Updates on Major Earthquake in Taiwan on April 3

Wafer foundry and DRAM production unaffected but suppliers and module factories have temporarily ceased pricing activities.

This is a Press Release edited by StorageNewsletter.com on April 5, 2024 at 2:03 pm1/ Minimal Initial Damage to DRAM and Foundry Production Lines

Following Major Earthquake in Taiwan on April 3

Details of losses still under assessment

2/ Post-Earthquake Survey Update

Taiwan’s wafer foundry and DRAM production unaffected

1/ Minimal Initial Damage to DRAM and Foundry Production Lines

Following Major Earthquake in Taiwan on April 3

Details of losses still under assessment

This report, published on April 3, 2024, was written by Ken Kuo, Avril Wu, Joanne Chiao and Ellie Wang, analysts at TrendForce Corp.

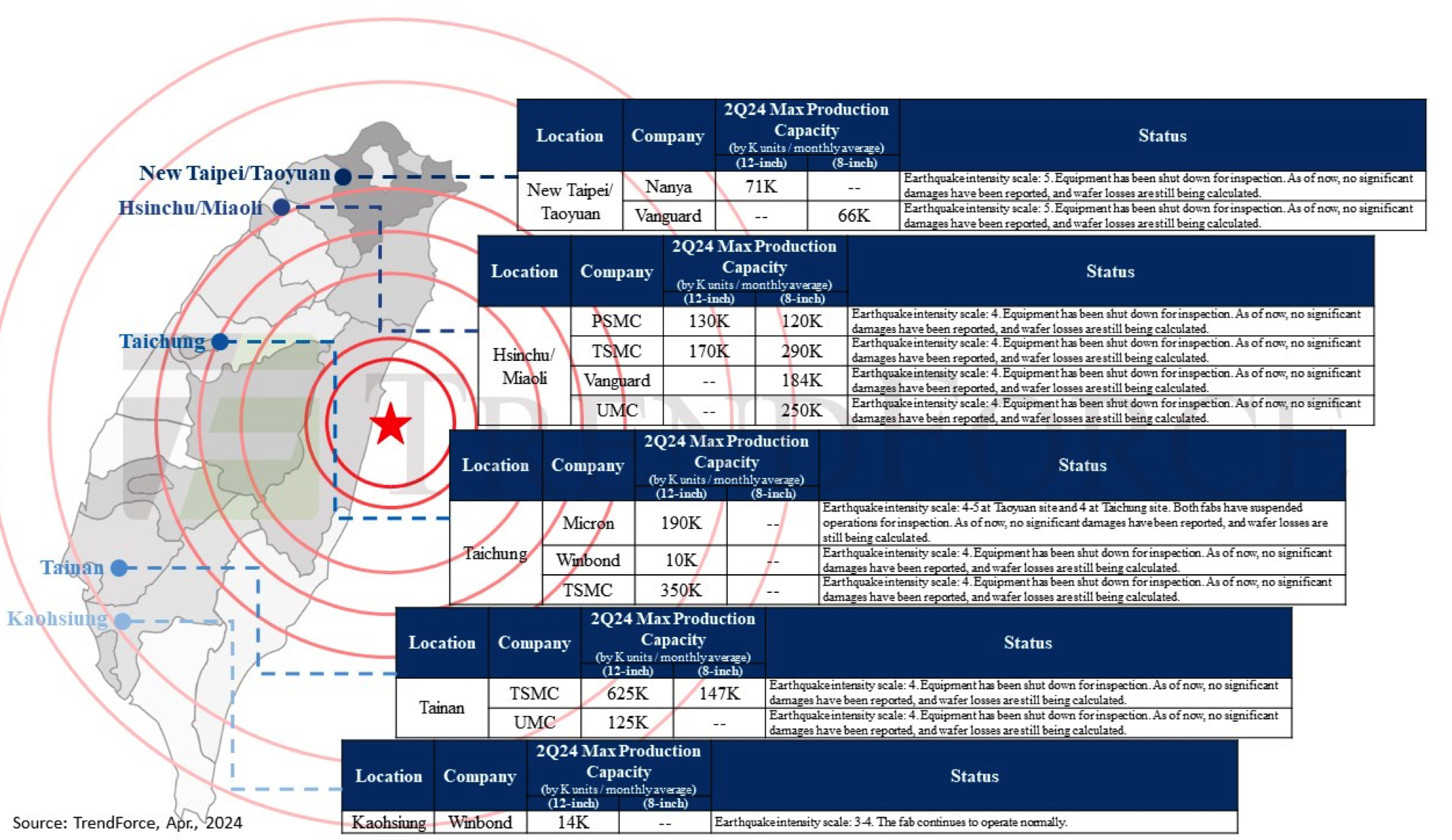

In the wake of a 7.2-magnitude earthquake off the eastern coast of Taiwan at 7:58AM on April 3, the analyst firm immediately investigated the damage and operational status of various manufacturers.

The DRAM industry, primarily located in the northern and central parts of Taiwan, and the foundry industry, spread across the north, central, and southern regions of Taiwan, appear to have sustained minimal initial damage.

The strongest tremors felt in the northern Linkou area ranged from intensity scale 4 to 5, with other regions experiencing around intensity scale 4 tremors. Manufacturers have begun sequential shutdowns for inspections. Despite the ongoing inspections, no significant equipment damages have been reported so far.

TrendForce highlights that they are currently assessing the damage to production line fragments and furnace tubes. They believe that manufacturers will manage to restore their production capacities by ramping up operations, as there have been no reports of significant disasters. Moreover, in light of the heightened attention on the supply of AI components, it’s noted that Nvidia chips, which utilize the 4nm process manufactured at TSMC’s Southern Taiwan Science Park, did not lead to the evacuation of personnel. However, the need for equipment inspections did require some temporary shutdowns. The analysts predicts that these operations can be quickly resumed with minimal impact on supply.

Micron, with its DRAM production capacity mainly located in Taiwan, has led the suspension of DRAM pricing, with a reassessment of post-disaster losses to restart negotiations for 2Q24 contract prices. Furthermore, Samsung and SK hynix have also halted their pricing, although neither supplier has DRAM production in Taiwan, opting to wait and see the market’s direction.

Despite the earthquake, the spot market for DRAM and NAND flash memory had been showing signs of weak demand for several weeks. Therefore, although Micron and Nanya experienced shutdowns, the ample supply has prevented significant price fluctuations. The overall price increase was minimal, with purchasing enthusiasm remaining low.

Conclusion: while there may be a slight short-term increase in DRAM spot prices, the continuation of this trend is uncertain due to persistent weak demand. It’s further noted that DRAM suppliers and module factories have temporarily ceased pricing activities, reflecting a cautious approach in the aftermath of the earthquake.

Click to enlarge

2/ Post-Earthquake Survey Update

Taiwan’s wafer foundry and DRAM production unaffected

This report, published on April 3, 2024, was written by TrendForce Corp.

The analyst firm has provided an update on the dynamics of Taiwan’s semiconductor factories following the earthquake on April 3.

Most wafer foundries were situated in areas that experienced a Level 4 intensity shake. Owing to the high-spec construction standards of Taiwan’s semiconductor factories, which feature world-class seismic mitigation measures capable of reducing seismic impacts by 1 to 2 levels, the facilities were largely able to resume operations after inspection shutdowns quickly. Even though there were instances of wafer breakages or damages due to emergency shutdowns or earthquake damages, the capacity utilization rates of mature process factories – averaging between 50–80% – meant that losses were quickly recovered after operations resumed, resulting in only minor impacts on capacity.

In the DRAM sector, the earthquake notably affected Nanya’s Fab 3A in New Taipei and Micron’s Linkou plant. Nanya’s impacted plant mainly focuses on 20/30nm processes, with its latest 1Bnm process in development. Micron’s Linkou and Taichung plants, internally merged into one system, serve as critical sites for DRAM production, already deploying the latest 1beta nm process technology. Both are expected to fully recover within a few days, with subsequent productions, including HBM, continuing in Taiwan. Other facilities resumed operations progressively after inspections. PSMC and Winbond reported no damages.

Regarding wafer foundry operations, TSMC’s 6-inch and 8-inch facilities, including Fab 2, Fab 3, Fab 5, Fab 8, its R&D headquarters Fab 12, and the newest Fab 20 in Baoshan, Hsinchu, were all located in a Level 4 intensity zone. Only Fab 12 suffered some water damage to equipment due to broken pipes, mainly affecting the not-yet-mass-produced 2nm process. This is expected to have a short-term impact on operations, potentially necessitating the acquisition of new equipment, thus slightly increasing capital expenditures. Other facilities resumed operations after inspections with no significant damage reported, and operations at other sites have progressively returned to normal following evacuation or inspection.

TSMC’s advanced 5/4/3nm process plants, boasting higher capacity utilization rates, did not evacuate personnel and managed to resume more than 90% of their operations within 6–8 hours post-quake, with impacts remaining within controllable limits. The CoWoS plants, particularly the Longtan AP3 and Zhunan AP6, immediately resumed after evacuations despite inspections revealing some water damage to the chiller units. However, thanks to backup facilities, operations were unaffected and have since resumed.

Furthermore, UMC operates one 6-inch and 6 8-inch plants in Hsinchu, and 1 12-inch plant in Tainan, primarily engaged in 90-22nm mass production.

PSMC includes 12-inch DRAM and 8-inch and 12-inch foundry plants in the Hsinchu and Miaoli area, focusing mainly on niche products with 25/21nm processes.

Vanguard operates 3 8-inch plants in Hsinchu and 1 in Taoyuan, all of which have resumed operations after brief shutdowns for inspection and staff evacuations.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter