization, acquisition expense, impairment of long-lived assets, financing costs, government funded programs, fair value adjustments from purchase accounting, stock-based compensation expense, and expenses related to discontinued operations.

Adjusted EBITDA is not a measurement of financial performance under generally accepted accounting principles in the US, or GAAP. Because of varying available valuation methodologies, subjective assumptions and the variety of equity instruments that can impact a company’s non-cash operating expenses, we believe that providing a non-GAAP financial measure that excludes non-cash and non-recurring expenses allows for meaningful comparisons between our core business operating results and those of other companies, as well as providing us with an important tool for financial and operational decision making and for evaluating our own core business operating results over different periods of time.

Our adjusted EBITDA measure may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently, particularly related to non-recurring and unusual items. Our adjusted EBITDA is not a measurement of financial performance under GAAP, and should not be considered as an alternative to operating income or as an indication of operating performance or any other measure of performance derived in accordance with GAAP. We do not consider adjusted EBITDA to be a substitute for, or superior to, the information provided by GAAP financial results.

(Dollars may not calculate due to rounding)

Adjusted EPS excludes the impact of certain items and, therefore, has not been calculated in accordance with GAAP. We believe that exclusion of certain selected items assists in providing a more complete understanding of our underlying results and trends and allows for comparability with our peer company index and industry. We use this measure along with the corresponding GAAP financial measures to manage our business and to evaluate our performance compared to prior periods and the marketplace. The Company defines non-GAAP income (loss) as income or (loss) before amortization, government funded programs, impairment of long lived assets, stock-based compensation, expenses related to discontinued operations, and acquisition costs. Adjusted EPS expresses adjusted income (loss) on a per share basis using weighted average diluted shares outstanding.

Adjusted EPS is a non-GAAP financial measure and should not be considered in isolation or as a substitute for financial information provided in accordance with GAAP. These non-GAAP financial measures may not be computed in the same manner as similarly titled measures used by other companies. We expect to continue to incur expenses similar to the adjusted income from continuing operations and adjusted EPS financial adjustments described above, and investors should not infer from our presentation of these non-GAAP financial measures that these costs are unusual, infrequent or non-recurring.

The following table reconciles non-GAAP net income and basic and diluted earnings per share: Forward-Looking Statements

Forward-Looking Statements

OSS cautions you that statements in this press release that are not a description of historical facts are forward-looking statements. . Words such as, but not limited to, “anticipate,” “aim,” “believe,” “contemplate,” “continue,” “could,” “design,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “suggest,” “strategy,” “target,” “will,” “would,” and similar expressions or phrases, or the negative of those expressions or phrases, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These statements include but are not limited to those relating to increased sales and revenues, non-GAAP financial measures, our multi-year strategy, increase in margins, and operating expenses. These statements are based on the company’s current beliefs and expectations. The inclusion of forward-looking statements should not be regarded as a representation by OSS or its partners that any of our plans or expectations will be achieved. Factors that could interfere with our ability to achieve our plans or expectations , include but are not limited to, our ability to expand our product offerings and further penetrate our target markets, future demand for AI/ML integrations, global socio-economic challenges, stock market uncertainty or volatility, reductions in business and/or government spending, and changes in our business strategies, management and/or senior leadership. Actual results may differ from those set forth in this press release due to the risk and uncertainties inherent in our business, including risks described in our prior press releases and in our filings with the SEC (SEC), including under the heading “Risk Factors” in our latest Annual Report on Form 10-K and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the company undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter