AI Demand Drives Enterprise SSD Contract Prices Up by 25% in 2Q24

And boosts supplier revenues by over 50%.

This is a Press Release edited by StorageNewsletter.com on September 18, 2024 at 2:01 pmThis market report was published on September 13, 2024 by TrendForce Corp.

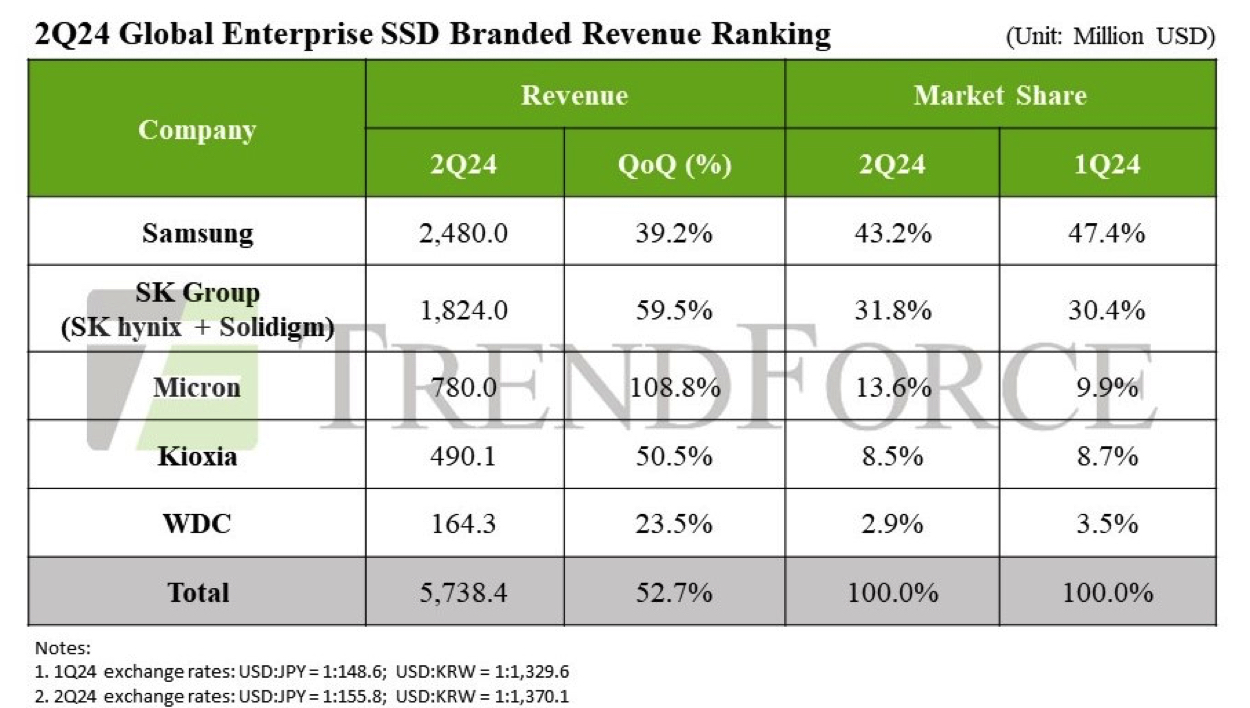

2Q24 saw a significant increase in demand for enterprise SSDs due to the increased deployment of NVIDIA GPU platforms and rising storage needs driven by AI applications, along with a surge in demand from server brands. The surge in demand for high-capacity SSDs for AI applications – coupled with suppliers’ inability to adjust capacity in the first half of the year – resulted in a supply shortage that drove average enterprise SSD prices up by more than 25% Q/Q. This price increase led to a revenue growth of over 50% for suppliers.

Looking ahead to 3Q24, demand from North American CSP customers continues to rise, and server brands show no signs of slowing down their orders, further boosting procurement volumes of enterprise SSD. With supply shortages persisting into 3Q24, TrendForce forecasts a 15% increase in contract prices compared to 2Q24, with supplier revenues expected to grow by nearly 20%.

Samsung emerges as the biggest beneficiary of market recovery; SK hynix’s shipments expected to grow in 3Q24

Adjustments of North American inventory concluded at the beginning of 2024 and enterprise SSD orders surged as companies actively invested in AI storage infrastructure. Samsung, maintaining a competitive edge with its comprehensive product lineup, secured its position as the market leader in 2Q24, with revenue rising to $2.48 billion.

With more NVIDIA GPUs arriving in 3Q24, CSPs will continue to increase their enterprise SSD purchases. Moreover, as Samsung’s PCIe 5.0 products progressively pass customer validation and begin ramping up in volume, the company’s profitability is expected to grow, with revenues projected to increase by more than 20% Q/Q.

Solidigm, a subsidiary of SK Group and the largest supplier of QLC enterprise SSDs, also benefited significantly from the surge in AI demand. Additionally, SK hynix secured more orders from server customers, boosting the group’s total revenue to $1.824 billion in 2Q24, with a slight increase in market share to nearly 32%. With Solidigms’ capacity expansion and continued momentum for high-capacity SSD orders into 2H24, SK hynix’s shipments are expected to grow further, with revenues likely to rise accordingly.

Micron ranked 3rd in enterprise SSD market share in 2Q24. Its early mass production of high-capacity products in 2023 significantly boosted its shipment volumes in 2Q24. Combined with rising orders from server brands, its revenue grew sharply to $780 million. The company is shifting its product focus to PCIe interface products as orders for high-capacity SSDs increase.

Kioxia also saw its 2Q24 enterprise SSD revenue rise to $490 million, driven by increasing demand from server brands. The surge in AI and big data computing will continue to drive growth in enterprise SSD demand, surpassing that of consumer-grade products. Kioxia’s advantage lies in its diverse product lineup, covering SATA, PCIe, and SAS interfaces, which could help it expand its market share in the future.

WDC saw a slight decline in demand from key customers in 2Q24, coupled with slower growth in its PCIe interface products compared to competitors, resulting in revenue of $164 million. In response, the company has shifted its focus to developing PCIe interface products and is increasing its collaboration with third-party controller manufacturers for PCIe 5.0. Additionally, WDC has introduced high-capacity QLC products.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter