FalconStor: Fiscal 1Q25 Financial Results

Revenue at $2.5 million (Up 8% Q/Q), EBITDA at $0.1 million (Flat Q/Q), CEO is confident about driving durable growth in 2025 and beyond.

This is a Press Release edited by StorageNewsletter.com on May 12, 2025 at 2:01 pmTotal Revenue, Net Income, and Hybrid Cloud ARR Run-Rate Growth

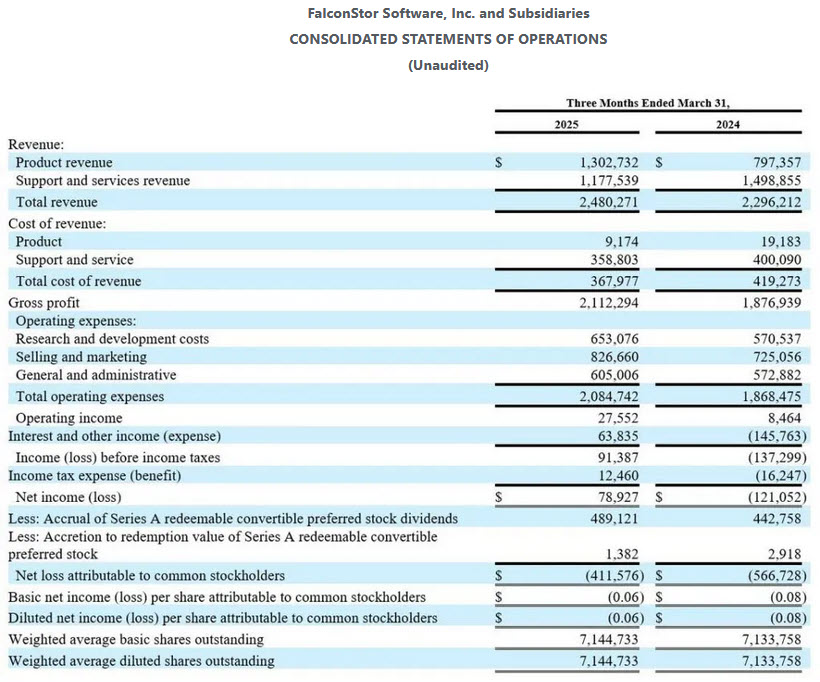

- 8% increase in total revenue vs. Q1 2024

- 65% increase in hybrid cloud ARR run-rate vs. Q1 2024

- 3% net income

FalconStor Software, Inc. announced financial results for its first quarter of 2025, which ended on March 31, 2025.

“We’re pleased to report solid total revenue growth and strong hybrid cloud ARR expansion in Q1, reflecting our continued momentum in the IBM ecosystem,” said Todd Brooks, CEO, FalconStor Software. “Hybrid cloud ARR run-rate grew 65% Y/Y, fueled by increased sales in IBM Power Virtual Server expansion, Kyndryl/Skytap deployments, on-prem hybrid cloud implementations, and MSP adoption.“

“This quarter also marked the launch of FalconStor Thomas, our IBM watsonx-based virtual data protection assistant, now in use by dozens of IBM partners in more than 20 countries. By enabling real-time collaboration with IBM partner sellers and technical architects – in their native languages – Thomas dramatically improves our ability to scale sales across the global IBM ecosystem.”

“With our expanding hybrid cloud footprint, focused innovation, and consistent profitability, we remain well-positioned to drive durable growth in 2025 and beyond.“

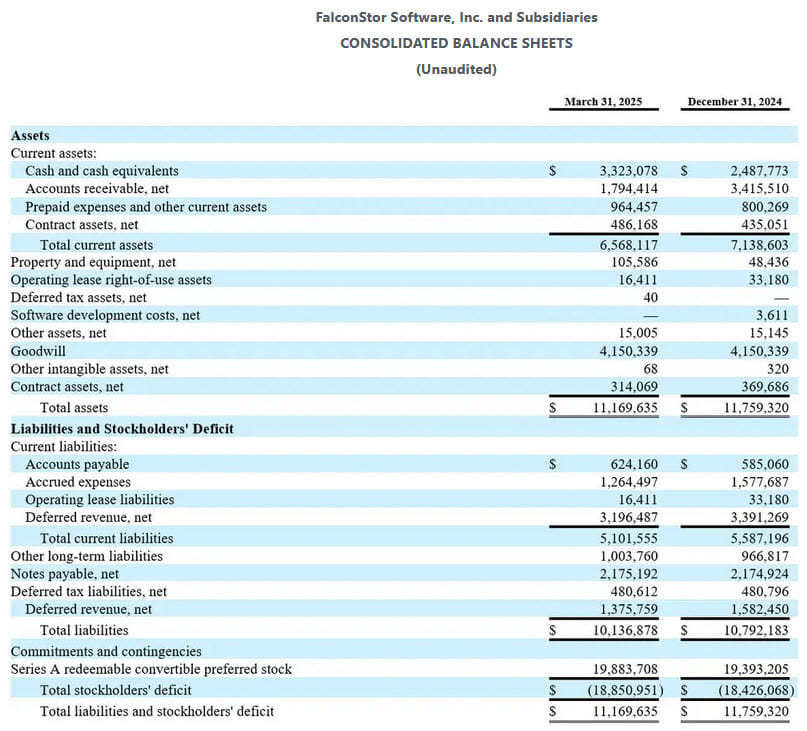

First Quarter 2025 Financial Results

- Hybrid Cloud ARR Run-Rate: 65% increase trailing 12 months

- Ending Cash: $3.3 million, compared to $2.9 million in the first quarter of fiscal year 2024

- Total Revenue: $2.5 million, compared to $2.3 million in the first quarter of fiscal year 2024

- Total Operating Expenses: $2.1 million, compared to $1.9 million in the first quarter of fiscal year 2024

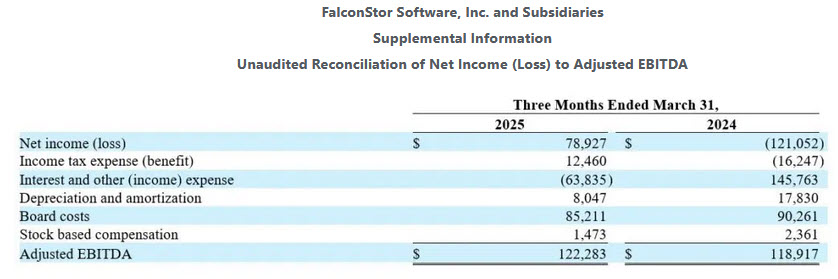

- Non-GAAP EBITDA: $0.1 million, compared to $0.1 million in the first quarter of fiscal year 2024

- GAAP Net Income (Loss): $0.1 million, compared to $(0.1) million in the first quarter of fiscal year 2024

“As we continue to focus on growth, innovation, and delivering excellent customer service, we remain disciplined in managing expenses and driving operational efficiency to maintain strong financial health and create the stability needed for sustainable, long-term growth“, said Vincent Sita, CFO, FalconStor.

Non-GAAP Financial Measures

The non-GAAP financial measures used in this press release are not prepared in accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. The Company’s management refers to these non-GAAP financial measures in making operating decisions because they provide meaningful supplemental information regarding the Company’s operating performance. In addition, these non-GAAP financial measures facilitate management’s internal comparisons to the Company’s historical operating results and comparisons to competitors’ operating results. We include these non-GAAP financial measures (which should be viewed as a supplement to, and not a substitute for, their comparable GAAP measures) in this press release because we believe they are useful to investors in allowing for greater transparency into the supplemental information used by management in its financial and operational decision-making. The non-GAAP financial measures exclude (i) depreciation, (ii) amortization, (iii) restructuring expenses, (iv) severance expenses, (v) board expenses, (vi) stock based compensation, (vii) non-operating expenses (income) including income taxes and interest & other expenses (income). For a reconciliation of our GAAP and non-GAAP financial results, please refer to our Reconciliation of Net Income (Loss) to Adjusted EBITDA presented in this release.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter