DRAM Manufacturers Gradually Resume Production

Impact on total 2Q24 DRAM output estimated to be less than 1%.

This is a Press Release edited by StorageNewsletter.com on April 12, 2024 at 2:02 pmPublished on April 10, 2024, this market report was written by Avril Wu, Mia Huang, Mark Liu and Ellie Wang, analysts at TrendForce Corp.

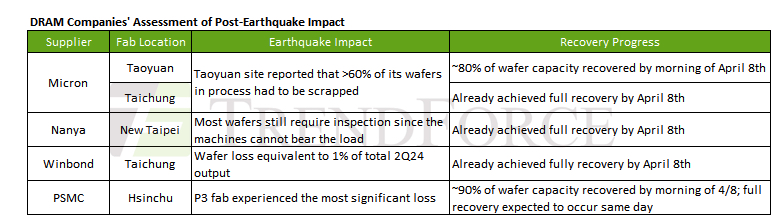

Following in the wake of an earthquake that struck on April 3, tye analysts undertook an in-depth analysis of its effects on the DRAM industry, uncovering a sector that has shown remarkable resilience and faced minimal interruptions. Despite some damage and the necessity for inspections or disposal of wafers among suppliers, the facilities’ strong earthquake preparedness of the facilities has kept the overall impact to a minimum.

Leading DRAM producers, including Micron, Nanya, PSMC, and Winbond had all returned to full operational status by April 8. In particular, Micron’s progression to cutting-edge processes – specifically the 1alpha and 1beta nm technologies – is anticipated to significantly alter the landscape of DRAM bit production. In contrast, other Taiwanese DRAM manufacturers are still working with 38 and 25nm processes, contributing less to total output. TrendForce estimates that the earthquake’s effect on DRAM production for the second quarter will be limited to a manageable 1%.

Minimal impact from earthquake leads to limited benefit as increases to 2Q24 DRAM contract prices expected

Following the earthquake, the analysts report a widespread halt in quotations for both contract and spot DRAM markets. Since then, spot market quotations have largely resumed, but contract prices have not fully restarted.

On the day of the earthquake, Micron and Samsung completely stopped issuing quotes for mobile DRAM, with no updates provided as of April 8.

On the other hand, SK hynix took a proactive approach by resuming quotations for smartphone customers on the day of the earthquake. SK hynix’s proposed price adjustments for 2Q24 mobile DRAM are notably more moderate compared to other suppliers, likely moderating pricing strategies across the industry. It is anticipated a seasonal contract price increase for 2Q24 mobile DRAM of approximately 3-8%.

For server DRAM, the earthquake primarily affected Micron’s advanced manufacturing processes. Consequently, the analysts suggest that the final sale prices for Micron’s server DRAM could rise, though the exact direction of future prices awaits further observation. On the HBM front, the majority of Micron’s production of HBM 1beta and TSV is based in Hiroshima, Japan. This location was not impacted by the earthquake, leading to stable supply levels and unchanged prices.

The spot market has seen some module makers, such as Kingston and Adata, recommence quoting without adjusting prices upwards, underscoring the earthquake’s limited capacity to propel price increases. Given the scarcity of DDR3 inventory, there remains some upward pricing potential, whereas the abundant inventory levels for DDR4 and DDR5, paired with tepid demand, suggest that the slight price elevations caused by the earthquake are expected to normalize swiftly.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter