History 2004: Adaptec Snaps Up Snap Appliance

For $100 million to enter NAS

By Jean Jacques Maleval | May 6, 2024 at 2:00 pmAdaptec’s strategy is clear enough: it would like from now on to be a player in external storage subsystems and not just in I/0 controllers and adapters, where the competition has been fierce.

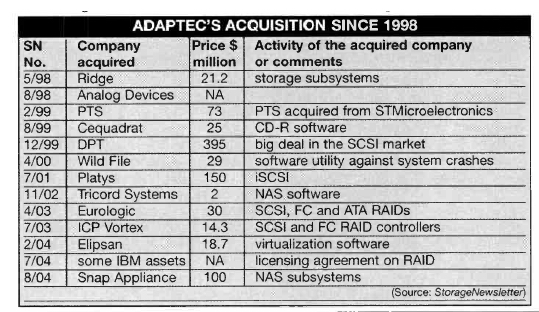

The company is now outfitting itself on a scale with its ambition, amassing various acquisitions in the new field for the past 2 years (ICP Vortec, Eurologic, etc.).

On the SCSI, iSCSI and FC storage arrays or JBOD side, it has built up a significant offering.

But, while it had acquired NAS software from Tricord in 2002, to little avail, Adaptec was nevertheless missing a NAS entry in its catalog, apart from a small, obscure product, the Adaptec File Saver that goes up to only 1TB.

The Milpitas, CA-based firm finally decided not to dawdle, and has gone ahead and gotten its hand on the world’s leading NAS company, in terms of units shipped, Snap Appliance, a hundred-strong company headquartered in San Jose, CA. And they paid dearly for it, $100 million, with $91 million in cash and $9 million in assumed stock options.

According to Gartner, for 2003 in the WW NAS market, Snap was ranked 5th in revenues, 3rd in terabytes shipped and 1st in unit shipments. Today, Snap claims 150,000 NAS already shipped WW.

This particular business has a complicated past: it was initially launched by Meridian Data, then acquired by Quantum in 1999 for $95 million. The latter added Connex to it, acquired from Western Digital in 2001 for $11 million, then decided to spin it off under the name Snap Appliance, to make it easier to sell in 2002, for $11.3 million, to several investment firms and a start-up called Broadband Storage, while still keeping 20% ownership.

Last year, Snap Appliance changed hands again, sold to a group headed by CEO Eric Kelly for a pittance, $12.7 million, when compared to the final sale price of $100 million.

In the NAS world, there are two distinct markets, one for high-end products from the likes of NetApp or EMC, in which Snap is not present, and the mid- and low-range subsystems where the competition goes primarily by the name of HP, Dell or Iomega.

While the latter 3 use Microsoft’s NAS software, Windows Storage Server, the new Adaptec division, which will continue to be managed by Eric Kelly, now reporting to Adaptec’s CEO Bob Stephens, has its own software platform, GuardianOS under Linux, which is both an advantage and a drawback.

It’s a disadvantage to be tied hands and feet to every change dictated by the software giant. Yet it’s advantageous to have greater flexibility, as confirmed by the recent launch by Snap Appliance of a version of GuardianOS that is capable of handling storage by files as well as by blocks, a real asset compared to the competition.

Adaptec expects that the transaction will generate $40 million in new revenue over the next 4 quarters.

It can also hope to sign on several OEMs, which Snap was never able to do on its own, since its NAS were only sold through the distribution channel. It’s even conceivable that IBM, Adaptec’s largest customer, could sign on, since it currently offers no NAS, only a NAS/SAN gateway.

This article is an abstract of news published on issue 199 on August 2004 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter