Backblaze: Fiscal 3Q24 Financial Results

Backblaze: Fiscal 3Q24 Financial Results

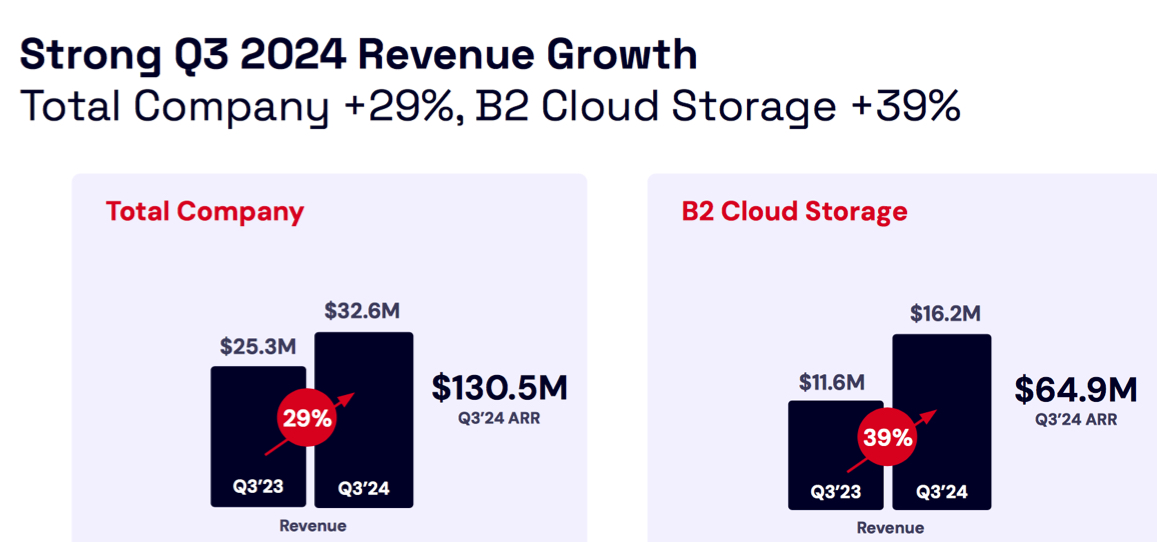

29% revenue growth Y/Y at $32.6 million, never profitable since 2019

This is a Press Release edited by StorageNewsletter.com on November 11, 2024 at 2:02 pm

| (in $ thousand) | 3Q23 | 3Q24 | 9 mo. 23 | 9 mo. 24 |

| Revenue | 25.3 | 32.6 | 73.3 | 93.8 |

| Growth | 29% | 28% | ||

| Net income (loss) | (16.1) | (12.8) | (47.5) | (34.2) |

Backblaze, Inc. announced results for its third quarter ended September 30, 2024.

“I’m excited that we have kicked off a go-to-market transformation and continue to build our upmarket momentum with 2 multi-year deals each totaling approximately $1 million,” said Gleb Budman, CEO”. “We are also aggressively executing cost efficiencies throughout the organization to accelerate being adjusted free cash flow positive by 4Q25.”

“I’m proud to share that our Adjusted EBITDA Margin for the quarter was 12%, which improved dramatically from (3%) last year, representing a 1,500 basis point improvement,” said Marc Suidan, CFO. “Our focus on growth and profitability will position us towards being a Rule of 40 company over time.”

3Q24 Highlights:

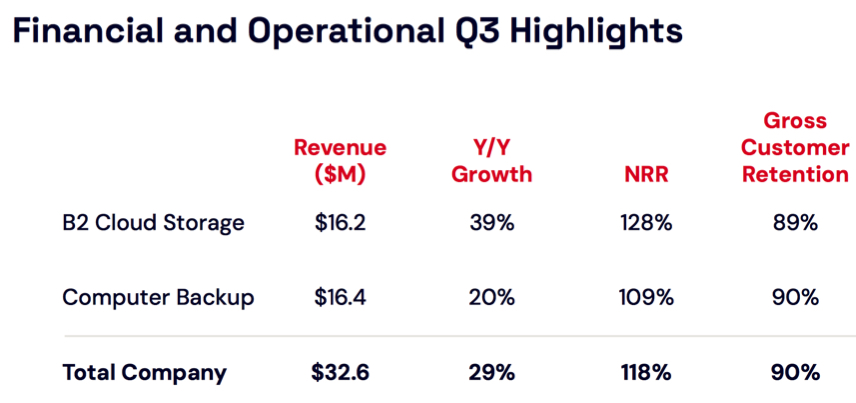

- Revenue of $32.6 million, an increase of 29% Y/Y.

- B2 Cloud Storage revenue was $16.2 million, an increase of 39% Y/Y.

- Computer Backup revenue was $16.4 million, an increase of 20% Y/Y.

- Gross profit of $17.8 million, or 55% of revenue, compared to $11.8 million or 46% of revenue, in 3FQ23.

- Adjusted gross profit of $25.5 million, or 78% of revenue, compared to $18.7 million or 74% of revenue in 3FQ23.

- Net loss was $12.8 million compared to a net loss of $16.1 million in 3FQ23.

- Net loss per share was $0.29 compared to a net loss per share of $0.44 3FQ23.

- Adjusted EBITDA was $3.7 million, or 12% of revenue, compared to $(0.8) million or (3%) of revenue in 3FQ23.

- Non-GAAP net loss of $4.3 million compared to non-GAAP net loss of $7.8 million in 3FQ23.

- Non-GAAP net loss per share of $0.10 compared to a non-GAAP net loss per share of $0.21 in 3FQ23.

- Net cash from operating activities during the 9 months ended September 30, 2024 was $10.3 million, compared to cash used in operating activities of $10.6 million in the 9 months ended September 30, 2023.

- Adjusted free cash flow during the 9 months ended September 30, 2024 was $(15.6) million, compared to $(38.0) million in the 9 months ended September 30, 2023.

- Cash, short-term investments and restricted cash, non-current totaled $25.6 million as of September 30, 2024.

3FQ24 Operational Highlights:

- Annual recurring revenue (ARR) was $130.5 million, an increase of 29% Y/Y.

- B2 Cloud Storage ARR was $64.9 million, an increase of 39% Y/Y.

- Computer Backup ARR was $65.6 million, an increase of 21% Y/Y.

- Net revenue retention (NRR) rate was 118% compared to 108% in 3FQ23.

- B2 Cloud Storage NRR was 128% compared to 120% in 3FQ23.

- Computer Backup NRR was 109% compared to 100% in 3FQ23.

- Gross customer retention rate was 90% in 3FQ24 compared to 91% in 3FQ23.

- B2 Cloud Storage gross customer retention rate was 89% in Q3 2024 compared to 90% in 3FQ23.

- Computer Backup gross customer retention rate was 90% in Q3 2024 compared to 91% in 3FQ23.

Outlook:

For 4FQ24 the company expects:

- Revenue between $33.5 million to $33.9 million

- Adjusted EBITDA margin between 12% to 14%

- Basic weighted average shares outstanding of 44.9 million to 45.4 million shares

For FY24 it expect:

- Revenue between $127.0 million to $128.0 million

- Adjusted EBITDA margin between 9% to 11%

Comments

Feeding the GenAI Supply Chain

- 3 new AI customers generating $500,000 in annual revenue run rate

- Data stored by AI customers grew 2x Y/Y

| (in $ million) | Revenue | Y/Y growth | Net income (loss) |

| FY19 | 40.7 | NA | (1.0) |

| FY20 | 53.8 | 32% | (6.6) |

| FY21 |

67.5 | 25% | (21.6) |

| FY22 |

85.2 |

26% |

(51.7) |

| 1FQ23 | 23.4 | 20% | (17.1) |

| 2FQ23 | 24.6 | 19% | (14.3) |

| 3FQ23 | 25.3 | 15% | (16.1) |

| 4FQ23 | 28.7 | 25% | (10.8) |

| FY23 | 102.0 | 20% | (58.9) |

| 1FQ24 | 30.0 | 28% | (11.1) |

| 2FQ24 | 31.3 | 27% | (10.3) |

| 3FQ24 | 32.6 | 29% | (12.8) |

| 4FQ24 (estim.) | 33.5-33.9 | 17%-18% | NA |

| FY24 (estim.) |

127-128 |

25% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter