Rubrik: Fiscal 2Q25 Financial Results

Rubrik: Fiscal 2Q25 Financial Results

Revenue up 35% Y/Y at $205 million with huge net loss

This is a Press Release edited by StorageNewsletter.com on September 10, 2024 at 2:01 pm

| (in $ million) | 2Q24 | 2Q25 | 6 mo. 24 | 6 mo. 25 |

| Revenue | 151.5 | 205.0 | 287.3 | 392.3 |

| Growth | 35% | 37% | ||

| Net income (loss) | (81.1) | (176.9) | (170.4) | (905.9) |

- Results exceeded all guided metrics

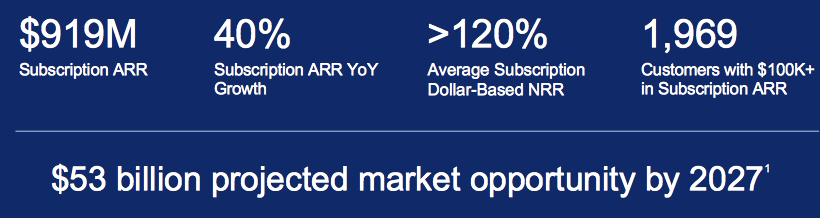

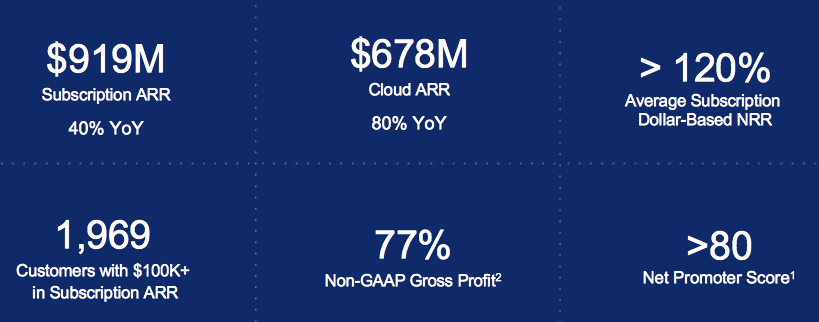

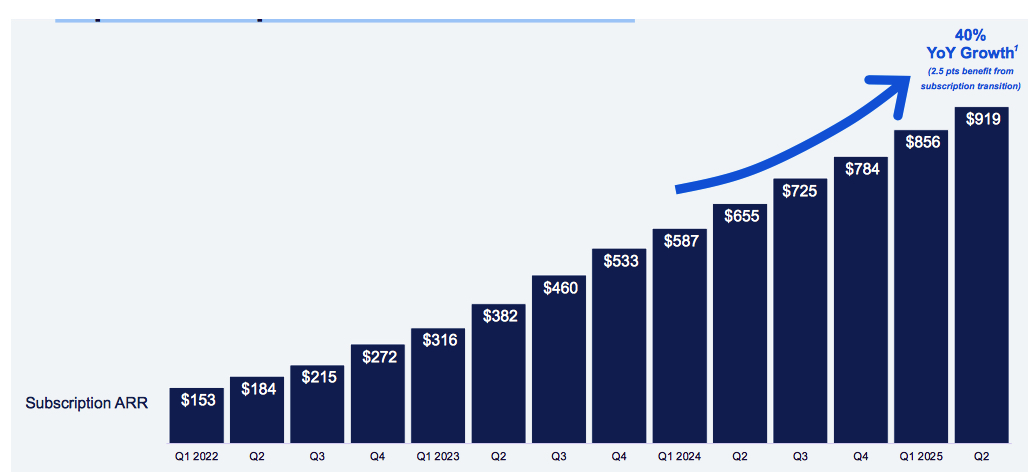

- Subscription ARR grew 40% Y/Y to $919.1 million

- Revenue grew 35% Y/Y to $205.0 million

- 1,969 customers with $100,000 or more in subscription ARR, up 35% Y/Y

- Company raises full year guidance across all metrics

Rubrik, Inc. announced financial results for the second quarter fiscal year 2025, ended July 31, 2024.

“The long list of recent successful cyber attacks and IT outages is driving organizations to increasingly recognize the need for a robust cyber resilience plan to ensure business continuity in the face of cyber disruptions. Our subscription ARR up 40% Y/T in 2FQ25 to $919 million showcases the value we provide to enterprises in delivering complete cyber resilience, which combines cyber recovery and data security posture management,” said Bipul Sinha, CEO, chairman, and co-founder.

Kiran Choudary, CFO, added: “We had a strong 2FQ25, outperforming our guidance across all metrics. In addition to strong growth at scale, our subscription ARR contribution margin was up over 1,300 basis points Y/Y, demonstrating our improving operational efficiency. These results demonstrate our ability to balance high top line growth and improved progress towards our long-term profitability targets.”

2FQ25 Highlights

- Subscription Annual Recurring Revenue (ARR): It was up 40% Y/Y, growing to $919.1 million as of July 31, 2024.

- Revenue: Subscription revenue was $191.3 million, a 50% increase, compared to $127.5 million in 2FQ24. Total revenue was $205.0 million, a 35% increase, compared to $151.5 million in 2FQ24.

- Gross Margin: GAAP gross margin was 73.1%, compared to 76.6% in 2FQ24. This includes $7.0 million in stock-based compensation expense, compared to $0.1 million in the year ago period, due to the vesting of certain equity awards after and as a result of the completion of IPO. Non-GAAP gross margin was 77.0%, compared to 76.7% in 2FQ24.

- Subscription ARR Contribution Margin: It was (8)% compared to (22)% in the second quarter of fiscal 2024, reflecting the improvement in operating leverage in the business. It was (6)% when adjusting for $22.8 million in 1FQ25 employer payroll taxes due to the vesting of certain equity awards in conjunction with the IPO.

- Net Loss per Share: GAAP net loss per share was $(0.98), compared to $(1.35) in 2FQ24. GAAP net loss includes $105.0 million in stock-based compensation expense, compared to $1.2 million in the year ago period, due to the vesting of certain equity awards after and as a result of the completion of IPO. Non-GAAP net loss per share was $(0.40), compared to $(1.33) in 2FQ24.

- Cash Flow from Operations: It was $(27.1) million, compared to $(6.7) million in 2FQ24. Free cash flow was $(32.0) million, compared to $(13.4) million in 2FQ24.

- Cash, Cash Equivalents, and Short-Term Investments: They were $601.3 million as of July 31, 2024.

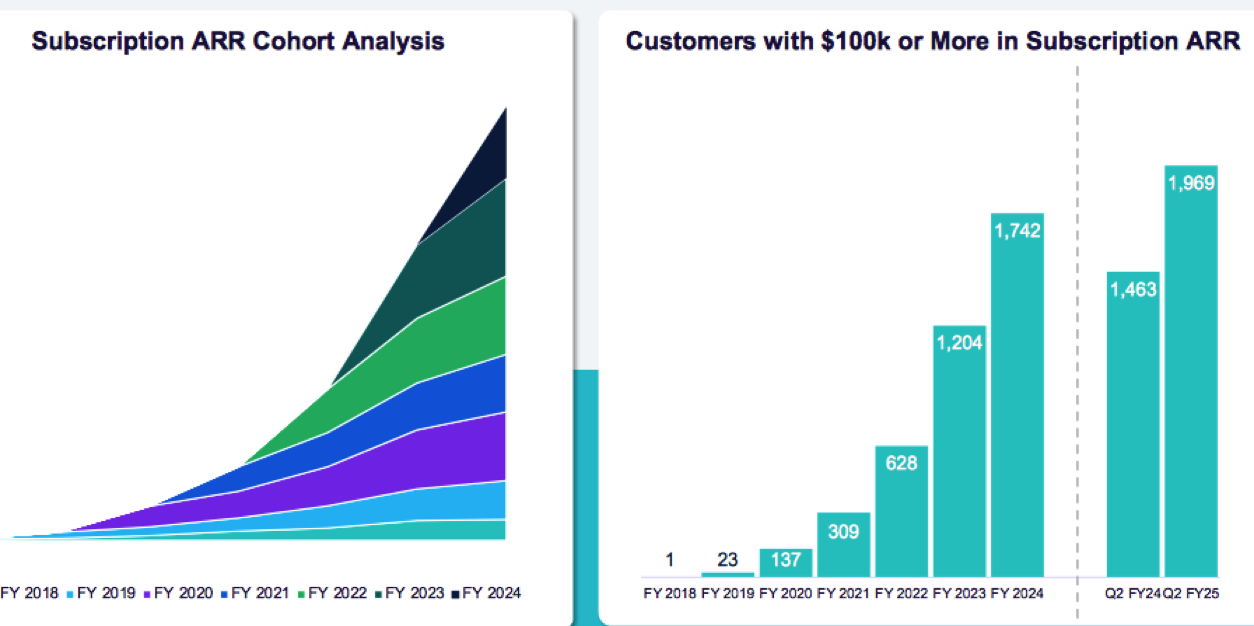

As of July 31, 2024, the company had 1,969 customers with subscription ARR of $100,000 or more, up 35% Y/Y.

3FQ25 Outlook:

- Revenue of $216.5 million to $218.5 million.

- Non-GAAP Subscription ARR contribution margin of approximately (8)% to (7)%.

- Non-GAAP EPS of $(0.41) to $(0.39).

- Weighted-average shares outstanding of approximately 185 million.

FY25 Outlook:

- Subscription ARR between $1,026 million and $1,032 million.

- Revenue of $830 million to $838 million.

- Non-GAAP subscription ARR contribution margin of approximately (7)% to (6)%.

- Non-GAAP EPS of $(2.12) to $(2.06).

- Weighted-average shares outstanding of approximately 155 million.

- Free cash flow of $(67) million to $(57) million, including $23 million of one-time payroll taxes related to the public offering.

Comments

The quarter was highlighted by continued prioritization of cyber resilience amongst customers, momentum in large deals and notable improvement in profitability. This drove results ahead of the high end of guidance across all of key operating metrics including subscription ARR and subscription ARR contribution margin.

High Growth Subscription Business at Scale

For 2FQ25, subscription revenue was $191 million, up 50%. Total revenue was $205 million, up 35%. Turning to the geographic mix of revenue. Revenue from the Americas grew 36% to $147 million. Revenue from outside the Americas grew 34% to $58 million.

Rapid Subscription ARR Growth at Scale

Strong Customer Growth and Expansion

The 3 main vectors that drive expansion with customers are:

- One, the growth of data from applications already secured by Rubrik

- Two, additional applications secured on our platform

- And three, adoption of additional data security products

The company ended 2FQ25 with 1,969 customers with subscription ARR of $100,000 or more up 35%. These larger customers now contribute 81% of subscription ARR, up from 78% in 2FQ24 as the firm become an increasingly strategic partner to vendor's enterprise customers.

FY ended January 31, in $ million

| Period | Revenue | Y/Y growth | Net loss |

| FY23 | 599.8 | NA | (277.7) |

| 1FQ24 | 135.7 | 3% | (89.3) |

| 2FQ24 | 151.5 | -9% | (81.1) |

| 3FQ24 | 165.6 | 1% | (86.3) |

| 4FQ24 | 175.0 | 29% | (97.5) |

| FY24 | 627.9 | 5% | (354.2) |

| 1FQ25 | 187.3 | 38% | (732.1) |

| 2FQ25 | 205.0 | 35% | (81.1) |

| 3FQ25 (estim.) | 216.5-218.5 | 31%-32% | NA |

| FY25 (estim.) | 830-838 | 32%-34% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter